Debitum Network – Investing in business loans on an upcoming platform

Debitum Network is a P2P platform from Riga, Latvia. Until now, it is not mentioned, when talking about the big platforms. Their concept about P2P lending differs a bit from the rest of the market, so it is worth to take a look. I really like their website-design as well as the design of the platform. But this does not bring interest into my account, so let’s check the substantial facts of Debitum Network.

Table of Contents

Debitum Network enables you to invest in businesses

I really like the idea to lend money to people, who are working with it. Create new things, products or services is even more inspiring to me, than financing the new 43” TV. So Debitum Network had my full attention from the first moment on. All of their projects to be financed on their platform are business loans. This has several advantages for me as an investor.

Neutral rating of business projects

When you want to invest in P2P lending, your decision should always base on a rating. Usually you do not know the person you are lending money to. This is why you have to trust in the rating, which is give to the P2P loan.

Debitum Network uses the score of third parties. So they do not rate the loan inquiry themselves. On their website you can check the partners, they are working with. Most of the partners are linked to their website, so you can check them as well.

All P2P loans are asset-backed

In one of my last posts I was talking about P2P lending. Especially trust is very important here. It is the base for everything, which is interesting for me as an investor. Debitum Network finances so called “asset-backed loans”. This is quite usual for business-loans, but worth to explain. So the people of the businesses use their assets to give more trust to the loan.

From the sight of an investor this gives me a good feeling. Whereas private P2P loans are sometimes hard to understand and not asset-backed, this kind of trust convinces me. Also, you do not see, what assets and how much asset value they have brought, it is still “something more”.

Buyback guarantee from the administrating broker

I love buyback guarantees. Also, I am not really sure, what their value is in times of a crisis, it is still a good feeling. Additionally, for me as an investor it brings another amount of trust. When the loan is asset backed and additionally with a buyback guarantee it is hard to believe, that my invested money will be totally lost one day.

So for my point of view my personal risks seem to be as low as possible. And concerning my target of financial freedom the platform Debitum Network seems to be a good choice to invest in. Due to their size and the small experiences I found about them, I will start with a smaller amount. As the P2P platform works for me and interested is paid, I will think about raising the invested amount of money.

Let’s invest on the Debitum Network platform

Usually I am not really into design-things. I do not need candles or decoration stuff for Christmas. As well as I do not need fancy things in my office. My walls are white and there is just one plant in my office. I call it the “decadent emptiness”.

When I was exploring the platform of Debitum, I was impressed by their design. I have seen some platforms before. Usually they are reduced to the bottom of information. The platform frontend of Debitum is designed in a quite stylish way. I really like it, because it makes navigation easier for me. In the end this is just a point for myself, but nothing which pays interest. So let’s just turn to the moneymaking issues.

Easy registration and creating an account

You just have to register with you name and your emailadress. In fact that is that easy as it sounds like. Additionally you have to choose a password. While typing it, you are shown bars and hints to improve the quality of your password.

I always try to use passwords, which are hard to crack. There I use the password generator of lastpass.com. There are even more generators to be found on the web. Just search for it in your favourite search engine.

After everything is entered you just need to confirm your emailadress. Afterwards you are able to enter the platform with your emailadress and password.

On a tour around the Debitum-platform

When signing in you will get a notice to be shown around. This notices is shown with every login, as long as you do not quit it.

So for the first time it is quite interesting. In a few steps the platform shows you around.

KYC-legitimation to receive interests

With registration your Debitum Network account you are able to deposit and invest money. That is quite cool and very fast. BUT you will not make a withdraw from your account, unless you have done the KYC-legitimation.

KYC is the short version for “know you customer”. This is process is absolutely necessary and is nothing you have to be afraid of. Usually you are walking into a bank and legitimate yourself with your passport or your ID-card. So the KYC-process is the same handling, but online and digital.

Your first deposit

Of course you are able to browse through the platform, but I am interested in passive income. And I want to show you Debitum Network, especially if this P2P platform is able to generate passive income for me. So I made my deposit of 250 Euro at first.

Exploring the Debitum Network Auto-Invest

As it is my main goal to generate passive income, I want to use the auto-invest. This works based on requirements, which I can adjust. So at first I need to setup the auto-invest and afterwards check, if it works the way I want it to work. Let’s see, whether I am able to.

Self-constructed auto-invest

When you browse through the platform, you will find a rocket-symbol on the left side. With a mouse-over you will be shown “Auto-Invest”, so please click it. You will be directed to a completely empty page. There you are forced to “create a new plan” for your auto-invest.

At first I wished to a little bit more support here, because it looks empty and not really useful. But let me explain how it works and in which way Debitum supports you. Necessarily you have to create a new plan for your auto-invest.

