Safety vs. interest: Is call money able to support my financial goals?

Just imagine you are going back home from an exhausting day at work in your car. The music plays and you are watching the sunset. You are planning the evening with your partner. And you are thinking about the next day in the office.

But then suddenly, you see smoke coming out of the engine. The car stops somewhere. The sound is horrible, when you try to start it but you are not able to start it again. And if you do not have a car, please imagine it would be your laptop or whatever is enormously important to earn your income. It breaks down, blows up or burns without any indication about it before.

What would you do?

In our mind we have often heard about the money safety stock. Something like a reserve somewhere, which could be used at any time. But do you really saved that money?

Table of Contents

Money safety stock on my way to financial freedom – really?

I will be aged 40 years next year. My life was okay the last years, but somehow I would like to reach out for the stars. In my eyes life is not over now. Maybe it is the male midlife crises or I am just a little bit late with starting my own way of life. I do not know and I guess it is not important to answer this question.

But usually there should be no question about the money safety stock in our lives. Any financial expert and guru tells you to have a reserve. But do you really saved it? Before the first investment? Six to twelve times your monthly income on a single account?

Honestly, that sounds horrible, right? You want to start the way to your financial freedom. Skyrocking investments and interest rates, which will give your financial freedom – and you start with a safety stock on a usual bank account with an interest rate of 0,01% to 0,05%. Awful idea, isn’t it?

I think so too, to be honest. The idea behind this reserve is clear to me. Build your money safety stock immediately. This will give your trust and freedom, because you are prepared if anything happens. Just as I described it in the beginning of this post. And I believe that the mental impact is huge. I experienced it myself.

You need something, to be prepared

No doubt – it is absolutely necessary. But there are several ideas and opinions about the size of your safety stock. And it depends from your living circumstances and living expenses. If you spend 4.000 Euro per month for rent, car and your lifestyle, you need to cover this amount.

But if you are earning 6.000 Euro per month, but your living expenses are just 1.500 Euro, you of course just need to cover your expenses on this level. The amount of the money safety stock is higher the more risks you have to cover in your life.

For example I have three kids the take care for. So my risks are pretty much higher than those from a single digital nomad living in Thailand or Vietnam. Of course this one has different risks like the health insurance, but in total my risks expressed in Euro is higher.

I do not know, what is the right amount for safety. Additionally I guess this depends on your general mindset. If you are very scary and do not believe in yourself, the amount will be very high. You will have to cover the risk of not being able to earn something the next period of time. But I am bit more relaxed about things, also I have a family and three kids.

What is right and what is wrong?

I do not know. And as I mentioned I guess it depends on several factors. It was not easy, but I have found my money safety stock. It is 30.000 Euro. This will cover our expenses for more than six months. And the most important fact: my wife is calm with it as well! To be honest the amount is her suggestion.

For me it was not important, what I calculated with several excel sheets. Or what some experts say what I have to take into consideration. I decided to set my own financial safety stock. My amount was 25.000 Euro in origin.

But after this decision I asked those people who are affected from my wired ideas of financial freedom. I think it is necessary and enormously important, that you are sure about the support of your partner (as long as you are supposed to reach financial freedom with him or her :p).

Safe your safety stock on call money conditions

As you have to take any risk out of the money safety stock you are of course not supposed to invest the money. The only thing you can do, is to put it into your bank account. Years ago there was a tiny interest rate in day money accounts. Nowadays it is just 0,01% to 0,1%.

So while setting up this blog I was like: there is so much money supposed to be, but it does not support my plans of financial freedom. How can I use this money to make money with?

Today there is no bank account of mine, which has the full sum of my calculated money safety stock. But after I crossed my first goal of 10.000 Euro I decided to start investing. Every month I save a percentage of my income to my money safety stock. But the rest will be invested right away.

Find your own, personal strategy of saving and investing

My way of doing could be right for some of you. And others will not be okay with it. I guess everyone has its own strategy and goals to reach, so I do not recommend to copy anybody. Find your own way and try to automatize it.

But just because it is the money safety stock you are of course able to work with the money. This might be a bit of work. But just imagine about the inflation, which will reduce the power of your safety stock every year by about 2%. That is 600 Euro on the full amount, which I have to earn additionally, to cover the consequences from inflation.

And this is why I split up my safety stock. I will not take any risk on 5.000 Euro. They have to be there at any time. And I want to have them on my account by one day. If our car breaks down or my laptop makes no sign anymore, I will be able to solve the problem instantly.

