Ventus Energy is a platform focused on sustainable energy production, launched in 2024. It is not aimed at very small-scale investors, but it does offer some notable features. The first projects in the energy sector were listed with returns of up to 18%, combined with daily interest payouts. That may sound unusual, and there are indeed aspects that support this impression – which we will look at later.

Before participating, it is essential for any investor to carefully evaluate the project and its conditions – a step that should always be considered mandatory.

Skin in the Game: Ventus Energy on My Watchlist

I have not invested on Ventus Energy yet, but the platform is on my list of possible investments in the future. So far, I’ve looked into the concept, studied how the daily payouts are structured, and reviewed the initial project terms. In this review, I’ll outline how Ventus Energy presents itself, what potential investors should know, and where I see the key risks and opportunities.

💬 Want to discuss Ventus Energy and other P2P platforms with like-minded investors? Join my Telegram group where I share updates, research, and answer questions.

What is Ventus Energy?

Ventus Energy was founded in 2024 in Estonia but operates out of Riga, Latvia. The platform acquires and develops regulated energy infrastructure companies in the fields of renewable energy, utilities, and sustainability sectors. At present, it is the only platform on the market with this particular business model.

In practice, this means that power plants are purchased or built, their operations optimized, and made fully functional so they can generate a continuous cash flow. Funding for these projects is intended to come partly – though not exclusively – from private investors.

The company’s current focus is entirely on Latvia, where the first power plant was taken over in 2024. Additional projects are scheduled to follow in 2025. All projects are fully owned and managed by Ventus Energy, with no reliance on external operating companies.

The concept is somewhat comparable to Fintown’s collaboration with the Vihorev Group, with one important difference: at Ventus Energy, the group itself also acts as the platform. This structure can influence the risk profile – while Fintown separates platform and company assets in case of insolvency, Ventus Energy would be liable with the full group assets.

Facts & Quick Overview – Ventus Energy at a Glance

Below is a snapshot of key data on Ventus Energy. Use this to get a quick feel for how the platform works before diving deeper into the review.

| KEY FACT | VALUE |

|---|---|

| Founded / HQ / CEO | 2024 / Riga, Latvia (registered as Ventus Energy OÜ in Estonia) / Henrijs Jansons (since launch) |

| Regulation | Not regulated as a platform; energy production itself is regulated |

