#2 Bondster – The second platform of my P2P High Yield Experiment

Today I would like to introduce Bondster, the second participant in my experiment. After my first post about Reinvest24 we will today travel digitally to Prague, Czech Republic. So I have a participant in my P2P portfolio who is not from the Baltic States. I’m happy about this on the one hand because it is something different for once and on the other hand because it has advantages for diversification.

In today’s article I would like to take a closer look at Bondster for you. How does the Bondster P2P platform work? Is the Czech Republic the next Baltic State? And what role will Bondster play in my high yield experiment? Enjoy listening and reading!

Table of Contents

What is Bondster?

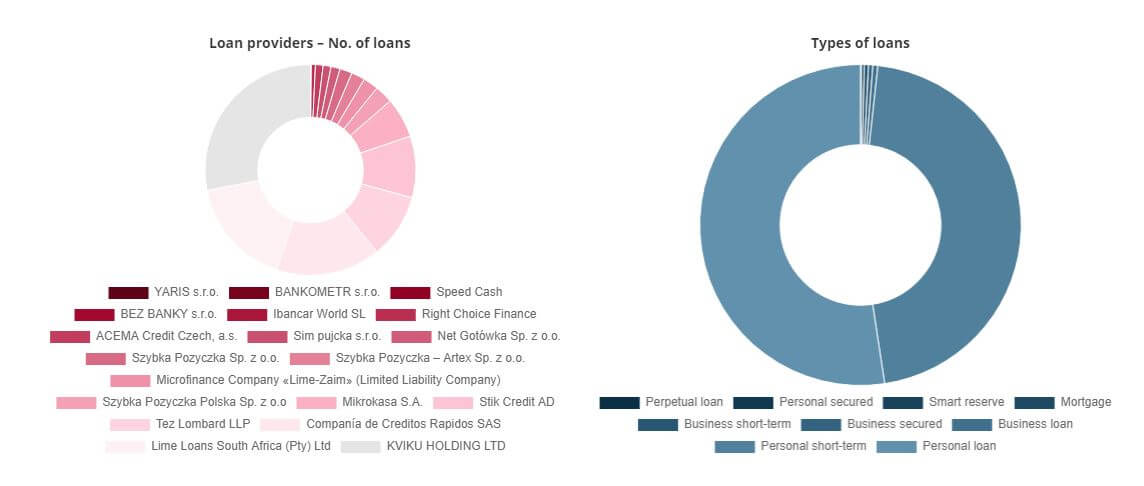

Bondster is a real P2P marketplace from the Czech Republic. It operates in Prague as BONDSTER Marketplace s.r.o. As with Mintos and other marketplaces, it is the interface between loan originators and lenders. Bondster was founded in 2017 and is owned by CEP Invest Private Equity. A main cooperation partner is the ACEMA Credit Czech Group, which can also be found on Mintos as a P2P loan originator. In total, Bondster currently works with approximately 20 loan originators.

Bondster offers not only consumer loans, but also real estate and business loans, which further loosens the murky consumer credit soup. However, if you look a little deeper into the statistics, you will see that 99% of the loans are personal loans after all. The investment can be made both in EUR and CZK. For me only the investments in EUR are relevant, so I can only say something about this in the future.

As you can see, at first glance Bondster appears to be a lot different from what you are used to from the well-known P2P lending platforms and this is one of the things that makes the investment interesting for us here. By the way, the website is also available in German, English und Czech language.

