P2P News CW 35/25 – Bondora closes Secondary Market – And Now?

The P2P lending market never stands still, and this week is no exception. From Bondora secondary market shutdowns to new cashback promotions, here are the key updates you need to know:

- Bondora officially shuts down its secondary market and API – though a safe €100 bonus might still be in play.

- InSoil Finance secures verification for its carbon program, reinforcing the credibility of its green loans.

- Afranga welcomes a new Bulgarian loan originator, Credirect, while keeping rates at the critical threshold.

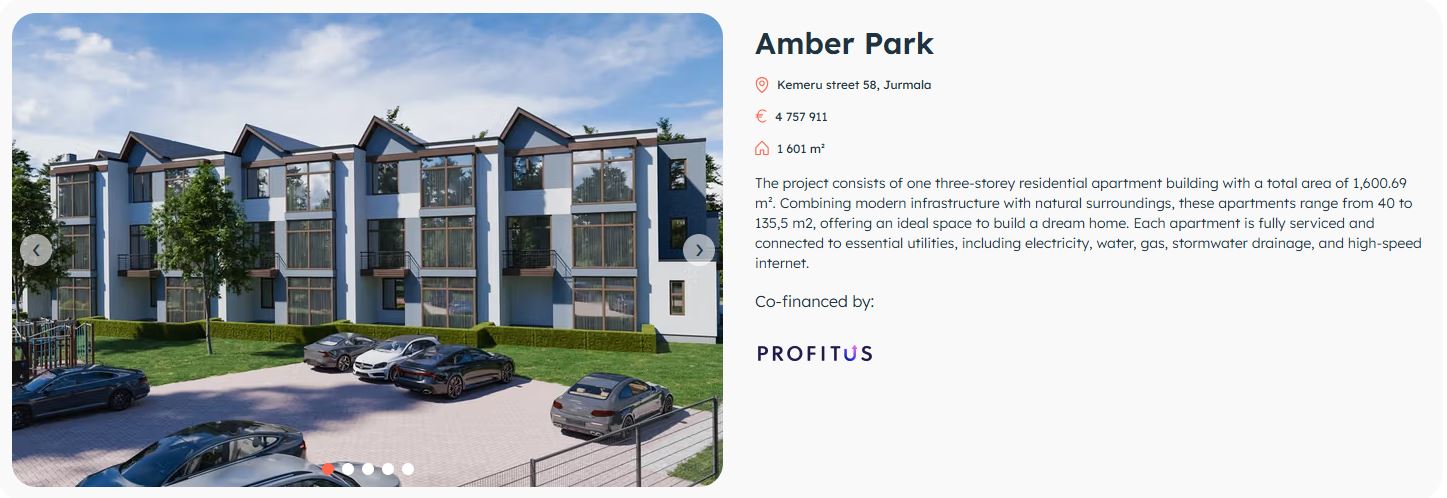

- Devon reports strong numbers and provides transparency on Amber Park through a live stream.

- Asterra Estate launches a 4% cashback campaign this autumn to speed up the expansion of Asterra Village.

Table of Contents

Disclaimer

I do not provide any investment advice or recommendations. On sevral P2P platforms I write about, I am personally invested. All information is provided without guarantee. Past performance is not an indicator of future results! All links to investment platforms are generally affiliate/advertising links (usually marked with *), where you typically receive benefits and I earn a small commission.

#1: Bondora Shuts Down API and Secondary Market

Starting October 1, 2025, Bondora* will update its terms and conditions. What may look like a mere formality at first glance actually marks the official end of features many long-time investors have relied on: the secondary market and the Bondora API will be permanently discontinued.

For those still holding older loan portfolios, there are now two options:

- either the loans continue as originally scheduled until maturity,

- or they can be transferred into Go & Grow—provided they qualify. New secondary market transactions will no longer be possible after September 30.

For investors, this means that the flexibility once offered by the secondary market will soon be history. Secondary market transactions will no longer be possible after September 30. Bondora wants to fully focus on Go & Grow. For those who were still investing manually, this represents a bitter turning point—though in reality, hardly anyone is still affected.

One interesting detail that many might overlook: Bondora has introduced a temporary incentive for the transition. If you shift your holdings to Go & Grow now, you can secure a bonus. Deposits over €1,000 earn an extra €20, and deposits over €5,000 even get €100. The bonus period runs from September 1 to October 31, with payouts scheduled for mid-January 2026. From my perspective, that’s a rare no-brainer with Bondora—an easy €100 bonus.