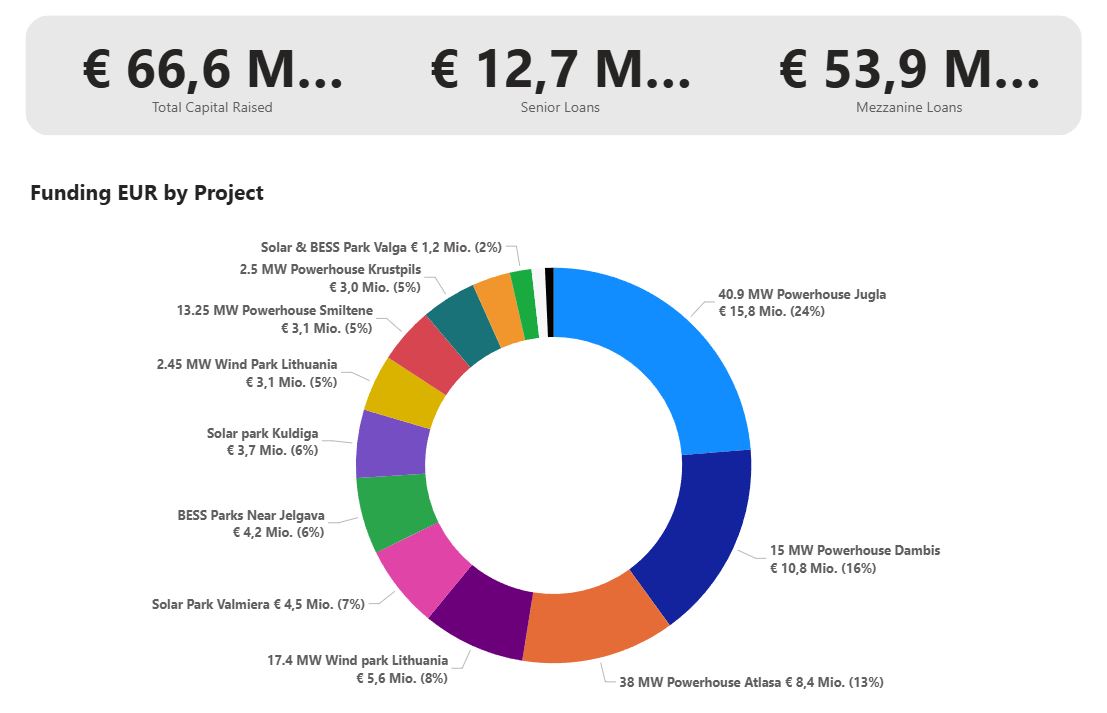

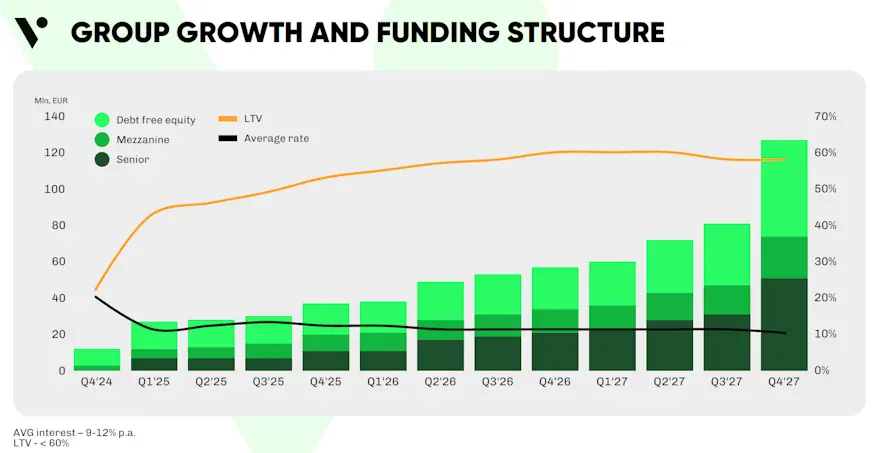

| Assets Under Management & Total Funded | ~€43.4 million AUM / ~€59.4 million funded |

| Number of Investors | ~3,700 active investors |

| Average Return | ~18.4% (according to official figures) |

| Buyback Obligation | Yes – Ventus Energy covers payments after 90 days |

| Minimum Investment | €1,000 |

| Auto-Invest / Secondary Market | No / No (early project exit possible) |

| Tax Reporting | Yes – annual certificate provided |

| Latest Financial Report | No audited financial report published yet (company still very young) |

*Data points may change over time; always check Ventus Energy’s platform for the latest information.

Funded Projects & Assets Under Management from Ventus Energy

Ventus Energy on a Timeline

News about Ventus Energy

📰 P2P News CW 48 – Ventus Energy Takes over First Plant – Read the full update here

Registration for Investors

Signing up on the platform is fairly straightforward. The process consists of the following steps:

- Create an account by entering your email address and password.

- Provide your personal details.

- Verify your identity (e.g., with your ID card or passport).

It is also possible to register as a company if you wish to invest through a corporate entity. Once registration and the first deposit are completed, you are ready to start investing in the initial energy projects.

How Do I Deposit Funds?

Depositing money is, as always, the simplest step when it comes to investing. In your account, click on “Deposit / Withdraw” to open the deposit screen. From there, you can transfer funds to the bank account provided.

Please note that the transfer must come from a personal bank account. This account will also be verified and used later for withdrawals.

How Do I Withdraw Funds?

If you want to withdraw capital or accrued interest from Ventus Energy, you also go through “Deposit / Withdraw”, but this time select the “Withdraw” tab at the top.

No fees are charged for withdrawals. Funds can only be transferred to a bank account in your name. If you wish to register a new account for withdrawals, you must first make a deposit from that new personal account. The minimum withdrawal amount is €10.

Can I Use a Credit Card for Deposits and Withdrawals?