Some more facts about Bondster and investors registration

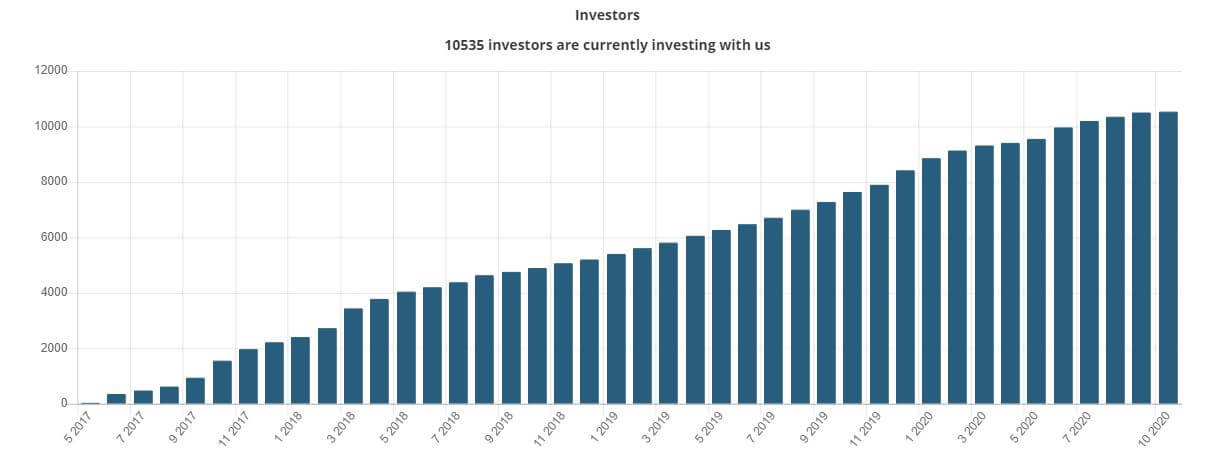

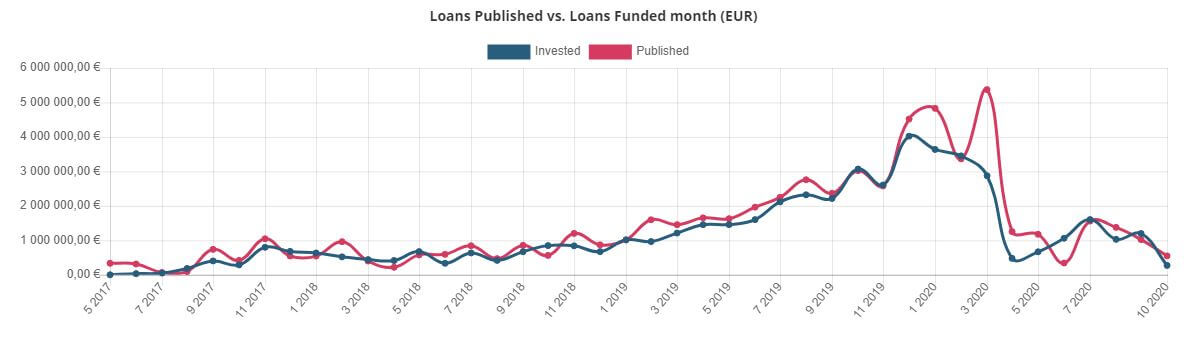

Bondster was launched in 2017. Since then they reached about 10,500 investors from all over the world. Their monthly volume of published loans is between 0,3 million EUR to 5,3 milion EUR. Especially during the Covidcrisis in the beginning of 2020 they struggled and their volume dropped. Since the mid of 2020 the volume is on a constant level and slightly increasing again.

Screenshot from Bondster statistics

So, if you sign up as an investor you do not have to pay any fee. Registering and investing is without any costs. There just might be some costs, when you plan to leave a P2P loan earlier, which is quite reasonable to me. Within the registration process you need to send details about your passport and bank account to Bondster. Nowadays this is usual as it is a part of the european antilaundry law.

Screenshot from Bondster statistics

As the minimum invest per P2P loan is at 5 EUR, you can start investing with quite small amounts. In my experiment I will transfer 50 EUR every month, which will (hopefully) invested by the Bondster Autoinvest.

Loans provided on Bondster are running between 22 days and 35 months. From most of the loan originators they come with a buyback guarantee. If you check their statistics Bondster shows an average return of 14.03 %. Lars shows 10,19% in his P2P portfolio. So the minim of 10% required for my experiment is given. As you can see I adjusted my autoinvest to 12% and above. If this will work out, we will see (and I will report about it).

Why is the Bondster P2P Marketplace a good addition to your portfolio?

Here you have to look at the extension from two sides. The first and very relevant point for me is the platform risk itself. Of course Bondster is also subject to such an economic risk, which cannot be excluded for any platform.

However the company headquarters is not in the Baltic States. Both topics with the regulation or general economic topics in the Baltic States do not impair Bondster thus in the first moment directly.

