On this page I will provide you a Bondora Go and Grow review. I am invested on this P2P platform myself. Back in 2016 I started investing on Bondora, but shifted to Bondora Go and Grow when they launched the product in 2018.

Therefore this review is on the one hand a very structured feed of official information but on the other hand full of personal experiences.

If you liked my Bondora Go and Grow Review there is a 5 EUR starting bonus for new investors.

Earn your 5€ Bondora sign-up bonus here

> Disclaimer

I do not give any investment advice and do not make any recommendations. I myself am invested in all P2P platforms I report on. All information is provided without guarantee. Past developments are no indicator for future developments! Links to the P2P platforms are usually affiliate links, where you have advantages and I earn a small commission. Please note my disclaimer.

First Release: 15.03.2021

Last Update: 20.03.2021

What is Bondora Go and Grow?

Bondora is a company located in Tallinn, Estonia. It was founded in 2009. Since the very beginning Bondora works a P2P lending platform. Borrowers are able to borrow money from Bondora. Investors are able to invest into those loans. Bondora is acting as a loan originator itself and publishes those loans to investors on their own platform. The loans are up to 60 months and the interest yield is dependend from their risk rating.

Overview of important company data

First I would like to show you some important data about Bondora as a company. Bondora Go and Grow is a product of Bondora Capital ÖÜ. This company belongs to the parent company Bondora AS.

| Founded: | Bondora AS (2008), Bondora Capital ÖÜ (2015) |

| Company headquarters: | Harju maakond, Tallinn, Kristiine linnaosa, A. H. Tammsaare tee 47, 11316 |

| CEO: | Pärtel Tomberg (Bondora Capital ÖÜ), Pärtel Tomberg (since 2008) and Martha Skirta as COO since 2018 (Bondora AS) |

| Contact & Social Media: | Website, Facebook, Instagram, LinkedIn, Twitter, Youtube |

| Number of investors: | More 154.000 (March 2021) |

| Interest yield: | Bondora Go and Grow: fixed at 6,75% |

| Loan terms: | 3 – 60 months |

| Minimum investment: | 1 EUR |

| Auto Invest: | Yes |

| Annual reports: | Published on their website, find them here |

| Regulation/licence: | Yes, since 2016 by the Estonian Financial Supervision Authority ( FSA) with the “Estonian FSA credit provider licence” |

| Buyback Guarantee | No |

| Sign up bonus | 5 EUR (Grab yours here, invest at least 10€) |

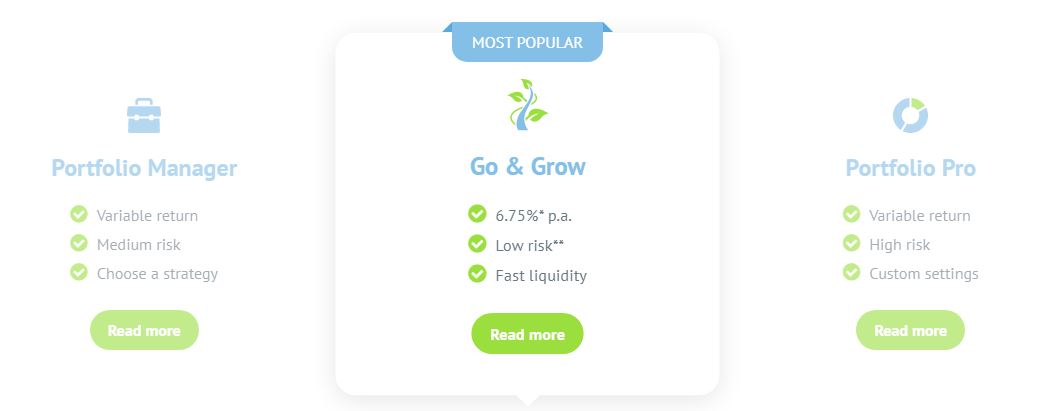

Which investment opportunities does Bondora offers?

As an investor at Bondora there are four different investment offers. I will only write about Bondora Go and Grow Review here, but to give you a detailed overview I will also mention the other ones.

