Robocash Update – How the tiny little helper grew over the last two years

In todays blogpost I would like to update my Robocash blogpost. I wrote it in the beginning of 2020, so nearly two years ago. Aligned to this blogpost I also wrote an official review on Robocash, which I will update every month if there are some news about the platform.

But let’s have a short look at what Robocash was back than in January of 2020. The platform has been a part of my portfolio since two years then – so today it is four years and counting. The interest rate was published with 12% and their performance was okay. Due to a lack of marketing and an unknown structure Robocash always fought a bit against the big platform like Mintos and Bondora. It was not really clear why to invest money on a russian platform when you receive the same interest on Mintos?

Let’s dive into a Robocash update trying to figure out how they did over the last two years and whether I am still investing on the platform.

Table of Contents

Robocash Update – For what reason?

Every year there is a bunch of new P2P platforms. Over the last years I tried to keep up with the growth and be invested on most of them. But due to financial reasons and also time reasons I am not able to do it. Therefore I changed my concept of investing a bit about a year ago, when the covid crisis hit the world.

I tried to figure out which platforms really fit into my portfolio. Maybe you have hear of my “Focus Four” platforms trying to increase my monthly passsive income by investing mainly on them. As there is only a restricted amount of money available every month I wanted to focus only on some of them. I still care about the rest, but with very small amounts.

As Robocash has been in my portfolio for a long time I wanted to review my assumptions from back than and have a look at the current numbers of Robocash.

From my point of view it is the same like checking the investment case for a share on the stock exchange. You create yourself a story, try to underline it with facts and than hope it will happen. The better your experiences and facts, the more success stories you will have in your portfolio. Easy as this – why not do it for P2P lending platforms?

No you got the point why I am reviewing my blogpost from 2020 and update the information. As I already mentioned you will find all of the data in my Robocash Review, which I will update reguarly. In this blogpost I want to look at the platform more from a personal point of view.

Is my investment case still valid?

Reading my blogpost again, which I wrote two years ago, I was quit enthusiastic about the P2P platform. Their understanding of making things easy for investors was dominant. Also this is maybe not the best reason to make an investment.

My personal investment case was investing on a platform being diversified in a different way than all the others. Well – that case is still valid to be honest.

In todays view on my portoflio some things developed and Robocash became a different platform from point of view. A russian platform, situated in Croatia with loans from Latvia, Kazhakstan and Asia – back then it was a great possibility to difersify. It is still today, but my view changed a bit.

Contrary to that we might have a look at DoFinance. The platform was also one which I really liked. Unfortunately the company following a pretty similar concept like Robocash struggeled heavily during the covid-crisis – and is still today. It is only some days ago when I received an email where DoFinance. They informed their investors that they are not able to recover all of the overdue loans.

Following my blogpost about DoFinance I was very convinced of the platform as the company behind it was solid funded and earning morning. From a todays view this is only a capture of the moment – just like it is here with Robocash. So I have to keep that example of DoFinance in mind, who were also not good at communicating.

But to answer the question: Yes my investment case is still valid.

Does the business model changed?

Robocash and the Group behind it are doing good and giving insights about their business. Their results are audited by a big company acting as a third party. It is all some kind of “scary” as I am not into the russian or croatian law to rate the trustworthiness. BUT interest never comes without risk. And in this case I think the risk is not bigger than the chances Robocash offers.

From my point of view Robocash is a similar P2P lending platform like Bondora. They also have their loan originators “inhouse”. With this there are coming several advantages and disadvantages which investors need to rate.

