Income Report April 2022

April is over and everything is moving into May. It looks like this year spring and summer will come around again, also the whole world is acting crazy. This is the most important time to keep on my pace and work on my goals while everyone is trying to clarify the rest of the world. Go for it – I will on my own.

Meanwhile I got used to working in an office again. And I still enjoy it very much. It gives me a lot of structure. And this is what I need to perform. But let’s look on the Income Report of April and how my money performed. There are some goods news coming for my portfolio which I want to share with you.

Table of Contents

Let’s get into the details of April 2022

In my March Report I mentioned, that I did not invested that much as plannend. Also during April I stocked my money in my emergency fund. The main reason therefore was the chance, that the stock exchanges might crash and I wanted to take that chance. But until now it does not happen. This is why I invested about 50% of my plannend P2P money over the month. Especially Income Marketplace and Bondora Go and Grow were platforms I invested with.

Let’s have a first look at the numbers for my Focus Four:

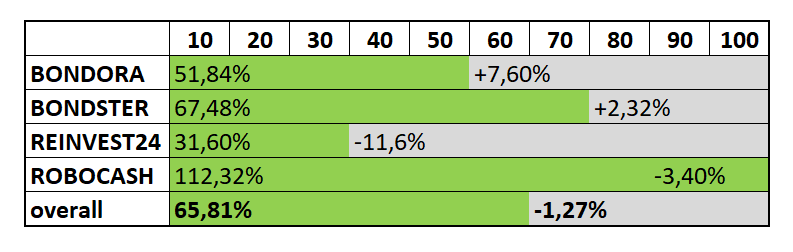

Focus Four Income Report 04-2022

Bondster’s current status: 67,48% (+2,32%)

After the interest payment at Bondster dropped last month by 23% it went stable during April. Regarding the total payment the amount increased a bit, which makes it grow 2,32%. That is nothing I am really happy about, but looking at the challenges Bondster and my personal portfolio are challenging it is good news.

Bondster portfolio April 2022

To be honest Bondster is currently not my first choice. I underestimated the risk of the Russian Ukrainian conflict (back than last year) and the influences it might have. And I also did not thought about the sanctions which will influence my investment directly. With currently 2.400EUR invested and an estimated interest rate of 13,9% the payment should be around 28EUR each month. In April it was nearly 17EUR, which is only a interest rate of 6,95%.

That is okay looking at the challenges they face. And I will not skip the platform, but currently there will be no more investment from me here. Let’s check it, when the situation is clearer. I will leave Bondster in this overview, but put them on an out of scope status.

Bondora’s current status: 51,84% (+7,60%)

As I already mentioned in the intro Bondora received a bigger payment last month. It somehow feels way more safer to invest here than anywhere else. Therefore I did not wasted time last month 🙂

Beside this wonderful fact for my portfolio there is nothing to report. In the News you were able to read, that Bondora launched Go & Grow Unlimited with no restrictions, but only at about 2% interest payment. In times of 7,4% inflation rate during April this does not look attractive to me. Might be interesting for others, but focussing on a payment-based portfolio I can skip that idea of investing with Unlimited.

Interest in investing with Bondora? Check my Bondora Go and Grow review here.

Reinvest24’s current status: 31,60% (-11,60%)

Well, let’s talk about Reinvest24. I really like the platform. But out of their first idea of investing with rental income it developed to a stage-oriented platform with focus in Moldova. Meanwhile the situation at the Moldovian border changed and I do not know what to think about it. I am absolutely not in the conflict and I do not know how to rate the latest news.

Therefore I will only invest into projects in the Baltics, Spain or any other country not being directly impacted by the war.

Last month there had been the first delays of payments. Reinvest24 informed their investors about them pointing out that those are not due to the current situation. Whatever, I need to believe in them – and I do – but currently here is also no investment case for me in Moldova.

Robocash’s current status: 112,32% (-3,40%)

If the interest payment will be above 25EUR next month again, Robocash is the first platform to drop successfully out of the Focus Four. During April the return was great again and went steady into my account.

Beside my personal portfolio Robocash also published their Q1-2022 data. Their revenue droppped down to 1.5MEUR, which looks scary, but reading the comments and putting it into the right place in the current situation it is still a good result. Until now I have not decided how to work with platforms who dropped out.

In case of Robocash I am planning to increase my investment here to at least 5.000EUR, which is the first Level to receive loyalty interest of 0.5% which would be another 2EUR per month. I have not decided yet.

Do you want to know more about Robocash? Check out my Robocash Review here.

Review of April 2022

The war is still normal. The media and politicans are discussing a lot – and Ukrainian soldiers and civilians are still dying. That does not sound right, also I am not able to offer the right solution to this problem.

On the rest of the world people seem to ignore, what is happening. I am really not the guy with the tin foil hat, but I am really wondering what people talk about. In Germany we had 7,4% of inflation last month and we are talking about what? About computer chips? About Elon Musk and what he wants to do with Twitter?

Guys, come on. Keep your head down. While everyone is slowing down and thinking I am focussing on getting my stuff in order. From my point of view this is the time when big wins are prepared. And after I more or less fucked up the covid crisis I will win this time.

P2P platforms during April to mention

As there is more than only those Focus Four platforms, I would like to mention the rest also in a short notice:

Income Marketplace: 7,92%

I decided to increase my investment here. Last month I had a very interesting interview with Kimmo, which I will share soon. From my point of view Income has a bright future and a good concept, where I feel quite save with my investment.

Here you will find my blogpost about the introduction of Income Marketplace.

DoFinance: 0,00 %

No words needed – still sucks.

Debitum Network: 2,63%

And the rate drops further. After there had been very good months including several late payments Debitum seems to struggle with their loans from Ukraine. Something I am not really worried about, but currently nothing I would invest more money into.

viainvest: 11,21%

Well, no news, no hazzle – just working on and on. Also my investment is not the biggest here, the performance is quite nice. Currently I am not really interesting in investing more for several reasons, but I will keep viainvest on the schedule.

Twino: 10,36%

After I had a loss last month, which was expected, Twinos interest now turned positive again. Therewith and until now the loss from exchange rates sumed up to about 10EUR. That is okay, as the rest of my investments performed very good before. And it seems like they will be again in the future.

Bulkestate: 0,00%

Once again no payment here. As the loans are all repaid at the end of a term including the interest payment this is nothing to worry about.

Moncera: 7,35%

In April the interest payment dropped by nearly 2% – which is okay. Looking at the number it might give the intention that Moncera is not performing. But as my portfolio is not very big here every late loan payment decreases the interest yield. So, I will relax and keep investing here.

If you want to know more about Moncera, please go to my platform-check!

What is up for me next month?

Well, I just looked at my last month resolutions. I was complaining about struggling the find the right words for my blog here. This was really something I wanted to change and put some time into. And it worked out. You will probably see and read the change over the next months. I feel quite comfortable with it, also it is a hell lot of work more to do.

Unfortunately I did not started either my podcast nor my Instagram profile again. I will do that during May, also I need some preparation time.

Something I learned over the last month: I am busy planing and trying to achieve, but I am horribly disciplined to stay on track when times get rougher. Therefore I will work on my habits and implement one habit at a time. This might took longer of course, but I am tired of planing, starting and skipping again – and next week all over again.

You re my accountability partner 🙂

Leave a Reply

Want to join the discussion?Feel free to contribute!