New P2P Platform-Check: Moncera – Estonian P2P platform earning up to 10% and One-Click-Exit

Moncera– another new platform without track record and high interest yield? Well, ehm, no. Moncera is a new platform brand, but the company behind this P2P lending platform is already good known and has a track record on Mintos. Today I would like to introduce Moncera to you, which I added into my P2P portfolio a while ago.

After I introduced Income Marketplace to you last month, this time the “new” platform is already good known. But nobody reminds them with this brand name as it is pretty new. Moncera is the platform brand of the Placet Group. And this company is already known as a loan originator from Mintos. The Placet Group is operating since 2005 and earning positively since 2007. In June 2018 they joined Mintos and are rated with a 8 (Placet Group) and 7 (Nodecum AEB) in the Mintos-Ranking.

But let’s check the details as I want to show you why Moncera has made it into my P2P portfolio.

Table of Contents

What is Moncera about?

The headquarter of Moncera is situated in Tallinn, Estonia. The company was founded in 2019, originally namend Bancera OÜ, and you can find some more information about the registration details on teatmik.ee. So here is the official registration entry.

Moncera OÜ registration, screenshotet on teatmik.ee

In their annual report of 2020 it is said, that Moncera started in December 2019 with their business. Following the report there has only been some small activity which really started in 2020. As mentioned on their website and the report Moncera mainly focusses on personal loans and added some business loans and real estate loans duing 2020. Currently their loan originators are all belonging to the Placet Group.

Which role does Moncera takes in the Placet Group?

Over the last months and years we have seen several new platforms. Looking behind them some of them are loan originators from bigger marketplaces who invented their own platform and openend it for investors.

For the loan originators itself this is a nice idea as they are “saving” fee in comparison to publishing the loan e.g. on Mintos. Investors should always take a closer look before investing. Usually the track record is very important for most investors and only a few of those loan originators have it at the start.

The Placet Group is a company which has 15 years of experience and seven different loan originators in his structure.

- Estonia

- smsmoney.ee

- smsraha.ee

- laen.ee

- Lithuania

- smspinigai.lt

- paskolos.lt

- Poland

- credit.pl

- sloan.pl

One of the first questions I had was: Looks nice, but how much share has every country in which loan type? The answer can be found in their company presentation from 01.03.2021. On page 12 you will see the following figures:

Share of Loans – Placet Group

Share of countries – Placet Group

Please keep in mind, that those figures are from the Placet Group. On the Moncera page I have not found anything about their shares, whereas this numbers should give you some insights. Not neccessarily this is also the loan distribution of the loans listed on Moncera.

What is Moncera offering to investors?

Investors need to register to the platform first. Afterwards they of course need to deposit money on it. And then you can have a look at the investment possibilities.

At the time when I wrote this blogpost there were 362 loans from Estonia and Lithuania listed. The overall volumen of these loans was a little bit more thant 420k€. Additionally there are two real estate projects with a total volume of 220k€ open for investors.

The average interest rate is published with 10.4%. When I researched for this blogpost I found consumer loans from 7% to 9% with a remaining term of 19 to 81 months, which is nearby 2 to 7 years. Maybe just bad timing…

When I started investing I adjusted the auto-invest. My whole money is invested with 9% into mainly loans from Lithuania. The latest maturity date is in June 2023.

To answer the question: Moncera is offering consumer loans and real estate loans to investors with an average interest of 7% to 9%. Those loans are always secured by a buyback guarantee (after 30 days) from the loan originator (currently all of them belong to the Placet Group).

Furthermore there is a so called Moneyback guarantee. This includes a One-Click-Exit whereas you can sell the loan back to the loan originator and receive your investment immediately. Accrued interest will be yours. You only lose those interest payments, which have not been paid until the moment you hit the On-Click-Exit. So it should not be more that maximum the payment for one month plus 30 days.

Who stands behind the marketplace?

