New P2P Platform-Check: Getincome / Income Marketplace

Getincome or Income Marketplace is a quite new P2P lending platform, who focusses on securing investors money. That sounds pretty good on the first sight. In todays blogpost I will try to find out, what Income Marketplace is about. And of course trying to find an answer to the question whether their platform is more safe for investors than others.

For investors and also interested investors there is the chance to meet CEO Kimmo Rytkönen on 04.09.2021. Lars Wrobbel, the pope of P2P lending in Germany, invited him to his monthly community meetup via Zoom. If you need any more information, join his Telegram channel and check the post from 15th of August. The content is mainly in german, but during the meetup with Kimmo it will be probably english.

Table of Contents

What is Income Marketplace about?

Trying to find some information about the P2P lending platform is not that easy. It was launched in the beginning of 2021, so their story is pretty short. Looking on my overall ratings of platforms their track record is near to zero – but only keep that in mind and do not stop reading here.

I was a bit confused as the platform calls himself “Income Marketplace” – but if you google it, you will find them on getincome.com. And on this website you will find again the company imprint, whereas it is registered in Estonia with an adress in Tallinn.

On the website inforegister.ee you will several information about the company like number of employees, paid taxes and so on. Feels a little bumpy and not really straight to find out about that.

But let’s focus on that Income Marketplace is about?

On their website it says:

“The Income Marketplace started from the idea of providing people with an easy and secure way to invest. […] Due to our deep knowledge of consumer lending and structured investments, we decided to start with consumer loans, but our long-term vision is to expand into multiple quality asset classes”

Sounds pretty familiar, doesn’t it? Down to the basics and really down to earth-statement. Due to their short track record, I checked the person behind Income Marketplace.

Screenshot from Incomes website

Who stands behind Income Marketplace?

First of all you have to mention Kimmo Rytkönen here. He is also listed first on the Teams-page on their website and mentioned as “CEO and founder”. Kimmo left the University of Lincoln with a Bachelors’ degree in Management & PR.

After leaving the univsersity there is a long stage on his CV as founder of Aasa Polska SA. The company scaled their business during Kimmos lead and is one of the best known consumer credit companies in Poland. Aasa Polska SA was also listed as a loan originator on Mintos from 2017 to 2021.

Kimmo Rytkönen, CEO and Founder

From 2016 to 2019 Kimmo also launched Supernova JL, which is somehow related to Aasa Polska. Supernova is the parent of several european consumer credit companies operating across Europe. Here Kimmo worked as Group Chief Executiv.

In the end of 2019 he left the group to “pursue a new venture in crowdfunding space”. Beside all of those businesses Kimmo is also working for PT Bank Amar Indonesia Tbk. This joint venture became the largest Fintech lending venture in Indonesia.

Secondly we have to take a look at Mikk Läänemets, the Co-Founder of Income Marketplace. On their website Mikk is introduced as a lawyer who “has significant experience in structured investments and the legal environment of consumer loans.”

Checking his CV on LinkedIn you will see, that he graduated at the University of Tartu, Estonia with a Bachelor and Master in Law. From May 2015 until 2018 he worked more than 3 years for Supernova JL and Aasa. After he left he joined Skeleton Technologies fulltime, where he was already member of the board since 2015. In late 2020 be joined Income Marketplace.

Mikk Läänements, Lawyer and Co-Founder

A team of experts

So, to sum it up: Income Marketplace has a founders team full of experience in the area of P2P lending. Of course both worked in the same companies, but still it is a lot of experiences on different fields of the topic of consumer lending, which is brought into Income Marketplace. Following the official stats Income had seven employees by the mid of 2021 working for the platform.

Also the track record is quite short, the persons behind Income Marketplace are pretty experienced in the field of P2P lending. That does not make the track record “better”, but for investors it gives you the good feeling of investing your money into a platform where the steering-founder-team is experienced and knowing what they are doing.

Is it safe to invest with this P2P lending platform?

There are a lot of reasons to take a closer look at the safety of a peer to peer platform. Those of you who are reading this blog since the very beginning know, that I love to diversify among those platforms, who have high ratings in my personal ranking.