At the moment, you cannot use credit cards for deposits or withdrawals. All transactions must be made through a bank account. Using a bank account also serves as part of the identity verification process.

However, if you use services like Wise or Revolut, you can top up those accounts via credit card and then transfer the funds to Ventus Energy from there.

How Long Does a Deposit Take?

Based on current Ventus Energy experiences, deposits are usually credited to your investor account within 1–2 business days. However, if you use services such as Revolut* or Wise*, the transfer may be available even faster.

Ventus Energy Review: How Does the Platform Work?

After registering with Ventus Energy, you can use the “Invest” button to view available projects and carry out your own research.

There won’t be a large number of investment opportunities, as we are talking about power plants rather than small consumer loans. This makes it worthwhile to read through the project documentation in detail.

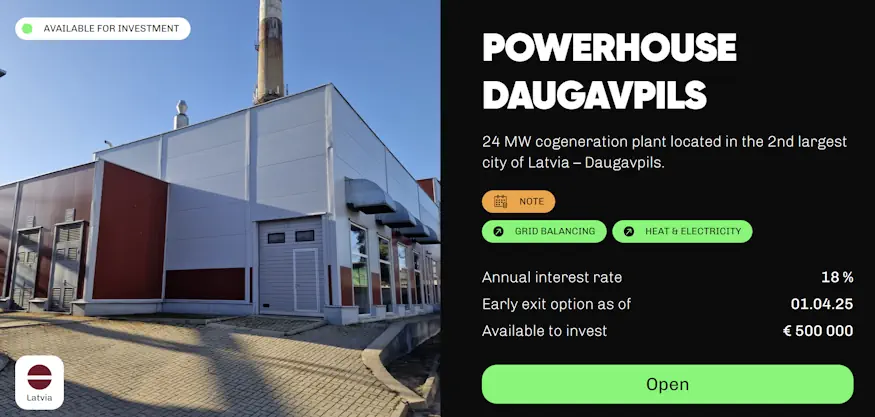

For example, one of the first offerings was a bond for the Daugavpils power plant. Alongside the financial outlook, investors can access a wide range of technical documents, evaluation reports, references to participating institutions, and even photos. Anyone genuinely interested in the subject can dive deep into the material.

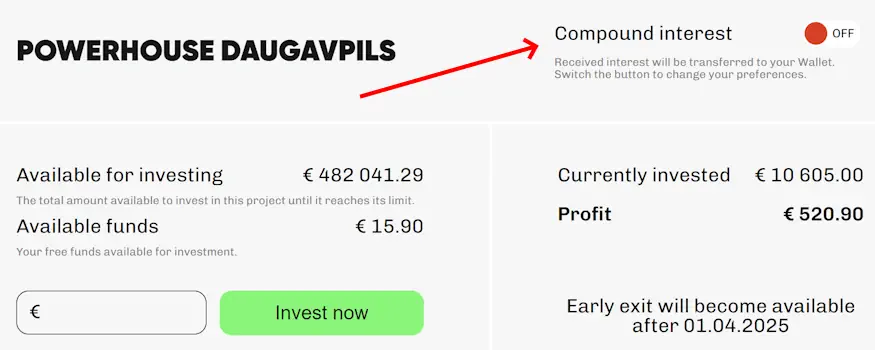

When it comes to your investment, you can also decide whether the interest should be reinvested into the same project or paid out directly. The option can be set individually for each project. Interest compounding can be enabled or disabled on a daily basis, which significantly increases the potential yield and is displayed transparently on the portfolio page.

Once invested, interest payments are credited to your account daily – similar to Bondora Go & Grow or Monefit SmartSaver, but at a somewhat higher rate.

Tip: If you plan to invest more than €1,000 and would like to withdraw your cashback instead of having it added to your project investment, the process is as follows.

- First invest the minimum €1,000.

- Disable compounding

- Invest the remaining amount.

Example: Deposit €10,000, invest €1,000, disable compounding, then invest the remaining €9,000. In this setup, the cashback from the €9,000 will be credited to your available funds and can be withdrawn directly.

Is There an Auto-Invest Option?

