Why Bulkestate made me break every investment rule

Bulkestate is a P2P lending platform offering investments in real estate projects mainly in Europe. The Bulkestate ÖÜ was registered in 2016 as a financial institute in Estonia. On their platform different real estate projects are offered to the investors. Beside several information about the project, the yield and time frame any investor can take part in the investment.

Baltic real estate for everyone? Yes, exactly. Investing in an european area of increasing economics does not sound like the worst idea!

Table of Contents

P2P lending in a different way with Bulkestate

If you check the P2P lending platforms you get an impression of how the lending is organized. Usually the borrower gets in touch with the platform and offers his loan. The P2P platform than rates his financial background and additionally makes a loan offer to him including the yield. So, the P2P loan mainly depends on the financial situation as well as the risk of the loan.

Lending and investing on Bulkestate works similar. But while checking the projects as an investor you get much more information and additionally an impression about where your money should go.

More information secures an investment for yourself

In the early days of P2P lending you also had this information on several platforms. I remember my first investments on Mintos, when I saw the details about an investment in a P2P loan. There was the real name of the borrower, the address as well as sometimes the telephone number.

And of course, you were able to see his income report and what he needs the loan for. But those times are over since years and you are hoping for your money and trusting the rating agencies from the platforms.

Real estate investments are a bit different. This is mainly because of the good the money is invested in. A new car, tv or holidays do not have a value itself, which can be sold on the same price level as they were bought. The value of real estate is decreasing ways slower and quite easy to cover. This is mainly the reason why people love to invest in real estate.

Check the information and rate it yourself

Who can rate real estate investments best? Right, real estate experts. The Bulkestate team has several of those experts, who worked for different real estate companies before. Igors Puntuss and Sandis Brengulis are mainly those being responsible for the offered investments as they are mentioned on the Bulkestate website.

Within the investment offer the investor gets quite something like an expose. With this information you are able to quote the project for yourself. The real estate experts give their point of view. As I do not know the real estate market in Riga, Tallinn or somewhere else I am quite thankful the be able to receive such valid information.

I was introduced to the business model of Bulkestate mainly by Kaspars Pēkšēns and Timo Neu. As both mentioned Bulkestate is very busy financing refurbishment works on real estate projects. The main goal is to higher the quality level to sell or rent the real estate later. Sounds quite logical, doesn’t it?

What a team at Bulkestate

Sure, marketing is an important aspect while trying to get investors. But when you are able to meet the leaders, developers and of course the support on a fair like the P2P Conference or even the INVEST Fair in Stuttgart they seem to be convinced. This is what gives me a good feeling about my small test-invest.

As I was not able to talk to anyone I still got a very good impression of what Bulkestate is doing. The business model is not fundamentally new. Estateguru for example as one of the biggest and oldest P2P lending platforms for real estate is ways bigger than Bulkestate. Talking to the Bulkestate people I felt something like “Let’s rock the market”, which I liked very much.

Back to business: What are the facts about Bulkestate?

Also, I like the people at Bulkestate, I am still on my way to financial freedom. Money is quite emotionless, so I have to reduce anything down to the bottom again. For sure, Bulkestate is not the biggest P2P platform on the market – until now. Today they have nearby 10.000 investments with an average loan term of 12 months. The weighted average annual return displayed with 15,53% on their website. The P2P platform has about 3.600 investors, whereas Estagurus has 25.000. Just to get an impression of the platform size.