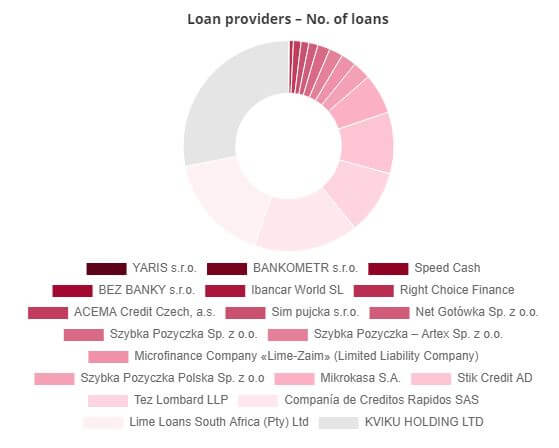

With another marketplace, you certainly have to be careful not to create any apparent diversification. By this I mean that you spread your investments over different platforms, but that they get their loans from the same sources.

Screenshot from https://www.bondster.com/en/poskytovatele

Some of Bondster’s loan originators are already known, but the much larger share is unknown. Thus Bondster is a useful addition to the P2P portfolio in the marketplaces next to Mintos, Peerberry or Viventor.

By Auto-Invest on Bondster, the individual strategy can be adjusted accordingly. You can select individual loan originators or not. This way Auto-Invest only invests your money in those loans whose source you have selected.

Overview made with Matador – https://matadornetwork.com/travel-map/

This point, however, is also an advantage for the loan originator in my view. Because with a further platform on which they can offer their loans, their “customer base” will also expand. The dependence on a single marketplace is reduced. This also means greater stability and security in the portfolio for us investors.

How do you invest in Bondster?

Investors are spoiled on the P2P platform with a clear menu navigation. So it is not particularly difficult to register here and transfer your money. I personally like the structure very much, because it is clear. You can see here immediately:

- How much money is currently invested in my P2P portfolio?

- What is the current performance of my money?

- How much return have I already earned in the current year?

- And also how much money had to be written off

By clicking on the “Account Summary” and “Detailed Portfolio Overview“, the investor can see how his capital is currently invested. This includes a view of the distribution across the individual loan originators.

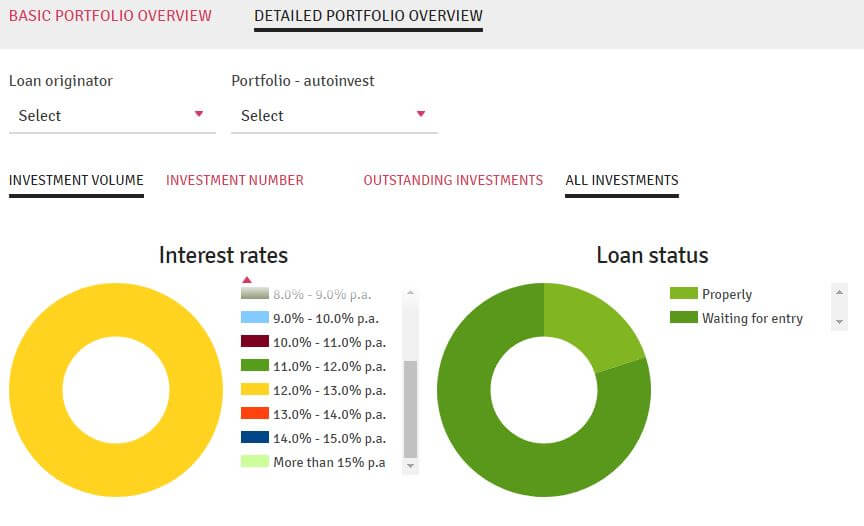

Screenshot from my Bondster account with only 50€ invested

Both on the Bondster site itself and in your personal account, you will find a navigation bar at the top of the page that allows you to move around the menu relatively easily. There you will find, among other things, the primary market, where you can filter and examine loans according to your requirements.