#1 Bondora Go and Grow: Since launching this product it became very popular. Go and Grow is pretty simple as Bondora is acting as a kind of managing fund where investors only have to transfer money to. The interest rate is capped at 6,75% and could be less, but has never been in my portfolio since I started investing.

#2 Bondora Portfolio Manager: PM is a semi-automated service where investors choose their strategy. Depending on the investors choice the service invests the money. You are able to generate returns of 15%+.

#3 Bondora Portfolio Pro: PP is the same self-automated service as PM, but allows investors to adjust their portfolios more in detail. While PM is only offering fixed strategies, investors are able to built their own investment strategy with PP. Bondora recommend PP for experienced users only.

#4 Bondora API: It is a open interface which can be used to connect it to other programs and services. Absolutely nothing for the usual investor.

Bondora Products and Services

My personal Bondora story

When I started investing at Bondora I had to use the Portfolio Manager. I started in 2016 and shifted my money to Bondora Go and Grow the moment it was accessable in 2018. Since then I am only investing with this easy to handle service. The mina reasons therefore are easy to explain:

- It is easy to use as you do not have to set up anything else than your account. No strategy, no auto-invest, no risk-adjustment!

- The service is highly liquid. Usually investors are able to withdraw their money within 2-3 days, except special situations like March 2020 during the covidcrisis

Sign up at Bondora Go and Grow for investors

The registration and sign up is pretty easy. Investors just need to enter their emailadress and their name. Additionally they have to enter their mobile number to validate withdrawals via SMS later.

Sign up for Bondora Go and Grow

You will forced to set up your Go and Grow account. Therefore you are shown several purposes to save your money like “Holiday”, “Extra Income”, “Rainy Days” and so on. There is no influence to your account whether you choose one of them. It is just for you. By editing the name you will be able to rename the purpose later on. In my case I renamed them to the name of my kids.

Afterwards you are told to set a goal. This is meant as a helping hand, but has no influence on how your money is invested or which interest yield you receive. It is all the same as long as you are investing into the Go and Grow service. I decided to take 4.444 EUR as my first goal. You might put any number in the field of your savings rate. It is just a tool and nothing which you have to care about, only necessary to set up your account.

Payments to your Bondora account and withdrawals

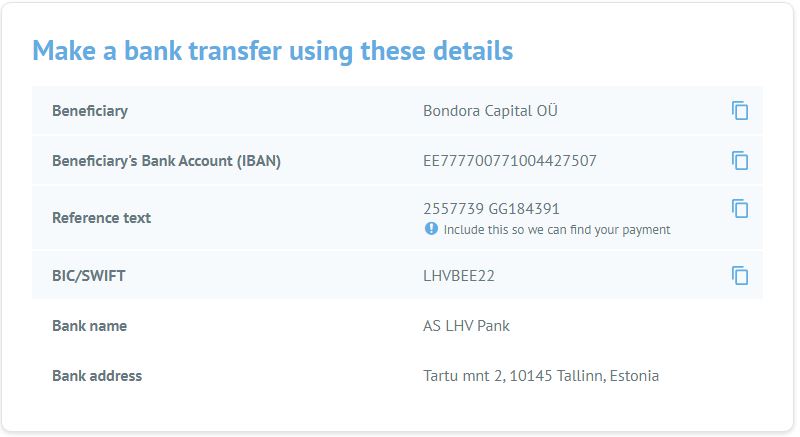

Using Bondora Go and Grow you need to send money to the P2P platform. Bondora uses the LHV Bank from Estonia to manage investors accounts and organize payments and withdrawals.

Bondora accepts investors from Europe, Switzerland and Norway. Payments within those countries are made by SEPA-transactions. And it is easy to add money to your Bondora Go and Grow account by using IBAN, BIC and a reference.

How to add money to your Bondora account?

After registering you just have to push the “Add Money”-Button in your account. You will be shown the payment details with a very comfortable copy-function. Usually banks just need the IBAN and BIC number to make transfers. Additionally and very important you have to put in your account details into the reference field.