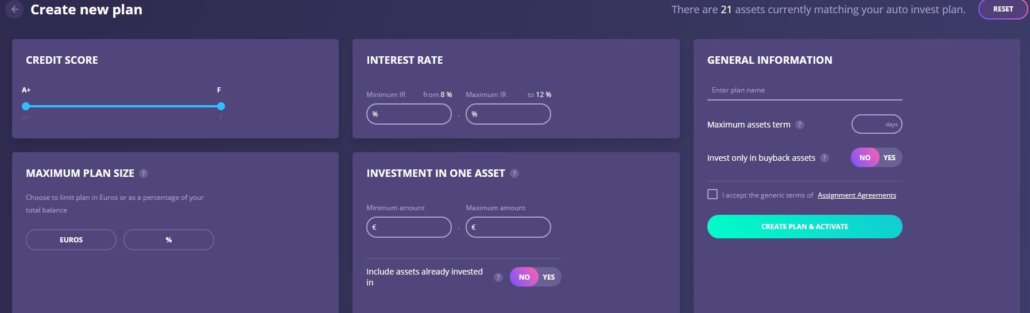

Choose your own conditions at Debitum Network

Now you can see, which conditions you are able to manage within your auto-invest. I would like to maximize my interested. Therefore I will adjust it to the most secure way of interest-income. The first button I click on “yes” is the “Invest only in buyback assets” on the right side.

Credit Scores from A+ to F

The credit score is one of the most important indicators. Debitum Network is working with third party scoring. This makes the credit score quite independent from the platform itself. When you have a special tend to invest secured, you can choose A+ to A. More risky will be every score below that rating, also you will receive more interest on those P2P loans.

I do not mind about the credit score. As long as the P2P loans have a buyback guarantee, I feel safe. So I will not adjust anything here. For me this additionally some kind of diversification. Investing in all credit scores will kick the interest.

Choose the interest rate

Well, I am always aiming for highest interest I get. But I will not be able to invest everything at this rate, because there will not be that much P2P loans at that level. So I setup my minimum at 8%. This helps me to create passive income.

If there are P2P loans with higher interest, I will enable the auto-invest to lend money therefore. There I take a 20% for the second rate.

What is the maximum plan size at Debitum Network?

I am now creating a new plan for the auto-invest. I do not want to have a minimum balance on my account. BUT if you are interested in having maybe 100 Euros in cash on your account, just fill in the value in this field.

I want all my invested money to work for me. This will lead to the maximum of passive income, so therefore I fill in “100%”. This leads to a zero-balance on my account, as soon as there are available P2P loans to invest in.

Adjust your diversification

If you lend 100% to one P2P loan, your risk is quite high. Also if this loan is secured by a buyback guarantee.

Why?

You get your invested money back. But you do not get the interest on your investment. Your risk is to invest money, but get no interest. Therefore I will set the maximum amount to 10 Euros.

This will lead to a diversification among a lot of P2P loans with a small invest. The more loans I invest in, the more risk is spread.

Below this adjustment-fields is a comment. It says “include assets already invested in” with a yes/no-button. If you invested 5 Euros into one asset, but have set a maximum amount of 10 Euros, the auto-invest will invest another time.

I will not activate this button, because I do not have any experiences until now with Debitum. I will keep this adjustment in mind and see what will happen the next weeks with my investments.

General information for the auto-invest of Debitum Network

In the last adjustment-field I am able to give my auto-invest a name. Furthermore you can adjust the maximum of days the investments are available. Usually and as far as I can see the P2P loans start all with 30 days left to be financed.

Just as an example: If you take 30 days as a value here, you investments can fail and you will have to wait another 30 days. As I already mentioned I want my money to work for me. Therefore I will set this field to 15 days. I will also keep this value in mind and check, whether is okay for my plan or not.

I already mentioned that I put the button for buyback guarantees “on”, to secure my portfolio on Debitum Network. After accepting the “Assignment Agreements” you can choose “Create Plan & Activate”. Now the plan is live. I am excited what will happen the next weeks. Will it work? Or do I have to edit it?

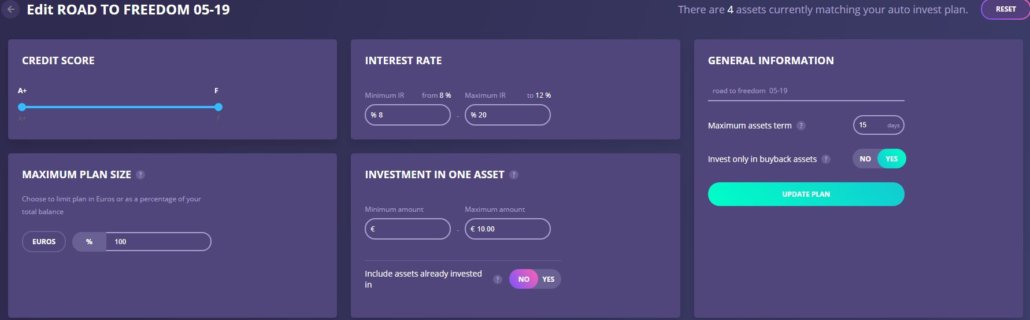

Edit the auto-invest with new information

On my screenshot you can see, that just four P2P loans match my current setting. When I want to invest 250 Euros with a maximum of 10 Euros each investment, this auto-invest will not work properly. Editting your auto-invest is easy. Just login and edit your plan. You update it with confirming “update plan”.