So, Bondora is pulling the plug on the individualist approach and betting everything on standardization. For Go & Grow investors without legacy loans, however, nothing changes.

Want to learn more about Bondora? Check out my in-depth Bondora Go & Grow review for the details.

#2: Afranga Adds Another Loan Originator

Afranga has welcomed a new loan originator to its platform: Credirect. The Bulgarian fintech has been active since 2017 and is part of the MV Finance Group, which operates in six countries, including Spain and Mexico.

By Q2 2025, Credirect reported more than 91,000 customers, a loan portfolio of BGN 11.5 million (approx. €5.8 million), and a net profit of over BGN 5 million (approx. €2.5 million). These figures point to solid profitability and sustainable growth.

Credirect offers the usual lending products: payday loans (up to 30 days) and installment loans (up to 18 months). Afranga emphasizes that Credirect has successfully passed the due diligence process, giving investors access to a diversified business loan portfolio in the EU market of Bulgaria.

In my view, while Afranga’s addition of Credirect is a solid expansion of its offering, the returns may disappoint some investors. At a nominal 11%, investors net just under 10% after withholding tax—a threshold where the risk, compared to alternatives, no longer looks quite as attractive.

Want to learn more about Afranga? Check out my full Afranga review for the basics.

CreDirect – Afranga’s new loan originator

#3: Devon Brings Amber Park Project to Live TV

Real estate platform Devon has launched a new feature with its Amber Park project: through a live stream, investors can now watch construction workers directly on site. Amber Park itself is progressing as planned.

Interior work is currently underway, and the first fully furnished apartments are expected to hit the rental market this autumn. For this, Devon is partnering with Design Box for interiors and Attēls R for kitchen fittings. The goal is to create modern rental apartments that meet growing demand.

At the platform level, Devon continues to deliver strong numbers. In July, around €680,000 was funded, bringing total volume to €3.22 million. The average return remains a solid 16.32%, with interest income topping €62,000 in July alone. The platform now counts roughly 450 active investors.

Also worth highlighting are the monthly updates for each project, which provide transparency. So far, all projects are running smoothly, and even the founder’s legacy issues with Crowdestate appear to be nearing final resolution.

Want to learn more about Devon? Check out my detailed Devon review for the basics.

Amber Park Project – Site on Devon-Website

#4: Asterra Estate Launches Autumn Offensive

Real estate platform Asterra Estate is enticing investors this autumn with a generous cashback campaign. From August 29 to October 31, 2025, all investments in Asterra projects will come with 4% cashback, paid out immediately! That pushes the already high-yield 15% loans to dizzying new levels of return.

The reasoning is clear: after an active summer with construction starting on seven projects in Asterra Village, the platform wants to keep the momentum going. For autumn, another 15 building permits are planned, along with the construction of seven to eight houses and a guesthouse. Two covered padel courts are also on the agenda.

As usual, the projects will be financed by the community. The campaign is designed not only to secure liquidity but also to encourage investors to double down. The model remains highly attractive: 100% project ownership at Asterra, collateralized by mortgages, daily interest payments, and flexible exit options.

With 4% cashback, Asterra Estate is extremely appealing this autumn. For those already considering expanding their portfolio with Asterra Estate, this is a great opportunity to boost returns—or, for new investors, a solid entry point with an extra 1% on top.

Want to learn more about Asterra Estate? Check out my detailed Asterra Estate review for the essentials.

Asterra Estate Cashback Projects

#5: InSoil Green Loans Officially Verified

InSoil Finance has reached an important milestone. Its Soil Carbon Program has been audited by SCS Global and verified under the Verified Carbon Standard (VCS). This confirms that the CO₂ reductions of around 155,000 tons achieved by farmers in Lithuania through regenerative agriculture are both traceable and certifiable.

In practice, this means that participating farmers can market their achieved emission savings as tradable carbon credits. The program foresees more than 4 million certificates by 2027. Financing is provided through InSoil’s well-known Green Loans, which help farmers transition to regenerative methods such as cover cropping, reduced tillage, or organic fertilization.

For investors on the platform, this is a positive signal for the credibility and sustainability of the projects. However, it’s important to note that this is primarily a confirmation of methodology and results, not an immediate repayment. Loan terms remain unchanged, and investors must continue to be patient until returns from these projects materialize. Given the uncertainties, I personally remain cautious and avoid Green Loans for now.

Want to learn more about InSoil Finance (formerly HeavyFinance)? Check out my detailed InSoil Finance review for the basics.

Leave a Reply

Want to join the discussion?Feel free to contribute!