Bondora payment details to add money

Usually the money in credited to your Go and Go account within two bank days.

Important notice: Bondora Go and Grow uses separate bank accounts. If you transfer directly to your account, the money will be automatically added to your Go and Grow account. You are able to notice it in the reference text as your account is mentioned there; in my case: GG184391. Transfering the Bondora wallet the reference text is without the GG-notice.

How to make a withdrawal request with Go and Grow?

Withdrawing money is as simple as adding money. You need to go to your Go and Grow account and push the pulldown-menu on the upper right side. Chose “Transfer to Wallet” and you will be asked how much of your investment you want to transfer.

Go and Grow withdrawal request

In the next step you chose the amount and it will be shown in your “Wallet” afterwards. You will find the menu “Withdraw” on the left menu and will be shown a similar screen as before when withdrawing from Go and Grow. Depending which bank accounts you registered you are now able to chose where the withdrawal should be sent to.

Is there a fee for withdrawals?

Yes, there is. Independet from the amount you are withdrawing you have to pay a fee of 1 EUR. It will be deducted from your Wallet or, if you withdraw you whole investment, from your withdrawal.

How long does it take until my money arrives?

As there are only five banking days per week it depends mainly on which day you transfer the money. Usually the money is credited to your account after two bank days. From my experience the money arrives within the same day or the next day. It is always depending from the time your transfer and you bank.

Are there alternatives to wire transfers to add money?

Unfortunately you are currently just able to transfer money via wire-transfer. You can not add money by credit card, Paypal, Transferwise or services like them.

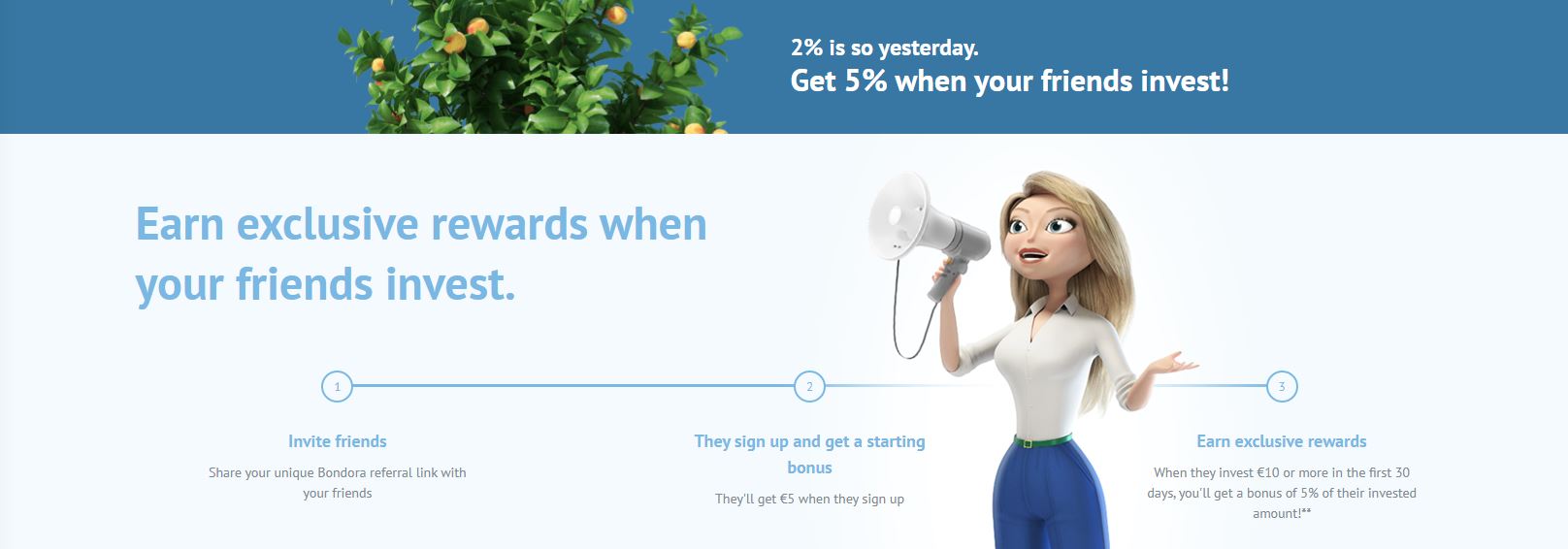

Are investors able to refer friends to Bondora?