Platforms will only be able to receive points here, when they have structured products with detailed informations. Absolutely following the rule “Never invest into something, what you do not understand”.

Let’s check what Income has to bring to the table here. In the last paragraph I talked about the founders team, which has quite a lot of experience. There is only one little detail, which I wondered about. Checking the past snapshots of their website there has been a COO, who was listed as founder.

It seems like Meliina Räty left the company in 2021, was in her LinkedIn feed she is now working for Tolaram Group. Kimmo also shared a post searching for a COO. Meliina shared this one as well saying it is a great opportunity to join a great team. Sounds like very smooth and nothing to worry about for investors.

Coming back to the topic, I would like dive a bit deeper into the security of the loans, which are published on Income Marketplace.

Type of loans on Income Marketplace

When starting off the platform published consumer loans only. That is quite easy to understand as the founders are very experienced in that field. On their website it says:

“Due to our deep knowledge of consumer lending and structured investments, we decided to start with consumer loans, but our long-term vision is to expand into multiple quality asset classes to offer our investors.”

To be honest, there are a lot of consumer loans in my P2P lending portfolio. It seems to be the easiest way for platforms to find and publish to their investors. But I really like the long-term idea of Income Marketplace, when they talk about adding “multiple quality assets classes” to their portfolio in the future. Things like business loans, real-estate loans or also agricultural loans are very welcome to my portfolio.

Looking at it with the first sight it does not really make a difference, but as I mentioned I love the roadmap to expand into other asset classes.

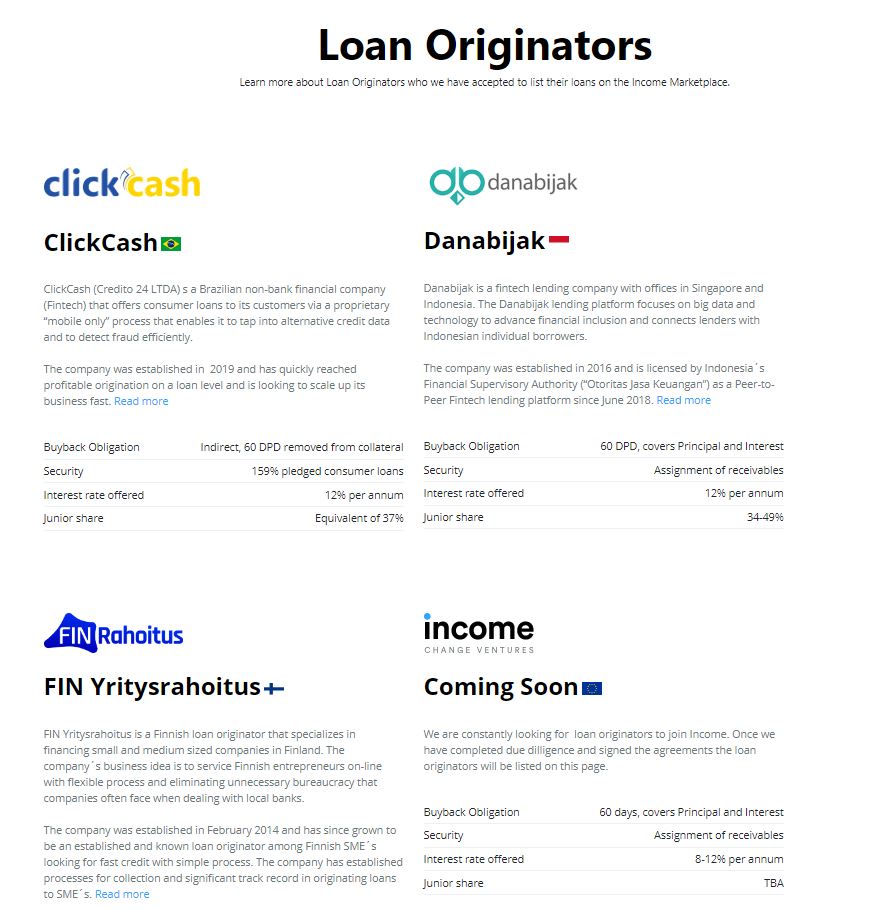

Who are the loan originators and what do they offer?

