7 habits of a successful passive investor in P2P lending

A passive investor is someone earning a lot of money while investing just a very little time into those investments. Quite a lot of people are talking about passive income. But what does passive income mean? I like to keep it very simple: The less active you must be to receive an income from any investment, the more passive income you have.

In my eyes passive income is nothing, which you are able to invest in. BlackRock or any other funds agency has no funds which are named passive income funds. Investing passively is a kind of habit you have to have and not a specific investment. Everyone is hunting to outperform the market – and they invest a lot of time. Why not use less time-consuming things like index funds or a good diversified P2P portfolio and concentrate on earning more money to invest?

Table of Contents

Care about your habits in life – you are born a passive investor

Our whole day is just about routines and habits. If you use habits like sleeping long or spending a lot of money into consumer products, those habits will not make you wealthy. But if you take care about your hard-earned money and avoid any debts, you will be able to invest your savings.

So, while anyone is talking about market timing, outperformance of stocks and insider news for investors you just concentrate on your income streams. And the bigger one of those or all of them become, the more money you receive from the interest of your investment.

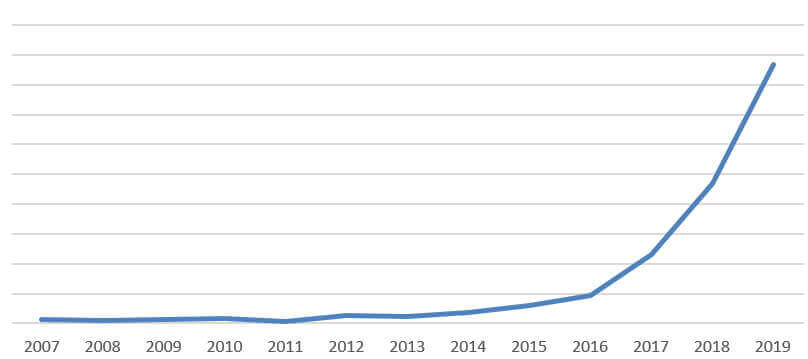

Let’s get on with the first habit of a passive investor in P2P lending. And at the end I will you show you a chart from someone you followed those rules, which looks very motivating to follow those habits.

#1 Care about your financial household and keep optimizing it

Most of us are receiving any kind of income. It does not matter, whether you are employed or self-employed or whatever. Everyone is receiving any income at the beginning of every month. And this is where everything starts. As long as you do not have to control of your financial household you will not be able to establish wealth.

There are several strategies for your household, which you can adopt. In the end the goal has to be to keep as much as possible for investing it. Start to be your own financial chief and a board of managers in one person to decide which spendings are necessary. The less emotional spending becomes for you, the more you will be able to safe.

And here is the basic advice: Keep control of your spendings!

You can read books, make online courses and watch videos about successful investors – as long as you are not able to watch your own financial statement of every month, you will not be able to invest. The passive investor manages his income streams once in an active way and automates the processes. So, he can care about the income afterwards and try to increase the streams.

Built your own funds at home and budget your expenses

I personally like benchmarks. Therefore, I check statistics to get a feeling what is “normal” or “average“. For example, the average income of a German person is 3.770 Euro per month before taxes and so on. And therefrom the average person is spending around 900 Euro for renting a home.

Additionally, he is debt with an average of 9.000 Euro. Of course, he has to pay average interest rates therefore every month. And the average person is spending 450 Euro on household things per months, 150 Euro on partying and 100 Euro into pension funds.

And this is the benchmark to beat. The more I am able to outperform the average, the higher my chances are to get wealthy. I think our financial household is okay so far, but there is always some potential you are able to realize. Just as an example: I used to go to a gym here in the town I am living. Since ever I was not very happy with their opening times. And it costed me around 280 Euro per year.

