How is P2P lending facing the Coronavirus crisis?

A few weeks ago the world seemed normal and the Coronavirus was just something far away. I myself was still in Malaysia at the end of January. Every weekend I did sports and ran. Strength training, endurance training and above all I paid attention to my diet.

And what is going on now?

Now Coronavirus has taken over the world. All these things that we usually take for granted no longer exist. There are curfews, many companies have had to close down temporarily and the stock markets have lost as much within a month as they did almost 100 years ago. The economic crisis of 1929 had similar effects on the stock markets then as the coronavirus and fear has now.

Table of Contents

Pure panic – everywhere you look!

In January, the coronavirus was still something that was far away in China. I too read the articles about it, but the danger was not really real for me. And then in February it started all of a sudden. First in Italy, then in Spain, France and of course also in Germany. The coronavirus is now everywhere.

And if you wanted to buy pasta or toilet paper here in Germany, you were suddenly standing in front of an empty shelf. So the panic had arrived!

Today, three weeks after our government has taken drastic measures, I work almost exclusively in the home office. Even today I still go running, but all my runs for which I wanted to prepare myself were cancelled. Or they are about to be cancelled. Our children are now the third week at home and are learning here while we try to work on the side.

And what happens in the P2P market?

A few weeks ago I published an article. It was about what happens to P2P investments in a crisis. I described that in the crisis of 2008 the impact on the P2P market was quite small.

But this was mainly because there were not many P2P platforms at that time. Today you can see live what happens to P2P investments in a crisis. After Kuetzal and envestio were recently identified as scam, it seems that there are also problems with some other P2P platforms.

Some P2P platforms communicate very openly. Also about the fact that they have problems. And about what problems they have and how they want to solve them. From other providers, on the other hand, you simply hear nothing as an investor. Is that a good sign?

It’s the chance I’ve been waiting for!

Up to here the article is very negative. And I hope you haven’t backed out yet. Because there are a lot of articles like this in the press right now. But I have a very different opinion. Of course I feel the crisis as well. My portfolio is in the red, my life is restricted and my children are not allowed to go to school.

But I have always wanted such a situation. The people who inspire me and from whom I try to learn as much as possible have laid the foundation for their success in the last crisis or before.

When I look at my portfolio today, I see red figures. But above all, I see there that I can buy the shares of good and successful companies very cheaply. And on the P2P market I see that they are being sorted out.

Those P2P platforms that are not stable enough are suffering and have big problems. But the well-positioned platforms practice active crisis management.

Does P2P lending have serious problems?

Yes. Without a doubt. There are platforms that are having really big problems right now. But they’re fighting and they’re showing that they want to survive. But there are also platforms that are not feeling the crisis very much. And unfortunately there are also some platforms that you don’t hear about.

Now the question for me is: Is it bad if someone has problems?

Especially when there are problems with my money and it is in danger? Of course it is bad. But every investor should be aware that such times of crisis are part of it. There are always such times. The crisis itself is not the problem, but rather how you as an investor react to it.

I would like to briefly describe to you the problems I think P2P lending is facing in this crisis. The coronavirus itself has no effect on business models. However, the reaction of the market and the investors have a great impact on my investment.

#1 Investors are selling their loans because they are afraid

P2P lending only works if there is a balance on the market between the credit supply and investors. If there are too few investors, interest rates will rise to make it more attractive for investors. If there are too many investors and thus money on the market, interest rates fall again because the money is cheaper to obtain.

In times of crisis, it seems that everyone wants their money in their account. So many investors withdraw their money from the P2P platforms. Just as many people are now selling their shares on the stock market. Better to have money in your account with a loss than to wait until the loss is balanced.

I read a lot of posts in forums in the last few weeks where investors wanted to get their capital out of Mintos, Bondora & Co. Often it was rather about smaller amounts. It was better to accept a discount of 20-30% on the secondary market to have the money back on your account. So exactly the same as with shares.

#2 Investors want fresh money for the stock market

Stock market gurus like Buffet keep saying that you should invest when everyone else is panicking. And the moment when everyone is panicking is right now. So investors are also withdrawing money from the P2P platforms to invest it in the stock market. I myself know someone who liquidated his P2P investments for 40,000 Euros. He then invested the money in the stock market.

