P2P News CW 38/2025: Estateguru’s Auctions, Record Profits & New Players

re overWelcome to the latest P2P lending news! This week’s highlights:

- Estateguru is launching its own auction platform where investors can buy real estate from defaulted projects.

- Bondora delivered strong August numbers, showing barely any weakness despite the holiday season.

- LANDE reports stable loan originations, interest payments, and steady progress in debt collection.

- Swaper’s biggest loan originator, Wandoo Finance, shines with record-breaking Q2 results and significantly lower refinancing costs.

- And on Bondster, a new loan originator has just appeared: ANVEST.

You’ll get the full recap in three formats – YouTube, podcast, and right here on the blog. Always fast, always short – 5 news items in 5 minutes. Enjoy the updates from last week!

Table of Contents

#1: Estateguru launches real estate auctions

Estateguru* has introduced a new auction platform for non-performing loans. Investors can directly purchase properties or claims that were pledged as collateral for defaulted projects. This approach allows original investors to recover funds more quickly, while buyers gain access to real estate at potentially significant discounts.

The offering is open to both private investors and companies with available capital and the ability to act quickly. Transactions are handled either via external auction platforms or, in some cases, directly through Estateguru itself.

Currently, six properties from Estonia, Finland, and Lithuania are listed. These include a residential development plot in Helsinki, a warehouse in Espoo, an apartment complex in Lahti, an equestrian facility with leisure amenities in Lithuania, a historic building in Tallinn, and another warehouse in Helsinki. Property values range from €512,000 to €3.6 million, in some cases exceeding the official valuations of the collateral.

It remains to be seen whether this model will prove successful. For investors, however, it could offer a more efficient way to exit problematic loans—provided that the assets attract buyers. As expected, there are currently no German properties listed on the new auction platform.

For further details, you can check out my full Estateguru review. The platform also offers a 0.5%* sign-up bonus on your investments during the first 90 days.

#2: Bondora reports a strong August

Bondora* recorded €36.7 million in new Go & Grow deposits in August. While this was slightly below July’s figure, it remains a very solid result for a holiday month. At the same time, investors received €3.3 million in interest payments—an increase of almost 7% compared to the previous month.

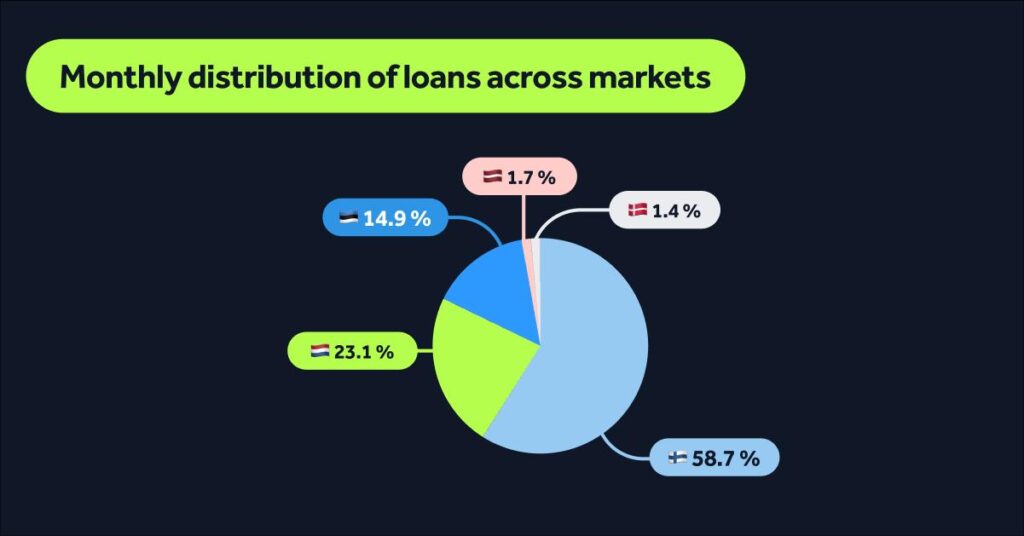

Loan originations also remained strong. In total, €31.5 million in new loans were issued. Finland continues to lead with €18.5 million, followed by the Netherlands with €7.3 million and Estonia with €4.7 million. Latvia (€0.5 million) and Denmark (€0.45 million) currently play only a minor role, although Denmark could become more significant if the market develops sustainably.