Calculate the example to bench your decision

Just last week I received an offer from my employer. He has made a deal with a gym company having around 100 gyms here in Germany. And they are opened 24/7. But the best: Being a member there will cost me 180 Euro per year. It does not seem to be a lot, but investing 100 Euro today and every year again, will pay around 900 Euro of interest the next 10 years.

Not changing the gym seems to be no loss today. That looks right, as I “just” will not be able to save 100 Euro. But if you care about the financial calculation in the long run – and it is just 10 years – this decision will cost me around 2.100 Euro. Therefrom 1.100 are the rate of 100 Euro every year being invested. And the rest of 900 Euro is the interest I would receive the next 10 years from this savings.

So, do care about your financial household. The more you optimize it, the faster you will be able to receive income from passive streams. It is the base for everything. The more sustainable it is, the more you are able to build on it.

#2 Passive investors are positive thinkers

Our society is a pool of doubters. Since years we are doubting the future of the EU. When Mr. Trump becomes president of the United States of America everyone was doubting his competence. And for two years everyone is talking about worldwide financial crises. And what do happen until now?

I do not want to discuss about Mr. Trump or anything else. I wanted to show you that our society is everything else than looking positively into the future times. But when the future is not positive, you will not be able generate income from it. So please check your thoughts and your habits.

A good way to stay positive is to check the charts of the huge indexes and funds. For example, take the chart of the S&P 500 or the MSCI World. Of course, those charts have their ups and downs and sometimes they were quite huge. For example, the years 2007 to 2009 when the world was really into financial crises. But guess what, today most of the charts are above the highest level before those crises.

Everything will be good, so you do not have to care about

If you implement a positive way of thinking into your mind, it will make you strong for crises times. The more you are convinced about a positive future, the less crises times will affect you. The average investor gets his income out of the market and waits until the storm is over. But this is average. Do you want to be average?

I often check my decision against the way of thinking of the whole society. What do they do? Where are they going to? I cannot really influence the future of a whole society, but I can have a guess. And I guess that Mr. Trump is a president caring about the US and less about the others. And I guess that the Brexit will not have those impacts, everyone is talking about. Am I right?

Stay positive as a passive investor

No idea but staying positive gives me the possibility to see chances and to use them. And if not, every chance will work out and be a chance in the future, it is still a chance. Just image one out of ten chances skyrocks and five just make a usual performance. How much income will you generate? And how much income will the average investor generate who stays out of any trouble?

Just be positive. Believe in those P2P lending platforms. Believe in a positive way our society will take. And of course use those chances, which you can identify. This makes me different from the average and I believe it is the right way to outperform the average.

#3 Manage your accounts passively

If you get to your board of managers about financial household and have to decide what to do, always take into consideration that you are supposed to lay in the sun and have a drink. So, when I make my financial decisions with my imaginary board of financial managers, I always think about doing nothing and keeping the things as they are.

Deciding to change the strategy will always cost time and money. Resources which are better investing to earn income. Of course there are P2P lending platforms offering the highest cashback or interest rate. But did you followed the way of the interest rate at Mintos? In my blogpost about Mintos invest and Access I was giving you screenshots about an interest rate of 13% and even more. Than in October the interest rate “crashed” down to 10% and less – and everybody was discussing about it. Today the interest level is nearby 12% again.

Being active means burning resources

Just imagine you would have taken action. Maybe you would have sold your P2P loans on the secondary market with a small loss to get rid of them. And you would have transferred your deposit to another P2P platform with 11%. You would have felt great, when everything is done, because now you receive 11% instead of 10%.

But today? Today you would receive again 12% at Mintos and invested a lot of time for at least nothing. Not getting active here would have saved you a lot of time. And today your active way of changing the investment has no more value to you.

So before getting to work on something, you should always rate the risks and chances of burning time. Was this action about Mintos really worth the time? I guess not. Even if you invested 10.000 Euro or more into Invest & Access we are just talking about the interest rate of some months. Between September and October your interest income would have a been 2-3 % less than usual, but that is it. Nothing more.