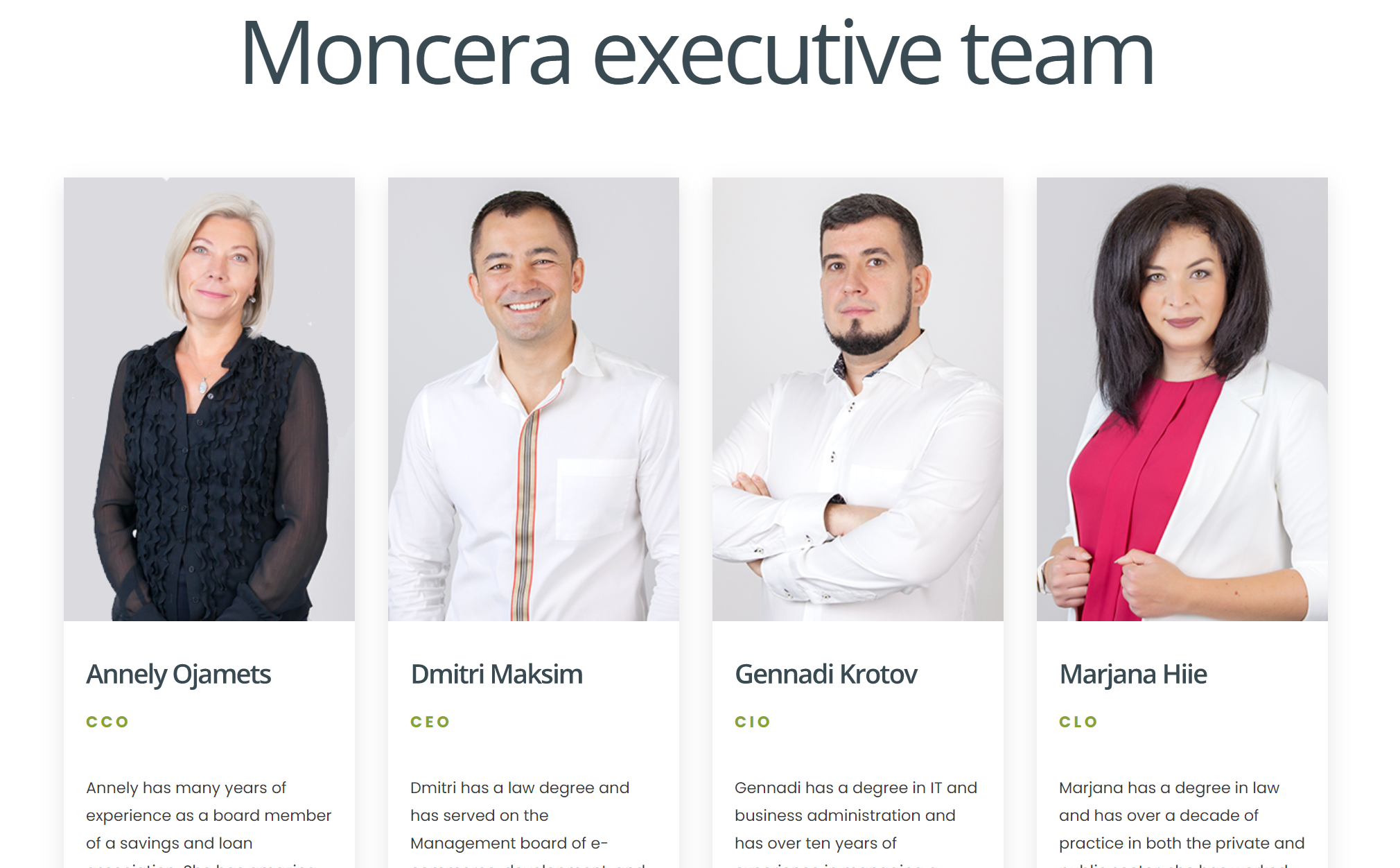

Interest rates and several functions are always nice to have – but what is a Ferrari without a good driver? A lot of potential not being used 🙂 Therefore I would like to look behind the scenes of Moncera and check which people are leading the company. On their website the marketplace has a “About Us” section which introduces the executive team to visitors and investors.

