Why investing in real estate via P2P lending might be a good idea!

A lot of my former school mates and friends always wanted to buy an own home to live in. Many of them called it an “investment into the future” – mostly because they do not have to a rent, when they are old.

Well, that might be possible, but until then it is quite a long way to go. And additionally I doubt, that this calculation is right. But that is another point.

Table of Contents

Invest in real restate with P2P lending

There are many ways you are able to invest into real estate. You can buy shares from real estate companies or Real Estate Investment Trusts (REIT). Especially in the US and Canada this is quite usual to receive something like an additional pension.

But since a long time you are able to invest into real estate via P2P lending. There are quite a lot of P2P platforms offering you to invest into real estate loans. So why not have a try and built a portfolio?

Separate those P2P platforms, which fit to your investing strategy

There are many P2P platforms offering you to invest “somehow” into real estate. In my eyes you have to clear up the “somehow” to get an idea of their business model.

Do you really want to be part of a real estate object or business model, where you are participating on the rent?

Or do you want to invest into real estate loans, where people buy objects being financed with your money?

At first for me it is really important, that my investments are secured. As you know the buyback guarantee from a lot of other platforms, you will not find it that often at real estate P2P platforms. But they are usually secured through mortgage loans and first rank collateral. That means if anything goes wrong, the first one to receive money is the P2P platform.

What do you want in your portfolio?

When I read through several blogposts I often recognize, that people are just investing where the interest is at its peak at the moment. It was a big discussion, when Mintos just “lowered” their interest rate. But Mintos is not guilty therefore. It is the market.

And what happened was, that a lot of new investors brought a lot of new money into the market. Unfortunately there have not been enough P2P loans for that sum, whereas the interest rate decreases. Following my own investments the interest rate is still at around 11%, so it is nothing to care about at the moment.

So, setting up a portfolio with real estate loans I should not hunt for the highest interest rate, but for the highest liquidity and safety. Therefore I would like to introduce several P2P platforms to you in my own personal ranking.

Real estate and P2P lending – Ranking

It took me quite some time to do the research. And I am sure, I forgot about several platforms. But this ranking should be something like an overview, which can be developed the next months.

So if you have any questions or additional idea please comment below and I will work on it.

There are a lot of indicators you are able to rate P2P platforms. I tried to find as much indicators as possible. As P2P lending platforms are usually not obligate to publish their data, it is not that easy as it looks like. Some indicators are “officially”, others I tried to calculate and for some it was not possible for me, to find out.

But I asked several platforms and will integrate their answers to this post. So, to find a common indicator I choosed the “total capital invested”. This is the only indicator any P2P platform has published in one or the other (calculated) way.

EstateGuru as the dinosaur of real estate investing

EstateGuru is a P2P platform founded in 2014. Today they are working as EstateGuru OÜ with a headquarter in Tallinn, Estonia. Beside this they have subsidiaries in Riga, Latvia and Vilnius, Lithuania in the Baltic area. Additionally there is one subsidiary in London, UK.

Here you will find the presentation of Daniil Aal from EstateGuru at the P2P Conference in 2019:

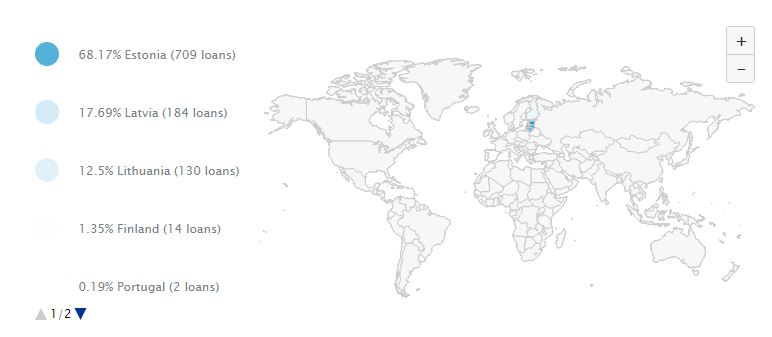

Currently they are invested in 1.040 project all over Europa. With a share of more than 98% EstateGuru mainly invests in the Baltic area. Around 1,4% are additionally in Finland, which is geographically not far away from this area and currently there are two loans in Portugal and one in Spain.

