P2P News CW 48 – Ventus Energy takes over first power plant

Welcome to the latest P2P news from the world of P2P platforms. Today we talk about taking over your first power plant on Ventus Energy, Black Friday deals, InRento’s expansion into Ireland, a brand new project on Fintown and Estateguru’s 2023 annual report.

5 P2P news in a nutshell on YouTube, the podcast & here to keep you up to date. Let’s go!

Table of Contents

#1 Ventus Energy generates first cash flow

Last Thursday Lars flew to Riga for a day to attend the inauguration of the first power plant acquired by Ventus Energy*, along with a number of other major investors. The “Riga Powerhouse” was inaugurated and financed much faster than expected.

This is great news for us investors! It means that Ventus Energy’s business plan seems to be working so far. From this week onwards, the income from the power plant will flow into the Ventus Energy Group and, of course, ensure that interest is no longer paid out of pocket.

We are talking about a monthly amount of EUR 300-400,000 after all costs, depending on the heating season. It is also possible to expand the system with additional components.

So anyone who has invested in the project can now sit back and look forward to the repayments.Lars himself has invested over €10,000 and will certainly not be using the early exit option again.

#2 Black Friday Deals continue

Ventus Energy, among others, is running a hefty cashback promotion that could net you up to 7%. Even though Black Friday is officially over, some promotions are still running.

Unfortunately, I missed out on Indemo as mentioned in last weeks P2P News.

I had also hoped to see something from Bondora, but nothing. So I only used the 1 year vault from Monefit at 10.52% as I was planning to switch to the 12 month step model anyway.

Lars also bought the 16.59% loans from Malaysia on Loanch as part of the P2P Las Vegas portfolio.

But if Ventus Energy launches a new project before the end of the year, I would certainly add a few euros here again, depending on the project.

#3 Expansion into Ireland for InRento

There was also good news from the property platform InRento, which after several years still has a clean bill of health when it comes to defaults. Although delays are becoming more frequent, they have so far remained the exception.

As of last week, investors can now invest in Ireland as well as Lithuania and Poland. The first project is a four-bedroom, single-storey house in Renmore, Galway, with a side garage. The developer plans to split the financed single storey house into two units to increase the expected rental income.

Renmore is one of Galway’s most popular districts, in a prime location with excellent transport links to the city’s most popular attractions. Lars is always cautious when it comes to new markets, but as he has a weakness for Ireland, this house went straight into his portfolio .

Incidentally, InRento is planning a permanent presence in Ireland, so this won’t just be a one-off project. According to CEO Gustas, rental yields in Ireland are among the highest in Europe, making it a good risk/reward proposition.