My mistake was to reduce the days in the general information. You can always see in advance how many P2P loans match your criteria, when you check the screen on the upper right side. I will find at least 19 available investments, when I set the value to “blank.

Investments within minutes

After setting the auto-invest and afterwards updating it, some minutes went by and all loans available were reserved. There are still 50 Euros in my account. Checking the auto-invest again there are no more loans available at my settings. I will leave things as they are. My auto-invest will invest the 50 Euros soon.

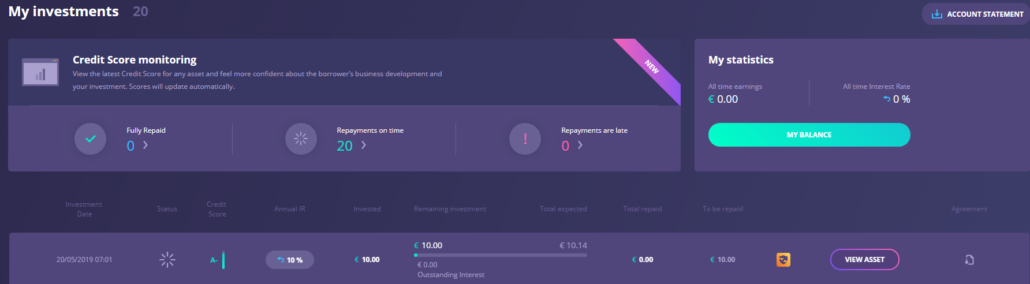

Investments overview on Debitum

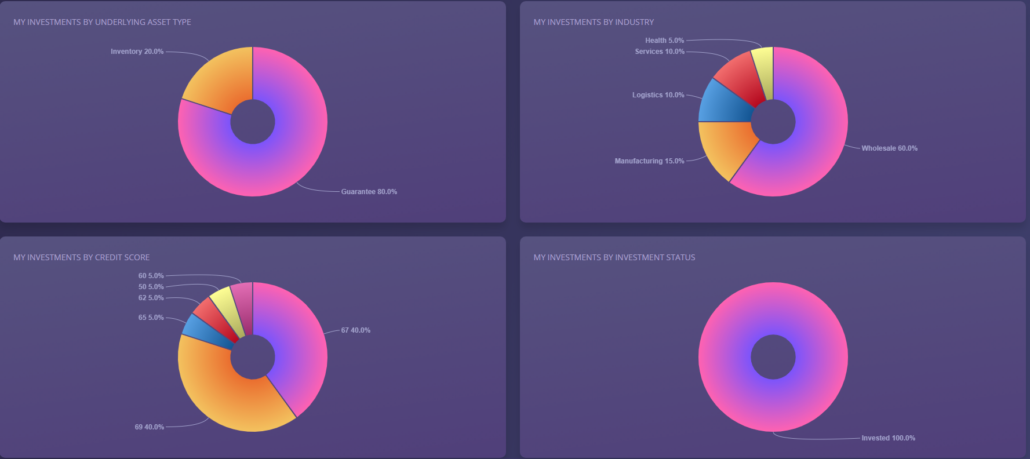

Now I can check the dashboards. You need to have some investments therefore. At first I can see in what investments the auto-invest invested money. I do not mind about that. You can find a lot of information about your investments. But you do not have the opportunity to cancel the investment, therefore I do not care.

Until there are no repayments the report “My repayments” is empty. I expect some information to given in that report by the next portfolio-update in June.

Within the report “Transaction timeline” you can see the several transactions of your account. I can see my 20 investments. Until now I can not see repayments, because there are none. Next time I will show you the dashboard with real data.

My “final” resume of Debitum Network

I really like the way Debitum Network works. Business loans whereas business developers can expand their business sounds very good to me. No additional TV or car or whatever, but usually something tangible.

The platform itself convinces me because of the design. The platform-frontend for me as an investors is a little playful, which I really like. You do not get interest on that gadget. But, the dashboard is still cool from a point of design but as well as from the point of information.

Setting up the account and creating the auto-invest was quite easy. I found a lot of information about nearly any field I have to work on. With a mouse-over the question mark I received the relevant information. Additionally I can read what my filled in value will cause. This makes me confident to do the right things.

Future times will show – do you invest too?

Also I am not able to make a final resume about Debitum Network I am quite excited about the things to come up with. After the first months I will be able to rate the platform better. Until now I do not have any experiences with their repayments and interested payed, but those are to most important things for me. Let’s wait for the updates the next months and I will get back to you.

What do you think about Debitum Network? Let chat about it below this blogpost and share opinions!

Leave a Reply

Want to join the discussion?Feel free to contribute!