#PAR06 Passive Income Report December 2019

2019 is over now – welcome 2020! I am wishing you a Happy New Year and all the very best for your plans this year. As nearby every year our New Years Eve was very quiet, as we were celebrating with the kids and friends of us. For any reason I was unbeatable in dancing “Just dance”. Maybe it was the amount of alcohol or I found out about the best way to cheat.

I think, I mentioned it in the last report from November. In 2020 I will write this report in a slightly different way in my monthly newsletter via mail. A bit shorter, focusing more on the important points and more content for you – this is my plan 2020. Therefore I will publish another blogpost about a P2P-topic on my blog here.

Table of Contents

Three words of December: easy, juvenile, accepting

Let’s get to the stories behind those words. Our December was full of impressions. We were working quite a lot and organizing the rest in our life beside that. But we were focusing on some calm days around Christmas and New Years Eve, which worked out very good for us.

Easy going on Christmas

Just the last weekend I sat down with Katrin. We were talking about 2019 and especially Christmas time. I am not the biggest fan of this Christmas stuff, but for the kids and her I try to hide it anyway. As we planned a lot before Christmas and additionally cut off some points from the last years, this time Christmas time was very easy for us.

No discussions, no stress, just a lot of time with each other in our family. For both of us this was very relaxing and easy going. We will save this experience for 2020 and try to even improve it, as it was a very good time to get relaxed and receive some strength again.

I have been to the disco once again – and I got old

Maybe this was the reason for my good dancing performance on Christmas? Well, I do not know. I am not really into a special type of music, but there is on DJ I wanted to a visit a concert in 2019. Two times I found some excuses to not go there, was no one was joining me. But in December her performed a show near my city – so there were no excuses.

I felt very old, and I just turned 39, when I entered the disco. But after some time I felt comfortable and really enjoyed the show. This once again shows that most of my personal fears are just made out of thinking. They do not have any rational basis. I already booked one show for 2020 again.

I grew beyond myself, but not really

In June of 2019 I wanted to finish a trail run in Austria. Things were complicated and for any reason I quit. At that moment it was not really a problem. I became a problem soon when I was thinking about it hours later. So I decided to challenge myself once again that year.

In the beginning of December I ran a race in Belgium. Fuck, I was excited and scared, as I did not know the track and even not Belgium. Additionally there were just two points to quit the race – the rest was somewhere in the Ardennes. It was great. I was not in my best shapes, but motivated. And this lasted for about 25 km.

Perfect, so I had to fight myself and overcome my fears. And with every step ahead I was able to get forward. Through the whole energy slump. The last 5 km I was pacing myself as I had the power left – incredible what you are able to achieve, when you defeat your fears.

7,5 hours and 46 kilometers later I reached the finish – happy! So I do not really grew beyond myself. I was just able to retrieve my full potential and it felt very good. The best preparation for my goals in 2020.

Passive income in 12-2019: 59,38 Euro!

This was not really what I wanted. As I wanted to increase my monthly passive income, I failed in December. I am sorry to not give you better news about it. But still I think I am on the right way.

I focused on my financial plans in 2020. And I established a very strict plan for this year. It says what I have to save and invest at a minimum level. Whenever I will be able to earn more (and to save more), this will be split in a strict way.

And this is what happened in December. It felt really great to focus on this plan. Unfortunately there were no P2P investments planned in December, this is why my passive income does not increase. But “behind the scenes” I invested into five new platforms. Let’s check the already know P2P platforms.

Mintos: 42,93 Euro with an increasing investment

Since the mid of 2019 I increased the P2P investment on Mintos. Today it is the biggest platform in my P2P portfolio – for very good reasons. The interest is always around 10% and still Mintos is one of the biggest players on the market.

Last months the interest was higher and another month before it was around 49 Euro. In December the interest was quite small compared to the other months, but for me this is okay. My target is to increase my passive income and not to think about 7 Euro of difference on one platform.

In 2020 I will always add a bit to my Mintos portfolio. The interest income is planned to be around 90-100 Euro by the end of 2020. If I hit this goals I am very pleased.

DoFinance: 10,09 Euro with a steady return

In December once again my interest income covered the minimum investment amount. I invested another 11 Euro at 12% for the next 12 months with the VIP program from DoFinance. It is just some cents per month, but every penny counts.

Meanwhile DoFinance has solved their problems and you are able to invest again. Perfect, as the investing-pause was less than a month – also I did not really care or watched the circumstances. Still I am very pleased with DoFinance and my investment plan says, that I will increase my investment here. The goal is to receive 25 Euro per month of passive income here.

Debitum Network: 4,08 Euro and counting

I did not changed the investment at Debitum Network since May. Therefore the interest payment is still on the same level. Checking my account I recognized, as I mentioned before, that most of the loans are factoring loans. That is okay for me, but something I have to take care about in my global portfolio diversification.

Screenshot from my Portfolio on Debitum showing the shares of investment types

Am I pleased with Debitum? Yes and no. I am very pleased, because there are just very short periods where the money is not invested. It is just some days in maximum. That is great as my money is always working and working and working for me.

I am not very happy with the interest rate. The internal interest rate is shown with around 10%, but that does not match with my calculation. Additionally sometimes the accrued payments differ in a big way with the paid interest. Nothing to worry about, but if my payments are between 2,33 Euro and 6,10 Euro for the same investment passive income is very volatile. Let’s stay in touch with those figures and see what will happen.

Bulkestate: Another 0.90 Euro to my account in December

Bulkestate is doing a big job. Again in the beginning of 2020 the published new investment opportunities to their investors. But still the problems seems to be the same, that money is not invested for a long period. In November I received 200 Euros back, wherefrom just 100 Euro are reinvested until now.