Since there will only be a limited number of projects on the platform – and investors are expected to review them carefully – Ventus Energy does not offer an auto-invest feature. It is also unlikely that such a function will be introduced in the future.

Is There a Secondary Market?

Ventus Energy does not offer a secondary market. However, similar to Fintown, investors are not required to hold projects until maturity. Each project comes with a minimum holding period, after which capital can be withdrawn (in the example above, as early as April 2025).

The process works by having another investor purchase your claim once they invest in the project. This means there must be sufficient demand for you to exit. Ventus Energy itself does not provide any interim financing.

In Which Countries Can You Invest?

On Ventus Energy, investments are currently limited to the home market of Latvia only.

What Projects Can You Invest in on Ventus Energy?

On Ventus Energy, you provide funds to the company through a mezzanine loan, which is used for the construction, purchase, modernization, and expansion of power plants. On the platform, this takes the form of notes (bonds).

These short-term bonds are issued by the specific legal entity that owns the respective power plant. Each of these entities is 100% owned by the Ventus Energy Group.

According to Ventus Energy, the bonds are issued in compliance with the Latvian Financial Instruments Market Law. Detailed information about each bond can be found in the respective project descriptions.

What Are the Costs on Ventus Energy?

Investing on Ventus Energy is free of charge at all levels.

What Is the Minimum Investment on Ventus Energy?

The minimum amount required to invest on Ventus Energy is a substantial €1,000. According to the company, this threshold is intended to avoid working with very small-scale investors, as these tend to generate the highest support effort based on their experience.

Does Ventus Energy Offer a Buyback Guarantee?

Ventus Energy provides a payment obligation after 90 days. In principle, projects you invest in may still default. However, Ventus commits to repaying principal and interest as long as the company remains able to do so.

If that is no longer the case, the payment obligation will not help – meaning, as always, you could lose your entire invested capital.

Is There a Ventus Energy App?

No, Ventus Energy does not currently offer a smartphone app.

Can You Invest in Other Currencies?

No, on Ventus Energy you can only invest in euros. There is also no currency risk within the projects.

Does Ventus Energy Provide a Tax Certificate?

Yes, Ventus Energy provides a tax certificate. You can find it in the “Statements” section under the “Tax Statement” tab.

How Does Ventus Energy Makes Money?

Financing is generated through the power plants that are put into operation. So far, there is one plant in Riga, with more projects expected to follow in 2025. In addition, the owners also support the business with their own capital.

With each additional power plant, the group’s income increases, which in turn strengthens the overall stability of the platform.

Is Ventus Energy Profitable?

Ventus Energy has only just launched, so there are no financial results available yet – only forward-looking projections. At this stage, the company is not profitable. It should be noted that the entire business model depends on the successful operation of the power plants.

What Happens if Ventus Energy Goes Bankrupt?

If something happens to the platform, your investments will initially continue to run. In the event of insolvency, an administrator would handle the settlement of the remaining projects and payments, and distribute funds accordingly.

It is also important to note that there are two types of investors on Ventus Energy: senior lenders outside the platform (e.g., banks) and mezzanine lenders on the platform (private investors like us). Mezzanine investors are not first in line in the case of insolvency – which is why they receive higher returns in exchange for this added risk.

Past cases have shown that insolvency proceedings are often lengthy and lack transparency. Therefore, a potential bankruptcy of Ventus Energy represents a significant risk to your capital.

How Reliable Is Ventus Energy?

