Income Report March 2022

March 2022 – the world is still spinning, war is still going on and it is getting warmer outside – that might be a good wrap up of the last month. But since we re facing different challenges like the war and several shortages of supplies the world seems like in an “onhold-modus” – another time.

I am happily back in my office. Meanwhile it got “normal” again and I really enjoy it. But beside these events my money kept working for me. That is great and we will have a look at the results in a minute.

Is there anything I might cover in this monthly income report? Or something else I should work on this blog, what you want to know? Just let me know in the comments and I will get back to you to improve 🙂

Table of Contents

Let’s get into the details of March 2021

Compared to my February Report I honestly did not invested that much during March. That was mainly because of the war, where several platforms had to discover whether they are involved with investments or not. That took a while. Peerberry was one of the first to wave their hands up. A huge share of their loans are either from Ukraine or Russia. Trying to solve this issue Peerberry invented a independet board and decided to pay the money back from their own sources. Just to get things right: Peerberry is not forced to do so, neither by law nor by moral aspects. It is the risk of investors and it is a massive move from Peerberry to go that way.

Currently I do not have Peerberry in my portfolio. But this move made me think about them. That is a good way to handle stuff. “Own your shit” – I really love it and will start investing here soon. But let’s have a first look at the numbers for my Focus Four:

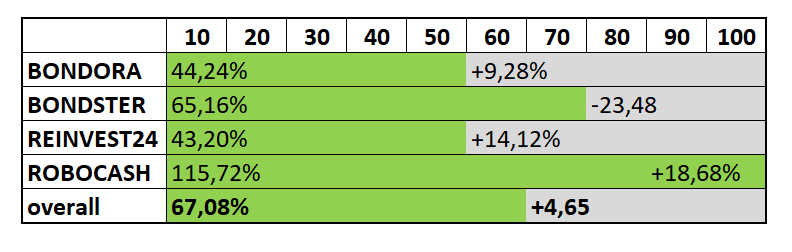

Focus Four Income Report 03-2022

Bondster’s current status: 65,16% (-23,48%)

Bondster is a platform I already reported being active in Russia with Kviku and Lime. My portfolio is invested with a bit more than 40% into Russian loans, so I am heavily into the trouble. Until now the portfolio is only “overdue” with 34%, which does not have to say anything.

It is more or less impossible to transfer money out of Ukraine or Russia at the moment. Like several platforms are saying the money still flows, but is held on accounts in the countries themselves. There is no good chance to transfer it outside the are and return it to the investors.

Bondster portfolio March 2022

On their blog Bondster says, which is exactly what other platforms are also reporting:

Following the economic sanctions imposed on Russia and the restrictions imposed by the Russian Federation itself (in particular the ban on any transactions outside Russia in currencies other than in RUB), Russian lenders are facing difficulties with cross-border money transfers.

I do not know how long the war will last. But as long as they money is paid and held in the countries, I am cool with some kind of delays. Let’s find out how I think about it in six months, but for the moment I am okay with that. Therefore it is reasonable that Bondster income dropped by nearly a fourth. I am awaiting a similar level of income next month.

Bondora’s current status: 44,24% (+9,28%)

Bondora made a bigger jump, as I invested here again. By the beginning of April I invested another bigger sum to work on my goal here. I am pretty sure Bondora is doing a great job – and they re not directly involved in the war. Therefore I think their business is “safe”, also the Baltics are pretty near to Ukraine. Of course Bondora is also affected by the macroeconomic influences, but that counts for any platform.

In the beginning fo March CEO Pärtel Tomberg held a Q&A via Youtube, where he showed the numbers Bondora is working on. In this pretty interesting session he answered several questions from the audience trying to give investors as much details as possible. This convinced me (again) and made it easy to invest my P2P share here for a while – while the others are readjusting.

Interest in investing with Bondora? Check my Bondora Go and Grow review here.

Reinvest24’s current status: 43,20% (+14,12%)

I am heavily invested in P2P real estate projects from Moldova here – which is directly beside Ukraine. Therefore I expected something to happen over the last weeks, but until now there was nothing. Last week Reinvested24 informed investors of one special project about a delay, but mentioned this has nothing to do with the geopolitical situation at the moment. Be my guest and tell me what the reason is 🙂 So for those investors who asked Viktorija had a good answer, which is absolutely reasonable.

The income this month was okay, after it dropped last month. As there are currently no more investments from my side I expect the interest income to stay on this level next month.