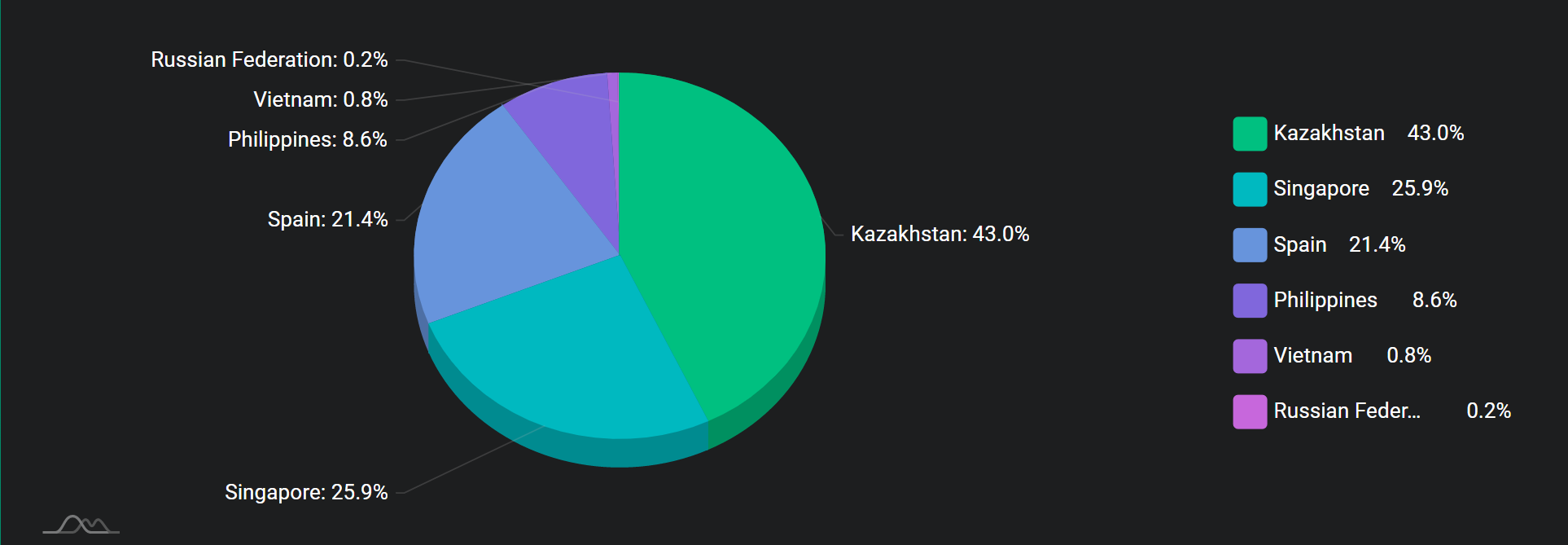

Over the years both Robocash and Bondora slightly changed their loan originators. With Bondora it was Spain who was first taken out of the portfolio and now added in again. Robocash did it the same with Singapore, which are currently not offering loans on the platform.

But did the business model really changed?

I do not think so. In my Robocash Update you can see that the main target for loans is still the same as two years ago. Maybe some loan originators changed. Why? I do not know, but this might be due to regional aspects which I am absolutely not into. And I do not want to.

When investors recognized that Bondora has a bigger problem with the spanish loans, they reacted. Maybe not in time, maybe not to please every investors – but they reacted. I cannot rate whether Robocash had similar problems with Singapore or any other region. From my point of view their job is to protect investors money. And I am pretty sure they will, when it comes to the point.

Right now this might be a risk, as the situation in Kazhakstan or the other regions is not really understandable for me. I do not know what happens to the loans when Kazhakastan faces a 25% inflation (currently they are at 8-9%). But am I able to know when this happens in Latvia? Probably not.

Focussing on the passive income

To be honest I think it is very complex to rate, whether the P2P platform is “good” or “better” or even “bad”. When it comes down to the fundamentals there will be always arguments for and against investing.

There are some big players like blue chip stocks, a pretty wide range of well funded but also risky platform and of course some trash. Mentioning the “big ones” Robocash might not be one of them. Mintos, Twino, viainvest and Bondora are those who are leading the market. Some of them are offering a regulated platform to investors, which is more security.

Robocash is not regulated that way and also not on the level of publishing loans. But together with Debitum they are in my personal ranking “Top of the rest” below those big lending platforms. That is a spot where the relation from risk and reward is very nice for me as an investor.

But as I mentioned: When it comes down, every invest needs to make up their own mixture of ratings. For me there is especially the interest payment, which I am looking for. The more continously it comes and the less risks there are, the more I would invest.

Whatever law- or platform-risk I have to take as an Robocash investor, the platform is able to make the interest payments very reguarly. There has been some struggles in the beginning of 2020, but before that and after this event, the payments came in time. In my account there is always only a small amount being overdue.

Payment reliability: 4 out of 5

Let’s wrap it into three different categories. The first one is the reliability of their payments. Interest payments are coming like every day. There is not a single event where everything comes to my account. It is more a steady flow over the month, also most of it is paid by the beginning of each month.

To rate this number I always take the intest amount and put it into relation to the amount invested. For example: I am paid 25EUR of interest during December. When rating this number the overall stack was 2.775EUR in my Robocash amount (and no deposits during the month). So the formular goes like: 25EUR x 12 months / 2.775EUR total amount x 100% = 10,80%.

This numbers is very personally and maybe not correct like the IRR interest, but for me it has to be on a similar level every month. When it comes down I would try to find out why and stop investing.

