P2P News CW 01/2026: Ventus Energy Criticism calms down, Devon repays & Baltic Terra on Debitum

Welcome to 2026 and a very Happy New Year to you. Of course we will follow the P2P industry here throught the year and I promise to improve my content. This is one of my New Year – New Me – Resolutions 🙂

So, don’t waste time and let’s get into the latest P2P News.

#1 Ventus Energy criticism: platform responds and situation stabilizes

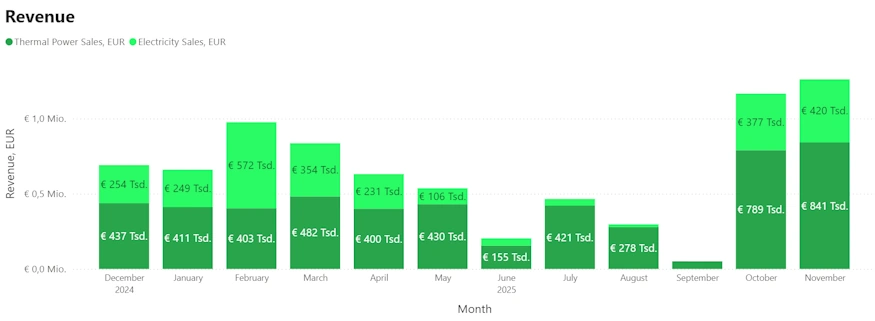

Following a week of intense Ventus Energy criticism, the situation around the energy lending platform has largely stabilized. Discussions across Telegram and investor communities have cooled down, funding activity continues uninterrupted, and operational figures remain solid. Loans offering up to 18% interest are once again being fully funded within minutes, while early-exit liquidity has improved noticeably.

The recent Ventus Energy criticism was triggered by a critical article raising serious allegations, including claims of inflated valuations, manipulated documents, unclear ownership structures, and potential regulatory risks. In response, Ventus Energy addressed these points during a live investor call, rejecting most of the accusations and outlining concrete countermeasures.

A central step in dealing with the Ventus Energy criticism is an independent external audit. According to the company, an international audit firm is currently reviewing valuations, ownership structures, cash flows, and contractual arrangements. The results of this review are expected to be published in full. In addition, Ventus announced increased transparency going forward, including clearer disclosure of potential conflicts of interest, more detailed valuation sources, signed documentation, and audited group financial statements.

Despite the ongoing Ventus Energy criticism, platform operations continue as normal. From an investor’s perspective, this continuity, combined with visible corrective actions, is currently the most relevant signal.

Meanwhile, speculation about a coordinated negative PR campaign has intensified after the appearance of two low-reach French-language videos spreading the allegations. The unusually high number of comments compared to views has raised further questions within the community.

If you want to dive deeper into the background beyond the recent Ventus Energy criticism, you can find a full overview in my Ventus Energy experience report. New users currently receive a 1.0%* investment bonus during their first 60 days on the platform.

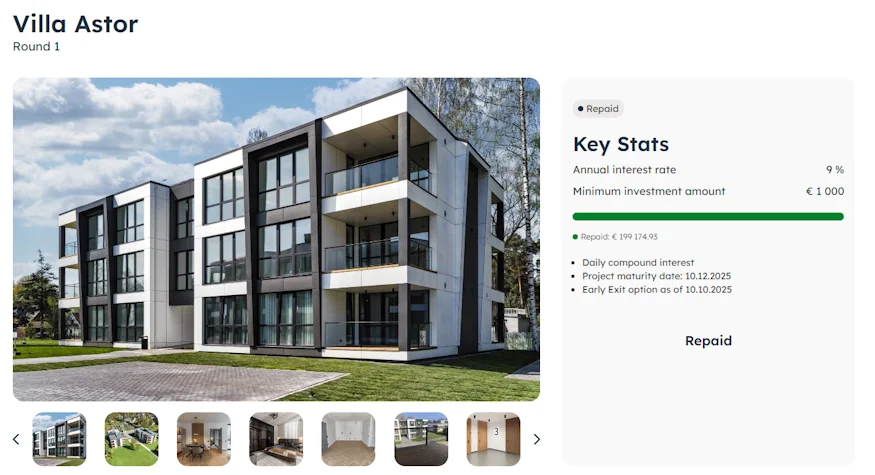

#2 Devon completes first repayment and builds early trust

Devon has delivered a small but important milestone. The first project on its white-label real estate platform has been fully repaid. The project Villa Astor has been completed successfully, with invested capital and interest paid out to investors. In total, around €199,000 in principal plus more than €10,000 in interest were returned to 87 investors.