Income Marketplace has an own area on their website to present their loan origininators. That is really cool – I think. For a pretty new platform this means trust for investors when talking about their business model.

Currently there are three loan originators listed:

- Clickcash from Brazil

- Danabijak from Indonesia

- FIN Yritysrahoitus from Finland

Loan Originators of Income Marketplace

Thus itself is nicely diversified. When writing this blogpost any of the loan originators had published loans where investors were able to invest in.

I cannot really rate their share on the whole portfolio, also it looked like a big share from Danabijak, but that may differ from day to day. My whole portfolio was invested into Indonesia, but it was only a pretty small amount.

All of the loan originators are offering a so called buyback guarantee. You might have heard of it, also the critics. This BBG is a good service, when everything is running smoothly and a lender gets into trouble. For investors it is senseless, when the provider itself providing the BBG gets into trouble.

For me personally buyback guarantee are essential for investing. It think it is a sign of quality to offer it to their investor. But investors should never rely on this one and keep diversifying their investments, as the buyback guarantee is not a guarantee as we think it is.

What interest investors should expect?

The most interesting question for most investors. There is a reason I put this one to the end, as I hope you guys are also reading the rest. A high interest is great – but it is useless if interests and buybacks are not paid because of a scam or bankrupcy.

Income Marketplace shows an official interest rate of 11,81% on their website. In their slogan they say “Earn up to 12%” which is a hint, that there interest rate will not raise above 12%.

Acc. interest rate on Income

For me that is great. You should not expect those 11% or 12% as there as plenty of loans with 8% and a bit higher. So investing bigger amounts diversified among all loan originators will automatically decrease your interest rate – but increase your diversification.

What is different to other P2P lending platforms?

I already mentioned the buyback guarantee to you. Income Marketplace offers investors more security than that. And to be honest, this is a big deal for investors – and it was the reason for me to test the platform.

Income has a so called “Cashflow Buffer” and a “Junior Share”. I will get into these details right now, but let’s point it out: THIS is something others do not have in that size.

Bondora Go and Grow is working with a kind of buffer, as the interest rate is fixed at 6,75% and everything above goes into the fund to make it liquid for investors.

Also Crowdestor uses some kind of buffer, when a share of the investors money is stored in a special “recovery fund”. As we have seen this idea is good, but useless if the number of overdue cases rises to 50% and more.

So let’s check what Income has to offer for their investors here.

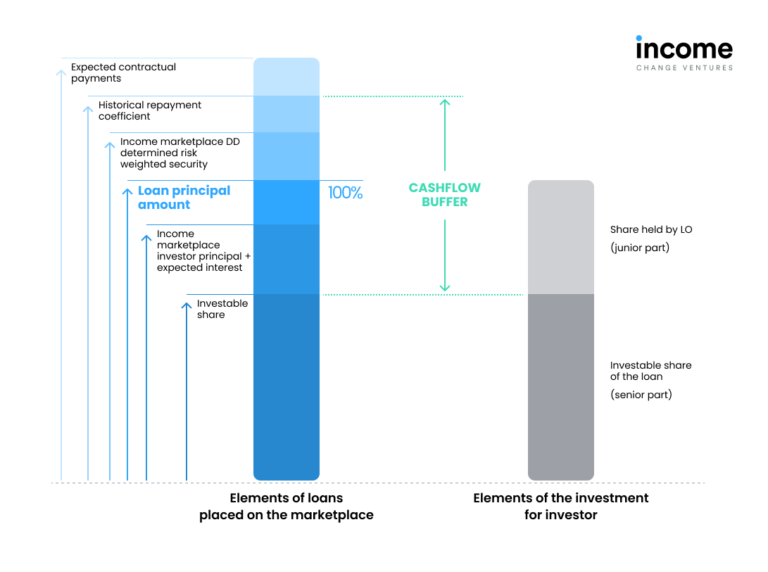

The Cashflow-Buffer

Usually P2P loans include at least two main risks. First of all and most common is the case, when the borrower misses to pay his debt back. This risk is nowadays often “solved” with a so called buyback guarantee. I explained that vehicel earlier, where the loan originator repays the loan to their investors after a grace-period of about 60 days.