The reason for this is that the chances on the stock market are greater. Perhaps this view is correct. We will probably be able to assess this better in five or ten years. But what happens if that’s not the case?

How much risk you take on yourself is, of course, up to you. But taking all your money and investing it in shares also shifts the risk there. And once you have invested everything in shares or ETFs, there is no balancing component in your portfolio.

#3 Valuable and risky P2P investments

The crisis shows which P2P platform is well financed. Just like with stocks. Companies that have created a sufficient cushion for themselves can now cope with declining sales, losses and similar things for a few months. This hits them very hard, but they will survive.

And that also applies to the P2P platforms. In a crisis, it becomes clear who has done well and who has not. Those who either have a strong partner or have taken good care of themselves will survive. Too few cash reserves or too high a risk of failure now ensure that those responsible have worry lines on their foreheads.

Losses are a part of it for every investor. So if you have diversified widely in the P2P market, you may have to accept the odd small loss. But the portfolio will also contain large and good P2P investments that will survive the crisis.

On the other hand, those who have put their money on the providers with the highest interest rates may now have very risky P2P investments in their portfolio. And they will also have to sweat a lot if they will ever see their money again.

#4 Communication is everything

In many of my articles I have repeatedly mentioned that trust is the basis for a P2P investment for me. I trust a stranger with my money and hope to see it again. The more that is communicated here, the better I can trust someone.

Mintos for example communicates very well in my opinion. Maybe there has always been a lot of advertising, but it communicated. And now Martin’s Sulte stands up in a video and explains that Mintos has difficulties, employees had to be fired and the crisis also affects Mintos.

Another example: DoFinance! Not one mail. No communication. Nothing. On the blog you won’t find anything about the crisis or a statement of the platform. But the loans from DoFinance come from Poland in Indonesia. So it’s almost impossible that you don’t feel anything of the crisis there!

And now the question for you: What do you prefer? Do you prefer nobody to contact you or do you want to know if there are problems? Do you want certainty and possibly openly addressed problems? Or would you rather not hear anything and want uncertainty instead?

It is not new that information is very important to me. And I prefer to listen to someone how they want to handle the problem. Then I can decide whether this is still an investment for me or not.

It’s not easy to…

For me too, it is a crisis. I’ve never experienced anything like it. But that’s why I see it as a great opportunity. Of course, it is annoying that I will probably not be able to keep my plans for 2020. But that doesn’t mean that 2020 is lost by a long shot.

I see it more as a wave of fate. Life wants to give me a chance for something completely different.

At the moment my working day is not made up of routines, but of pure chaos. But that’s a wake-up call. And it shows what of my work is really important and what is not. This is important for me, but it is also just as important for my company and my boss.

So far we’ve gotten out of every crisis

There have been several crises worldwide so far. Some have been stronger, some weaker. In some cases, only regions have been affected. But no matter when or where – so far we have made it out of every crisis.

And that’s what I believe about the coronavirus crisis. I have no idea how much longer the virus will affect us. Maybe months, maybe years. But I am very sure that in five years’ time we will be able to look back to 2020 and see that in 2025 we will be better off than we are today.

And I see a very big opportunity for me in that. Maybe even the chance of a lifetime. Right now I have the best conditions. If I invest time and money today, I will benefit much more by 2025.

I will not liquidate my P2P investments – I will invest!

I received a very nice mail from Tanel Orro of Reinvest24 last week. In it he described his feeling how the P2P market is changing. It seems that a few have contributed to the reputation of P2P lending being damaged.

Now everyone can bury their head in the sand and cry. Or everyone could see their chances. I have decided to see only opportunities here. This does not mean that I only see positive things. But it is much easier to divide “good” from “bad” in a crisis than it is when the economy and stock markets are at an all-time high, as was the case two months ago.

Let’s make P2P investments great again – Tanel Orro

Probably everyone knows the quote that actually comes from Donald Trump. Personally, however, I think that Tanel uses this very correctly. Unfortunately, the P2P industry has experienced very negative developments in recent months. First two scams were discovered and now the industry is being tested in the crisis.

But do the negative news mean that P2P lending is wrong overall?