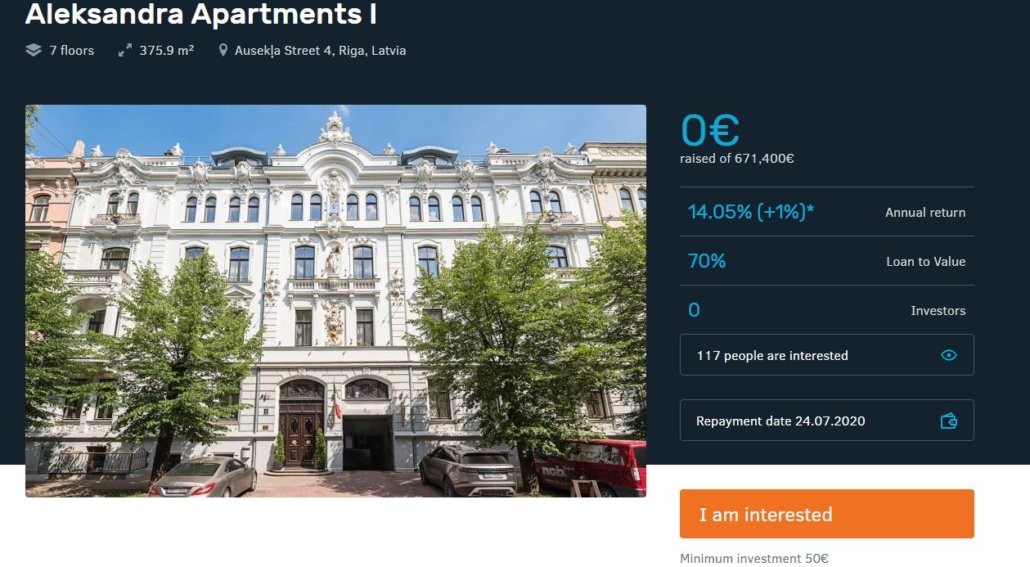

Becoming an investor at Bulkestate is quite easy. But you have to know the terms before, as they differ from the usual P2P lending terms. Your minimum invest per P2P loan is 50 Euros, which is quite a lot in comparison to Mintos (10 Euros) or Bondora (1 Euro) but the same as at Estateguru (50 Euros).

No buyback guarantee, but secured real estate projects

As the P2P loans are secured with the real estate itself, there is no special buyback guarantee. At first this seems to be a disadvantage. If you are into the business model of Bulkestate you are able to understand, that the investment into the P2P loan is always with priority. So, if the project fails and the loan is no longer repaid, Bulkestate is the first one to receive money from the sale.

Until today there were just a few cases as I was told in Riga on the P2P Conference, but all of them have been solved. That means that any investors were paid back their investment. It could take some time, as a buyer has to be found for the project. In relation to the buyback guarantees of Mintos for example the risk for the investor is slightly higher due to the waiting time and uncertain result.

Bulkestate: Crowdlending and group buying on one platform

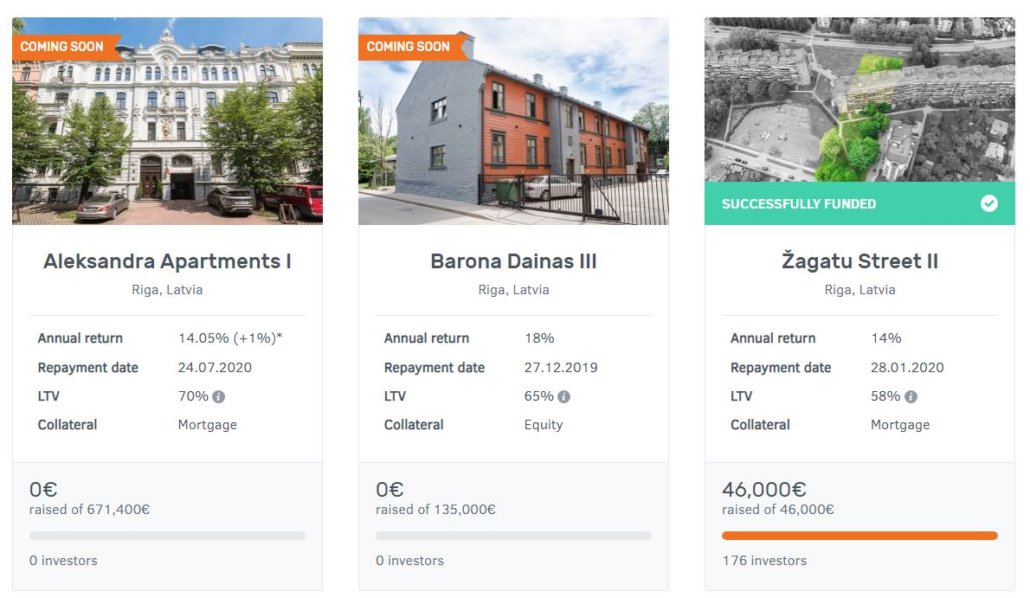

Bulkestate offers their investors two different types of investing. On the one hand you have crowdlending at its best. A lot of investors put together their investments beginning at 50 Euros. With the sum, as it matches the loan completely, the project is financed. If not, the investors are payed back their investment without any yield and the project is stopped.

