Iban Wallet: Big deal or big fail?

Iban Wallet sounds quite cool, does not it? When I first heard of them via a newsletter, I surfed to their website. The content is very good structured, nice pictures and the explanations sound quite easy.

If you are used to the “normal” interest rates from P2P lending, you are more or less shocked from 2,5% to 6% – but still far better than you day money account. So I thought to myself: Why not having a try with Iban Wallet in order to diversify risk among several P2P lending platforms.

Table of Contents

What is Iban Wallet

Iban Wallet is peer to peer lending platform from the UK. If you check their company data they are registered in the UK and Wales:

“Iban Wallet Corporation Ltd. is registered with the Information Commissioner’s Office (ICO) (registration number ZA464230). Iban Wallet Corporation Ltd. is registered in England and Wales (company number 11599770) and its registered office is at Level 39, One Canada Square, Canary Wharf, London E14 5AB.”

If you search for those registration numbers on the web, you will find the following entries. As there several rumors about this company, I was interested in the official registration of them. On the first sight this seems to be okay, also the adresses might differ slightly.

Coming back to who Iban Wallet is. They describe themself as a P2P platform offering a simple way to invest. Focussing on self responsibitly they would like to give their piece to your cake of managing your finances.

“We work day in, day out to offer you the flexibility of saving, modifying your security configurations with transparency and simplicity, without the annoying paperwork.”

Huge words I think and a very good idea. So let’s check, whether the provider is able to meet their own criterias.

Fixed returns from 2.5 % on up to 6%

Well, honestly, this is nothing what drives me. As I mentioned before I really would like to invest into P2P lending with at least 10% of interest income. At this point Iban is out as a income source in my original idea.

But nevertheless they are still offering more interest rate with their accounts than a day money provider. Some weeks ago I wrote a blogpost about my crisis fund. There I already mentioned Iban Wallet as one of the options to make an investment out of a part of my crisis fund.

The system is quite similar to offers like Bondora Go & Grow or Mintos Invest & Access. But if you compare the interest for investors, Iban is not really able to keep up with. Really? I think we have to have a more detailled view therefore to understand the meaning of those low rates.

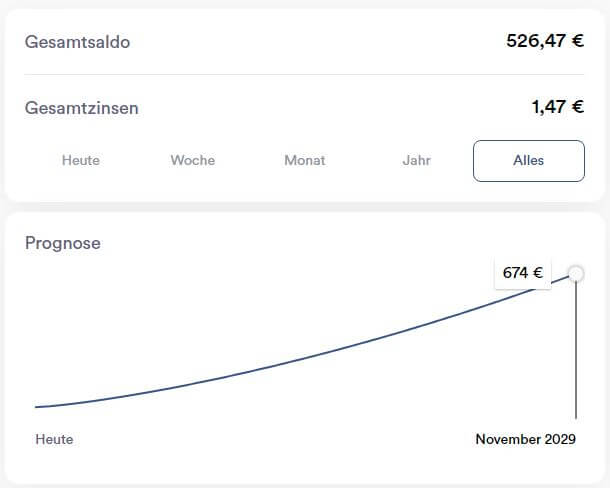

Investing money and having instant daily availabilty, you can get 2.5 % here. If you lend the money for one year, you will receive 3 % and for 3 years it is 6 %. I just tried the lowest rate for my test, therefore I cannot really tell you how things are working in longer terms.

Where is my money invested to?

As every time, the answer to this question is the holy grail of P2P lending. The more details the platform provides about their loans and their loan originator the better. As many of the investors I would like know about the risk of my investments to set it into a relation to the interest.

Unfortunately Iban Wallet is somehow not very detailled about their loans. The system Iban Wallet works for itself, so it is an auto-invest and you do not have to care about the investment into each loan. This is great news, as it meets my wishes to invest passively. But not knowing in which loan my money is invested or not being able to even know about the criteria and loan originator does not sound very trustable.

