CW 03 – Top #3 P2P News: Bondster strategies, Update von KAZ + Income Seedrs campaign

DoFinance Recovery, Update on EstateGurus aut-invest and Mintos pauses loan originators from Kazahkstan- that is what I want to talk about this week!

Welcome to my latest P2P News. Honestly I am little bit late. Nevertheless, I still want to deliver as there have been enough throughout the week.

Table of Contents

#1 Bondster strategies are now offered to investors

Bondster is meanwhile known to everyone who is interested in P2P lending. The czech P2P lending platform is a kind of marketplace like for example Mintos and developing fast. While Mintos has its own problems over the last months and years Bondster only knows one direction – increase upwards. In comparison they are still quite small, but it is interesting to see their development.

In the beginning of 2022 Bondster relaunches their interface. And they also added easy-to-handle strategies for investors. We already know this kind of strategies from Bondora, Mintos and several more P2P lending platforms, so it is not really soemthing new. But those strastegies are currently with an impressive interest rate.

Bondster strategies offered to investors, when creating a new strategy in your investors account

Overall I am not a marketing guy to rate the relaunch in the smallest detail. From a view of an investor I like the colors – it makes the website somehow more serious, also I can not really describe what it makes me feel like it. Furthermore I really welcome those strategies as it makes investing easy for new investors. I am quite curious what Bondster will built around those strategies. As my current personal interest rate here is aroudn 14,3% there is no need for me to change my strategy to any of them. Go to my blogpost about Bondster, if you want to know more about the P2P platform!

#2 Situation in Kazahkstan seems “solved”

Last week I reported in my P2P News, that Mintos suspended several loan originators from Kazahkstan as there have been some kind of political unrests. Shortly after they started they already stopped again. So maybe this kind of news has been put out too fast from me? Maybe, but as I am invested with Mintos and especially Robocash quite big in Kazahkstan those news were pretty relevant for me.

Honestly, there was nothing I changed the last week. And there is still nothing I want to change, but it was a short breathtaker for me. So maybe this is what I should work on to not get influenced next time.

Meanwhile the situation in Kazahkstan calmed down. Most of the interventions have been taken back again like the closing of banks, generally bank transfer, the Russian army in the capital and so on. This is why Mintos also reacted fast and took back the suspension from the loan originators.

Robocash informed their investors via a Robocash-Telegram-channel at any time. As I am really not the expert for this area of the world I absolutely trust the experts out there from the P2P lending platforms. And now I am happy investor again. If you want to know more about them, click on my Robocash Review.

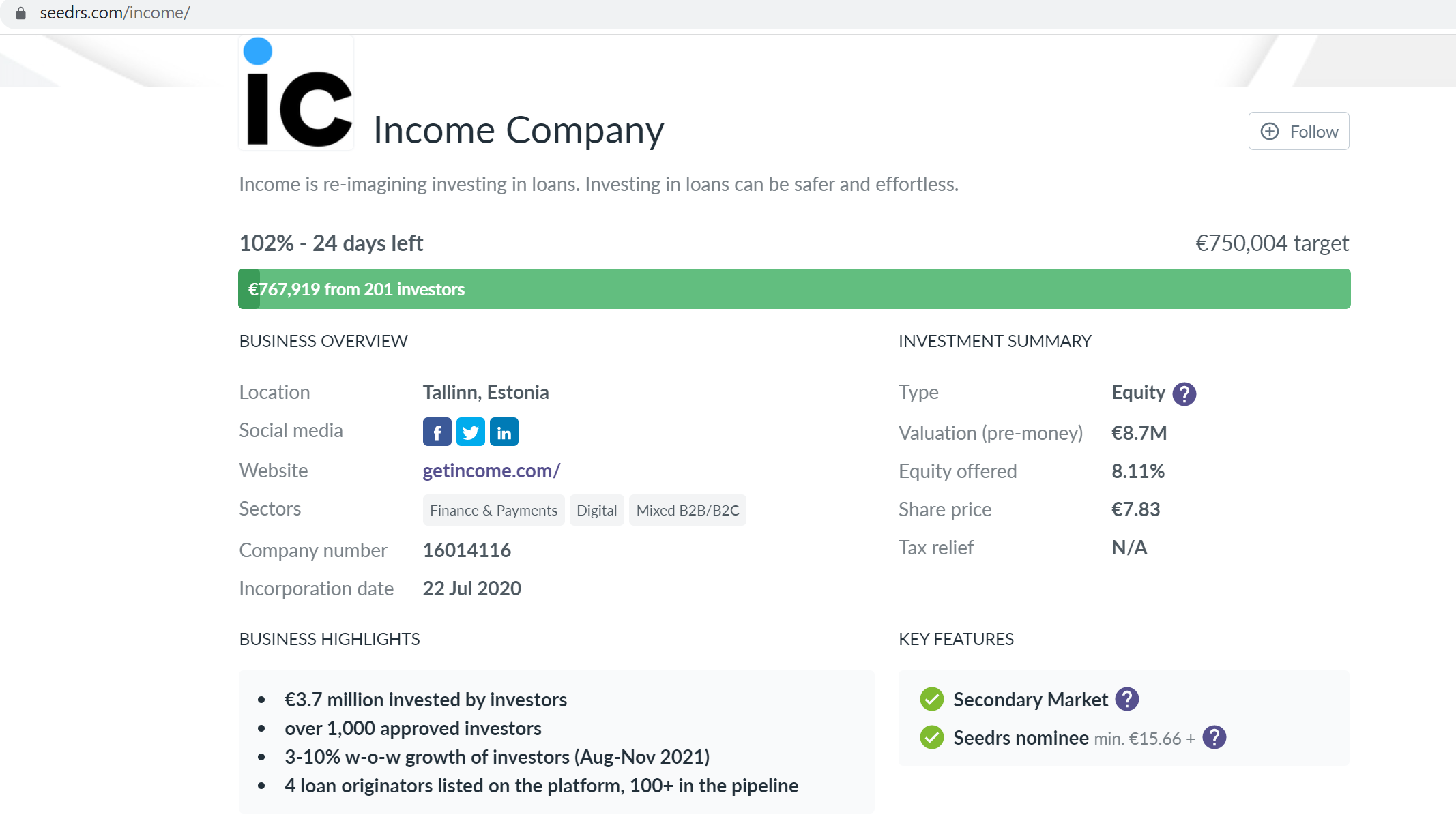

#3 Income on Seedrs

Income is an upcoming platform from Estonia. I started investing here months ago, also my investment is still quite small. To grow their P2P lending platform they are now offering a crowdfunding campaign on Seedrs.

The target was to fund at least 750k out of the campaign. Currently the crowdfunded at little bit more than that and I am expecting good things to happen to the P2P platform. Especially the Mintos crowdfunding campaign showed that investors are also likely to invest directly into P2P platform companies. So here is another chance on Seedrs for you guys 🙂

Income Seedrs campaign

I already introduced Income to my audience last year. So if you are interested in more information about it, go to my Income Review here. Especially their concept to secure investors money is pretty impressive and interesting as there is nothing similiar in the P2P lending are currently. It is worth a look to get an idea about their concept.

Up to you – What is relevant for you?

Next. Done. This is how 2022 started and there have been a lot around the last week, which made me struggle. I am really sorry for not publishing my blogposts in time. The next one which usually comes on sunday will follow tomorrow on Monday. It is not ready yet, also it will not be that much work as this weeks P2P News.

What was your most interesting fact this week? Any news with a huge impact on your P2P portfolio?

If you want to talk about P2P lending just join my small Telegram Channel.

Leave a Reply

Want to join the discussion?Feel free to contribute!