The idea behind a buyback guarantee is to secure the share of overdue loans and defaults who are “carried” from the rest of the portfolio. If you for example have a 10% default rate, the other 90% of the loans repay this with their interest payments. It is a kind of cross-payment, also the loan originator of course tries to get the money back from the borrower also after those 60 days.

Secondly we have to mention the risk of a loan originators default. There are several reasons why this could happen. And especially during the last 1.5 years we have seen a lot of them. Just check the long list on Mintos, where some loan originators went bankrupt or had others reasons for not being able to repay the investments.

If a loan originator goes down, he takes the buyback guarantee with himself. This is pretty easy to understand: Imagine the share of defaults rises to 50% or more – where should the money for the repayment come from? It will not rain down on the loan originator. Looks like it is more a fact of mismanagement, when too many loans went into a default.

How does the Cashflow Buffer and the Junior Share are working?

Cashflow-Buffer against the LO default risk

The Cashflow Buffer tries to solve the second risk. Therefore the loans are rated into seperate risk classes, on which a kind of provision is held back. Imagine a loan with rating of A+ which will lead to a small amount. An F-loan has a pretty bad rating, whereas the amount is ways bigger.

Now, what happens if a loan runs overdue?

First of all the loan originator covers the repayment and interest payment with his buyback guarantee. But if the loan originators goes down, Income steps into place and repays investors out of the Cashflow Buffer. It is the last money reserve to repay investors from and a kind of safety net others do not have in that size.

But before paying money out of the Cashflow Buffer, there is another security fact, which we want to talk about.

The Junior-Share

Looking around in the area of P2P lending we will find the so called “skin in the game”. There are several P2P platforms and/or loan originators who are skin in the game. Meaning, they invest their own money into a loan up to a certain share. Commonly there is a share of 5% to 10% skin in the game on those platforms, who use this kind of trust-building investment.

For investors this is a sign, that the loan originator or platform himself believes in the quality of the loan and puts his own money “at risk”. Of course, they will receive the interest payment, when the loan is repaid.

But what happens, when the loan defaults? Right – both, investors and skin in the gamers do not receive their money back. It is like saying “Oops, we did not expect that”. In my eyes this okay and still the skin in the game-thing is trustworthy, but Income constructed something new here.

The Junior Share is a seperate share on each P2P loan, which is paid and held back. It is not invested. When a loan gets overdue, repayments to investors are taken from this Junior Share.

It is a kind of promise of the loan originator to take back their claims on the repayment after investors received their money. So the Junior Share is a share, which is not invest-able and some kind of security on every loan for investors. The loan originator receives his money back after all investor received theirs.

Does this make my investment riskless on Income Marketplace?

When reading about the Junior Share and the Cashflow Buffer it seems like your money is not at risk anymore. It still is! But in my eyes this system of Income Marketplace offers investors a lot more than a usual skin in the game or buyback guarantee. Often you find one of the trustbuilding-facts, but not combined. Income tops it all and creates a way to protect investors money even more.

Let’s say: It is still possible to lose money, but it is nearly impossible to lose 100% of your investment.

Why that? Imagine your investment is the share of a loan originators portfolio, who is a default. First of all the loan originators tries to get the money back within the first 60 days. After that he overtakes the loan and repays investors from his emergency fund. If there is nothing left, investors will be repaid from the Junior share, which is held by Income and not invested.

There is more security for investors

So, imagine the loan originator goes down and is not able to repay anything, Income has alignments with local debt collection companies. In case this does not work and no money is brought back, there is still the Cashflow Buffer, to repay investors.

Investors will not receive 100% of their investment back, but

- they will receive the share a debt collection company will raise

- they will receive their share of the Junior Share

- and lastly they will receive a share of the Cashflow Buffer.

In my eyes there are two chances more than in comparison to other platforms to get your parts of your investment back. Maybe the share is pretty small, but your loss will not be at 100%.

And now think of Crowdestor, Bondoras and Mintos’ badest times: How much of your portfolio was overdue and above the 60-days-line? 30%, 40%, maybe 50%? But in my case it has never been 100%. Having the security of being repaid a share of those 30-50% after 60 days is quite a good feeling as an investor.