No, never. P2P lending has its justification and works if everyone plays by the rules. So during a crisis, those whose business model is not substantial are sorted out. And even there, the effects can be painful. But they will survive.

The great opportunity of the crisis

It is not always easy to talk about opportunities with a minus in the portfolio. I have gotten into the habit of doing that and I always try to find the little gold nugget in the pile of shit. And let’s face it: companies, whether on the stock exchange or P2P lending, that master the crisis will be more successful in the end. They will be the winners of the crisis.

“Crises-prooven” – this is a fairly new predicate, especially in the field of P2P lending. So far, only a few P2P platforms have this. In this respect, the opportunity here is not only to compare one’s own business model against the “good times”, but also against the hard times of a crisis.

It is now up to us all to make P2P great again. I would like to make my small contribution and make sure that we get through the crisis and emerge stronger.

In my life, it was always the stormy times which counted

I’m not old. But I can already look back on the one or other year in my life. And whenever it was particularly stormy there, I made a leap in my development afterwards. This applies to my career at work as well as my private development.

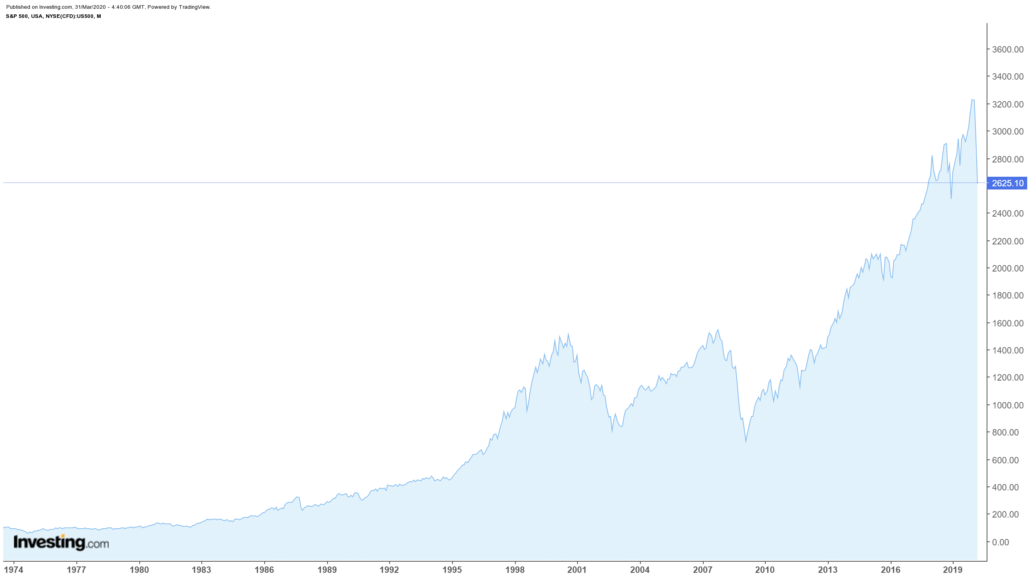

Take a look at the stock market performance of the S&P 500 – just as an example, every other index is also doing it as well.

Chart S&P 500

The trend has been going up and up for over 100 years. But in between there are always small and large losses. Sometimes they are even huge. Nevertheless, the S&P 500 has risen again and again thereafter.

We all want to get further. We want to develop and grow. And those who want to do so most quickly often sit in companies as CEOs. In this way, these drivers ensure that the economy turns the consequences of a crisis into an opportunity and makes the best of it.

What is still safe today in P2P lending?

Basically nothing is certain. Every investment is associated with risk. But this risk must be assessed. P2P platforms that do not respond at all, for example, currently mean a much higher risk for me. I have no idea how they deal with the effects of the crisis. And I can’t believe that they won’t have any impact when everyone else reports it.

Moreover, the reporting of the other P2P platforms shows that a solid financing and possibly a strong partner can significantly mitigate the effects of the Coronavirus crisis. So for me, that would be a second point to consider when making my selection.

And finally, of course, it is the business model. Less money is earned in crises, as unemployment typically rises at some point. Consequently, the first question is how a platform is prepared for this and the second question is whether its business model will continue to function so successfully in the new situation.

“Secure platforms” in my opinion

People always seek support in a crisis. Something that gives them security and gives them hope that the decision will be the right one in the future. I base this decision above all on how the platforms currently behave and communicate.