Is call money an option

If you just send your money to the account, you will not receive any interest on it. You have to invest some time into a solution. But this could be very interesting with a bigger amount of money. Also you are not supposed to take any risks, you are still able to make a small interest on it.

Banks often promise bounties on opening accounts or investing certain amounts of money. So you can use this amount of money to hop on and hop off with those bounties. You just have read carefully through the conditions and take care about them.

For example you will receive a 10 Euro bonus on making your first investment at Zinspilot. This website offers call money options for different periods. And there are as well options, where you are able to get access to your money within one day. The so called “flex-money” will give you an interest of about 0,5% to 0,8%. And if you are investing 5.000 Euro you will receive the 10 Euro bonus as well. So you “income” for one year will be 35 Euro to 50 Euro. This is around 0,7% to 1,0% per year.

And what about the risk?

You are just lending your money to European banks. So your money is always protected and there is no risk of losing it. The European deposit protection guarantees you up to 100.000 Euro of your “investment”.

Hop on, hop off to make your own call money

Banks and providers of investments opportunities always search for new clients. Their business model often bases on trust and laziness in the longrun. Why laziness? Usually people do not like to challenge theirself and their decisions. It is input of time they have to invest. Often it is more comfortable to watch Netflix or Amazon Prime.

Many providers make a first goodie when investing in their products. For instance you receive 50 Euro, when you invest 1.000 into an fund or any other product. People want to have those 50 Euro and make their investment. They feel good, but they do not benchmark their investment after six months. Maybe there is another provider offering a bonus?

They are satisfied and never ask again. So the provider is also able to charge fees after some time and usually people do not think about switching the investment again. By doing it different you are able to collect the different bonuses.

That is your interest rate of your “own call money account”. Of course you always have to check and rate the risk. But as long as the risk is the same for call money you are supposed to collect the bonus.

What has P2P lending to do with call money?

Please do NEVER use P2P lending in its usual way as call money. Since Mintos launched their product “Invest & Access” a lot of people think it is something like call money.

Invest & Access has the great advantage, that you are able to withdraw the bigger amount of your deposit. But you will never be able to withdraw 100% tomorrow. And additionally you are not able to influence the percentage of how much you are able to withdraw.

You have the same at Bondora “Go & Grow”. Here you are able to withdraw 100% at once, but Bondora does not guarantee the 6,75% at any time. Also it looks nice I would not rely on the possibility to withdraw your money at any time.

Just imagine a lot of people would like to withdraw their money – where does Bondora takes the liquidity from? Go & Grow are P2P investments, which are usually lend to the borrower. There is no money Bondora or Mintos are in possession of. They just provide the P2P loans from the loan originator to their investors.

Possibilities of call money in P2P investments

Some weeks ago I stumbled on “Ibanwallet”. Their business model is to invest the money similar to Go & Grow or Invest & Access. You are able to make a deposit and your receive a fixed interest rate. There are several interest-rate models. The 2,5%-model includes the withdraw of money at any time. So this is like call money.

If you check the service and business model of Ibanwallet, you will recognize, that their P2P investments are always double-secured. At first all their P2P loans have a buyback guarantee, which will pay your investment back after the loan is overdue more than 90 days. Secondly they just invest into loan, who are backed up with an asset, e.g. real estate.

Would you invest your safety money into P2P lending?

There are several ideas about it in my head. At first I will not accept any more risk on my money safety stock than I have on my bank account. Okay, maybe this is not true at all. Because I would like to work this amount for me as well, as it is quite a huge amount.

If you think about the “hop on, hop off”-strategy the money is secured the same way as on my bank account. It is just another bank which has a deposit protection until 100.000 Euro. My only risk is to lose the overview on my several accounts, but financially there is not more risk than before.

But I would like to try another possibility, as Ibanwallet sounds quite safe to me until now. I will have a try with a small amount to get an idea of how it is working. And of course I will check, whether the money is always available to be withdrawn.

Is there any different idea of “investing” your call money?

Well, maybe you judge me because of this weird idea. But I think it is of course possible to invest your money safety stock as long as the risk is not higher than on a usual day money account.

In my eyes it is always okay to make levels out of your safety stock. And depending and your levels you are able to invest the money quite safely.

Level #1: I need the money urgent on a Saturday night 2 am

Your car breaks down, you laptop gives up, you split up with your partner and need a hotel for the night – those things can happen. The idea of this first level is to have immediately money to not sleep under a bridge and eat from garbage can.

Currently here are 5.000 Euro on a day money account with 0,05% interest rate. When the whole amount of my money safety stock is filled up, I would like to increase this amount to 7.500 Euro.

