P2P News CW 07/2026: Indemo Strengthens Liquidity Strategy While Broader P2P Risks Emerge

Welcome to the latest P2P lending news update. Indemo is focusing on improving liquidity in 2026 and is preparing the launch of an early exit feature. Asterra Estate introduces a new loyalty program offering up to 1.5% in bonus interest. Nectaro delivers important platform upgrades aimed at improving the investor experience. Esketit expands its lender panel by adding Jet Finance, a well-known loan originator from Kazakhstan. Meanwhile, fresh reports surrounding Quicko and Loanch raise new questions about potential Russia connections and the background of the recent license withdrawal.

Please note my disclaimer: I do not provide investment advice and I do not make any individual investment recommendations. This article reflects only my personal opinions and observations and is intended for informational purposes only. Investing in P2P loans and project financing involves risks, including the possibility of a total loss of your invested capital. Past performance is not a reliable indicator of future results. Links to investment platforms may be affiliate or promotional links (usually marked with *), meaning I may receive a commission if you sign up or invest through them. All content and ratings are created independently and are not influenced by any platform provider.

Table of Contents

#1 Indemo puts liquidity at the center of its 2026 roadmap

Indemo is directly addressing one of its biggest structural challenges: liquidity. The real estate-focused platform has made it clear that improving tradability and capital flexibility will be a key priority for Indemo in 2026.

Most investors are already aware that Indemo plans to launch a full secondary market in Q3 2026. Once live, this will allow users not only to buy Notes, but also to sell them to other investors. The introduction of this marketplace is intended to significantly strengthen liquidity within the Indemo ecosystem.

What is new, however, is that Indemo plans to roll out an additional feature even earlier. In Q2 2026, the platform intends to introduce an Early Exit function. Under this system, investors will be able to sell eligible Notes back through a structured mechanism without waiting for an institutional buyer.

The model will include monthly buyback budgets, a transparent list of qualifying Notes, and FIFO-based processing. If implemented effectively, this could materially improve liquidity planning for Indemo investors. It will be interesting to see how Indemo handles pricing and allocation in practice.

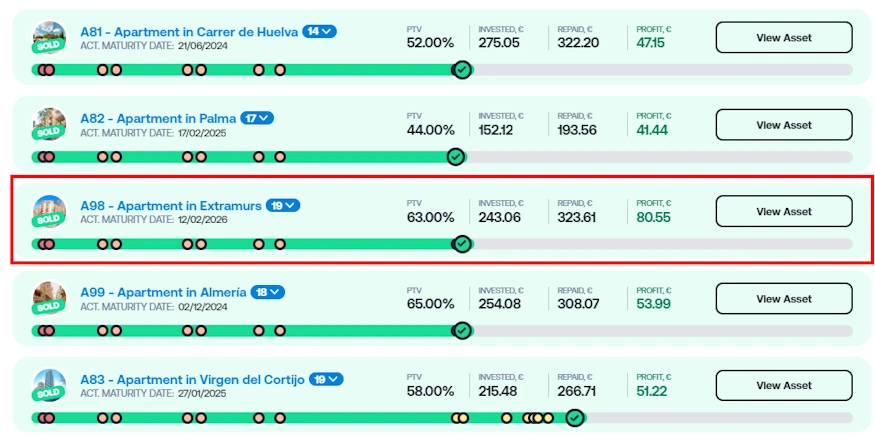

Beyond the liquidity roadmap, Indemo also reported a successful repayment last week. Property A98 was fully repaid, distributing approximately €233,000 in principal and interest to 631 investors. This represented 12.1% of all active Notes on Indemo. The weighted annual ROI reached 15.3%, with individual returns ranging up to 21.84%, depending on entry timing. As with previous exits, repayment was executed via the institutional secondary market.

#2 Asterra Estate introduces a new loyalty program

Asterra Estate will launch its new loyalty program on February 18. The structure mirrors the well-known model used by Devon. No separate registration is required — once an investor reaches a defined investment threshold, the corresponding status is activated automatically, and the higher interest rate applies from the following day.

The bonus tiers are clearly structured. From €10,000 invested, investors receive an additional 0.5% per year. At €25,000, the bonus increases to 0.75%. From €50,000 onward, the extra return reaches 1%, and investors with €100,000 or more qualify for a 1.5% annual bonus. The loyalty premium is added on top of the standard project interest, meaning each active investment accrues a higher daily return once the threshold is reached.

Operationally, Asterra Estate continues to develop according to plan. The first houses have been fully completed, and the initial tenants are scheduled to move in on March 20. At present, three houses are rented out, and an additional sales contract is already in place. The strategic focus remains clearly on selling the units.