The type of P2P loans available on the platform and what the platform specializes in, among other things, also plays an important role. For example, I see a much smaller risk in real estate projects than in personal loans, for example, which depend on the employee and his employment itself.

Bondora – Go & Grow

My experience with the normal Bondora Auto-Invest is not very good. However, they are already many years “old”, so for some time now I have only saved the Go & Grow account. This worked quite well and the interest came very reliably.

Important: Go & Grow is NOT a call money account. In times of crisis, Bondora has switched to regulating the payments from the account itself. That was always in the Terms & Conditions – but nobody read it. So you must never invest money with Go & Grow which you have to access immediately and completely in case of doubt. But if you’re cool with your money being paid out over several days in a row, depending on availability, Go & Grow is a very easy way to invest in P2P.

Since Bondora is less dependent on loan originators and is more or less its own originator, I think the risk is rather lower in terms of size. There will always be failures on the platform as everywhere else, but with Go & Grow you will always get 6.75% if possible. Bondora will take care of the rest.

Mintos – Auto-Invest and Invest & Access

Mintos is currently my biggest investment. With over 60 loan originators, Mintos is the largest platform. But as Martins said in his video, they are also struggling quite a bit. The advantage here is the much broader possibility of diversification. But that is also the disadvantage, because Mintos has to manage these many partners.

In my opinion, the much talked about argument of buyback guarantees is worth as much as the person who pays for this guarantee. So if there is a strong partner behind the loan originator, the buyback guarantee will probably be served even in times of crisis.

However, if the buyback guarantee is not solidly secured and financed, it will be worth nothing in times of crisis and fly off the curve.

I firmly believe that Mintos will manage to survive the crisis as the industry leader. Martins communicates openly and explains his approach. Why should I not trust him if he stands by what he says? For me, the signs here are above all trust in the right approach.

Estateguru – Investment in real estate

I myself am currently not invested in Estateguru. Nevertheless I would like to mention the platform here. Estateguru is with almost 6 years one of the most experienced P2P platforms in business. It insists especially on financing real estate projects.

What effects the crisis will have on the real estate market is currently not yet foreseeable. Presumably it will also have effects. As one of the largest platforms, Estateguru is in my opinion very well positioned and equipped.

And Estateguru also reports in its own blog on how it intends to protect its investors’ investments in times of crisis. This gives me security and confirms that Estateguru is still on my list of P2P platforms I want to invest in the long term.

Bulkestate – the next real estate investment

Bulkestate’s business model is primarily based on providing financing for the restoration of real estate. In the past, there have been many projects in which very attractive living space was created from somewhat older buildings. The concept will continue to work in the future.

In view of the presumably rising unemployment, I almost believe that Bulkestate will also feel the crisis. After all, money will be less easy to spend on attractive housing when there is no income. But for bulk states this is also an opportunity to scan the market for attractive properties.

At the moment I feel secure and above all my money. However, Bulkestate could work a bit more on communication. I have information about the second and third hand as sources, but not directly as postings, mails or information from Bulkestate itself.

Debitum Network – A small platform develops

I firmly believe that it will be the companies that will pull Europe out of the crisis. These will be, among others, the large corporations, but above all all, all the smaller companies in the respective countries. Even though Debitum is comparatively small, they specialise in business loans and factoring.

They can thus make a major contribution and use the crisis as an opportunity. They can help the companies to organize the upswing and are involved in it themselves or via the investors.

I had a very intensive exchange with Martins at the P2P Conference last year. He explained the direction of Debitum to me and I was allowed to ask all the questions – and I got answers. The guy is a bit weird, but he has his heart in exactly the right place and always works to keep his investors interested.

Companies will be the engine of the build-up; capable guy with the right team behind him – chances are good that my investment will be good with that, right? I have confidence in it.

Reinvest24 – The trigger for this article

When it comes to finance, one should never be guided by emotions. But the blog post of Reinvest24 and the mail from Tanel are statements and gestures that impressed me very much. I myself am currently not invested in Reinvest24. But they are on my list for 2020.

If you look at the business model, this is also about real estate. However, the focus is more on buying properties and then renting them out. The properties are located in Tallinn and are mainly designed for long-term rental.