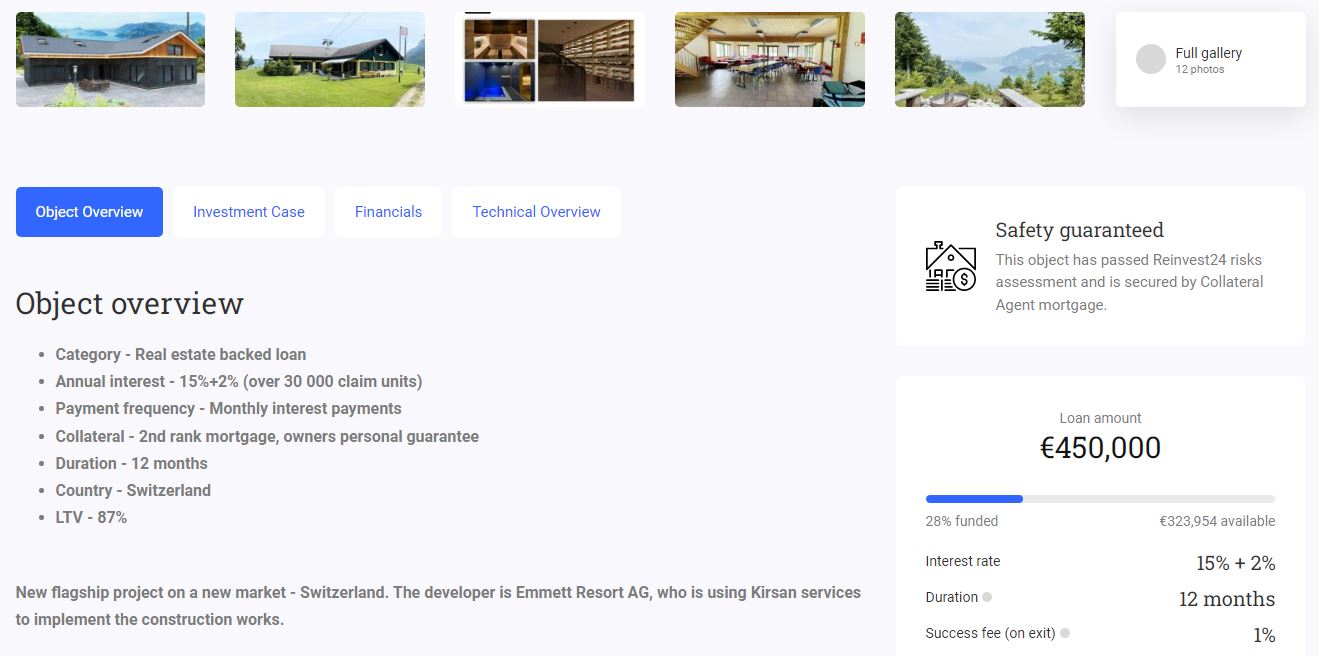

Reinvest Emmett Resort Apart Hotel – Swiss Real Estate Investment

Reinvest24 seems to discover the Swiss real estate market for themselves. Currently there is 3rd stage project in Switzerland dealing with a hotel to be renewed. Especially for a mountain lover like me it might be interest, also it is only 2nd ranked mortgage secured.

Robocash’s current status: 115,72% (+18,68%)

Robocash faced some kind of bankrun directly at the beginning of the war. The reason for investors were especially that it looks like Robocash is Russian. This is not the case. Robocash itself uses Latvian banks and has its headquarter in Croatia.

But of course Robocash is somehow related to Russia. A huge part of their team is working there.

Meanwhile Robocash was able to clear things and attracted investor with increasing interest rates. For me it has never been a question to stay with Robocash. To be honest I did not even found out about the trouble they faced – I was only reported.

Robocash’s interest income increase again above the magical 25EUR-hurdle. Therefore the process is triggered again to drop out of my Focus Four after three payments abover the hurdle in a row.

Do you want to know more about Robocash? Check out my Robocash Review here.

Review of March 2022

The war got some kind of “normal” in this world. It is weird and shocking how cruel things turn out to be normal after such a short period. And I want to be honest: It is the same with me. There is war and I hear about it, but it seems like it does not really matter to me for many hours of my day. How do people get used to this kind of stuff?

Unbelieveable, which made me think about my kind of help. I am really not the guy to donate money to anywhom. But I did, when there was some kind shoutout in my runners community. Somehow it is related to the distance you ran during a special period of time. Beside that I would like to support the economic figures there.

For example I decided to open a Peerberry account and help them earn money and cover the decision to pay back anything to investors from Russian and Ukrainian loans. Have you decided to help in this situation? What was your favourite way to do so?

The money turned out to not be my focus last month. I invested a little bit into P2P lending, but more into ETFs and stocks, which was hopefully the best decision. Unfortunately my interest income overall dropped during March. But that is reasonable for the conflicts and problems everyone can see in the world. So, let’s move on with the next paragraph.

P2P platforms to mention

As there is more than only those Focus Four platforms, I would like to mention the rest also in a short notice:

Income Marketplace: 8,32%

March was strong, but there is still some kind of delay in it. Meanwhile the account grow to over 300EUR. Just these week I had an interesting call with Kimmo, CEO of Income Marketplace. It will show you some of the content as soon as I find time to cut and work on it.

Here you will find my blogpost about the introduction of Income Marketplace.

DoFinance: 0,00 %

No words needed – still sucks.

Debitum Network: 4.62%

Well, this drop from 9,6% to 4,6% was not expected. With Chain Finance Debitum has loans from Ukraine facing the same problems like any other platforms. In the tab of investors investments Debitum added a box to check concering “Ukraine affected” to give a fast overview for investors. That is great, also my portfolio is affected quite heavy here. Totally reasonable that the interest payment dropped.

viainvest: 10,67%

Only a small improvement here. Viainvest is working on the implementation of the regulatory requierements. Still works as wished and I am happy here.

Twino: -8,69%

The loos I expected last month was now booked into March. That is okay, but looking at Twino they are working on that topic. Currently I am keeping my position on the sideline and watch how things develop.

Bulkestate: 0,00%

Once again no payment here. As the loans are all repaid at the end of a term including the interest payment this is nothing to worry about.

Moncera: 9,89%

During March Moncera was able to gain some “interest ground” and increase by more thant 1% in my personal portfolio. Great to read and nice to see – keep up the good work :p

If you want to know more about Moncera, please go to my platform-check!

What is up for me next month?

I will work on my blog here. Over the last weeks and months I have found it troubling to keep up with the topics and always find the right things to write. I would like to be better at that and therefore improve the overall topic a bit as well as especially my working style. First of all I want to reanimated my blog as well as the podcast and secondly I want to post interesting stuff again on Instagram.

That is what it is all about for me during April.

Beside that there are three projects I need to finish until the mid of 2022. That will take quite a lot of time and I will be happy to report about the first success here in my next Income Report.

Leave a Reply

Want to join the discussion?Feel free to contribute!