To be clear, this was a relatively small project and did not involve a large number of investors. However, for a young platform, a first successful repayment is a crucial trust signal.

The project itself was conservatively structured: a senior loan, a completed residential property, a moderate 9% interest rate, and a clearly defined exit strategy. The repayment was received positively within the community.

Overall, Devon remains a very young platform, but now one that has provided its first proof that repayments work. That alone marks a meaningful step forward.

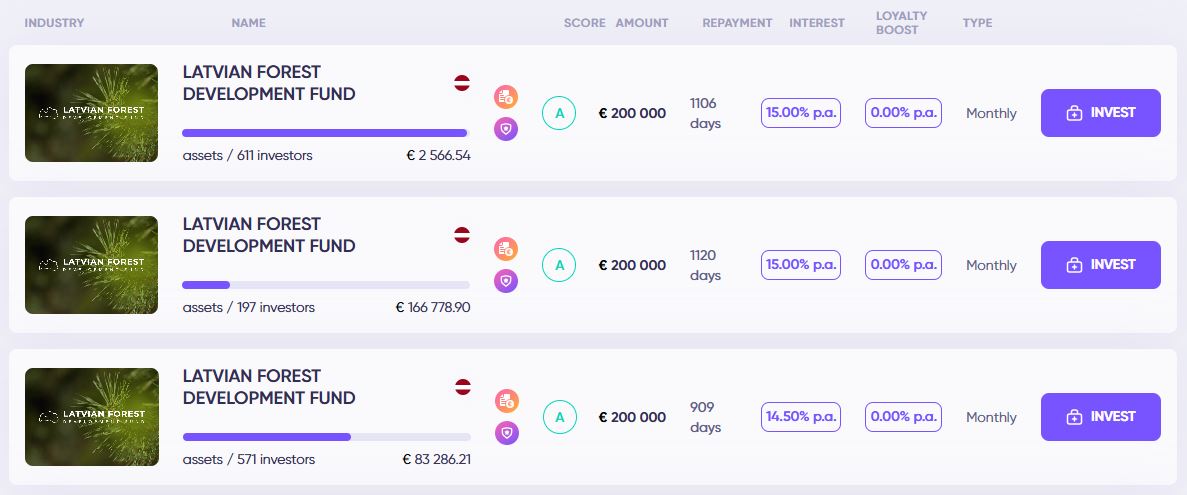

#3 Baltic Terra outlines farmland investment model

Debitum’s loan originator Baltic Terra focuses on financing agricultural land in Latvia, offering investors exposure to a tangible real-economy asset. The model is based on acquiring undervalued land, improving its quality and usability, and generating returns through long-term leasing and capital appreciation.

Baltic Terra targets land parcels that are often avoided by traditional investors, including poorly maintained plots, fragmented land holdings, overgrown meadows, low-fertility farmland, and properties with legal or cadastral complications. Due to these inefficiencies, such land is typically available below market value. Acquisition is carried out via partnerships with private landowners, forest owners, and municipalities, often outside of public auctions.

After acquisition, value is added through active land management. This includes clearing overgrowth, consolidating small plots into larger agricultural units, and improving soil quality by leasing the land to professional local farmers. According to the company, higher soil fertility increases productivity and supports higher long-term land values.

Returns are generated through several channels. Improved farmland is leased under long-term contracts, providing recurring income. In addition, Baltic Terra benefits from agricultural land price growth in Latvia, estimated at around 6–7% annually, and from selective land sales to municipalities or legal entities at a premium.

For Debitum investors, Baltic Terra expands the platform’s asset base beyond traditional business lending. Agricultural land offers diversification through a low-volatility asset class backed by physical property and long-term demand, largely independent of short-term financial market movements.

Leave a Reply

Want to join the discussion?Feel free to contribute!