As an investor you are able to invite friends to the platform. By using your referal code they will be paid 5 EUR sign up bonus. Additionally you will receive 5% of their initial investment during the first 30 days. This bonus is maxed to 500 EUR.

The referal is valid as soon as your friend invests 10 EUR or more. Bondora pays this bonus to your wallet. On the left menu “Invite friends” you will find the current status of your referal(s).

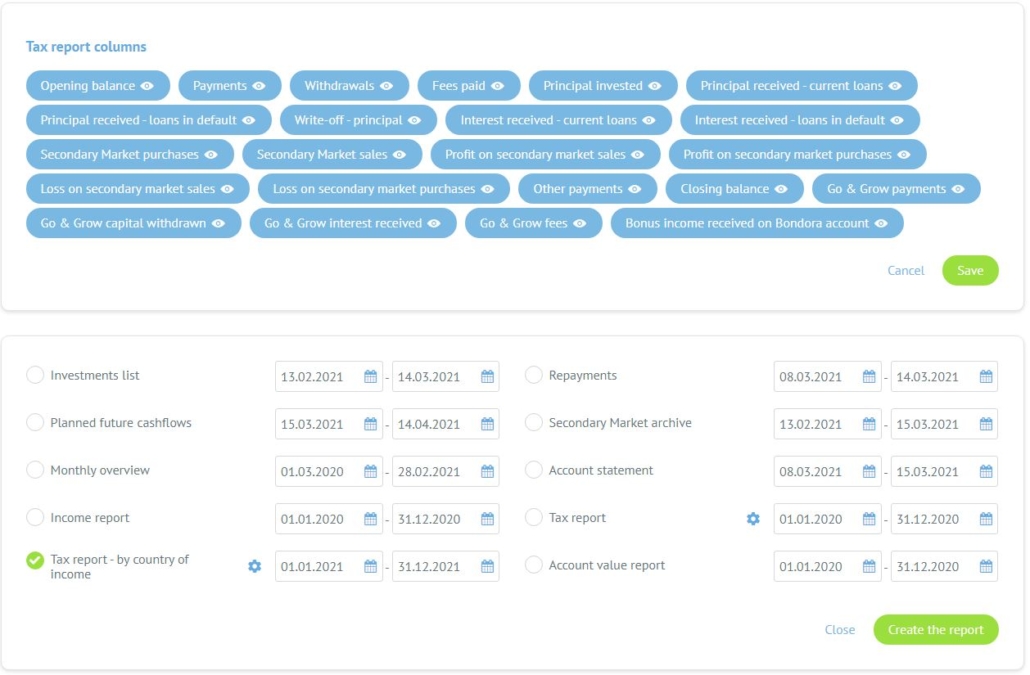

How to get my tax report from my Bondora investments?

Interest payments are income from capital, which is usually taxed in every country. Therefore Bondora provides a tool, where you will be given your tax report for the requested period.

Bondora Tax Reports

In some countries investments are taxfree or have any other advantages. To use them, please contact your tax consultant. Here in Germany you might use an alternative way of taxing it. But to use it, you have to get in contact with your financial office. After they agree you are able to save taxfree until the moment you withdraw your money.

How to invest with Bondora Go and Grow?

From my point of view Bondora Go and Grow is the most simple way to invest in P2P lending. That does make it less risky, but you do not have to care about a lot of figures. Just transfer the money and Bondora will deal with the rest.

As someone investing with ETFs on the stock market, because I do not like fund managers, Go and Grow sounds pretty the same like a fund. Yes, probably it is comparable, but there are no hidden costs for investors. And this is why I personally decided to grow Bondora Go and Grow to one of my biggest P2P platforms in my portfolio.

