P2P business loans are your chance to participate from business capital

P2P business loans – have you ever recognized about them? Several P2P platforms especially concentrate on those investments, but it is not really popular. As you maybe know from my Debitum Network blogpost I really like investing into P2P business loans.

Today I want to talk about my view on the advantages and how I am able to participate from worldwide entrepreneurship. Some weeks ago I made another blogpost about investments into real estate with P2P lending. With this blogpost I want to add another category for you as investors into business loans via a platform.

Table of Contents

What are P2P business loans?

A loan requires two partners meeting on the capital market. Investors, who are willing to invest their money lent it to business owners who need money. Usually business loans are needed for either short periodes to pay something in advance or for long-term projects. But lending money to a business owner always means you have to approve his idea of the loan.

There are good loans and als bad ones. A bad loan for example would be a new car for the business owner himself. A good loan might be an investment into other businesses, which will bring money to the company and interest to the investors. Lenders are always hunting for good chances of lending money for huge interest rates, but in the end you have to check what is the story behind the loan.

Loans for businesses are typically checked for their financial background and reason. A P2P business loan should always have a clear “vision” as a security for the lenders.

And of course it needs to have securities to handle the risks for the investors. But then investing into loans from businesses is a very intersting idea, because I am able to participate from the worldwide economy.

Lending money to businesses – Peer-to-peer funding at its best

Honestly, I do not know in which businesses I already invested. As I am really lazy investor and try to not use any time for the P2P lending platforms everything is running on auto-pilot.

But being one of the lenders for business loans makes me happy for a simple reason: Businesses are always following the way to earn money!

Would you invest in a rostering business here?

Investing into peer-to-peer loans for a private loan might be a good idea. For example if the person needs a car, to drive to his new office and earn money, wherefrom he is repaying the credit for the car. But do I want to finance the next Smart TV in his house? Where is the value of this credit?

Therefore I like being one of the lenders investing into P2P lending from business loans. In my eyes there is a chance for a lower risk of loosing money, because businesses usually aim for profit – profit, with which they pay my interest and repay the credit.

Which P2P platform offers peer-to-peer loans from companies?

Well, meanwhile there are quite a lot of loan originators offering those funding investments. Until now this part is not as big as I want it to be, but I am working on it.

It think if you rate the risk of P2P investments real estate and a business credit is less risky that car or personal loans. But that is just my opinion. I think there is value as a security behind the loan like a property or a motivated business man or team, wanting to succeed.

Do I check the financial statement of every investment?

Of course not. Also I studied finance and economy before I do not invest the time to read any financial statement. I make sure, that my capital is safe at the platform. Therefore I check the rules of the platform.

- What securities does the P2P platform wants to see or be in charge of?

- How do they rate business risks from the view of a lender?

- Is there another peer group at the platform investing?

In fact you can take care about a lot of risks or points. I am really easy with those, maybe a bit too easy. Therefore I usually invest just a small amount of my capital as a lender on a new platform. And when things are running smoothly, I am willing to invest even more capital.

Maybe it is really exciting for me to invest into business funding as I am not mainly selfemployed. Sounds like a huge desire to run my own business and therefore I invest into business loans to participate from the advantages.

Is there a future for peer-to-peer business lending?

I really do not know. But in my eyes traditional banks are no longer interesting for new companies. Why? Well, banks need a lot of securities and additionally loads of paperwork to rate the idea.

Writing a financial statement, giving a view to the status of finance things and of course the business plan – this takes a lot of time from the entrepreneur.

Funding is much easier, as investors are mainly interested in the financial statement, their interest and their securities. Meanwhile a lot of companies are funded with crowdfunding and other concepts, which are existing beside traditional banks.

Still banks will have their role, but for companies and lenders business loans via crowdfunding are ways easier to handle to save a lot of time.

So I think lending into P2P business loans will be something which is on the one hand a easy way for new companies to receive capital from investors and on the other hand a growing market in future times through a lot of startups coming into this sector of finance every year.

Debitum Network – being a lender for business loan

Debitum Network was one of my first investment with this new blog. And I was really convinced of doing the right thing, because Debitum is just investing into P2 business loans. At the P2P Conference in June i met the CEO Martins for a short talk, which was very nice. I really enjoyed their idea of supporting companies with their type of lending capital to them.

Currently Debitum is growing very fast reaching the one million new deposited capital in September 2019. Also the interest rate is quite low with 10% (compared to the big ones like Mintos, Estateguru or bondora), it is still a very good number. Just imagine your capital being paid 10% interest on every year!?

Bondora – still going strong and making the market

Bondora is a company from Estonia, with his headquarter in Tallinn. My start with Bondora was a bit shitty. I guess it was me making some mistakes. Some months ago I sold my whole portfolio to Bondora. But last week I had a short talk with Lars, who is currently in Tallinn visiting Bondora.