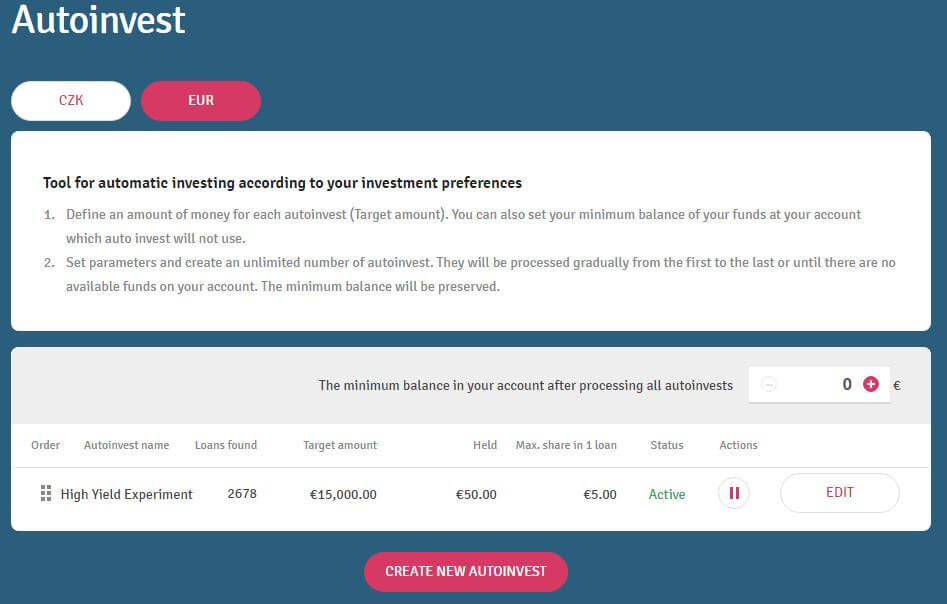

Investing made easy with Bondster Auto Invest

As you know I am lazy. In my requirements for a P2P platform I already mentioned that a functioning auto-invest is of fundamental importance. And Bondster can provide that. Since I haven’t invested any money myself at the moment, I’m relying on Lars for the time being, who is enthusiastic about it. From October on, I will be able to test the functionality myself and give more insights into it as part of my experiment.

The Auto-Invest can be found in the menu itself and you can configure your own. Bondster does not offer ready-made strategies here, as is the case with Mintos or Bondora, for example. Personally, this bothers me, but it forces everyone to take action if you want to earn interest on your money.

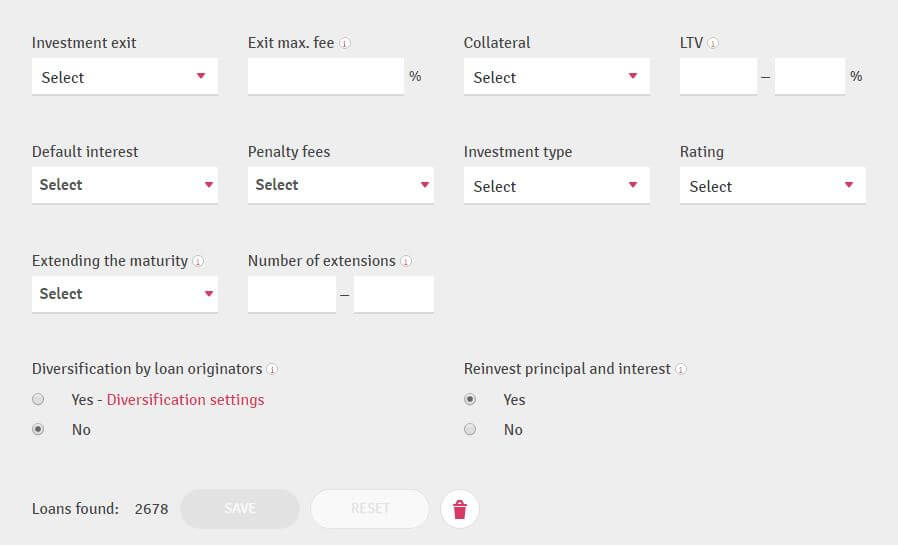

Screenshot from my Bondster account

Click on the button “Create New Autoinvest” and you can define the corresponding parameters yourself. Since the selection here is very extensive, I would like to go briefly into the individual fields. First I would give the strategy a name so that you can distinguish between several strategies.

The Bondster Auto-Invest settings in detail

If you leave all the fields blank and save the strategy, this means that you include all the new features of Bondster accordingly. If you want to keep it simple, you are welcome to do so. There is nothing at all to be said against it. However, I would like to make some settings with Bondster as part of my project.

Already in the first line next to the name of your strategy you can set the minimum amount of credit per P2P. On Bondster you can invest as little as 5 EUR. I leave this unchanged, so that the diversification is much easier to start with.

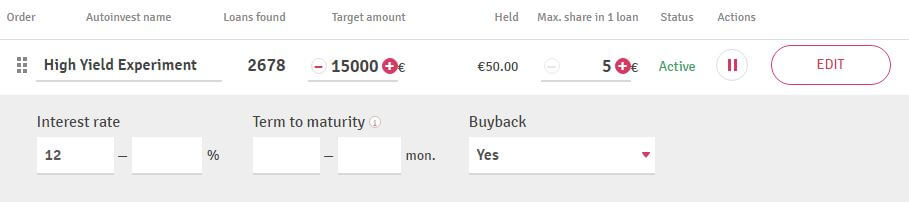

Interest Rate, Terms of Maturity & Buyback

Interest Rate: Here you can specify how much return a P2P Loan you invest in should have. You can get an insight via the menu item “Investment Offers”. Using the function “Detailed Filters” you can adjust the selection accordingly.

