#PAR13 Passive Income Report November 2020

Welcome to my newest update of my passive income. For those of you being invested in stocks the period should have been quite successful. Watching several people on Instagram with their months statements their portfolio grow by 10% to 18%. Incredible! My personal growth rate in stocks was just about 9%, which is compared to the rest of the year quite okay. I am closing the distance to the market performance, which is my main target.

In P2P lending times are still quite rough. The overall volume of issued loans is slightly increasing again, but the level is still around 50% lower than before the corona crisis. I saw a post about that the other day with a headline just like “P2P lending is still on crisis”. Well, everyone is allowed to make their own research and opinion about the P2P market. In my case I understand this interpretation, but my sight is different.

Table of Contents

The P2P platforms learned a lot – and still do!

With Kuetzal and envestio two platforms were probably the beginning of the crisis times in P2P lending. Also the quite huge amount of struggeling loan originators for example at Mintos are something like a hint to this. From this point of view the area seems to be in big trouble – and I am sure, some are!

But let’s focus on the wins: All of those P2P platforms who still exist, which is most of them, learned where to focus on. You are not able to issue loans like heck without any fallback-scenario. This might cost investors of Grupeer a lot of money. Furtheron there were some loan originators who failed to make their repayment and are still fighting. Investors also learned again, that the highest interest rate is not always the best pick. Interest rate and risk is still a strong correlation, which means that you are able to lose your money.

Overall I think that there were a lot of learnings during this period of time and still ongoing. P2P platforms made stricter standards for issueing loans and investors may know to not invest everything into one single platform or loan. Therefore I think this time was and still is very valueable for P2P lending as investing here becomes safer though better restrictions and conditions.

My personal November was one of the best months 2020

I was able to get a bit more back on track than before. I managed to ignore the news about Corona most of the time. This gave my head and my energy a lot of space for others things, which pushed me through this month.

First of all I did an Instagram course to learn more about the platform and their algorythm. Insane! For me it looks like the same as search engine optimazitation, which is a topic, I really like. It is great to understand the connection between valueable content and engagement on those post. So I am slightly increasing my content and my followers, which is fun to interact with and have the feeling to be able to help sometimes.

Additionally I did my plans for 2021. Might be a little bit early, but as I was expecting a hot month at work in December and wanted to do it in advance. Like the last years I made a evaluation of 2020 and tried to find things, which disturbed my way towards my goals. With this knowledge I made a rough plan for 2021. The goals are pretty huge, but I tried to make it as simple as possible. This year I spend a lot of time on re-focussing, adjusting and stuff like that due to my quite complicated way of setting goals. So I avoided this time wasting things for next year and tried to keep it stupid simple.

P2P lending in November

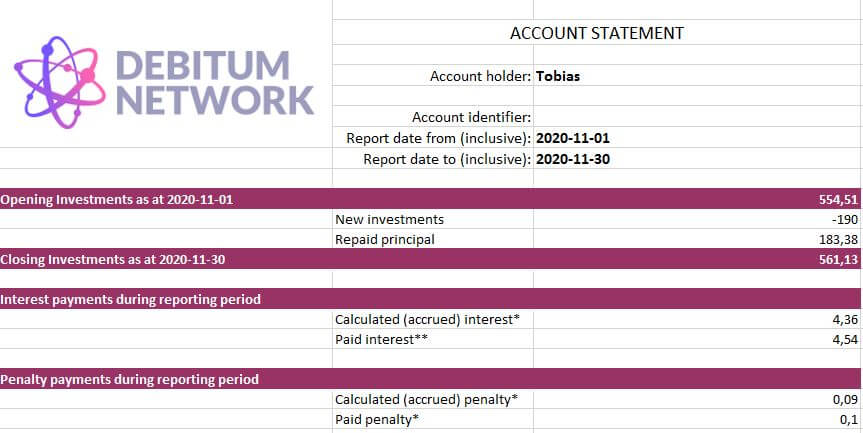

There were several news in November, which might affect the P2P area the next time. But I will get to them when talking about each platform. My overall investment in P2P lending increased by around 450 Euro. In those figures you are just able to see about 320 Euro of it, as I am testing three others platforms which are not included in this overview. And additionally there was a small mistake at Brickstarters in my last overview.