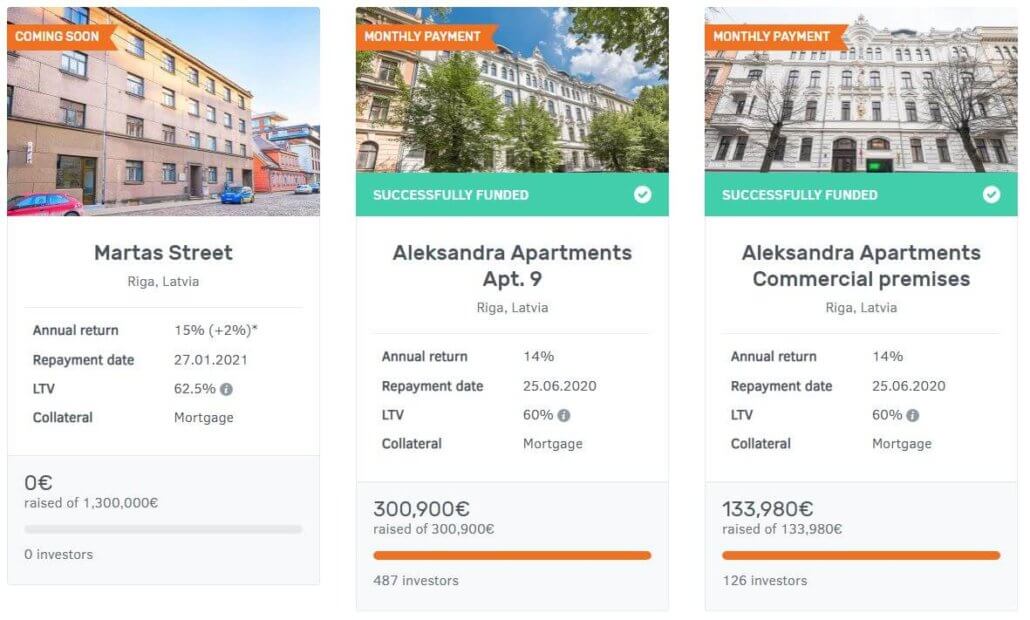

Screenshot from the Investment Opportunities on Bulkestate

This is very different to other P2P platforms, where you receive interest payments every day. But it is just something I have to get used to (even more) as Bulkestate is still paying a interest rate. Let’s wait and see what will come, when most of my projects are ending by mid of 2020. This will be payday!

IbanWallet: 0,93 Euro and still a lot of questions

I do not really know what to think about IbanWallet. Until today there are no questions to my question about their investment portfolio. I do not know where I am investing and which kind of loans I am invested in.

Of course this leads to an investment-stop for me. There will be no more money in this account until I receive more information about their loans. I already thought about ending this investment. But I guess this will be unfair and I would be able to cope a 500 Euro loss, when IbanWallet turns out to break down. And who knows, maybe everything is okay and it is just a lack of communication.

My P2P goals in 2020

I think I mentioned it quite often, but I would like to diversify my P2P portfolio based on loan types, loan originators and countries – and of course P2P platforms. In 2020 my goal is to establish a good diversified portfolio until the end of the year. Additionally the goal is the receive passive income out of this P2P portfolio of 250 Euro in December.

Until now the saving rates are planned, but not exactly where to invest. This will depend on the opportunities and as well as on their performance. And reaching the goal means to have a financial freedom of 12,5% from the average German net-salary (1.996 Euro per month). Of course, this is just the part from my P2P investments and others have to be added for a total view. Still this is the right way I guess.

Comparing and benching myself

To be honest, when I first saw those figures, it is more or less depressing. Since September 2019 I am benching myself against my former numbers and several “official” things like the S&P 500 and the MSCI World Index. As 250 Euro do not sound huge in that moment, it always made me a bit sad and some kind of “I will never reach financial freedom”.

But if you calculated those numbers for the next five to ten years, it is every year another 250 Euro on top. So in 2021 it will be 500 Euro, in 2022 750 Euro and so on. This track is exactly what I want to. I do not care about others who receive more passive income. For me in 2020 is most important to stick to my plan and make no excuses about it.

One and another Euro will add up to my financial freedom sooner or later. And this is what I found while benching myself. In comparison to 2018, 2017 and sooner my performance in 2019 was absolutely great. I mean, Mintos started with just a few Euro per Months and in December it was more than 40 Euro. Why not keep that pace and do not care about anything else?

Right, this is my plan. And when my investments into shares are more or less moving the same direction as the market, I am very happy. And I am really looking forward to meet my goals by the end of 2020.

”Beyond Basketball” and more stuff to come..

The last audio-book I heard was “Beyond Basketball” from Mike Krzyzewski. Also this audio-book was quite short with about 3 hours, the content was very interesting. Mike talks about the different types of teams and problems within the teams he coached during his very successful career in college basketball.

And there is one quote, which really suits to my financial goals. I do not know whether it was Mike or someone else, but it is about the 1%-rule. When a basketball coach, who had won everything the last season, tried to motivate his team he asked, whether they would be able to improve their performance by just 1%. So if everyone increases his performance the overall improvement will be 5% over a period of time.

I really like this idea. This is what works in the longrun in my eyes. When I am able to increase my assets and/or my P2P investments with 1% per week, my overall performance will be 50% and more. Of course this is just about the saving rates, and not about the interest rate. But the more I am able to save and invest, the more interest payment will be paid to my account(s).

Leave a Reply

Want to join the discussion?Feel free to contribute!