Level #2: I need money within the next 1-2 days

Here is another 5.000 Euro planned, but not completely filled until today. This is mainly because level #3 is more interesting because of the interest rate. So I save a fixed rate per month on this account.

My risk? Well, we usually should get along with the level #1-money up to two months. And if the car breaks down and anyone gets fired, there is still 2 additional months with this level #2-money. I feel quite safe as long as level #1 is completely filled.

With this amount of money I am doing my “hop on, hop off”-business and try to make 100-200 Euro per year with it. That is a 4% interest rate, which is quite okay, as long as the risk the same as my level #1-day money account.

Level #3: I need the money in 1-3 months

Here is the biggest amount of money. And this one is not filled up until now (also). But I invest this money into secured day money accounts like offers from Zinspilot. I try to split the amount into two or three pieces, which I invest for a maximum term of three months.

Every month one investment will be free again and I can use for my living expenses. Within one month minimum one third is “free”, another third comes after two months and latest after three months the whole amount is available.

Today the interest rate of my investments is somewhere between 0,5% and 2,5% depending on what offers I was given. Also I like swapping accounts with this money, but the offers are quite rare, so it is very time consuming to find better possibilities for a higher interest rate.

Level #4: Money I need in 3 months and later

And here comes P2P lending. I think it might be okay to invest into P2P platforms like Ibanwallet with a double-secured safety. Of course, nobody knows what the buyback guarantee is worth, when P2P lending is affected by financial crisis.

Do I think Go & Grow as well as Invest & Access are also alternatives?

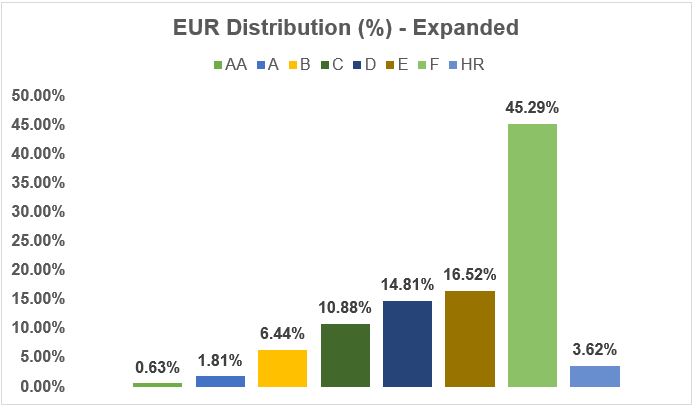

They could be, but in fact they are not. This is mainly because of their conditions. At Bondora you are able to withdraw the whole amount within 1-2 days. That works, no doubt. But you do not have the possibility to adjust in what kind of P2P loans you are investing.

Check in full here: https://www.bondora.com/blog/go-grow-portfolio-distribution-july-2019/

If you check the latest statistics the share of E- and F-rated loans increased the last months. In my eyes the risk increases and you can not be sure to withdraw your money at any time and the whole amount. 6,75% interest rate would be nice, but for a money safety stock it is too risky for my part.

At Invest & Access this problem is nearly the same. You get a much higher interest rate with 11%-12%, but you are not able to adjust the investments. While checking my usual I&A-investments in my Mintos-account I can not confirm, that the investments are more into “risky” P2P -loans. But Mintos just withdraws money from loans with a current status. The share of overdue loans is between 10% to 35%.

Screenshot from my personal Mintos account: Invest & Access

P2P lending is not an call money option, but…

Bondora’s and Mintos’ alternatives are not really alternatives. Both are good investments for sure, but not for your money safety stock. Maybe it works out, but the risk is ways too high for me. It think Go & Grow and Invest & Access are perfect products for lazy investors. People who do not want to check the auto-invest or do not want to understand the adjustment options are made for this.

Only Ibanwallet might be an option. They combine the higher interest rate and automatized investment with a double-security of the P2P investments. 2,5% does not sound much for usual investments. But for a money safety stock it is a lot – and even more than the usual inflation rate.

I will make an test in September for you and give you a first idea of it in October. Maybe the option is valid to meet my requirements for the safety stock.

What do you think about it? Where do you save your money safety stock?

Let’s discus about it and exchange ideas about it. I am sure you have great ideas to share about that topic, so just go ahead and write them into the comments.

You would like to follow my way to financial freedom? Just hit me on Instagram and Facebook and get connected.

Leave a Reply

Want to join the discussion?Feel free to contribute!