At the time of this article, only seven of the 2,678 investment offers are below the 12% with which Bondster officially advertises. Nevertheless I set 12% as the minimum return for my P2P portfolio.

Screenshot from my Bondster account

Terms of Maturity: Here you define the maturity. This may be important for some investors. For me, however, the point is not important. Neither in my experiment nor in the long-term view can I see disadvantages or advantages in limiting the loans to a certain period of time.

Buyback: Here you can choose between “Yes” and “No”. You know my opinion about the Buyback Guarantee. In my opinion it is not worth very much because there are no standardized rules and I as a layman cannot see all the details.

But as long as there is a Buyback, I will use it. It’s not absolute security, but as long as the marketplace works, and it does at Bondster currently, the Buyback Guarantee offers a little more security.

Country, Loan Originator, Loan Type & Loan Status

Country: Currently you can invest with Bondster in 10 different countries around the world. Among them are Colombia, Mexico and South Africa, which are rather exotic and therefore a good addition to my P2P portfolio. I do not make any restrictions here.

Overview made with Matador – https://matadornetwork.com/travel-map/

Loan Originator: In the beginning I wrote that Bondster currently has just under 20 LO. There are currently only nine listed here. One of the reasons for this is that a LO can work with several of its own national companies. For example, LIME has three different companies for South Africa (Lime Loans SA), Mexico (Lime MX) and Russia (Lime Zaim).

Screenshot from Bondster statistics

Loan Type: In the overview there are a lot of specifications. The selection is almost too complex for me. However, it offers the possibility to diversify accordingly, if you are an investor. I would be cautious with one restriction, however, as the current overview at Bondster shows that 49.8% are personal loans and 48.4% are personal short-term loans. If you exclude these two, for example, in order to invest in business loans with Bondster, you are thus excluding 99% of the available investment offers.

Loan Status: Here you can specify the status of the loans you invest in. Again, the selection is very extensive – and too complex for me. What is the advantage or disadvantage of not investing in loans that are 31-60 days late, but in which the payment is only 8-15 days overdue? No idea, I don’t care – I don’t make a selection.

Screenshot from Bondster statistics

Many more settings in Bondster Auto-Invest

- Investment Exit: You have the possibility to exit earlier with a long term loan against payment of a fee. Here you can determine the time.

- Exit Maximum Fee: Here you can define the maximum exit fee for an early exit.

- Collateral: Here you can define how exactly your investment should be secured

- LTV (Loan To Value): Proportion of P2P Loan coverage to the volume of loans granted and disbursed

- Default Interest: Here you can define if a penalty interest should be due when the P2P Loan in which you are invested becomes overdue

- Penalty Fees: And here you can define whether penalty fees should be due when the P2P you are invested in becomes overdue

- Investment Type: If Claim Assignment and/or Participation are relevant as legal structure of a loan, you can select it here

- Rating: Here you can choose in which Bondster-own ratings your money should be invested

- Extending The Maturity: Here you decide whether to invest money in P2P Loans, whose term can be extended by the LO

- Number Of Extensions: And here you define how often an extension can be made

- Diversification By Loan Originators: With this setting you can determine whether to diversify among LOs (or not) and to what extent.

- Reinvest Principal And Interest: If repaid money is to be reinvested, you can set this here.

- Loans Found: The number indicates how many P2P loans are found on Bondster for your currently selected criteria

Save & Start, Save Only und Reset

Here you can now decide whether the Auto Invest settings should be applied. Don’t worry, you can adjust them later. I click “Save & Start” here and my deposit will be invested according to the criteria. Most importantly, my future monthly deposits on the account will be invested directly without me having to do anything else here.

This is especially important for me because I don’t want to spend time with it. It is not called “Auto-Invest” for nothing. Then it should also please contribute to my assets and with the configuration invest and reinvest the money.

There I trust in the artificial intelligence of the Bondster Auto-Invest and my small brain, which once had to work with the data in Auto-Invest, but now has a break until mid 2021.