Moncera Executive Team as shown on their website

Like I did it in my last blogpost about Income Marketplace I will check these guys a bit and try to find out what experiences they have in the field of P2P lending. Of course this introduction will not be outstanding, but I think I am able to get a rough idea about them by checking some facts.

Unfortunately I was not able to find any LinkedIn-profiles of Annely Ojamets. Annely is presented as the Chief Channel Officer (CCO). On the website it says as follows:

Annely has many years of experience as a board member of a savings and loan association. She has amazing people skills and has already established herself as a valuable member of Moncera.

Sounds good, but I was not able to find any proof or link about it (in english). There is an estonian source saying Annely works as board member in several organisations, but in the end I am not able to prove this source at all. As there is an additional paywall for the information it is let’s say pretty low information about her.

Chief Legal Officer CLO Marjana Hiie

Next one is Marjana Hiie working as CLO at Moncera OÜ. As a Chief Legal Officer she is responsible for legal stuff and regulation things. Please do not ask me what is included here exactly, as I am absolutely not into the topic nor in the estonian financial law.

Marjana has a LinkedIn profile. In her CV it is said, that she worked twice in a law firm for each 11 month (2011/2012 and 2015/2016). Inbetween she joined ITM Inkasso OÜ also situated in Tallinn and – it is getting interesting – partner of Placet Group and some of their loan originators. So here is the link between Moncera and her.

After working in a law firm again she joined Lindorff. She stayed there for about 1,5 years working as a lawyer. Lindorff and Intrum AB is a pretty big company situatioted in Sweden and Norway, which works on credit management solutions. With branches in about 25 countries and more than 8.000 employees this merge is pretty impressive, also I never heard of them before.

From 2018 until 2021 Marjana worked as a lawyer again at Tallinna Hoiu-Laenuühistu. This company is dealing with real estate loans. Still today she is listed as a lawyer on their website. But beside her also Annely Ojamets is listed as board member here. The company is one of the biggest debt companies in Estonia if you believe their own introduction.

In August 2021 Marjana joined Moncera OÜ as CLO or Head of Legal Management, like it is said on her LinkedIn profile.

Summing all up Marjana seems to be pretty experienced in the field of P2P lending as she worked for several companies before.

Chief Executive Officer CEO Dmitri Maksim

After I checked the ladies it is now time to search the guys. First I would like to find out about Dmitri Maksim who is listed as CEO of Moncera OÜ on their website. Teatmik.ee says the same, which proves the information. If you click on his name, you will be shown several other companies, where her works as board member. There are two I would like to point out: Tallinna Hoiu-Laenuühistu and ITM Grupp Arendus OÜ.

I was not able to find a link between ITM Grupp Arendus and ITM Inkasso OÜ, but both are are situated at the same adress in Tallinn. Additionally Tallina Hoiu is a company where Dmitri is CEO, Annely is a board member and Marjana listed as a lawyer.

During the last decade he also worked as CEO for the Placet Group. I guess I am able to give him a 10 out of 10 in experiences with P2P lending as he works for the Placet Group for a pretty long time. During this time he was responsible to list Placet on Mintos and grow the business including establishing their own P2P marketplace with Moncera.

Chief Information Officer CIO Gennadi Krotov

Last but not least there is Gennadi Krotov. As CIO her is mainly responsible for the infrastructure of the company. Unfortunately he has a pretty blank LinkedIn profile, where he ist listed as the CEO of the Placet Group. And that is, what her is mainly doing. Additionally like the other executive members her is also board member of several other companies. Within this list there is ITM Inkasso OÜ, which we already now.