Group buying is near to crowdlending, but totally different. Usually the investor invests in loans, whereas he receives his yield from. Offering a group buying deal the investors invests in the real estate itself. Afterwards the yield comes from the rent. As Bulkestate manages the project they get e rent from the resident. Sounds great, BUT if you want to sell your share of that project, you need someone to buy it.

The focus of Bulkestate is clearly on crowdlending for real estate objects. The are a few group buying projects, but in comparison to the real estate investments it is minimal. In my eyes the group buying idea is a good one. If I do not need the money today or in future times and just want to receive the yield, it is great. In case I need the money in future times the investment case is not interesting, as I can not be sure to sell my share in time.

Investing manually or by auto-invest?

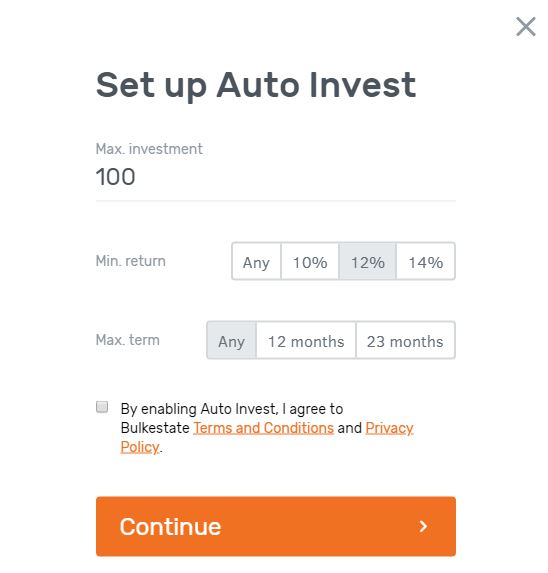

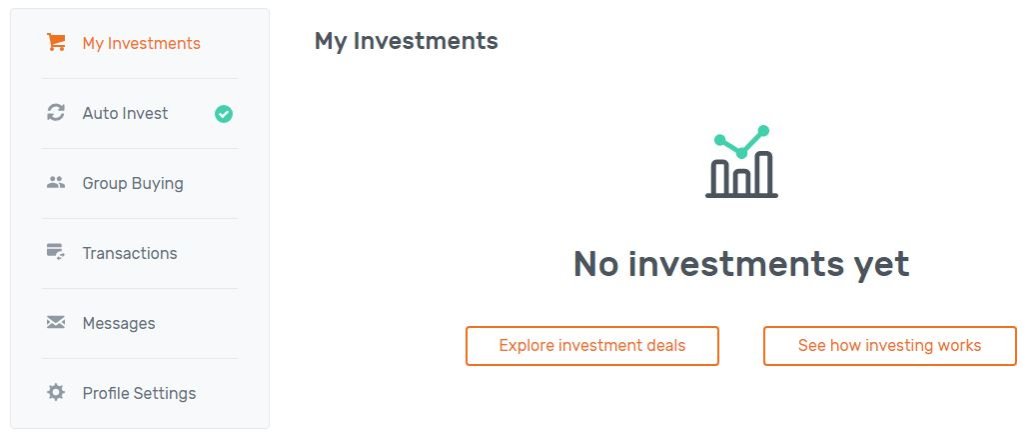

For me one of the most important requirements is the auto-invest on a P2P lending platform. Of course, Bulkestate is offering an auto-invest for their investors.

In your account you will have an own area for the auto-invest. But in fact, you just have to configure three parameters.

How much shall I invest in each real estate project?

As you know Mintos from my blogpost or Debitum, their minimum investment is 10 Euros. If you click on “Invest” it just takes some minutes, until your deposit is invested. That is quite different at Bulkestate. Due to their size and additionally the initial work for one project, there are just a few projects to invest in.