Stay out of trouble, but invest your time wisely

I try to just focus on investing. And there are some investment-cases which work and some which perform less. But still investing somewhere, where I receive “just” 7% is a good investment. The only action I would take at that time is not to invest more. But while others are thinking about changing the investment strategy, I focus on earning more income to invest it into another fund or possibility.

For me this is really a big deal. I always like to see what my portfolio is doing. Therefore, I made the rule to just check the assets once a week. And just every two weeks I am able to invest my received income into another possibility.

#4 A passive investor automates his investing rules

Investing passively is not just about making the investment itself. It is as well everything around this process. So, if you have to do a transfer every month to each of 15 P2P platforms, this might be very time consuming. Therefore, I make ONCE a year a strategy.

It is very simple as I just calculate, which amounts have to be transferred to which P2P platform. As I already mentioned P2P lending has a share of about 20-25% of my portfolio. When calculating the rate for P2P lending, I just check my saving rates and divide it into pieces. A 25% piece goes into P2P lending, a 50% piece goes into stocks and funds and the rest is for my crises fund.

And now I just have to divide this 25% for P2P lending into the platforms I would like to send my deposit to every month. For those I do a standing order in my account, which transfers the fixed sum to my account every month. Of course, I am just saving money to P2P platforms who are offering an auto-invest. So, the amount is sent to the account, deposited after one to three days and then directly invested by the auto-invest. Time, I need every month? Zero hours. Time which is necessary to implement this solution? Less than half an hour per year.

ROTI – Return on Time invested

There are several key performance indicators you are able to show in your overview. For me there is one additionally indicator, which is very hard to measure: ROTI. The return on Time invested shows which income is possible from your invested work. As everyone of us has an hourly rate, this is my benchmark to rate it.

Imagine you are paid 20 Euro per hour. If you invest one hour every month to do the setup for your investments, it will cost your 20 Euro every month and 240 Euro per year. The idea is simple, as you would be able to work that hour and earn 20 Euro additionally.

If I am able to get a minimum of 20 Euro per hour through making an investment, the time is invested in a good way. But very often the outcome is zero, so I check whether I am able to automate it.

On the 3rd of every month the work is done

Every new month the standing orders are done automatically. It is just my income coming to my bank account and afterwards sent to several investment accounts. Also, my account for the household things is filled with the budget for the coming month. I do not have to invest any time beside setting it up.

But things sometimes change?

Yeah, right. Sometimes things change. But what is supposed to change? If our car breaks down, there will be the crises fund. In case of any other emergency there is the crises fund. And of course, the “problem” could be, that I earned more. In this case the money is just left on the account.

Once a quarter I do something like a cleanup on my accounts. Everything above 100 Euro which summed up over the time, is spread over my investments. Often, I collect it on one account and sent it manually somewhere. The easiest thing is to just do one transfer, but that depends on the amount.

How to invest with zero time as a passive investor?

If you want to invest passively, you need to take care of your time. Therefore (and as a start) I recommend using either Bondoras “Go & Grow” or Mintos “Invest & Access”. Here you just have ONE SINGLE bank account, where you have to transfer the amount to. As soon as it arrives your depostiv will be invested following the investment rules of those products. You do not have to do something more or invest more time.

You do not have to check your accounts. Just keep sending the amount to it and your assets will grow. If you have automated any steps, you do not have to invest any more time. And in case you want to increase the sum of your savings, you just have to adjust the standing order. This is usually done within less than two minutes.

#5 Do not care about the news as a passive investor

During the year of 2019 there were several news on the P2P blogs. Whatever happens nowadays news are always written with an intent. They always try to act you the way they want you to act. Not caring about the news means no action and no invested time.

I stopped listening to the news on the radio and tv some years ago. I am just interested in the soccer results and that is it. Do I miss something special? Well, there some moments where I thought: “Ouch, you should have a listened to the news”, but in the end nothing serious happened. There I decided to stay on my track and not listen to the news further on.