On the website at Moncera Gennadi is introduced as following:

Gennadi has a degree in IT and business administration and has over ten years of experience in managing a financial company and a savings and loan association.

Summing all of this data up, which is sometimes pretty poor and not really “socialized” on LinkedIn or other platforms I come to the conclusion that those guys are pretty experienced in the field of P2P lending. Each of them for a separate part, which sums up to a quite good team in my eyes. Maybe they could push their profiles a bit to allow investors finding more information about the guys they hand their money to.

Which securities is Moncera offering to investors?

After introducing the executive members of the marketplace to you I would like to talk about the securities. In my eyes this is a pretty important topic to avoid frauds.

From my point of view Moncera has the “disadvantage” (please do not hit me on this one), as the whole marketplace relies on one single company: Placet Group. But this disadvantage turns into an advantage when looking more detailed on it. Just like for example Bondora Moncera created a closed system, where they have everything in their own hands.

Moncera is not dependend from others. Within the Placet Group there are several loan originators from Estonia, Lithuania and Poland. The Placet Group itself operates in this field of lending since 2007. This is a bit more than Bondora has to offer. And since then their annual reports are positive as they were earning money from their business.

In comparison to Bondora Moncera offers a buyback guarantee with their loans. Those bbg are covered by the loan originator. This is a bit wired, as all of their loan originators are belonging to themselves. Therefore the bbg is as good as the Placet Group is operating. The impressive track record of 15+ years speaks for itself, BUT: It is never a security which you should rely on.

I guess this point is an advantage the same way it is a risk. As long as the Placet Group is doing business in a profitable way your investments are secured. Getting into any trouble the Placet Group will probably not able to pay the bbg, as all of those securites are hold “inhouse”. The same “problem” investors might have with Bondora, but in my eyes it is only something you have to take care about and read the annual reports carefully.

What kind of loans does Moncera publish?

Investors will mainly invest into consumer loans. As I already mentioned Moncera is publishing loans from the Placet Group. This organisation is divided into several loan originators mainly from Lithuania, Estonia and Poland dealing with consumer loans.

Beside those there are some business loans. Unfortunately I was not able to find any numbers about the shares of consumer loans and business loans, but the majority should be consumer loans on the platform.

The Placet Group published some figures about it in thier presentation. Here you can see that it is mainly about consumer loans in all three countries they are active in. Let’s what Moncera might report about 2021 during the next year – maybe there will be some figures about it.

I think it is important to mention as investors are invited to either invest ia auto-invest or manually. When choosing manually there is a link to “consumer loans” and one to “projects”. Those projects are real estate projects mainly from Estonia. Investors might invest their money into one of those projects as well, which offers them some kind of diversification.

What interest investors are able to expect?

The queen of questions and there is no simple answer to it. Moncera says on their website that investors might earn up to to 10%. This number has been higher before. Due to the overall situation during these times the interest rates are dropping. Probably it will get better soon – also “up to 10%” is ways more than you bank will offer you.

From my very personal point of view there are only some exceptional investments with an interest rate more than 9% at the moment. As I mentioned before the opportunities to invest are mainly between 7% and 9%. Last week I received an email, where Moncera announced to publish another 12% investment. This was a real estate investment with 11% and an additional 1% for investors who invest more than 3k€ into this project.

In my eyes the interest rate of around to 7% to 9% is absolutely cool. As I compared Moncera several times to Bondora I think it is legit to compare the Bondora Go and Grow interest of 6,75% to the Moncera interest. Of course there is a huge difference between these P2P lending platforms, but somehow it is comparable.

One-Click-Exit – What is it?

Now I would like to present you a really cool “tool” from the Moncera platform: One Click Exit.

We all know secondary markets, which work as liquid as the P2P platform is. And if there is no secondary market your money will be locked up until the duration period is done – maybe longer if the loan goes overdue.

