#PAR09 Passive Income Report March 2020

„Tough times“ – this is what I hear quite often at the moment. And yes, I guess those times are really tough. Especially for those people, who are directly influenced by the coronavirus. And I mean “directly” as a direction and not just a simple excuse for everything. Elderly people, sick people and of course those, who are belonging to the high-risk groups.

For all the other people I can see a lot of misunderstanding, complaining and low mood to face the challenges. Do not get me wrong: My parents are 72 and 68; my stepparents are 77 and 70 – I know those people belonging to the high-risk group as well.

But instead of complaining we as a family try to find new ways of communication, interaction and contact. And yes, we are afraid of parents as well, but that does not mean we are concentrating on complaining and wishing back the “good old times”.

Table of Contents

This is a challenge and a big chance

When Mintos had its “interest-problems” last year in October, everyone was talking and writing about a serious problem. Everybody was just concentrating on those “bad news”, which ain’t bad in my eyes. It was just the usual behavior of the market, what happened there. But today nobody is talking the same way about the interest rates at Mintos, which are at about 13% to 14% on my auto-invest.

This is once again a wonderful example of: “Where focus goes, energy flows”!

If you are not able to adjust your focus or do not want to do it, you will probably entertained by the media. Just this week here in Germany there was as hiccup about President Trump. How could this man fool the people by saying at Easter times everything will be okay again?

And now, the US are more or less the epidemic centre of the virus. You are right, that the he was wrong. But everyone else was wrong. Mr Conte from Italy, Mr Kurz from Austria, Mr. Johnson from the UK and of course Ms. Merkel from Germany as well. You can google their same statements as from Mr Trump just some weeks ago.

I am concentrating on myself

I nearly stopped consuming the media about the coronavirus some weeks ago. It is not what I want my life to be influenced by. As I wrote in my last Passive Income Report from February I am not really confident with my own performance.

Therefore it seems to be better for myself to concentrate on my own stuffs, than to be led by the media. And with it the opinion of others, who might have other interests than just keeping my informed. After some weeks of cleaning up my stuff I will be able to get on my track again.

It feels quite good, also I am neither at the pace I want to go nor and the point I planned myself for the moment. BUT I am moving again and this is the most important fact for myself. Just as Limp Bizkit sang on their song “Keep Rollin’” – listen to the lyrics and maybe interpret them just as I did it for myself. So Keep rolling – it is never too late!

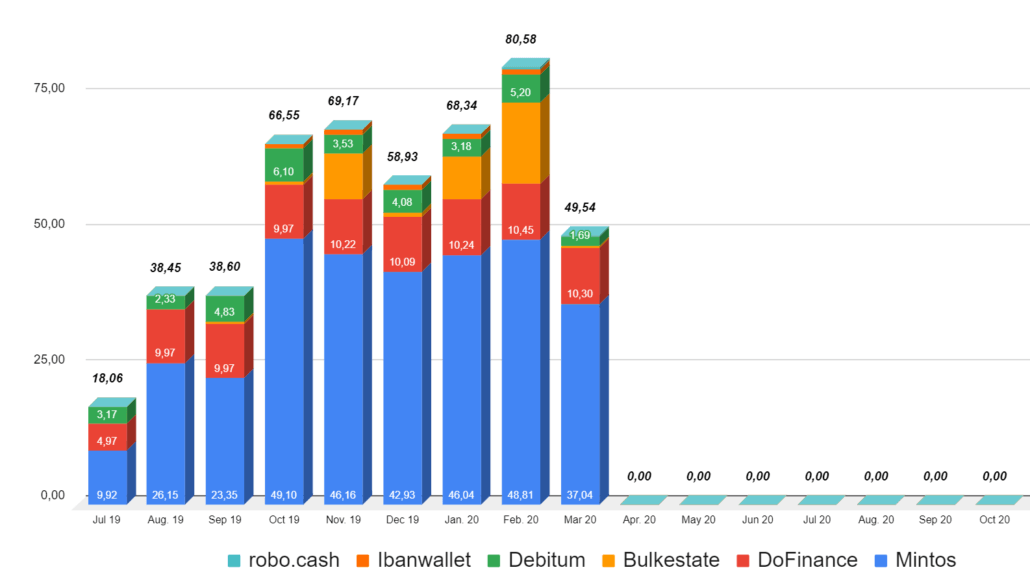

Passive Income in March: 49,54 Euro!

This month was not good, if you just concentrate on the sum of passive income. That is right. In February I had about 80 Euros. The income dropped back to nearby 50 Euro. That might sound like P2P lending has a serious problem, right? On the first sight, you are right – and this is what the media often takes as their advantage.

Because if you dive deep into the figures, you will find out, that those last months were that good due to payments on Bulkestate (check the orange one in the picture). Last month there were no extra payments from loans, which ended earlier. And therefore the sum dropped.