You might see, that the amount at my Bondora account is growing. Thats right as I shifted some money from DoFinance to Bondora. Additionally I am still doing my NoSpendChallenge with my Bondora Go and Grow account transferring savings to it.

I transferred additional investments to the following platforms:

- Bondster -> 50 €

- viainvest -> 50 €

- Reinvest24 -> 100 €

- Bondora -> 100 €

- Moncera (testing) -> 50 €

- Kviku Finance (testing) -> 100 €

My overall savingsrate was great in November as I already made my financial plans and goals for 2021. And I directly stick to them, which is a great feeling to keep. But let’s get into the details now.

Mintos with an incredible crowdfunding campaign

As there were a lot of “bad news” about Mintos in 2020 due to struggeling loan originators, Martins and his decided started a crowdfunding campaign in November. You were able to buy a share from Mintos and to be part of it. The inital target was to crowdfund one million Euro. But shortly after the campaign was started it skyrocket and closed a short above seven million Euro.

For my personal passive income Mintos generated 33,98 Euro in November. If you read my last report you might know, that I am shifting money from Mintos to other platforms. The reason therefore was a 60% overweight of Mintos in my current portfolio. My plan is to have four big P2P players in my portfolio, whereas Mintos will be one of them. As I dont have the money and additionally dont want to rise my P2P share in my portfolio I had to do it with shifting.

Bondora as the second big player in my portfolio

You might have read my blogpost about Bondora. I re-entered the platform by the mid of this year and want to grow it constantly to another big player in P2P portfolio. Therefore I “used” initially the NoSpendChallenge until October sind since then I continued transferring savings to the Bondora Go and Grow account. Currently I do not want to invest on their primary market – just with Go and Grow. And in November I received 6,53 Euro from Bondora Go and Grow.

Grab your 5 € bonus at Bondora here + 5% on your investment for the first 30 days

I will keep it to transfer savings to the account. And additionally there will be at least two more fixed transfer my bonusses I will receive in 2021. Until now I am very happy with investing via Go and Grow. The main target currently is to grow it to 1 € interest per day, which is an account total 4450 Euro. It is impressing how much money comes together if you constantly save your personal savings from tiny amounts. Sometimes it is just 4-5 Euro and once a week it is 20 Euro from the plasma donation – a lot of small steps with a big impact in the end.

DoFinance testing my patience

Well, I am little unsure what to write or say here. I was a DoFinance-fan for more than one year. And I was really forbearing when the covid shock hit the P2P lending platforms. But since most of the other platforms are getting back on track DoFinance seems to still struggle. In November they announced on their blog that they will continue doing the P2P business, which seemed to be ending during the year as there were no new investment opportunities.

The thing I am quite angry about is the fact, that my “investment period” ended, but the money seems to be stuck in P2P loans. Therefore I do not receive around 10 Euro per month interest, but just something up to 1-2 Euro. There are still nearly 1.000 Euro stuck in the investment, which are repaid by 10-50 Euro per month. That s not very cool. There is no information about on the website and also in my account, so it seems like they are currently not knowing how to shift the existing loans into new investments. Currently no investment case for me!