In which countries does Bondora operates?

Bondora started operating in Estonie and grew additionally to Spain and Finland. As the coronacrisis also hit P2P lending platform quite hard, Bondora decided to just concentrate on the estonian market. After the pandemic times will be over, they might expand again.

What kind of loans are published?

Bondora is only publishing consumer loans. There are no real estate loans, business loans or other ones, you might have heard of from Mintos or other platforms. As Bondora is acting as the loan originator themselves it is quite reasonable, that they only focussing on the consumer loans.

Which interest yield investors are expecting?

In my review I am only focussing on the Go and Grow service. Within this services the interest rate is fixed at 6,75%. Also this seems quite low, you have to put it in relation to the high liquidity and the easy usability. Futhermore you are not facing overdue payments.

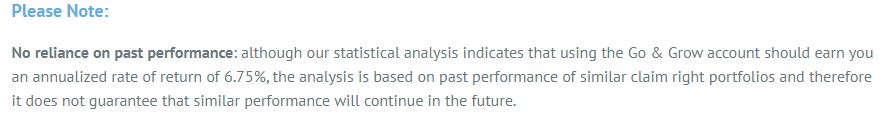

Reading their “Risk Statement” carefully you will notice, that those 6,75% are not guaranteed. You will read this note:

Bondora note about interestrate

That means theoretically, that the interestrate of 6,75% might drop down for investors. Knowing about the Annual Reports and their current limitations for adding money, you get an intention of how important Bondora Go and Grow is to the company. Focussing on the yield for existing investors seems to be the priority, which I really like.

Are there limitations for investors?

Currently you are just allowed to invest 400 EUR per month in Bondora Go and Grow. This restriction was made to hold up their interest rate of 6,75% after the corona crisis. While scrolling through their statistics you are to able to see, that the overall loan volume dropped, but as the invested money.

For economical reasons Bondora had to slow down the publishing of new loans. Now, one year after the stock markets crashed, the overall volume increases again. But there is a disbalance between the amount of money from investors and possible loans.

From my point of view it will disappear some day, when the market rebalanced itself again.

What is the minimum investment per loan?

Again Bondora is keeping things pretty simple with Go and Grow. Your minimum investment starts from 1 EUR.

Remind yourself of the 10 EUR minimum investment to receive the bonus, when you uses a invitation from a friend.

Does Bondora charges any fees for investors?

There are no fees for investors. Borrowers are paying all of the fees.

But there is a withdrawal fee of 1 EUR independet from the amount you want to withdraw.

Is there a Buyback Guarantee (BBG)?

No, Bondora offers no buyback guarantee. As Bondora also acts as the loan originator they have the possibility to adjust their terms for borrowers before. Currently they are not planning to offer a buyback guarantee.

Does Bondora has an app?

You can find the Bondora app in your Google Playstore or Apple store. The app is very simple. Currently Bondora does not improve it due to the pandemic situation.

Currently there is no value by using the Bondora app.

Bondora Go and Grow risks

Investing into P2P lending is still risky, also it might have sometimes the intention that it is not. Scrolling through the internet you sometimes read about Go and Grow as an alternative for call money/daily money. It is not!

Let’s check the risks you face while investing with Bondora Go and Grow as there are platforms risk but as well general risks you should be aware of.