Depending on how badly real estate is hit by the crisis, there may be great opportunities for Reinvest24. Rents have never been lowered during a crisis, so the income stream will continue to exist. But for new projects, with the help of the investors, there might be the chance to profit especially but also to contribute to the P2P market and the economy to recover significantly.

I met Tanel and his team at the P2P Conference and I am convinced that the business model is solid and sustainable. Reinvest24’s statement also shows that they are very much connected to the P2P business and want to make their contribution to overcome the crisis.

Is P2P lending more secure now?

No, definitely not. My presentation of the P2P platforms is also just my view of things. I am not a financial expert with a global view of the financial markets. P2P lending has always been very risky. And the crisis is not making it safer. In listing the P2P platforms above, I just wanted to explain which providers are currently available to me and why.

But that doesn’t have to be right at all. In general, I believe that P2P investments are even more risky at the moment because it is the first real crisis for the industry. So it could mean the complete downfall – although I don’t believe in that, although it would be possible.

How are my P2P investments doing?

Don’t worry, they’re fine. So far there are no more failures than before and my portfolio is unshaken so far. And even if all P2P investments from my portfolio go down, I still have some other assets that will keep me alive.

At the moment P2P lending in portfolio is about 30%. This is mainly because the stock market and cryptos have fallen so much.

Platforms that do not currently receive my money

But the crisis does not seem to have spared my portfolio entirely. That’s okay and the normal risk. However, I have decided not to save on the following platforms for the time being and not to invest any more money there.

The reason is the same everywhere: Lack of communication! It’s so damn easy to give investors information during the crisis with a mail or a blogpost or any other message. This is completely missing here and not only causes trouble but also raises the question if my money is still safe there.

IbanWallet: Investment ended!

In my last monthly report I had already written that I had ended my investment in IbanWallet. I have always received my interest payments there on time, but I have never received any information about what and where I am actually investing in.

This is just now in the crisis absolutely no investment for me and so I have decided to end this. At the same time there is no statement from the platform about the effects of the Coronavirus crisis or whether I have to worry about my money as an investor.

Robocash – Stagnation and no signal

Robocash seems to have some problems. But they had that before the coronavirus crisis. Only the problems aren’t exactly getting any smaller now. Even then, communication was rather poor. It hasn’t gotten any better until now.

Again, it would be easy to give a signal and explain to investors why things are not moving forward. I’d rather have an email saying that there is only 8% interest, but that it goes further than nothing! Here there is currently also no further money from me!

DoFinance – actually… But then again

Actually, DoFinance is a P2P platform with the ALFA Group in the background, which should cope well with the crisis. Actually, because I have not heard anything about DoFinance until today. Neither on the blog nor by mail was there any statement.

That is a great pity, because DoFinance has actually convinced me so far. Nothing to say shows, however, that I perhaps have too much confidence in it. In this respect, there is no more money on my investor account, as I have no idea how DoFinance is doing at the moment and how the P2P platform wants to overcome the crisis.

Grupeer – Rumors and no infomation

I myself am not invested in Grupeer. But for weeks Lars has been trying to get a statement from the platform. There are rumors that some of the employees have been laid off. And then also that there are difficulties with payments.

I can’t evaluate this, since I’m not an investor. But even here it would be easy to give a statement. This has been completely omitted so far, so that I would not invest a single cent here either at the moment. The platform wasn’t at the top of my list anyway – but now it is quite far behind.

Conclusion on P2P lending in the Coronavirus crisis

It is obvious that the P2P market is affected by the crisis. Already Kuetzal and envestio have shown that the market is “not quite clean”. The current crisis caused by the coronavirus and the losses on the stock markets are also causing a lot of turmoil on the P2P platforms.

Is this bad? No, not at all. It’s actually exactly what the industry has been needing for quite some time. Many providers with partly opaque business models – a crisis ensures that everything dubious and poorly financed is sorted out.

So for us investors the process is actually very good. Of course there will be losses and maybe one or the other supplier will be hit, but the more that is sorted out now, the better the chances for us investors in the future!

So, let’s follow Tanel’s motto together and make P2P investments great again!

Leave a Reply

Want to join the discussion?Feel free to contribute!