Unpaid interest / overdue loans: 4 out of 5

Another important number for is the amount of overdue or unpaid interests. P2P investors should know the risk. So there is nothing to be estonished about overdue loans. That is the P2P business and it is maybe comparable to a draw down on the stock market. Maybe the share prices recovers, maybe not.

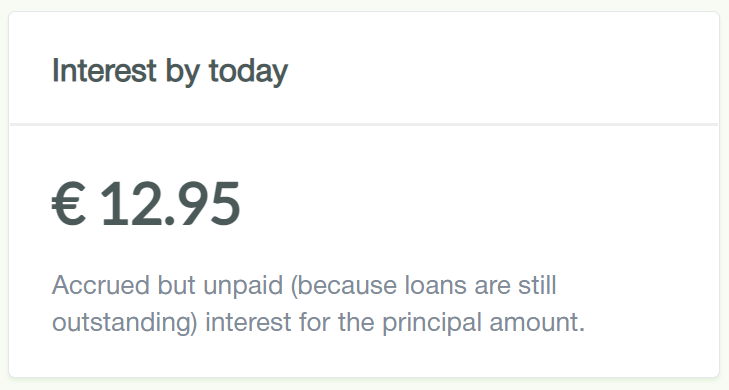

To rate this potential of coming up again stock experts usually look deeper into the books of a company. And that is what I do here on a completely different and ways more easier basis. In your investors account on Robocash you can see the amount of unpaid interest. The box itself is called “Interest by today” and described as accrued but unpaid interest for principal amount.

Robocash accrued interest by today, taken from my personal account

So, having for example accrued 10EUR here as the amount, you need to calculate it by the interest rate. With this calculation you will find out, how much of your P2P portfolio is overdue – overdue principal against overall investment.

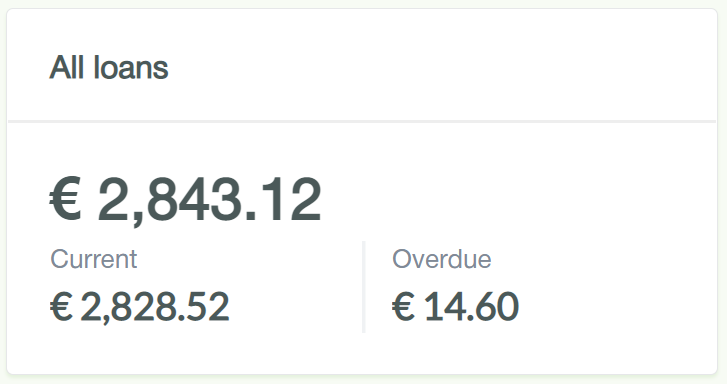

Robocash loans overdue, taken from my account

Keep an eye on that number, but do not overrate it. Maybe you should compare this number directly or calculated to the principal to your other P2P lending platforms. Therewith you will get an idea of how good or bad the number is.