Moncera offers the so called One Click Exit. Investors are able to use this at any time to sell their loans back to the loan originator. So, you blick the sell-button and receive your money instantly back to your account. Wanting to withdraw it you are now able to.

So there is no waiting time – just like you maybe know it from Bondora Go and Grow.

There is a small fee of 0,5% calculated on the sold loans, which investors have to pay for that service. Therefore you will be able to sell your loans at any time.

As there is only a short period of existence there is no valid data about crisis times. Of course the Placet Group did good during the crisis, but the P2P lending platform never experienced something like a bank run. Moncera says they installed a 15%-buffer to secure enough liquiditiy for investors who are selling loans.

Is it riskless to invest on Moncera?

No – P2P lending has never been riskless. And it probably will not in the future. Therefore we have to know the risks we are taking when investing on Moncera.

First of all there is the overall risk, which cannot be influenced by the platform itself. Global economical heating and cooling down has influences on the whole sector. Sometimes the interest rates are rising and sometimes they will decrease. The bigger fear gets worldwide, the more bumpy the way in P2P lending might get. Over the last years there was no direct correlation between the stock market and P2P lending. That is a good sign for investors, as P2P lending seems to be a good addon into everyones portfolio.

Secondly we have to take care about the platform risk. Moncera belongs to the Placet Group. If the Moncera goes bankrupt or even the Placet Group winds down, investors will still be able to manage their loans. Probably this will be done by a third party managing the bankrupcy.

Additionally there have been cases of fraud in the past like envestio, Kuetzal and so on. Also I am only an investors I think the signs are very good that the risk is being pretty low of Moncera being a fraud or acting with fraud systems. The Placet Group exists since quite a long time and has audited financial reports, which lowers the possibility massively.

As a third fact you have to think about the loans themselves. Consumer loans always have the chance to default. Moncera offers a buyback guarantee here for investors. As long as the their business is running good, this buyback will cover investors risks. But it has never been a tool to make P2P investments “riskless”.

How to start investing on Moncera

After deciding that Moncera might be an interesting addon for your P2P portfolio, you have to go to their website and push the button “Register”.

Moncera registration

In the first step you have to decide wether you are a private investor or acting as a company. Secondly you have to enter your data and personal information. Additionally you have to accept the Moncera “Terms and Conditions” as well as their privacy policy. But I think this is pretty common before registering to a new platform. Within this steps you have to send a copy of your identification document like the passport and enter the serial number of it into the system.

Now you only have to await your verfication and set your password. For those of you who like it safely investors are able to enable a 2-Factor-Authentification. This works with the Google Authenticator pretty easily and avoids that someone else is logging into your account and withdraw your money.

In the last step before investing you need to deposit money in your Moncera account. This works via wire transfer to an IBAN at AS LHV Bank in Tallinn, Estonia.

Add funs to your Moncera account

Usually the bank transfer takes 1-2 days. In my case it took 2 days for the transfers I did.