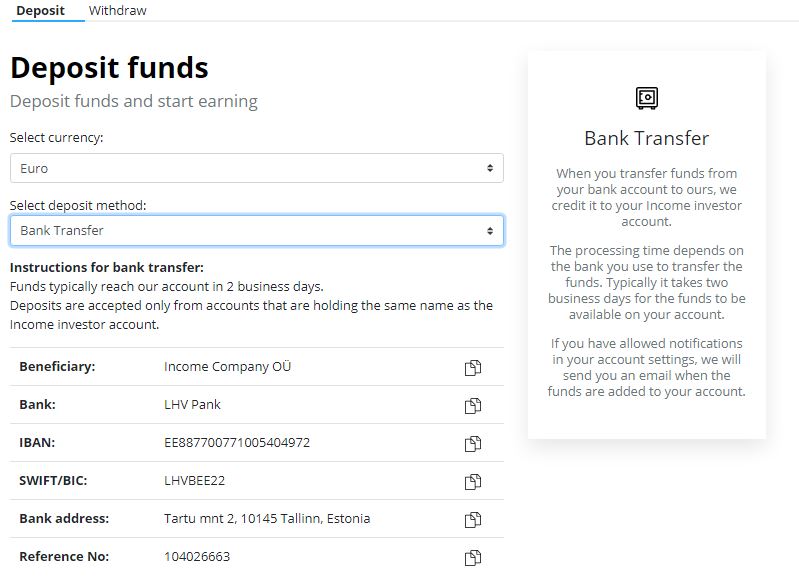

How to start investing on Income Marketplace?

First of all you need to register on the website. That is pretty easy and requires some fundamental data about you. In the second step you have to verify yourself. That works with a ID card or passport and your smartphone as you have to take some pictures. After reviewing your pictures you profile will be available.

Now you have to deposit your funds. Currently you are only able to deposit money wire bank transfer in Euro. No credit card deposits or transfers from exchanges. Every bank account you use to deposit will be able to choose when withdraw money.

Deposit on Income Marketplace

Usually the bank transfer takes one to two days until the money is credited to your account. In my case it was two days, but it was also the first deposit ever made on this P2P lending platform.

Create auto-invest strategy

Probably most of you are used to the auto-invest function. Therefore I will keep it short. It is pretty simple to create a new strategy. Just click on “Invest” in the top menu and push “Create New Strategy”.

You will be lead to a page like it is shown in the screenshot below. Here you are able to adjust several facts about your investment like the amount of investment per loan, the interest rate and whatsoever.

The auto-invest is very flexible and adjustable, also after you saved it once.

Auto-Invest on Income Marketplace

After filling out the terms your investment should follow you will be shown the number of loans which fit to them. I would personally check where the big leverage is in my portfolio to avoid cashdrag. I mean, it is great to only invest into those loans with 12%, but as long as this interest rate is the top of everything there is a huge risk than money stays uninvested.

Try to find out, where most of the loans are situated on the scale and adjust it to a level you are feeling comfortable with.

My personal review of Income Marketplace

I came along Income as they are quite active on Instagram and LinkedIn. After checking their website and platform I decided to invest a small amount. Mainly to check how things are working and investors are taken care of. It does not took long after my registration that I received a call from a german-speaking office in Vienna belonging to Income asking if there are any problems.

The first transfer of money worked out well and the money was invested instantly. As it is only a very small amount until now I am not really able to rate their performance. I think this will be possible later on, maybe in 2022 when Income will publish their first annual report and the first year of a tracking record is full.

To be honest, especially their safety net out of the buyback guarantee from the loan originator plus the Junior Share plus the Cashflow Buffer is a fact investors have to keep in mind.

I have never seen this constellation anywhere else and never felt my money that safe, as on Income Marketplace. I will definitely increase my investment here. But let’s see how the platform is doing over the next month while increasing the investment. I will keep you updated!

If you want to register, I would be happy if you d use my link.You will 1% cashback upon your investment of the first 30 days plus 10 Euro as long as long you invest at least a minimum of 50 Euro on Income.

Leave a Reply

Want to join the discussion?Feel free to contribute!