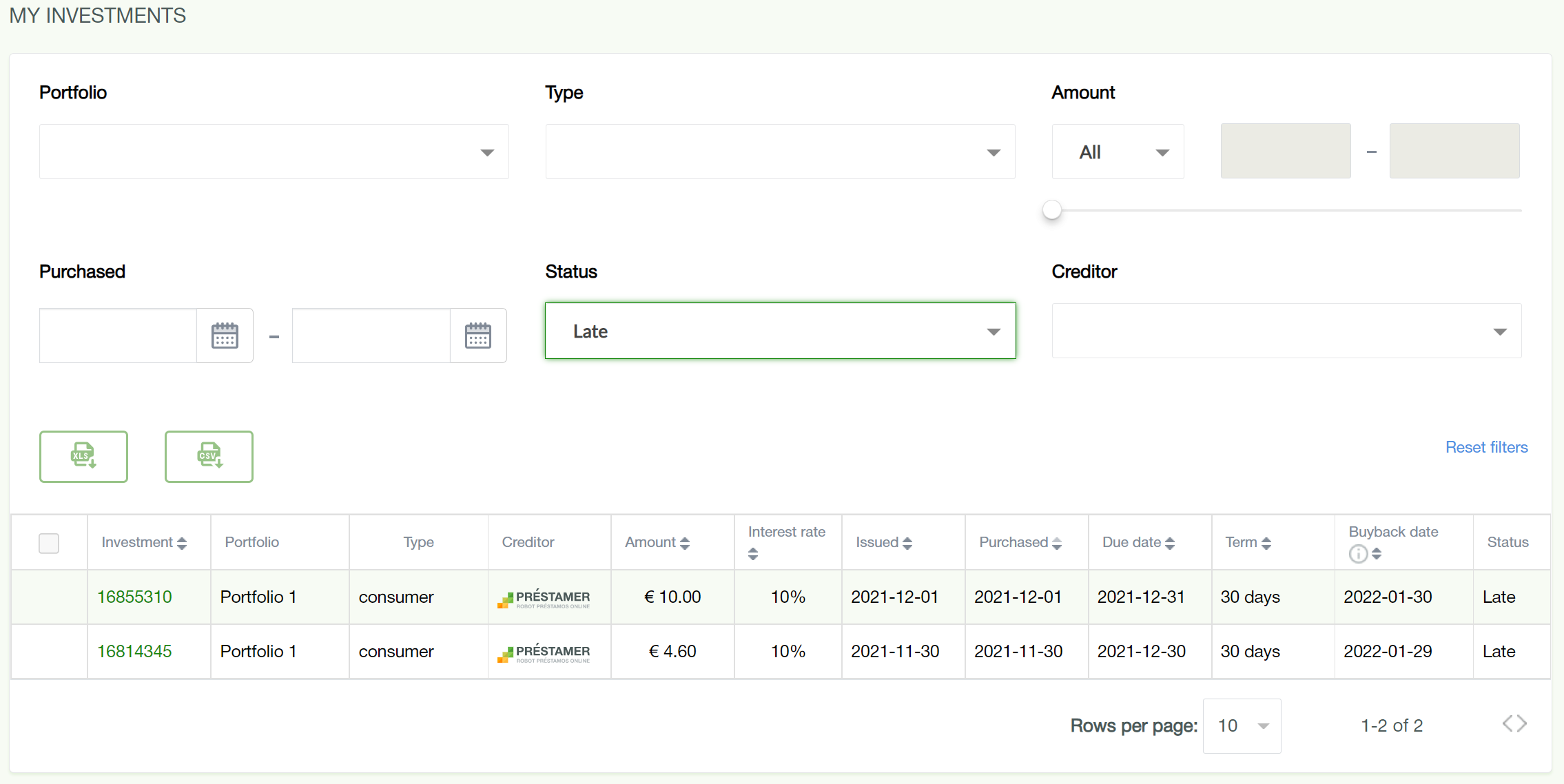

Robocash select late loans

Personally I would start acting when the number rises to more than 30%. So in my case everything is fine so far, also I think Robocash might be better off to display the total amount of overdue investments. It would make it easier to compare. But with some manual work you can always find out, which loans are late/overdue when you check your investments in the section “My Investments” and adjust the search.

Rating changes from third parties: 5 out of 5

This third and last point is very critical I think. I would rather invest in a company who is rated less good with a good chance to win in the future again than into a small one without any official rating. I guess this process develops in the field of P2P lending and it will take years until there is some kind of standard. Therefore those P2P platforms have an advantage in my portfolio today, who are able to offer some kind of rating and/or audited numbers. And thats two things investors might have to differ from.

Publishing audited numbers and reports is the one thing. In my Robocash Review I checked that fact and found out that the platform is audited by FBK Grant Thorton, who is globally active. That is a good sign, when a company audits their numbers by an official third party.

But beside that there are more third parties rating the company. For example SneakyPeer is offering a lot of information about the P2P lending platforms. Of course those numbers are behind a paywall, as it is a lot of work to get those rating system together, but you get an intention whether your investment might be more on risk that you expected. Furthermore the P2P expert himself Lars offers a P2P ranking on his website which is only 5EUR per month.

In this ranking Robocash is currently ranked in the top quarter, place #7 out of 37 P2P platforms. Probably they will rise soon, when they are celebrating their 5th birthday in 2022, which will bring them another 2 points on the score to at least secure their score.

What is the outcome of my Robocash Update?

Well, to be honest I wrote this blogpost after I increased my investment here massively. Therefore the answer is somehow already given: I trust this platform, there are no big signs of problems and I feel pretty save about my money. The interest payments are dropping into my account monthly with a very good performance.

I just wanted to wrap up my knowledge which I researched for my internal Robocash Update for you. I made up the decision some months ago to invest even more based on this knowledge. So it is more a legitimation for myself to acted this way and give this know-how to you.

Little did I know that since last week Robocash faces a new challenge, when politically Kazahkstan got into trouble. Therefore it will be very interesting to know, how Robocash rates this trouble after Mintos already paused loans from loan originators with loans from Kazahkstan.

Robocash loans by country, taken from https://robo.cash/about

Am I afraid? No way, you should never be afraid of losing money. I am absolutely not the expert for this region and Robocash has my trust they are taking of my money. As Kazahkastan has a huge share on their loan portfolio I am convinced that they are watching the situation closely.

Leave a Reply

Want to join the discussion?Feel free to contribute!