But overall and on any platform you are able to find several statements. Those information you are also able to see in my passive income: it fell a bit! For example on Mintos the income came down from 48 Euro to 37 Euro. Diving deeper into this figures you will find out, that the rate of overdue loans rised. In my portfolio it is nearly 50% – before it was around 30%.

Do I worry? No.

Just listen to your politicians. Everywhere in this world companies and businesses seek problems and are not able to pay their rents, employees and whatever. And of course those impacts lead to problems with paying personal loans.

That is just the “usual way” as things run and in my eyes nothing to wonder or complain about. I mean P2P investments are mainly working with money people do not have for any reason. So it is at a quite high risk. And this includes problems as well.

Therefore I will just keep waiting. Let’s check the situation again in one year, when everything will probably (and hopefully) rise again. I will keep that in mind and try to compare it, how P2P lending made its first crisis times – and how much was right or wrong in my blogpost about it.

Mintos: 37,04 Euro of passive income

Just as I mentioned the total of overdue loans rised in my Mintos portfolio from around 30% to nearby 50% currently. As Mintos is one of the biggest players on the P2P lending market and I trust people like their CEO Martins to act the right way, I do not really care about this fact.

I think now is the time which will prove the buyback guarantees for investors. In the past this was often mentioned as one of the main facts for P2P investments. But I doubt that people really checked, what the guarantee was about and who was publishing it. Now, when crisis times shake the P2P market it is really important to see, which buyback guarantees will redeem the warranty – and whose financial background will collaps.

DoFinance: 10,30 Euro and very late information

Maybe you remember my words about DoFinance, where I was very enthusiastic about the P2P platform? Unfortunately this changed a bit the last weeks. It is NOT because they were not able to pay. As you can see they paid the interest rate in time and full.

But I felt and still feel a bit lonely as an investor. More than a month after the coronavirus came to Europe and nearly two weeks after the Baltics closed their borders, DoFinance published their first statement by the end of the last week. I think this is poor and does not match my criteria of an open information stream for investors.

Let’s see what DoFinance will publish within the next weeks and months to keep their investors up to date. Until now they were quite good at it, but for any reason the current crisis teams seems to had an impact on their way of communication. But nevertheless, I will keep my investment there.

Bulkestate: 0,45 Euro of montly income

Bulkestate is mainly concentrating on real estate objects, which are restored and sold again at a higher price. As real estate is not really affected UNTIL NOW from the coronavirus, everything is running smoothly at Bulkestate.

I am curious how things might change, when the healthcrisis turns into a economical crisis and the people note it in their pocket. I guess tough times will maybe come to Bulkestate in the future, when nobody wants to restore their homes or houses and maybe prices from real estate drop a bit.

As well here it is a proof of their business model and I am very sure they will rock it. Because the first things what people will change after crisis times is again their homes. So maybe Bulkestate will be one of the first to publish new restoration loans, when the economic situation rises again.

Debitum Network: 1,69 Euro – What a drop / a chance

I do not want to judge Debitum for this small interest rate this months. Debitum is handling with business loans and of course those loans might struggle within crisis times. Completely different to others Debitum used the chance to spread their information quite wide and intensively.

For example Martins made an interesting online-session with Lars last week. He talks about Debitum and of course the chances this situation bring – and how the P2P platform might use them for their benefit.

Maybe you remember, that I was a bit confused about Debitum in my last report, as my investments there are mainly factoring. But maybe I have to think about my point after this video – I am not really sure at the moment.

Robocash: 0,06 Euro – not the best idea until now

Honestly I am not really happy with Robocash at the moment. I am invested in Robocash since more than two years now and it was always quite okay. But since the beginning of 2020 there seems to be a problem, which I have not seen.

Shit happens and I will keep my money there. Maybe it is just because of the corona-crisis, but the problems already started in January. I will keep an eye on it. Currently I would not really recommend investing in Robocash, as my passive income was just 6 Cents in March out of nearby 550 Euros.

What are my tasks for April?

In my last report I mentioned, that I (once again) have to restructure a bit. My plan felt okay for 2020, but the coronavirus completely wiped it out. So it was not really made for crisis times. I guess it was not resistant against those crisis times, as I even do not even thought about.

Meanwhile I tried to structured my day a bit more (god, I hate Trello :p). First of all my biggest task for the day is to keep my “Inbox zero” at work. Last Friday was the first day, where it worked again. And my second task is to keep my private plan rolling.

I am not really able to find out what is more important for me, but I know that I do not want to decide for one direction at the moment. Somehow it feels like I am needed at work, but I do not want to give up anything I worked for in my sidebusiness. Therefore it has to be both at the same time.

As I said in my last blogpost: For me this crisis times is the biggest chance I ever received. So I guess I need to work even more to hunt for my dreams as they are as near as they never been before.

Leave a Reply

Want to join the discussion?Feel free to contribute!