Overall, Bondora has managed to keep growth stable, despite the usual summer slowdown. For investors, Go & Grow remains one of the most flexible ways to stay liquid while still earning a steady return.

If you’d like to learn more, you can read my full Bondora review, including a dedicated guide to Go & Grow. New investors still receive a €5 sign-up bonus*.

#3: LANDE maintains solid performance

LANDE* issued €1.37 million in loans during August, spread across 45 projects with an average size of around €30,000. Collateral consisted mainly of land or machinery, with coverage ratios averaging around 90%, depending on the market.

On the technical side, LANDE has switched its two-factor authentication to an app-based system, now considered the market standard. Surprisingly, there are still a few platforms without 2FA—among them Viainvest.

Recovery efforts on problematic loans continue to make progress. In Latvia, several cases were resolved through refinancing or voluntary repayments.

Moreover, there were positive arbitration rulings and initial enforcement actions by bailiffs. In Lithuania, demand slowed temporarily due to the harvest season, while in Romania the platform is working on automation to speed up loan assessments.

From an investor’s perspective, the overall risk management remains encouraging. My own portfolio has not experienced any new defaults this year, and based on recent updates, a few older cases may finally be resolved in the coming weeks.

For further details, you can read my full LANDE review. The platform currently offers a 3%* sign-up bonus on your investments during the first 30 days.

#4: Wandoo Finance posts record half-year results

Wandoo Finance Group, the largest loan originator on Swaper*, delivered another strong performance in Q2 2025. Revenue increased to €14.3 million, up 88% year-on-year.

- EBITDA reached €3.1 million—stable compared to the previous quarter, but nearly double the figure from Q2 2024.

- Net profit rose to €1.7 million, representing a 500% increase versus the same period last year.

With these results, Wandoo has already generated more profit in the first half of 2025 than in the whole of 2024.

Portfolio quality remained stable, with the default rate unchanged at 10.3%. Losses continue to be mitigated by buyback guarantees, ensuring that Swaper investors receive their principal and interest.

At the same time, Wandoo reduced refinancing costs, slightly adjusted investor interest rates downward, and strengthened its management team with experienced new hires. The company also improved marketing efficiency and gained greater visibility in Romania through a sponsorship agreement with CFR Cluj, a professional football club.

Overall, Wandoo appears to be on a solid trajectory, supporting Swaper’s position in the market.

If you’d like to learn more, you can check out my full Swaper review. Registration for the platform is available here*.

#5: Bondster adds new loan originator

Bondster* has introduced a new loan originator from Slovakia: ANVEST. Founded in 2013, the company issues business loans ranging from €20,000 to €2 million, secured by real estate. Loan terms vary between 1 and 7 years, with a maximum loan-to-value ratio of 70%. Investors can currently expect returns of around 8%.

Bondster has assigned ANVEST a B+ rating. Financially, the company is considered stable, with €500,000 in equity and no outstanding liabilities. Still, investors should treat these platform ratings with caution, as past cases have shown that they don’t always provide reliable guidance.

Aside from this addition, little has changed at Bondster in recent months. The platform continues to struggle with transparency (statistics remain limited), and several loan originators have defaulted. Compared to Swaper, there are still few signs of a sustainable recovery.

For more details, you can read my full Bondster review. The platform currently offers a 1.0%* sign-up bonus on investments during the first 90 days.

That wraps up this week’s P2P lending updates. From Estateguru’s new auction platform to Bondora’s steady growth, LANDE’s progress in recoveries, Wandoo’s record results, and Bondster’s latest addition—there’s plenty happening across the market.

Stay tuned for next week’s roundup, where I’ll once again bring you the key developments in just a few minutes. Until then, invest wisely and keep an eye on the details.

HAPPY INVESTING 🙂

Leave a Reply

Want to join the discussion?Feel free to contribute!