#4 New major development in Fintown

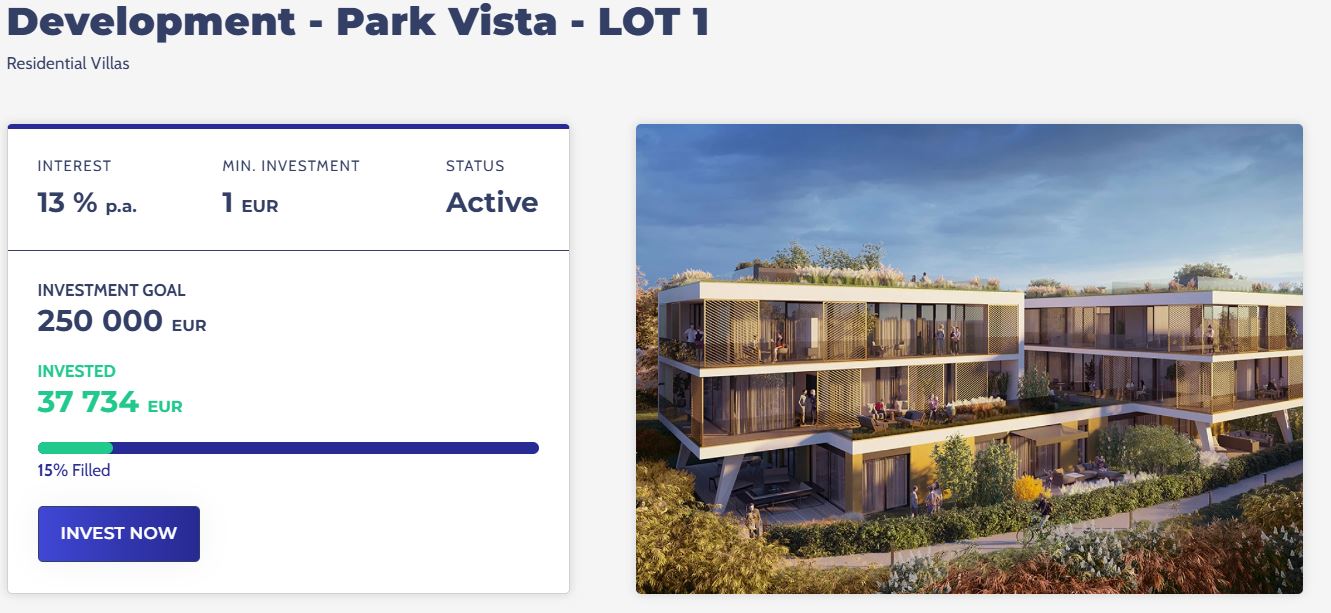

The real estate platform Fintown is also breaking new ground with a development project that is not for rent but for sale. The new “Park Vista” project is a new villa complex to be built in Prague. They are really starting from scratch here. Demolition of the old building will start in December and is expected to last until March 2025. The new building will then be completed by September 2026.