I mean, there are several platforms you are not able to find out about their loans and loan originators. But if you check several blogs and investors-profiles those platforms do not raise big funds and deposits. It is more like some people test it and that is it.

Doing some research on Iban Wallet

As the platform is not really good known until now, I invested some time for the research. On their website you do not find a good explanation or even a hint, where the money is invested to. It just says: “Iban is an online platform allowing you to invest in different accounts with estiamted fixed returns based on asset-backed-loan investments underwritten by loan originators”. Sounds great, but does not help me to get a feeling about the risk.

If you are searching for details, you will find a presention back from 2017. The company was called ibanonline then and the CEO and Founder Daniel Suero Alonso shared it via linkedin.

On the second slide it says:

“Iban connects lenders in Europe – looking for higher returns – and borrowers in LatAm – looking for lower interest rates.”

The next hint is on the third slide when it is talking about lenders

“searching for the opportunity to invest in small businesses in developing countries.”

That is not really a lot of successful information, but it is some until now. The rest of the presentation is more a catalogue why to invest the fintech-start up Iban. As it seems the platform offers loans from Latin America and spanish/portuguese talking countries.

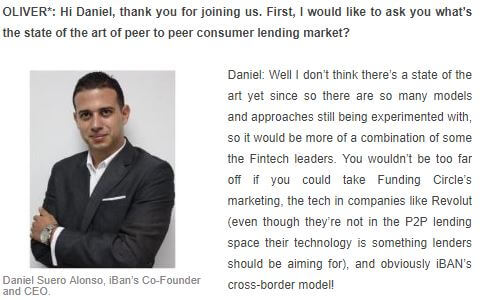

An interesting interview with the CEO Daniel Suero Alonso

While searching the web for more information I found an interview with the CEO. It was held in January 2017, which was the time, when Iban was doing another crowdfunding round to get theirself some more money. Yeah, right – Iban Wallet is completely financed via crowdfunding itself. But more to come about this in a second.

First I would like to give some interesting news out of the interview. Daniel was asked about the state of the art of the peer to peer consumer lending market. His answer was the following one.

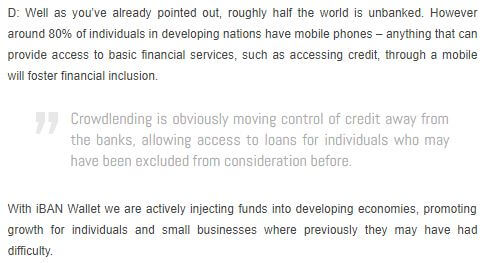

With the second question Daniel was asked “how crowdlending can help in fostering financial inclusion on a global scale?” And here we have the answer to this question, where one particual part is very interesting for our risk-research.

As you can read Daniel is talking about

“funds into developing economies, promoting growth for individuals und small businesses where previrously they may have had difficulty.”

I guess this not a proof, but still another hint that their loan originators come from Latin American countries.

And here is the video content for their Seedrs crowdfunding campain

Iban Wallet vs. Go & Grow vs. Invest & Access

I think the information do not lead to any transparany, but you will get an indication of what they are doing and offering on their platform. You are supposed to deposit your savings and the team behind Iban will manage your money on the P2P lending market.

Therefore I think it makes sense to compare it with G & G as well as I & A. Why? The products are quite similar to each other, as my money is invested automatically. My accounts will be managed concerning to their strategy and you are able to make a deposit at any time or withdraw you money. Interest is paid on a daily basis.

What do they have in common?

All three platforms are providing a very simple opportunity of investing into P2P lending. All of those are using an auto-invest for your investment. But be please be aware that none of them is a day money account.

I discussed this with with Georg from Crowdlendingrocks some weeks ago, as we were not able to find a difference between those three platforms. In our eyes there is none until now, which makes them comparable. Easy investing at its best 🙂

What are the differences?