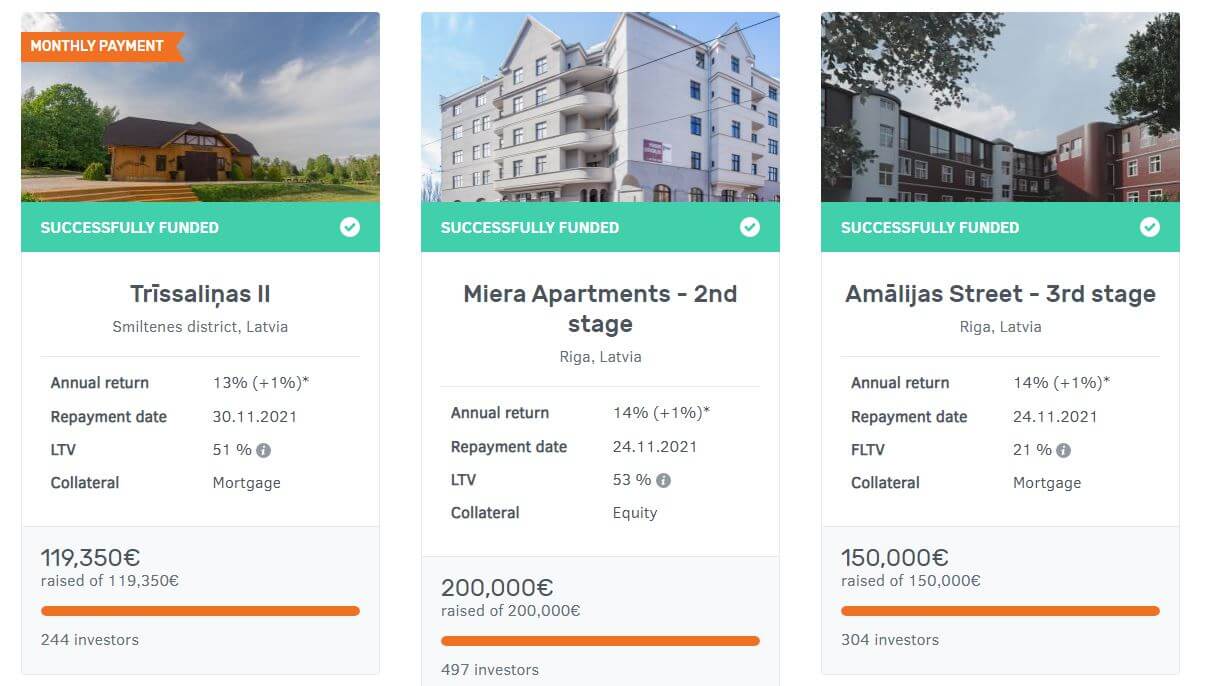

Bulkestate with zero income, but new projects

Knowing Bulkestate you usually do not receive a monthly income. Interest is paid at the end of the investment period. Therefore zero income is nothing special here and nothing to worry about. There is just one project I am invested in which is supposed to pay a monthy interest of 0,45 Euro. Unfortunately this one is overdue and Bulkestate is in contact with the responsible person. As Covid also affected the Baltics it takes time to bring this one officially to court, wherefore I guess I just have to wait for a longer time.

Meanwhile Bulkestate issued several news projects. Also my repayments from August and September were directly reinvested. So it seems like the platform is constantly growing and being able to publish more new projects. I will stay invested here and see how the real estate sector in the Baltics will cope with the newest wave of corona infections. I am not quite sure what will happen, wherefore I will keep it like it is.

Robocash is coming back

At the beginning of 2020 it seemed like your money was lost on Robocash. Unfortunately I just wrote a blogpost at that time about the platform. And I was really happy with Robocash until then. During the crisis times in March and April I was a bit scared, but it turned out that Robocash was also affected from the typical P2P problems. Since the mid 2020 the platform is publishing a lot of new data. You are able to find their financial report and stuff like that – also there is some communication, which I really appreciate.

I did not stopped anything here and I will stay invested as the financial report was really good and interesting. Guess they change for several reasons which are all to be more transparent to their investors. So in November I generated 5,27 Euro of passive income from Robocash. In 2021 I want to increase my investment here, but I have not decided yet when.