Do not give away your time – you are a passive investor

If there are news, those will influence you. If a sack of rice has fallen over it still costed your time to read or hear this information. And if there is a bomb attack or war somewhere, you will be influenced by this information somehow. You are giving away the pilot seat of your life and offer it to someone else.

Do you really want someone else to drive your life?

Nope, I do not want it. Sometimes, as I mentioned, it is threatening, but until now it was always the right decision to do so. What are the costs of this kind of ignorance? Think about you following the news about Aforti Finance, which is a loan originator at Mintos and some more P2P platforms. There were rumors and rumors all over and you had to read a minimum of 5-10 different posts and news about it. Maybe you sold your Aforti loans with a small loss and invested them somewhere else. Or you maybe read about potential P2P crises…..

As you can see the news loop takes a lot of time from you. Time, which I invest another way to improve my performance. Coming back to the Aforti topic – what does this news helped you if you are checking those situation today? I think the answer is simple: nothing!

No doubt, there are important news

If a new US president is elected or the Brexit topic comes once again to an end, those news might influence you more than others. But still I think consuming the news will not give me any advantage. Therefore, I still do not listen to the news. I could get into the news about the Brexit, but what is the advantage of it? Especially if you rate any hour invested with those 20 Euro?

Those news, who are really important, will reach you anyway. Friends, colleagues and whomever will talk about it – so I will take notice from it. Until today this was the way to do it right for me. I guess I was informed about everything, which was relevant for me. But I saved a lot of time with those things not being interesting, which I did not consumed or listened to.

#6 Invest at any time, especially during crises times

A passive investor invests at any time. As he wants to reduce his risks, he is not investing with market timing. With this behavior he is not able to beat the market, but his performance will be near the market performance. If you invest into any P2P platform just try to reach the average performance. It is always displayed at the first page of any P2P platform, so you do not have to search for it.

Crises always mean unsecure circumstances. People do not know what will happen next. This sometimes scares the hell out of them. Honestly, it is the same for me. But I try to leave those emotions where they come from. And they are not coming from my investment portfolio. Just check the chart of any stock index you prefer. There you will be displayed that after every bad time the good times returned again. Also, it is sometimes hard I do not worry about the future.

Famous investors used crises times

Once again crises times are always a situation of news. Our society believes everything the read and listen to and follow the common way to behave. If the stock exchanges collapses, they sell all of their stocks, etfs and funds. It seems like cash is the best idea during this period of time. Nobody wants to see his portfolio horribly red.

But what does those people did, who became wealthy? Maybe Georg Soros, Warren Buffet or other famous investors – they invested. They invested their money during crises times. And additionally, they invested in companies they are convinced about. Very often those companies do not perform very well, but the investors found something they believe in.

Is this behavior somehow transferable to P2P lending? I think it is. In my blogpost about financial crises during 2008 and 2009 there is just a few data about it. But the data shows, that the P2P lending platforms survived the financial crises times.

P2P lending is not stocks, etfs or fund – but still an investment

P2P lending does not have those volatile charts as we are maybe used to from stocks and shares. So, it is hard so find out the best moment to invest in and the best to get out the investment. Once again this is market timing, where I do not want to invest into.

I check the business model of a P2P lending platform once before I make my investment. And when I am sure about them I make my investment. From now on all other investors rely on their performance. And this is exactly what I do – I rely on them.

This is why I diversify so much. I rely on quite a big bunch of people not even knowing them. But if one of those fail, the loss will be one out of twenty or thirty. Nothing which is a crises for me. And this is the perfect way to my last habit of a successful investor.

#7 Rely on the future and the longrun

If you take anything too serious you will invest a lot of time into solving those problems. And this is what the average does. They are trying to solve problems, which are no problems in the longrun. It is just a short period of time within a long horizon. Also financial crises during 2008 are just a dip on the charts.

