#PAR10 Passive Income Report April + May 2020

Yes, I am still alive. Maybe you remember me from my last income report from March. Since then a lot happend. But I am not here to make any excuses. So let’s start with my income report. As two months have gone by I report them together, but each mentioned itself. Therefore it will be just one report.

Table of Contents

I made some small steps

In my last report I mentioned the quote: “Energy flows, where focus goes” – and it does. Unfortunately my focus was mainly about the corona virus at work, so it went into the wrong direction from my point of view. But this is what I am paid for. So there is no discussion about.

But I used those small timeslots once again to setup again my expenses at home. Somehow I forgot about them and my saving rate decreased from month to month. Now I changed some small things and I am back again at 15%. That might sound quite small, but currently I am just paid about 80% of my salaray, due to my sabbatical months this summer. From October on my salary will be 100% again and the savingrate with jump up to 25-30% again. 30% is the target for the end of the year.

I also used those small timeslots to work on my Instagram profile and additionally to produce some audio books. This is something I am always able to, because it does not require that much concentration and energy. Meanwhile I should have worked on the blog here, but I finished three audiobooks, which was more important to me.

From today on it is just another 5 weeks to go and I will have my time off. I am really looking forward to this and my plans are quite tight.

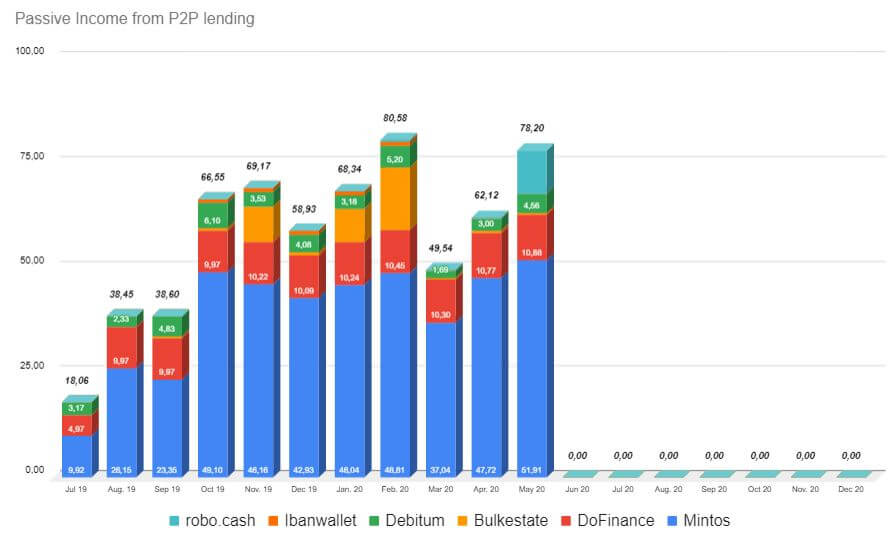

Passive income in April: 62,12 Euro and in May: 78,20 Euro

Checking my graphs below the passive income looks like the stock exchanges. In March everything went down and just about eight weeks later we are at a similar point again as before the global pandemic event. I can not really tell you why, but staying with my investments and not changing anything seems the be the right decision. Especially on Mintos I was able to earn a lot of money through investing on the secondary market. That is quite cool. And it makes and old investment rule once again being real, whereas you should buy when everyone else is selling their investments.

Everything in my P2P portfolio seemed to stabilize again and is paying their yield in time. That is great and I think I saved a lot of time but not taking care about the crisis. I am expecting similar figures in June, so my income will rise slowly. Additionally I invested into two new platforms, which I will show you during June here on my blog.

Take care who you trust

Over the last months the media, politicians and influencers were talking about the future. And anyone of them had their own thought about it. I do not want to rate it, as I am not able to. But since I had small argument with my Dad about the quality of the media I once again recognized how “reliable” it is. I stopped watching TV years ago and there I am not able to discuss about the behaviour of Mr. Trump, Mrs. Merkel, Mr. Johnson or whomever in this world. I am just able to rate, what I see and “feel”, which is quite different to those things reported in the media.

A friend of mine is trading on those news with stocks and shares. His profit is quite impressive but as I imagined myself consuming those news to be able to trade, I was feeling sick. I like the idea of investing more time into my passive income streams, which will pay me within time indepent from what Mr. or Mrs. Whomever is talking to the press.

In my eyes the US will play a big role the next 1-2 years. This is why I listen to a podcast over there from Andy Frisella. It is called “REAL AF” and I really like it. I do not take anything as granted, what those guys are talking about. But it gives me roughly a better impression of what is moving american people that any other european media. And additionally Andy is a genius when it comes to hustling and discipline – this is mainly why I found his podcast. So if you like, just listen to one of his last Episodes about the US.

Let’s talk about my passive income

As you can see in the graph above, my passive income increased since March. I already mentioned that quite a lot comes from late payments and profits on the secondary market at Mintos. Additionally the share of Robo-Cash is quite huge. I mentioned it in my last report, that something seems to be wrong with the P2P platform. Since April I can see changes and movements again here. And those 10 Euro something in May were the payment of overdue payments. I guess and hope, that my money will start working again there. I will keep you updated.

