P2P News CW 39/2025: Fintown P2P introduces quarterly payouts & more updates across the market

The P2P lending landscape keeps evolving — and this week brings several noteworthy updates for investors across Europe. The highlight for income-investors like me comes from Fintown P2P, which has introduced quarterly interest payments on its real estate projects, offering a more predictable and investor-friendly model.

Meanwhile, Modena enhances its welcome offer with a strong cashback campaign, Capitalia expands into Finland and prepares a cooperation with the European Investment Fund, Ventus Energy celebrates its first year with €50M in raised capital and expansion into Estonia, and Mintos adds a new bond Risk Score to increase transparency.

All in all, it’s been a busy week in P2P — packed with platform updates that show how rapidly the market continues to professionalize.

Table of Contents

#1 Modena launches improved cashback offer for new investors

The still relatively new platform Modena* has just made its welcome offer a lot more attractive. New investors now receive 1% cashback on all investments made within the first 90 days, plus an extra €25 welcome bonus.

In total, that’s up to €1,025 in extra returns – a solid upgrade compared to the previous offer, which was only 0.5% cashback capped at €5 per day for one week. Honestly, that old deal was nothing to get excited about.

Fair terms and transparent structure

To qualify, funds need to stay invested for at least 90 days – which is perfectly fair. Cashback is credited gradually, while the €25 bonus is paid after the holding period ends.

If you withdraw early, you’ll still receive partial cashback, but you’ll lose the €25 bonus.

Interesting for newcomers

This update is especially appealing for newcomers who’ve been on the fence about trying Modena.

The platform offers two investment options:

- Dynamic Vault: flexible access to your money

- Fixed-Term Vault: 12-month term with significantly higher expected returns

Current interest rates range between 9.5% and 11%, which is even slightly above competitors like Monefit* (up to 9.4%).

Want to dive deeper? Check out my Modena review for all the basics and performance insights.

#2 Capitalia expands to Finland and simplifies signup for new investors

Capitalia* has announced several updates designed to make onboarding easier and to strengthen investor confidence. The registration process has been modernized, meaning new accounts can now be opened faster and more conveniently. Investors only need one ID document instead of two, removing a small but real hurdle that kept many from signing up in the past.

Capitalia enters the Finnish market

At the same time, Capitalia launched its first two projects in Finland , marking another step toward broader regional diversification for investors.

Partnership with the European Investment Fund

Even more exciting is a planned partnership with the European Investment Fund (EIF). Under this program, certain loans will once again be partially guaranteed by the EIF, leaving investors exposed to only around 10% of the total risk. In practice, this could make selected projects almost default-proof – a huge advantage in the current environment.

Want to learn more about Capitalia? You can find all the essential details and my personal insights in my full Capitalia review.

If you’d like to give the platform a try, you can sign up directly via this link*.

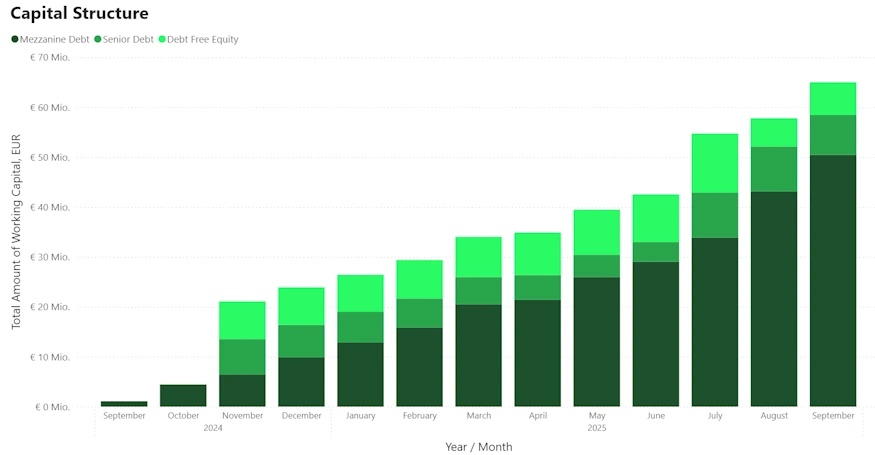

#3 Ventus Energy celebrates a strong first year

Just a week after I shared my first review of Ventus Energy*, the platform has now released its official one-year report — and it’s packed with milestones worth noting.

During the past week, Ventus reached two impressive benchmarks:

- A total of €50 million in mezzanine capital raised, and

- A continued high investor demand, even though projects now “only” yield around 16% returns.

100 members in the Founder’s Club

Another major milestone is the platform’s 100th Founder’s Club member — a threshold I had already predicted would be crossed in September.

This isn’t just a sign of investor confidence but also of the growing professionalization of the Ventus investor community. After all, not everyone has €100,000 sitting around to invest in a startup-level opportunity.

Expansion into Estonia

Ventus also entered its third Baltic market, Estonia, with the successful funding of its first solar and BESS project in Valga. After Latvia and Lithuania, this marks another step in the company’s consistent expansion strategy. Given their strong reputation, it’s likely that Ventus will continue to gain access to even more attractive renewable projects in the region.

In just one year, Ventus Energy has grown from zero to €50 million in mezzanine capital, 100+ high-net-worth investors, and operations across three countries.

For me, that makes Ventus one of the most interesting investment platforms of 2025.

Want to learn more about Ventus Energy? Check out my full Ventus Energy review for detailed insights.

New investors currently receive a 1.0% signup bonus* on all investments made within the first 60 days.

#4 Mintos introduces new Risk Score for bonds

Mintos has launched a dedicated Risk Score for its bond investments. The internally developed model evaluates several factors — including financial data, business profile, country risk, and bond structure — to give investors a quick overview of potential risk exposure.

The scores range from very high risk (0–24) to relatively low risk (75–100), helping investors better compare different issuances.

For now, the Risk Score is only available to investors purchasing bonds directly on the Mintos primary market, and it’s not yet applied to all listings.

A step toward more transparency

With this addition, Mintos expands its well-known scoring system beyond loan originators into the bond space.

That’s a useful improvement for investors, as it adds transparency and makes risk levels easier to interpret — though, as always, platform-generated ratings should be treated with caution.

My take

After a brief test phase, I’ve personally decided not to expand my bond exposure on Mintos for now. While my existing portfolio has performed decently (around 10% return so far), I find that bonds add unnecessary complexity to a P2P portfolio.

For investors who want bond exposure, I believe diversified ETFs or funds in traditional markets offer a cleaner and safer approach than hand-picking individual issues here.

Still, everyone has to make that call for themselves.

Want to learn more about Mintos? Check out my detailed Mintos review for a full overview.

New investors currently receive a €25 welcome bonus starting from €1,500 invested, plus up to €500 extra for newcomers until October 31, 2025.

#5 Fintown introduces quarterly interest payouts

Fintown has responded to one of the most common points of criticism among investors. Until now, interest from development projects was only paid at the end of the investment term, which many found unattractive. Starting with the second phase of the “The Seed” construction project, investors will now receive quarterly interest payments instead.

A more predictable cash flow

This means investors will receive interest every three months, rather than waiting until project completion. That makes the investments easier to plan, improves cash flow, and should also help speed up project funding.

Fintown presents this as a new product model, and it’s likely being tested — but if successful, it may become the new standard going forward. Of course, monthly payouts would be even more appealing, but quarterly payments already match Crowdpear’s approach, which many investors are familiar with.

Want to learn more about Fintown? Check out my full Fintown review for details and platform insights.

Leave a Reply

Want to join the discussion?Feel free to contribute!