Just rely on those who you invest in to be interested in a positive future. Everyone wants to grow himself and reach higher goals. So, you just have to rely on those and stay invested. A passive investor in P2P lending is just caring about more income to invest. But he does not care about short stormy times.

Give yourself rules and stick to them

Relying and trusting does not mean you do not have to care about it. If a P2P lending platform does not meet your requirements anymore, just leave it. As an example, I am just investing in those P2P platforms, which will bring me more than 10% of passive income through interest. I was invested in Twino for a long time. But inbetween their interest rate fell and I stopped investing. Today I am not invested there anymore.

I try to be more active with earning income. A passive investor stays passive with his investments, but is active in what he is good in. On my way to financial freedom this is the fast lane in my eyes. When I stay focused on what I am good in and increase my portfolio, wealthiness will come even faster.

Rules, especially for my time and my portfolio, help me a lot with dealing with it. Sometimes it is really hard for me to stay focused. The rules are helping me a lot to refocus again and stay on my track.

There is always a happy end for a passive investor…

… as long as you believe in it! One of the main factors about my and your financial freedom is the way we think about it. I am absolutely convinced of it. And also, sometimes things are not running like I want them to, there are still good for anything. You have often heard it: “Success is not a straight way” – but we often wish it to be.

Success comes from taking chances. And chances are you around, when the risk is high. So therefore, you have to believe in yourself and stay on your track. There is no common track to financial freedom. It is just the average way, but also this is not bad it is not ending in wealthiness. This is not the way I decided for.

Conclusion of the 7 habits a passive investor in P2P lending

We are coming an end. Do you find yourself in some of the points? Do you recognized anything which you are able to optimize? Seriously, I often think about my habits. And I am checking them every three to six months as I want to be sure to still stay on my track. And nearly everytime there a smaller thing which I have to adjust to get on my road again.

Let’s have a short overview about those seven habits:

- #1 Care about your financial household

- #2 Passive investors are positive thinkers

- #3 Manage your accounts passively

- #4 A passive investor automates his investing rules

- #5 Do not care about the news as a passive investor

- #6 Invest at any time

- #7 Rely on the future

Manage your habits and you are managing your life

There are a lot of studies about habits. All of them agree on the fact, that we are doing most of our tasks automatically. As our time during a day is limited, we are able to manage our habits through automatization. The more “good habits” you automate, the more good things will happen.

I think it is essentially important to manage your habits. Often, I tried to make something a habit and forgot about it weeks later. So, nothing happened in the longrun. Therefore, I try to make habits through automated processes and keep them. P2P lending allows me to automate quite a lot and to have nearly zero time invested on this assets.

And at the end managing your habits leads to the sum of all habits. If you are saving a lot and keep it invested, financial freedom is just the result out of mathematic figures. There is nothing magic about it, just pure calculation.

Thanks to Lars for inspiring me with his habits. And as well this blogpost is based on an inspiring post from Lars in German, where he is discussing those seven habits of a successful passive investor in P2P lending from his point of view.

Chart of Lars’ assets as a passive investor

Think about being a passive investor and take it as a chance

From reading my blog you maybe know, that I am not the best one with discipline. I am often running out of time to do things for quite a lot of reasons. Automatizing some habits especially focusing on my goal of financial freedom brought me to a new level. Since ever I was looking to those who are financially free. With my habits I can see my personal financial freedom in an Excel sheet. Also, it is far away, it is not impossible. I am able to handle it my way and to increase the focus on it, so I will reach it earlier.

It is just in my hands and nobody else is staying in my way. I am able to manage it the way I want to do it and that is it. Habits and routines are very important for me to reach my goals. So maybe you are able to take the chance, when you struggled until now.

I would be happy to read about your opinion. What are your habits and fastlane routines? I am sure we are able to learn from each other, so let’s share ideas. Just comment below and maybe we find an 8th and 9th habit of a successful passive investor.

Leave a Reply

Want to join the discussion?Feel free to contribute!