And this is were it gets interesting. If you deposit money in your account at Mintos and Bondora and activate the auto-invest of the products, you will be able to see in which loans your savings are invested. On both platforms investors can analyze what the auto-invest is doing. Therefore they are able to calculate their personal risk-rate and can decide whether this ratio is okay to invest in or not.

Iban Wallet is different here, as you are not able to see in which loans you make an investment. Furthermore you do not even get an official idea in which countries, businesses and loan types you are investing. The only thing we were able to find out was, that it seems like there are individuals and small businesses loans from Latin America. But there is not proof of it.

Of course you have to mention the interest rate of those products. While Invest & Access is leading with around 10 % the product Go & Grow offers you 6.75 %. With Iban Wallet you are able to get up to 6 %, which is more or less the range, also the start with 2.5 % is far away from the others.

Risk management from the P2P platforms

Another big difference is the ability to see the risk management. At Mintos and Bondora you are able to see which investments are overdue. Also they are buyback-guaranteed at Mintos, there is still a rate of failing loans. Currently you do not have to take this risk as the buyback fund is paying your money. But what will happen, when P2P comes into financial crises?

I do not know.

Iban Wallet is going another way here. As you are not able to see details of your investment, but rely on their detail they are just investing in buybacked assets, they will also have a usual rate of overdue and failing loans. As it says on their website, they are managing the investments:

“Iban supervises and manages your investments: selecting the right type of loan and borrower profile”.

I guess, that the money of the investors is used to make interest out of P2P lending. Just a small part it paid to their customers, after covering their costs. With the rest they might built a fund to protect overdue und failing cases, just as Crowdestor does it the same way. Unfortunately there is just a rumour about this, but no proof.

Is Iban Wallet an investment case for me?

In September I invested 500 Euro to learn about the platform. I really like their idea of security. You have to double-check your data with a personal PIN and additionally a PIN you are send to your mobile phone, every time your want to login. This is quite new in P2P lending and is more known from cryptocurrency brokers. So I like their two factor authentification very much, because it gives me a good and safe feeling for any reason.

Today I understand, why the platform was making som much advertisements in mid of 2019. On their roadmap you can see, that is was the market entry in Germany. I think that is quite okay to do some campaigns therefore and you are still able to get 25 Euro upon your registration and first investment.

Why I invested…

I already mentioned, that I am quite curious about new P2P lending platforms for my strategy to diversify my money and my savings. On the first sight Iban is not very attractive due to the low interest rate. A lot of people turned down the idea to deposit money here at this point.

If you take a second and third sight on this P2P lending platform you get an intention about their business. The platform is quite young and seems to follow a business concept with credits in Latin America. This is quite interesting as I do not know a lot of platforms offering investment possibilities over there.

…But I will not increase my deposit there at the moment

Currently I will not put more money into it. For my feelings there are ways to much risks, which I have to cover as an investors. There is no idea about originators, the individual risk of the credit, even not a clear statement about the geographical region, where the money flows to.

Adidtionally there are some very bad reviews on TrustPilot, which makes me very skeptical. I am not able to rate it, but I have a feeling for my own. And there are a lot of reviews being very positive about Iban lusing words like “transparent” and “great investment rates” which sound a bit wired if you invested more than 2 minutes to get to know the product.

Maybe their time will come

Daily interest on my account and the possibility to withdraw my money when I want makes it easy to use. The webapp as well as the smartphone app is cool and gets you an intention of where P2P lending providers have to go in the near and far future.

Today Iban Wallet is no (more) investment case for me due to the lack of transparancy. But I guess it is a easy way to establish trust from potential investors with more proofen details and therefore more information about the risk profile.

I would recommend using it in case you want to diversify, just as I did it. Unfortunately I do not know and was not given an answer about the roadmap from 2020 on. And as you know I waited quite some time to find my deposit in my account. Sounds bad, but they paid me the interest for the days lost.