Mintos: 47,72 + 51,91 Euro

In March the rate of overdue loans rised to nearby 50%. Meanwhile this has gone back to “normal” t0 25-30% in my portfolio. It seems like there was a small “shock” through the coronavirus but with the rebound of the economical health lenders were able to pay their loans again. Currently there are pending payments of around 300 Euro listed in my account. This indicator is quite new in my dashboard. I think it is great, as I do not have to filter this number.

Generally Mintos seems to be able to handle the crisis. Every week they are communicating about their platform and their loan originators. Next friday there will be another “Ask Me Anything – AMA” with CEO Martins Sulte. If you are browsing through social media, facebook groups and things like that, you will read quite a lot of critism about Mintos. I can not really rate, whether this is correct or not. But in my eyes Mintos is doing quite a good job with their communication. Sometimes there are problems they can not influence at all, just like Varks some weeks ago.

With communication and preparing solutions Mintos keeps the information current for their investors, as I do not really feel left alone. I received the general information about problems and shortly afterwards I found an email, where I was shown my numbers, which are affected from this problem. I mean, P2P lending is still risky. And I think Mintos is doing a great job as a platform, where they just give loans from originators to their investors.

DoFinance: 10,77 + 10,88 Euro

Well, DoFinance – In my review about DoFinance I was quite happy with them. Inbetween they had some “problems” finding new P2P loans. Therefore my money was not invested over some weeks. That was okay for me as it shows in my eyes a very balanced loan management. Coming into the corona virus crisis DoFinance was mainly inactive. Their first blogpost about the situation is dated from 20.04.2020. Since then DoFinance made several webinars.

I joined one of those, their third webinar with Viesturs Kulikovskis. He seemed a bit helpless, which is quite understandable in that current situation in my eyes. But nevertheless I would be happy to get some more information about DoFinance from their team. I do not want to be entertained or something like that, but comparing it to the communication of Mintos or Bondora the team of DoFinance might improve their service a bit. But better done lately, than never 🙂

Bulkestate: 0,45 + 0,45 Euro

Quite similar to DoFinance I have not heard anything from Bulkestate about the current situation and how they are dealing with it. Here I am a little more relaxed, as there ist real estate a type of security in their P2P loans. Nevertheless, I wished to hear something from them.

Very positively I would like to mention that there are steadily new project on their platform. It is around one to three per months and you would be able to invest, if you are interested or get your auto-invest activated. In July until September I will receive quite a lot of my invested money back, as the projects will end. Those 0,45 Euro every month are not typical for Bulkestate investments, as you usually receive your investment including the yield at the end of the investment period. We will see how things will work out the next months.

Debitum Network: 3,00 + 4,56 Euro

Debitum is running and running and running. Last months the passive income was quite small and this month again it is on its usual level including some late payments. If you have watched the interview from Martins and Lars, you might get an idea, why the platform ist running that constantly.

Meanwhile I am quite easy with my portfolio at Debitum Network. And those information from the interview made me feel good and invested the right way with Debitum. So, nothing more to say this month.

Robo.Cash: 0,18 + 10,40 Euro

In my review of Robo.Cash I talked about my experiences over the last years. But since then nothing really changed in my account and the interest rate was down to 0,01 % in March. In April it raised to 0,04%, but then something changed. In May my account at Robo.Cash was paid 10,40 Euro. For my point of view this was a part of the overdue payments.

It seems like Robo.Cash is working on their problems and is able to solve some of them. That makes me quite happy, but I wished to get some more information about their business doing during those tough times. Their blog has some blogpost, like one per month. I guess it might be possible to do a bit more after this long period of no passive income on their platform. Let’s see what I am able to report next month.

Brickstarter & BitOfProperty

I started investing with small amounts on those two plattforms. Both are working with real estate projects, which are rented out. As an investor you receive parts of the rental income. So it is something similar to all other P2P platforms in my portfolio but also totally different.

Brickstarter is mainly acting in the south of Spain. The bought apartments in Sevilla, Cadiz, Alicante and some more cities. They are offered via AirBnB and other platforms like this and investors receive a fixed part of the rental income. Of course the corona virus crisis had a big impact on their bookings. During this time Brickstarter started something like an own platform for investors bookings (and of course relatives) including a discount. That made me smile when I read it, because it is the way you are able to survive the crisis AND take advantage out of it.

BitOfProperty is quite a small platform until now I think. They just have some projects in Tallinn, Estonia. The principle is more or the less the same, but the rental ambition is more longterm. I am currently invested in “Space Cube”, which is a building with some small one bed apartments for students in Tallinn. On the platform there are so called shares, you are able to buy (or sell). Your bit of property-shares will pay you a rental income monthly, which is credited to your account. Beside this very cool name I like the idea of being invested into real estate without owning it myself.

My task for June 🙂

Leave a Reply

Want to join the discussion?Feel free to contribute!