During this short time I realised, that it was Bondora establishing “Go & Grow” as a new product. Mintos made something similar to it with “Invest & Access” but you still cannot compare those products with each other, as Mintos is “just a platform” with a lot of originators. Also they are quite big, they are still dependent from their loan originators. Bondora is a loan offiiciallly licensed loan originator itself and is able to expand from itself.

And of course bondora is offering P2P business loans, also you cannot select just on those with their Portfolio Manager. I will soon setup a new portfolio at Bondora to check their possibilities in my peer-to-peer portfolio. As one of the biggest players in the baltic market I want to have another try with bondora.

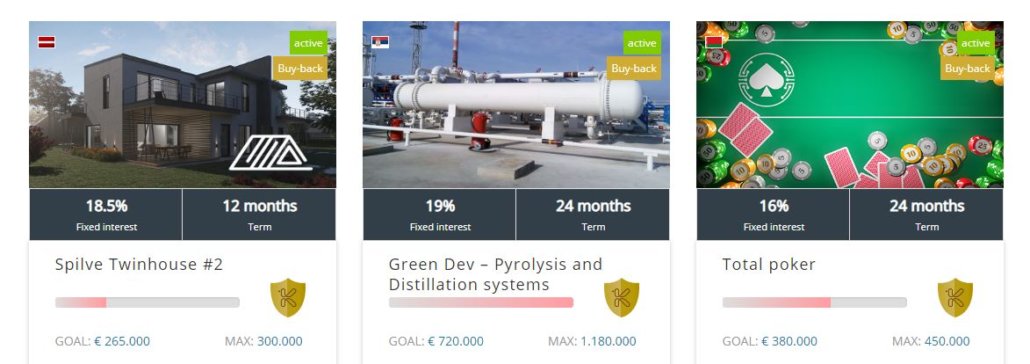

Kuetzal as a platform for european crowd funding

I have no investments on Kuetzal currently, but this will change by the beginning of 2020. Kuetzal is specialised on business loans for european projects, startups and companies. Checking their website made me really curious, also it seems like they do not have an auto-invest.

But let’s check it soon, when my first investment will be send to Kuetzal and I will be an lender for european businesses. Beside some real estate projects there are a lot of different business loans. Crypto-mining, transportation, nutrition products – nearly everything. And the funding starts at 30.000 Euro and goes up to more than a million as I was able to catch a glimp on the first sight.

And of course: Mintos

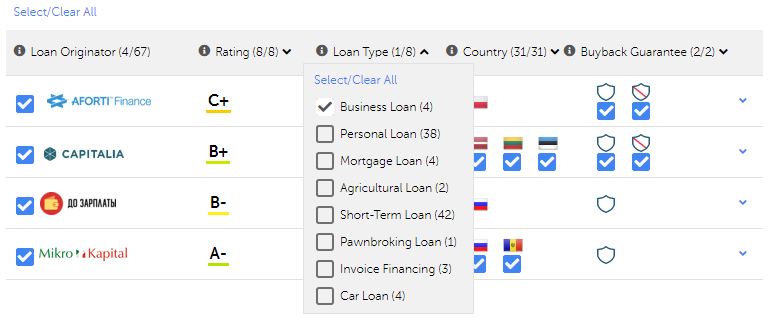

It might be estonishing, but you can invest into business loans with Mintos. When adjusting your auto-invest you can only tick the box for “business loans” and will just invest in those loan type. Honestly, it is just four loan originators out of more than 60, but it is still possible.

Maybe those loan type is not the main focus from Mintos, but you are still able to invest into it. So you diversify your P2P portfolio on a single platform, which is especially interesting for those investors, who are starting or not lending big sums for any other reasons.

What platforms do you know for investing into P2P business loans?

Again I would like to mention all the lending platforms here, where you are able to invest into. I already did it the last time with my blogpost about real estate. I know about even more platforms, but I do not have them on my short list for investing.

When I have several more ideas and information, I will work on this blogpost again and add those P2P platforms with the possibility to invest into business loans.

I want to give myself an overview of the possibilites to invest into business capital worldwide. I mean those companies will be the future (check the study from 2015 in the link). Of course some will not make it until the end, but I think most of them will be able to grow. So why not be part of this change over the next years.

If you want to know more about loans originators and their kind of work to get loans the platform, I really recommend the Youtube-video from Lars, who visited Varks.am (do not forget to use the Google translator) in Armenia and Kredit Pintar in Indonesia.

Maybe it is a but scary for us European investors, but this is exactly where business capital is needed and has the biggest impact (also risk and interest).

Have any more platforms and experiences about them? Just comment below and I will add them soon, when I work on this blogpost again.

Leave a Reply

Want to join the discussion?Feel free to contribute!