Conclusion and outlook

Still I am quite skeptical, but I think this is usual with new platforms. Just imagine they would provide 15% and more? I guess everyone will be jumping on it without taking the risk into considerating. Maybe this is the reason why I am still waiting with my investment: The current risk for me as an investor ist currently not pleased with the interest rate.

Ladies and Gents from Iban Wallet, your offer is great, your app is outstanding. I trust in you to give investors more information about your business and investment cases. Just looking good has never been successful, so please take care about the service afterwards to bringt the risk-win-ratio to a level where I would invest more money.

I have a question, they offer to put money on the account by paying with a credit/debit card. In case they go bankrupt , can you ask then for a chargeback from your credit card bank to get back your money? 🙂

Dear Uros,

thank you very much for taing the time for my blogpost. Unfortunately I am not able to answer your question. I did not tested the deposit and withdrawal via debit card. Via wire transfer I was able to make a deposit and to withdraw the money again, but I am not able to rate things in case of an bankrupcy

Best wishes,

Tobias

WATCH OUT FOR DANGER

I asked for my money back.

it took me a month to get it back on my account.

an accountant who asked me for a GNI of less than three months…

I was on vacation I needed my money and I couldn’t get it back.

I strongly advise against this application

Thanks for your comprehensive explanation on this, pls what’s the best way to invest your money or the best and authentic platform to invest your funds. Thanks

Dear Barth,

thank you for your comment 🙂

P2P lending ist currently shaking due to the crisis and several scams, which have blown up. I personally invest at Mintos and Bondora at the moment. I would also recommend Debitum Network. Check my newest Passive Income Report from March as their is a video about Debitum which might influence your opinion. Mintos and Bondora are mainly the biggest players on the P2P market here in Europe and seem to cope with those crisis times.

You were right to be skeptical, but not sure – if you will get your 500 EUR back. Based on other reviews – investors get accounts blocked, shitty support, document requests, long delays.

On top of that – company had 0 EUR revenue, 0 employees in 2019, and is now owned by a guy from Afghanistan. Does not inspire much trust…

Hi Kristaps,

thank you for your comment.

I received the money back, lucky me. Still today there are some comments from user, who are struggling with their money on that platform. Let’s hope Ibanwallet is able to bring more transparancy into their platform. I dont mind whether the owner comes from Afghanistan, China, Brazil or Germany – but you are right, that not knowing what they are doing with your money does not bring trust.

Where did you get the data about the revenue and employees from? When I received my money back I stopped informing about the platform.

I am 99% sure it is a fraud. Some facts I’ve uncovered so far:

– ibanwallet.com says that they are a Latvian company, but this company had 0 EUR revenue in 2019 according to their reports, and this company is not reachable in their address, and the phone listed does not exist. You can check this yourself in lursoft.lv (phone number), and financial reports in http://ur.gov.lv

– this Latvian company is owned by some guy from Afghanistan, who is a French resident. Not reachable. There is a LinkedIn profile with his name, but he does not respond to questions.

– there is a criminal investigation in Mexico about ibanwallet.com about their illegal operations – collecting investments, and issuing loans without any licenses, and blocking investor accounts, not returning money

– when investors deposit money to IBAN Wallet, no one really knows to which company the money is sent. And IBAN wallet is refusing to answer this or any other question. Sounds reasonable to you?

I’ve sent questions to IBAN themselves, to TargetCircle (affiliate platform that promotes them), to IBAN communication manager. No one is answering or commenting, just silence.

Hello, I´m from Mexico. I´m worried about this comment, you´ll have more information about it. With leagues and sources, as a user and investor i am extremely concerned.

Hello, Im from Mexico, currently i have investedin the platform, i have had no problem, here the platform went online is the one that makes loans to people and companies. i recomend 100% just one thing, you have the documents that ask for well-recryledged because if none is missing they don´t return you money until everything is complete.