Your minimum real estate investment is 50 Euros at Bulkestate. I even raised this minimum invest in my auto-invest, because it will take some time until the deposit will be invested. So now I try to work with 100 Euros in the auto-invest and will maybe change it later.

Of course, this is not the way to diversify correctly. But to not invest in real estate is a bigger problem for my assets, so I have to cope with those circumstances. Additionally, I am not willing to wait until the end of the year to see my deposit being invested.

How fast is the deposit invested?

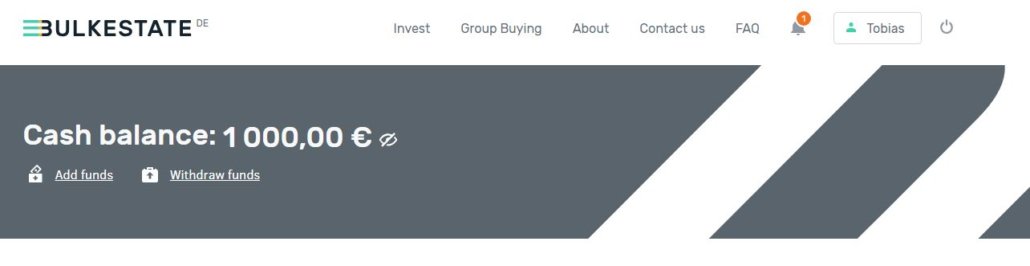

I made my deposit of 1.000 Euros by the mid of June. Until today, which is nearby one month later, “just” 200 Euros are invested. So, the P2P platform is not that liquid as other platforms are. In my eyes this is no disadvantage, just something you have to get used to.

I guess you also have to recognize, that Bulkestate is an increasing P2P platform. They made quite a lot of marketing at the INVEST fair in Stuttgart and at the P2P Conference in Riga. So, there are a lot of new investors, which are interested in lending money into the projects. Talking to Kaspars from Bulkestate he informed me, that there will be new projects soon.

As I am interested in the long run, I will wait. Let’s say another two to three months, until the whole deposit is paid into the real estate investments. Of course, I am losing a yield in comparison to Mintos for example, BUT my diversification will raise, and my risk will decrease by investing on another platform into different assets. When calculating the notional “loss” it is just 14% from 1.000 Euro for three months.

What are my future plans with Bulkestate?

Checking the frontpage of Bulkestate you see, that the average yield is about 15,53 %. The average LTV (loan to value) is 54,08%. Those indicators are convincing me to make a real estate investment here for a longer period.

And what about my passive income?

Well, the yield of 15,53% seems to be very attractive. Until now my personal (expected) yield is 14,50% in my account. I am cool with that, but of course I will try to beat the average with the outstanding 800 Euros, which are not invested until now.

I am quite relaxed and guess the money will be invested soon. Until then, I will not make any additional deposit on the Bulkestate platform. Let’s check what time will show and evaluate it later that year.

Something personal about Bulkestate

Investing money into projects should be without any emotion. For me this is impossible here. Bulkestate made an impressing job in their marketing at the INVEST fair as well as at the P2P Conference. I felt very well informed as an investor. Also, after the conferences the email support was great when all my questions were answered.

I feel very safe when investing on Bulkestate, as the team and their vision are great. There is also nothing to complain about in their support. Personally, I think it is a real advantage for investors, when the CEO Igors Puntass is talking about the few problems they had. He was critical with himself but showed how he solved the problems. And everything without any loss for the investors.

Lets evaluate Bulkestate

For my plans to reach financial freedom Bulkestate offers a huge chance. The average yield is about 15,5%, so the passive income from this P2P platform could be massive.

Today, I will not invest more money until my deposit is completely invested into real estate investments. Afterwards I will evaluate my personal yield and risk again, but I guess I will invest even more. It is just a matter of the investment-possibilities on the platform.

To be honest I really like the way Bulkestate works and how their employees are infected by the idea to rock the market. They have a great team, so there is no doubt about the motivation. I think the way they are going is the right one, so I am of course invested to be part of the story and to make Bulkestate part of my story.

Let’s see the next how huge the impact will be ?

Do you want to invest into real estate investments at Bulkestate? Just click on the link!

Leave a Reply

Want to join the discussion?Feel free to contribute!