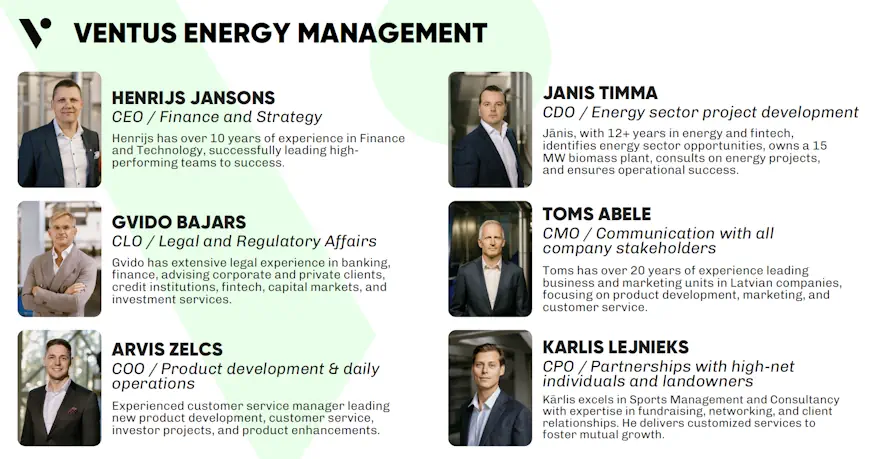

Ventus Energy is a new platform with a professional team behind it. However, one name often raises questions about credibility: Janis Timma, the CEO of Crowdestor. He has been criticized in the past for financing high-risk third-party projects with investor funds, many of which collapsed during the Covid-19 pandemic.

That said, Janis Timma comes from the energy sector and has over 12 years of experience in the field. The energy projects on Crowdestor (Crowdestor Flex) were, to the best of available knowledge, largely successful. He also owns a fully operational biomass power plant in Riga, which I personally visited years ago. At Ventus Energy, no third-party projects are financed – the company itself retains full control over all plants.

At Ventus Energy, Janis serves as Chief Development Officer (CDO), responsible for identifying acquisition opportunities as well as grid balancing and heat generation strategies.

It is also worth noting that the Latvian energy market is highly regulated, and Janis does not run the company alone. The CEO, Henrijs Jansons, has a proven track record and operational control. Ultimately, it is up to each investor to evaluate this aspect individually. For me, this is not a red flag by itself, and the reality is rarely just black and white.

How Safe Is Ventus Energy?

At this stage, it is too early to draw solid conclusions about the safety of Ventus Energy, as the track record is still very limited. While the energy business in Latvia is regulated, there are many factors that could affect the operational calculations of the power plants and prevent them from generating positive results. For example, rising raw material costs could impact profitability.

It is therefore crucial that the plants operate profitably, since they are responsible for ensuring that bonds can be repaid to both investors and banks. As private investors are subordinated, we would be the first to face problems if the numbers no longer add up.

That being said, double-digit returns never come without risk. Investors should be fully aware of this and understand that part of the investment case is also a bet on a future vision.

Ventus Energy: Pros & Cons

A quick overview of the main advantages and disadvantages of investing with Ventus Energy.

| Pros | Cons |

|---|---|

| 100% in-house projects operated by Ventus Energy | Controversy around Janis Timma’s past (credibility concerns) |

| Energy business is highly regulated in Latvia | Platform itself is not regulated |

| Daily interest payouts; optional reinvestment (compounding) | Subordinated mezzanine loans (higher risk) |

| Focus on sustainable, renewable energy production | High entry barrier (€1,000 minimum investment) |

| Potentially high returns, above industry averages | Very young company with limited track record |

| Early exit option (subject to demand from new investors) |

Evaluation of Ventus Energy

Based on the experiences shared by Lars, the first year of Ventus Energy has developed positively. The initial power plant is running smoothly and, according to his feedback, has been delivering stable returns of around 18% with daily interest payouts. Several additional projects have also been launched since then.

One point of discussion has been the involvement of Janis Timma, known from Crowdestor. While Crowdestor was often criticized and associated with negative outcomes for many investors, it is worth noting that Timma’s background is in the energy sector. The energy-focused projects at Crowdestor (Crowdestor Flex) reportedly performed well, and his expertise is considered a valuable asset at Ventus Energy.

Equally important is the leadership of CEO Henrijs Jansons, formerly of Debitum, who is credited with helping that platform regain stability. His role at Ventus Energy is seen as a strong factor for potential success.

Overall, Ventus Energy remains a high-risk opportunity, given the company’s young age and limited track record. However, the combination of daily payouts, a regulated energy market, and experienced leadership has made the platform noteworthy for some investors. While I am not currently invested myself, Ventus Energy stays on my watchlist as a project to monitor in the coming years.