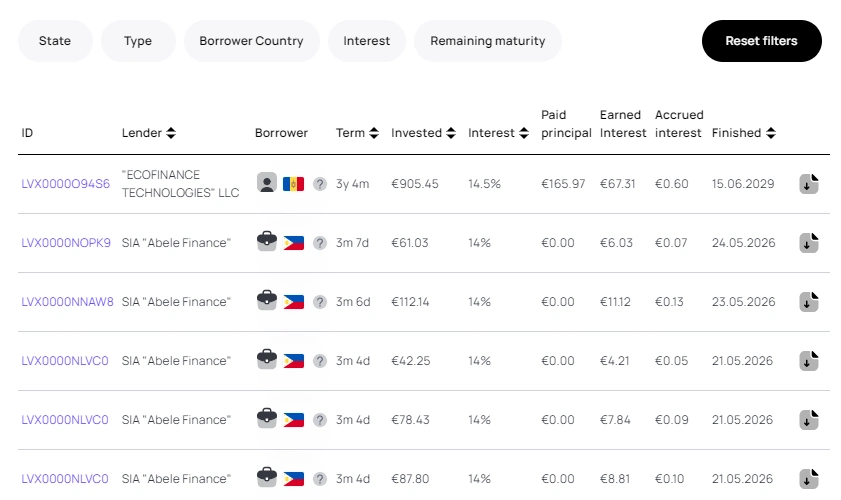

#3 Nectaro improves interface and investment overview

Nectaro has rolled out several functional updates aimed primarily at improving clarity and navigation across the platform. The manual investment page, in particular, has been significantly enhanced. Previously, only the borrower’s country was displayed.

Investors now see additional details at a glance, including the country flag, the borrower, the loan originator, the loan type, and other key metrics. This makes it much clearer what exactly they are investing in.

The portfolio section has also been redesigned — a long overdue step. The structure is now more organized and provides deeper insight into individual investments. The goal is a clearer separation and better categorization of ongoing positions within the portfolio.

In addition, Nectaro has introduced new filtering options. Investors can now filter by status, loan type, originator, borrower country, interest rate, term, and remaining maturity. While these updates do not change the underlying investment model, they represent meaningful functional improvements that enhance usability and transparency.

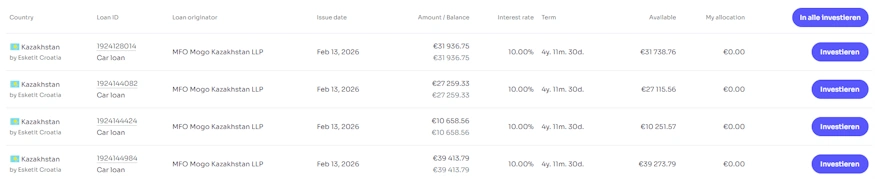

#4 Esketit adds Jet Finance from Kazakhstan to the platform

Esketit is expanding its lender lineup by adding Jet Finance from Kazakhstan. The loan originator is already known from Mintos and has been operating since 2019. Jet Finance is a regulated microfinance institution with a strong focus on vehicle-backed loans.

Around 70% of its portfolio consists of car loans, complemented by SME financing and installment loans. Average ticket sizes range between €12,000 and €30,000, with maturities extending up to 84 months.

The outstanding loan portfolio recently stood at approximately €84.8 million, which is not insignificant. On Esketit, the indicated target return for investors is 10% per year — a level that may appear less attractive given the risk profile. In our P2P rating, Jet Finance ranks among the more risk-exposed lenders on Mintos.

Investments on Esketit are structured indirectly and come with a 100% buyback obligation in case of payment delays. Jet Finance is currently available for manual investments and through the Custom Auto Invest feature, but not yet included in the Diversified Strategy.

For context, my own Esketit portfolio now includes roughly €2,800 invested via the Croatian entity, while just under €12,000 continues to run through Ireland. A few months after the restructuring, this results in approximately 19% Croatia and 81% Ireland. The allocation is gradually shifting, and liquidity on Esketit is slowly improving again.

#5 Quicko license withdrawal raises new concerns

The recent license withdrawal of Polish payment provider Quicko, which is connected to the P2P platform Loanch, is generating increasing scrutiny. On January 21, 2026, the Polish financial supervisor revoked Quicko’s license with immediate effect. Officially cited were deficiencies in risk management and corporate governance. However, the speed and decisiveness of the action suggest that the underlying issues may have been more serious.

A recent media report now highlights potential links to Russian actors and transaction structures involving sanctioned markets. Questions are being raised about whether payment flows and business relationships were sufficiently reviewed and whether geopolitical risks may have played a role. While no concrete evidence of illegal activity has been presented, the speculation alone adds pressure to all parties involved.

For Loanch, the situation is particularly sensitive. The platform is backed by Fingular, whose team has strong Russian roots. One of the key capital providers behind Fingular is Vadim Gurinov, widely regarded as its main investor.

In light of the reported Russia-related connections, this could pose reputational challenges. Nearly a month after the license withdrawal, deposits on Loanch remain suspended, and reports from the Telegram community indicate that withdrawals may also be facing delays.

Experienced P2P investors know how quickly sentiment can shift in such situations. More than 14,000 investors have financed over €60 million through Loanch — making clarity and transparency critical in the weeks ahead.

Leave a Reply

Want to join the discussion?Feel free to contribute!