Income Report January 2022

The first month of 2022 is already over. And today we will get into the details of my passive income during January. There are some nice details with Robocash and Bondster but also something which hit me unexpected with Twino.

In my last income report I wrote about my focus during January. Well, guess it worked out. But I faced some struggles, which made it hard to follow my plan. In the mid of January my youngest son was tested positive. He just had some fever and nothing more. For me this was some kind of challenging as he stayed for more than a week home with me. He did a great job and we had loads of fun, but still the days were longer, the nights shorter and I was pretty done after that week.

Usually I wanted to go to Tenerife in the third week of January. This was unfortunately cancelled due to his quarantine. In the end I was happy to join the finfellas event about P2P lending. You can watch the panels on Youtube here:

“Is open banking making waves into P2P?” from 26th of January with Juris Grinsis (Capitalia) and Robert Piliar (Trustly)

“How platforms can save investors from losses” from 27th January with Twino, Capitalia, Esketit and Altero

Presentation Stage with Sergei Demchuk from Debitum Network from 26th of January

It was great fun again. And I am looking forward to the next event in March which will deal with Real Estate in P2P lending.

Table of Contents

Let’s get into the details of January 2021

During January I had to work from home again. Already experienced it during December, but especially through my youngest son a challenging month to work on my stuff 🙂

Nevertheless, my money worked at least as through January – probably harder than I was able to work. As I already mentioned in the intro Bondster made huge close up to its target And Robocash again delivered the 25EUR/month. That were great news.

Looking into my Twino account I could not believe it: -0,88€ during January? How was that possible? I will talk about that later in the Twino part. But that circumstance shows that P2P lending is great fun to invest in, but also has its risks.

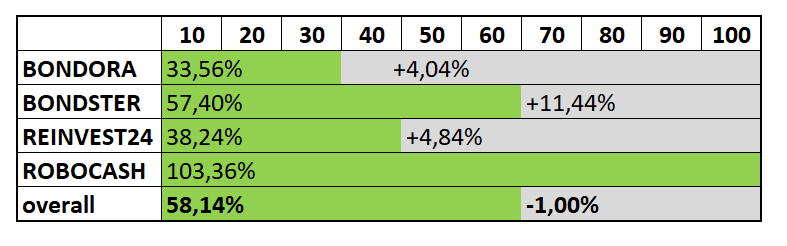

Let’s have a first look at the numbers for my Focus Four:

Passive Income Report – Focus Four

Bondster’s current status: 57,40% (+11,44%)

Nearly two thirds of my way through here – and really happy about it. Looking at the numbers the share of overdue loans went down. Maybe you remember when I wrote about the comment on my blog, that Bondster is a scam. Here I was showing my figures back then, when about 22% of my Bondster portfolio was overdue. Meanwhile this share went down to 20%.

This might probably be for the reason that my account balance increased dramatically. But for me it shows, that the share of overdue loans is on a similar level.

What to talk about a running investment? Well, it looks like there are no big news here. Pavel Klema, the current CEO of Bondster also held a Presentation stage on the finfellas event. It was interesting to listen to it. For me this was once again the approval that my investment within my own restrictions. If you want to watch it, check the Youtube channel of finfellas.

Bondora’s current status: 33,56% (+4,04%)

Slowly my account balance increases here. To be honest Bondora Go and Grow joined my Focus Fous for the reason of their stability. But within these Focus Fous it takes the fourth place concerning the focus. It will take a long time to hit my target here as the 6,75% interest rates requires an investment of at least 4.500EUR.

Deciding between for example Bondster and Bondora I would always choose the option with more interest rate. But as we are still talking about my Focus Four there is a steady transfer of money to my Bondora account keeping the investment running (and increasing).

By the way, Bondora reports huge growth during January. About 4.700 investors joined the platform. The platform itself was able to offer 14.2 million Euro in loans, which is not their All-Time-High. Compared to January 2021 the number increased by 132% from 6.1 million Euro. That’s great news for investors.

Reinvest24’s current status: 38,24% (+4,84%)

In Januar I received interest rate from a project, which exited. Therefore my interest income skyrocket in comparion to the months before. As I want to make the report honestly here I deducted this interest payment from my overall interest payment. Therefore it is “just” a little more than 9EUR instead of 20,60EUR which were paid to my account.

My investment once again raised making me another nearly 5% more of income compared to last month. I already mentioned that investing with Reinvest24 always results in a kind of timelag of the interest payment. This is due to the moment you invest and the time until you receive the first payment.