An overview of the advantages and disadvantages of Bondster

I would like to give you my final impression of the platform with a simple overview of the advantages and disadvantages. Please note that I am investing in Bondster as part of my High Yield experiment and am especially interested in a high cash flow. For you there may be other criteria where the evaluation may be different.

Disadvantages:

- Bondster offers a wide range of loans, but the focus is on personal loans

- Investments in CZK are not worthwhile in comparison

- The configuration possibilities with the Auto-Invest are various, but partly “too much” for the current offer

- There is no secondary market

- Bondster is still relatively young, although liquidity is quite good. Bondster coped well with the corona crash and seems to have the problems under control

Advantages:

- Bondster offers a diversification opportunity through its headquarters in Prague, CZ

- The Auto-Invest is intuitive to use and, if only a few details are given, it can be configured very quickly

- There is a tax report to download in your account

- The Bondster team is very committed and strives

- 12% to 14% returns are gigantic

What is on your mind which might be an advantage or disadvantage to add in this overview here? Just comment below or drop me a short message and I will add it.

My preliminary evaluation for Bondster

I chose Bondster for the project for two main reasons: Firstly, Bondster offers a very attractive return of 12%+, which is very beneficial for my project. And secondly, being based outside the Baltic States is a real advantage for me, as it allows me to diversify better.

Actually I wanted to visit Bondster here in September for the start of the series, but unfortunately Corona didn’t work out. But I will definitely make up for it as soon as you are allowed to travel again and the opportunity arises.

As an additional marketplace to Mintos, Bondster also offers a different selection of loan originators, giving it the opportunity to diversify.

A good quote from Lars:

“In my opinion, the Bondster platform is in no way inferior to competitors such as Viventor or Peerberry, and brings with it one or two advantages.”

No question, Bondster is comparatively young and small. But the platform makes a solid impression and performs on a very good level. It is therefore a very good addition to my current portfolio. And for my project you have voted it into the top 4, even on place 1 of the voting. If this is not a good start!

Start investing on Bondster here an receive 0,5% cashback on your investment

Hello,

sorry, but this seems to me as a PR article. I am extremely dissatisfied with the Bondster portal. Personal experience – this so-called “guarantee” of repurchase means nothing at all for them. After being 60 days late, loans under this guarantee should be repurchased, but it did not happen at all… I have most of my investments’ payments late for more than 60 days (some of them even more than 200 days !!), all of them have this buyback “guarantee” of course and I still can’t get my money back from them…. Whenever I write to customer support to solve this problem, I only get a generic answer that the loan providers in question do not have enough resources, but that it is being solved in the moment and money will come in the next few weeks. This has been going on for over half a year, even more and more loans are getting late every day, only a few (around 10% !!) are being paid properly. And still no repurchase takes place…

Don’t get fooled and don’t send money to this platform!

Hey MM,

thank you very for your comment.

So first of all my blogpost is NO PR article. Is it as description of my first impression about the platform and my first steps on it. I have not received any money from anywhom for this content. There is an affiliate link in, which gives me a small amount covering my time for this blogpost and the ongoing experiment.

How much money have you invested and when? Your experiences are quite interesting, as I havent heard of something like this now. But nevertheless, I would like to know more about it. So maybe you can give me some more info about it here or via email.

And having some stuff I would like to ask Bondster about those cases. As I wrote in my article the bbg is always something being as good as the one giving it. So its just an additional security as long as long things are running. But struggeling might lead to anothers struggles here, as well as it does at other P2P platforms.

So please get in touch with me and lets work on your case together, which might have valuebale content and influence on my decisions here.

Best wishes,

Tobias

PR article.

Bondster is highly unreliable. Low quality lenders offering loans with low payments discipline. They keep your money for several days prior to paying it to you. My reco: Avoid Bondster.

Hi Stefan,

thank you for commenting on my blogpost.

Unfortunately we re not the same. Following my blog you will find a project where I heavily invest in Bondster. Furthermore I can not confirm your comment on low payment discipline and also not on mentioning my blogpost a PR article. Until now I am quite happy with my investment on Bondster, still increasing it and from my point of view there is no need to recommend avoiding Bondster.

Let’s get in touch and discuss about it. Just send me an email!

So after 2 more weeks the status is: more than 70% of loans are unpaid, and I invested in the so-called low risk 6-7% loans. Bondster still claim 6.5% ROI, when in reality my ROI is -60%. Bondster is a scam.