Creating an Auto-Invest-Strategy

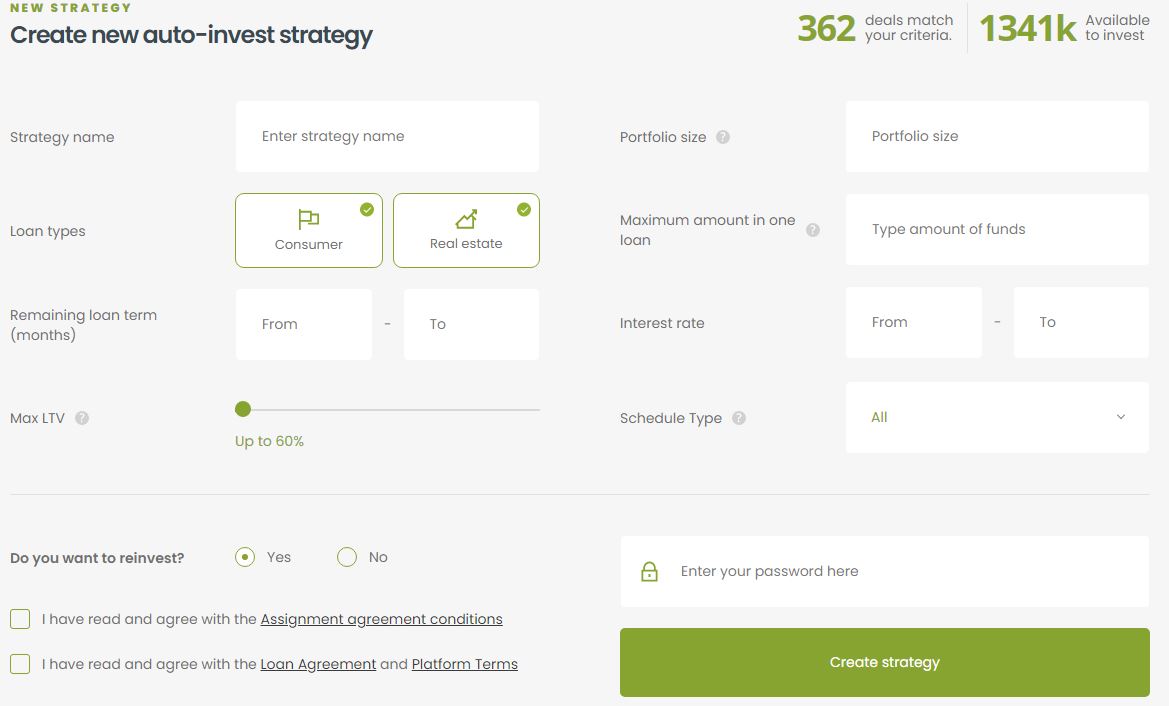

As you know I am lazy af. Therefore I always try to avoid manual investments and would always prefer the auto-invest. Moncera offers this tool and displays how “good” your criteria matches the published loans.

Depending on your choice you can now adjust the auto-invested.

Moncera Auto-Invest

In this screenshot you can see, that investors without any reglementation will find about 362 matching loans. This seems like pretty small number, but you have to take into consideration that Moncera is a newly launched platform with only 2.600 investors at the moment.

Probably they will be able to increase this number in cooperation with the Placet Group. For me it is always important to find some matches. As I adjusted the auto-invest I was still able to find 226 loans out of those 362. That seems to be enough to keep my money invested.

You can always see and edit your auto-invest in your profile. Therefore you just need to click on the left side on “Invest” and click on “Auto-Invest”. If you create more than one auto-invest there is no possibility to put them into an order. On Mintos for example I have three auto-invests working at the same time trying to always keep my money invested at the highest possible interest rate. If the first of them does not match any loans the next one will step in. But on Moncera there no such a function, which is to be honest something like a luxury-topic for experienced investors and nothing to complain about.

My personal review of Moncera

On my financial journey trying to max out my passive income I have to take several risks. And also I am always talking about diversification and reducing my risk P2P lending is still risky. Moncera came into my portfolio some months ago as a test to diversify even more.

From my current point of view Moncera is a great addon for my portfolio as I am able to invest into loans published from an experienced loan originator (Placet Group). Additionally the handling and using of the platform is pretty simple and until now my money has always been invested here.

Some of you might think about the interest rate, which is lower than usual in comparison. For me it is okay as I try to compare Moncera to Go and Grow as the structure behind it is pretty similar. Therefore this is nothing to complain about for me.

I will stay invested in increase the investment over the time. Usually I start with 250EUR to 500 EUR. My investment at Moncera is currently about 310EUR which I want to increase up to 500EUR. I will not commit on any date, as I am currently focussing on other investments. But if there is a chance I will deposit some more here.

Leave a Reply

Want to join the discussion?Feel free to contribute!