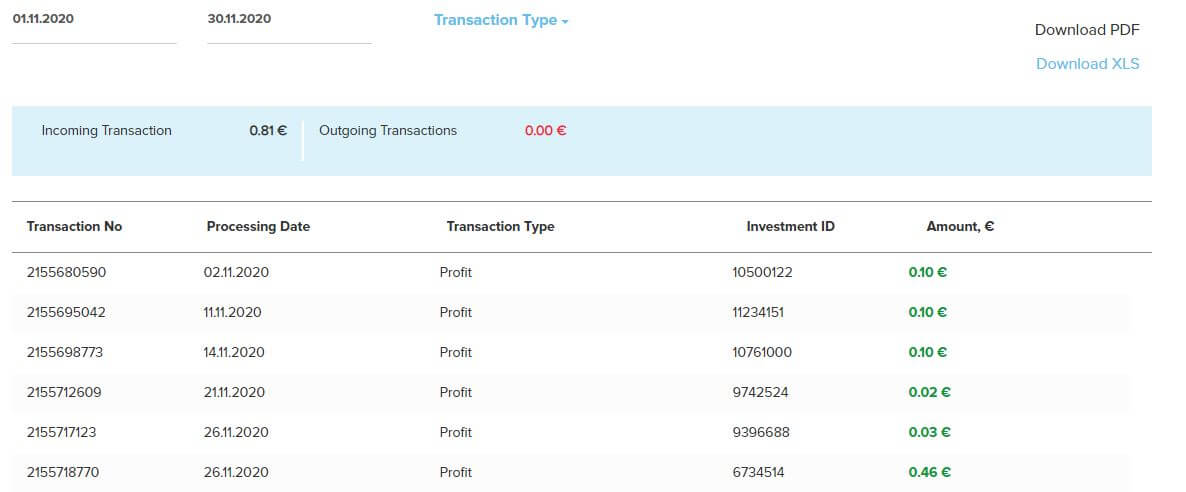

Debitum is running…and running….and running!

There are no big news from Debitum. On their blog they publish new blogposts from time to time, but there are no “big news” which are making doubt my investment. In 2021 I will grow my account here with a steady sum per month. With my personal view Debitum is a very good B-candidate after my big four. There is a targetted sum behind it, which I want to achieve in 2021.

During November my account was able to generate 4,64 Euro of income. During 2019 I often reported that the figures of planed and paid interest often differ. Since several months this “problem” became quite small. In November is was just some cents which I hope will be the new standard for the future 🙂

I am doing things wrong at Twino 🙂

The platform Twino is supposed another basic pillar of my P2P portfolio. My plan is to grow them to one of the four big players. But meanwhile there is not enough money in my pocket, to do so 🙂 So without any fault Twino is the one in the back of the field. This will change in 2021, but currently it looks like they are just a test-baloon in my portfolio – which is definitely not the case!

So I am not wondering about just 1,84 Euro of income here in November. But guys, this income stream will grow next year. Depending on how good my business will be running I hope to stake an four-figures-amount into P2P loans here by the mid of 2021.

Grab your 15 € bonus at Twino here (invest at least 100 €)

Just another year – nope!

2020 has been wild. There is a quote in German which I am not able to translate. But it says from its meaning: “If you expect things to run smoothly, the unexpected will come from a point you would not have expected it there!” I guess, that is 2020. Scrolling a bit on my blog you will maybe find my last years resolution. I wrote about “rocking 2020” and “stick to my goals every damn day”. Phhh, did I do that?

Who cares! 2020 is almost over and my plans for 2021 are made. But I am not unhappy with 2020. In my resolution-post I wrote about more diversification in my P2P lending portfolio. Guess, I achieved that. Additionally I was able to invest severals Euros into P2P lending and als generate a passive income of approcimately 800 Euro this year. Does this sound like failing? Maybe I failed my goals, but I moved forward.

I think I am meanwhile stable enough to focus on my goals and to not let covid or whatever influence me again than strong. So, I learned quite a lot this year too! Maybe I will write about my P2P goals in one of the next blogposts. My main goal is to consistently post here. 2019 was a great experience on this blog, 2020 was mainly okay, but in 2021 I am planning one blogpost per week. Whoever wants to be accountability partner might DM me on Instagram – let’s get in contact 🙂

That’s it for now – keep your heads and always watch out for the loan sharks!

Leave a Reply

Want to join the discussion?Feel free to contribute!