During January Reinvest24 offered several new investment opportunities for investors. Beside their main market Moldova there have also been some investments stages from their German, Estonian and Spanish projects. So it was a wide variety of investment chances.

Unfortunately the interest payment from their Moldovan projects is now often restricted to “every six month”. Regarding my project of an increasing monthly cashflow I decided to buy some shares on the secondary market from existing rental projects with a monthly payment.

Robocash’s current status: 103,36% (-24,32%)

The year started off with some struggles for Robocash. In Kazhakstan, one of their main markets, political unrests caused the closing of banks for about two weeks. Beside the concern of what is happening this also makes transfers of money impossible. Therefore the number of overdue loans increased fast in my account.

Robocash communicated during this period in their Telegram channel. From their expert view the unrests were not damaging their business model and quite fast after they came up, Kazhakstan returned to “business as usual” again. By the end of January most of the overdue payments were transfered and the share decreased.

Looking at the numbers the overall interest payment was 24% smaller than last month. The reason is easy to understand looking at the unrests in Kazhakstan, so there is nothing to take action from my point of view.

If Robocash is able to hit the 25EUR/month in February again, they will officially drop out of my Focus Four in March. Another platform will jump right in, but let’s discuss this, when time has come.

If you want to learn more about Robocash, I published a Robocash Review in December for you.

Review of last month

During January the level of interest payments were likely the numbers of December. This was mainly because of the “weakness” of Robocash due to the unrests in Kazhakstan which made the payments later than usual. As long as you as an investor know about it, everything is okay 🙂

My overall numbers were pretty the same as in December, especially because I had a loss on Twino. Within the next paragraphs I will discover that for you.

P2P platforms to mention

As there is more than only those Focus Four platforms, I would like to mention the rest also in a short notice:

Income Marketplace: 10,83%

After my last report I did the KYC. Until then my investment were repaid and the money was held back due to the missing verification. So in January there were only 0,10€ of interest payment.

I was able to meet Kimmo, the CEO of Income Marketplace, during the finfellas event. It was very nice and he offered me a lot of information about the safety concept of the P2P platform. Hopefully I will be able to offer you some more information about it as I really like the concept, which I already described in a short review.

Here you will find my blogpost about the introduction of Income Marketplace.

DoFinance: 0,00 %

No words needed – still sucks.

Debitum Network: 10,52%

As I mentioned in the last report I expected Debitum to get back to normal. And this is what happend. After my year-to-date interest rate in 2021 is near 9% the January was still very good with 10,52%.

viainvest: 11,02%

Viainvest performed good again. My investment here is still at about 500EUR, but this already paid me 4,92EUR last month. I am really curios how viainvest will perform this year as they are also in the transformation phase becoming a regulated P2P platform. Stay tuned!

Twino: -1,55%

Now coming to the “problem” this month. To be honest the platform itself is not the problem. While investing into P2P loans from Ukraine investors had to take the currency risk. This was something investors had to accept in their auto-invest manually, of they wanted to invest into these loans. I did it.

Over the last months those loans performed great and were a reason, why my interest rate was between 13-15% at Twino. Now with the political issues with Russia the currency droppped and investors had to “pay” therefore. In my account there are several lines called “currency adjustment” which comensated the currency loss. Unfortunately this took all of my profit during January.

What to do next? Nothing. Stay calm and invested.

Bulkestate: 0,00%

Once again no payment here. As the loans are all repaid at the end of a term including the interest payment this is nothing to worry about.

Moncera: 8,72%

The interest is nearly the same as last month. There is only a small drop of 0,02%. But to get better numbers here I decided to save at least 50EUR per month in this platform and scale it over the year. The more money, the more investment, the better and more reliable the numbers.

If you want to know more about Moncera, please go to my platform-check!

What is up for me next month?

What are your New Years Resolutions doing? Statistics from the last years are showing that from the mid of January on less and less people following their goals. I am probably guilty of this as well, but I guess the important thing is to still follow goals.

I started #75HARD in January and failed. It is a program to reach mental toughness – and I wasn’t tough enough. In February I will start again, independent from the date. All of my goals require discipline and this is not doable without mental toughness. Therefore my biggest issue to fix is my mental toughness.

My investment will keep running. My savings rate will be transfered automatically, so there is nothing to worry about when focussing on #75HARD. That’s it!

Let’s freaking go into the new month and stay hard!

Leave a Reply

Want to join the discussion?Feel free to contribute!