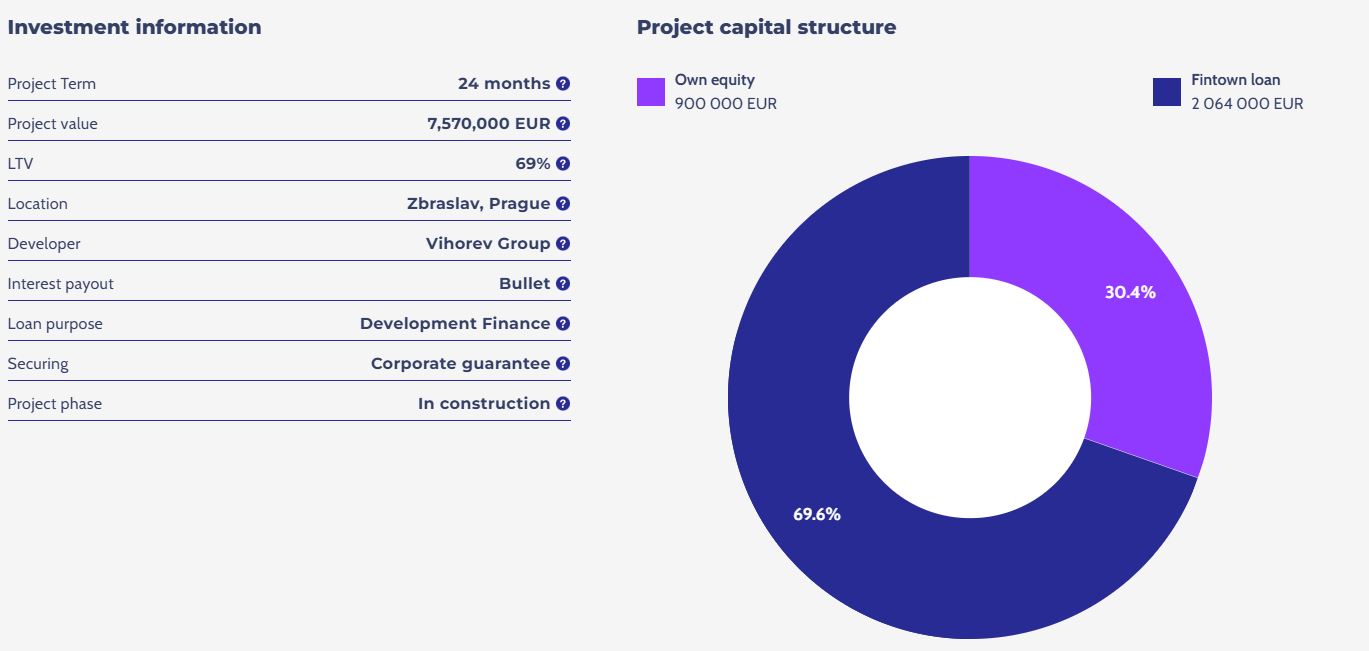

For investors, the project means a 24-month term with a 13% return, and as always, it is a subordinated loan, but covered by the Vihorev Group’s group guarantee. When completed, the project will include 6 luxury apartments with direct access to the park, high quality materials and sustainable features. It is aimed primarily at modern and environmentally conscious buyers who are also looking for high quality living space.

This project is not my personal favourite, as the sale of such properties is very often associated with delays and problems. This does not have to be the case here, but I prefer to stick with what we already know from the platform. By the way, about 70% of the funds will be raised through Fintown. The rest is equity from the Vihorev Group.

#5 Estateguru Annual Report 2023 online

Estateguru’s annual report has been in the official Estonian business directory for some time, but I hadn’t seen it on their website. I thought it was because they wanted to make it look nice, as Estateguru always does. But that wasn’t the case, because they uploaded it almost exactly the same way, and this time they didn’t even bother to update the German site. You still can’t find it there.

If you look at the report, you will quickly notice that the auditor’s report is missing. It is listed in the table of contents, but if you look for it in the uploaded report, you will not find it. They probably had their reasons. Otherwise, the loss has been reduced slightly, but the debt-equity ratio has deteriorated significantly. The equity itself is catastrophic. A fund has probably been liquidated to counteract this.

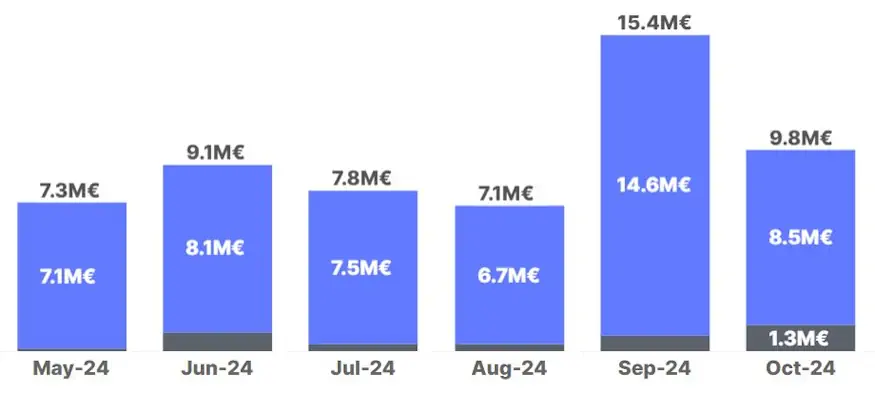

The latest monthly report, on the other hand, is a little more positive, with a return of EUR 1.3 million, and I also received almost EUR 1,000 in November. The German loans are still not coming through, but at least something is happening now and then. I still don’t expect Estateguru to lose any capital, but the return will probably end up being minimal and below the Bondora Go & Grow level. Anything else would surprise me.

Your feedback on the P2P lending news

That was the short news for this week, which this time was mainly about the “Ventus Energy Cashflow” issue. Feel free to leave me a comment on the blog with your feedback and if you find the content valuable, please share it! Thank you very much!

Leave a Reply

Want to join the discussion?Feel free to contribute!