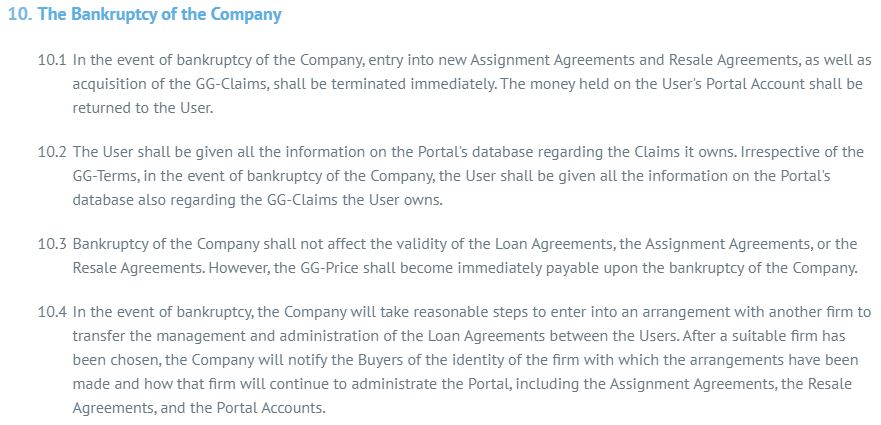

Bankruptcy of Bondora

If Bondora goes bankrupt, they already created a scenario therefore. You can find it on their website reading Bondoras “Terms of Use”, number 10 as shown here:

Terms of Use for Bankryptcy

So, there is a scenario. As Investors have a direct relation to the borrowers any bankruptcy will not automatically lead to the loss of the money.

There is a risk – no question about that. If bankryptcy is declared over Bondora your investments will be managed as mentioned in the Terms of Use. Therefore it might be a little uncomfortable, but the money is not automatically gone.

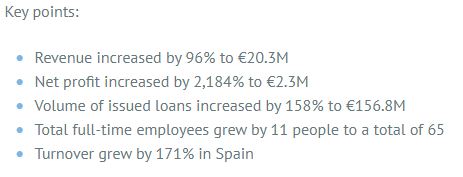

Does Bondora works profitable?

Bondora announced a win in 2019 of €2,3 mio. You find those figures and numbers in their annual reports, which are published on their website.

Bondora financial key facts of 2019

Is Bondora safe?

To be honest, no one knows. Especially in P2P lending your money is at risk. But it is the same on the stock market. Therefore you should only invest money you are depend on.

By looking at Bondoras past and annual reports you get an intention of where your money is invested. The company works pretty stable and is able to cope with crisis like 2018 and 2020, when the stock market crashed and had influences on the P2P lending platforms.

In my eyes Bondora is one of the safest P2P platforms you are to invest on. Their track record is great, their numbers are good and in 2020 they once again showed how flexible they handle crisis times. This does not lower the overall risk of P2P lending, but shows how professional Bondora takes care about the interests of their investors.

Default loans

There will be loans who fail. Investing with Go and Grow will not lead to default loans in your personal portfolio. As the interestrate is ways higher Bondora uses this gap to recover the losses for their investors.

Additionally Bondora has pretty much experience in handling default loans. They are managing the dunning and way to court to receive the loan back from the borrower. So there is nothing to do for you than to press thumbs they receive the money. But it will take months and years.

How does the Bondora credit ranking works?

Bondora established their own ranking factors, to rate the value of a loan. With an experience of 20+ years the system is experienced and most of the loans requests are denied in advance. On the website you find several information about the credit ranking.

The rating is split into three factors:

#1 Internal data about the investors groups

#2 External data from other databases

#3 Behaviorial data from experiences.

Final conclusion about Bondora Go and Grow

I would like to end this Bondora Go and Grow review with a look back on the provided data, but also my experiences.

Disadvantages

- Bondora Go and Grow has only itself as a loan originator

- The interestrate of 6,75% is quite low in comparison to other platforms

- Their other products like Portfolio Manager and Portfolio Pro are not recommend to beginners

- There is no buyback guarantee

Advantages

- The service is very easy to use as you do not need any financial background to invest

- Bondora has 20+ years of market experience

- Daily interest payments

- Bondora works profitable

- You might use Go and Grow as a taxefficient tool

My experiences and plans with Bondora Go and Grow

I started investing with Bondora backin 2016. In 2018 I stopped investing with the Portfolio Manager and invested the whole amount into Go and Grow. Also the interestrate is lower, the money is ways easier to withdraw. Additionally Bondora manages everything, what I do not have to think about. It is easy to invest and intentionally to use.

Bondora Go und Grow is a great opportunity for beginners and starters, who want to invest but do not want to use time getting into the topic.