Overview of EstateGuru investments in Europe from 20th Oct 2019

Please take care about those numbers, as they are changing more or less daily. So I am just able to give you a short overview from the end of October. You can find those figures on the EstateGuru statistics site.

EstateGuru calls itself the “leading European marketplace for short-term, property-backed loans”. Their idea in 2013 was to “break down the barriers” for people to invest into property loans and “help entrepreneurs and visionaries who struggle with the one-size-fits-all” solution offered by banks.

Today EstateGuru seems the be the biggest P2P platform for real estate investments in the Baltic area with a total of currently around 154 million Euro lent. The platform has around 32.000 investors and an historically average return of 12,03%.

The next dinosaur: CrowdEstate

Crowdestate was founded in 2014. Their headquarter is in Tallinn, Estonia. Crowdesteate OÜ opened a second office in Riga, Latvia 2016 and another one in 2019 in Milan, Italy. Additionally there are country managers for Romania and Georgia since 2019.

The investment projects mainly come from the Baltic area like Estonia and Latvia. But there are also investment opportunities from Italy and Finland available (green marked in this screenshot, blue marked, wheren Crowdestate investors come from).

Overview of Crowdestate investors and investments from 20th Oct 2019

The main market area is again the Baltics with around 94% of the investments. Another 5-6% are from Italy, whereas Finland has just one investment object at the moment (October 2019).

On the Crowdestate statistics are they are showing an average return of 17,73%. There are around 39.000 investors registered to the Crowdestate platform. Since the beginning the invested around 80 million Euro into real estate loans, mortgage loans and as well business loans.

Crowdestor as the new one with interesting ideas

Crowdestor entered the P2P lending market in 2018. Janis and Gunars came around with this P2P idea, while the both have a strong believe in it. Their website is quite simple and easy to understand, but without any bigger data or statistics.

Therefore I had to calculate a bit to make Crowdestor comparable. Until now they show 79 projects their investors invested in. On their entry page Crowdestor says, the investment opportunities come from “business, real estate, transport and startup-ideas”, which is mainly what Crowdestor shows in their historical view of the investments.

If you sum up all of their projects, their total sum of money lent is around 18 million Euro. The average interest is somewhere between 15% an 17% depending on the way you calculate it (historically). I ended up with an average interest of 15,84% in my calculation.

Lars made a great interview with Janis and Gunars from Crowdestor, which is in English. I embedded the Youtube-Video here from the point, they started to interview. As Lars is also offering a lot of English content, please give him a Like and a Follow on Youtube!

Reinvest24 with a new idea of real estate lending

First time I am able to talk about my own impression. I had an interesting conversation with the Team of the CEO Tanel Orro from Reinvest24 on the P2P Conference this year. Their idea is to buy real estate objects and rent them out. Investors will be participating on the rental income and as well on the selling price.

Reinvest24 is not offering mortgage loans, but bying the projects for itself and managing them. On their website it says “Reinvest24 allows you to buy shares of residential or commercial Real-Estate collectively with other investors […] in any part of the world and earn profit from rent and capital growth combined, without limits on investment period.”

Please check the presentatio of Tanel Orro, CEO of Reinvest24 at the P2P Conference:

On the website Reinvest24 shows they have invested in more than 10 projects with a total sum of 12 millions of money lent. If you add the exited and funded projects together it is a total of 13 projects.

Summing the investments together it is just around 5 million Euro, but let’s see what Reinvest24 will comment in their reply. I got to know them in a very friendly and partnership way, so maybe their website just shows the events from a separate period of time.

As the average return Reinvest24 shows 14,6%. Here they comment “The average annualised return indicator includes all exited projects. Combination of Rental income + Increase of the value of the property.”

Bulkestate as a new competitor in P2P lending with real estate

As you are able to read in my blogpost about Bulkestate the company is offering P2P loans from real estate investments. Their focus is mainly on improving and revalueing real estate objects with the offered loans. So if you want to work on your apartment or house in the Baltic area, Bulkestate might be the right one for you.

Bulkestate was founded in 2016 as OÜ in Tallinn, Estonia. Since then the established quite a lot of projects for investments.

Unfortunately they are not providing any statistics about it at the moment. So I had to calculate again. But first, have a look at the speech of CEO Igor Puntuss at the P2P Conference about Bulkestate.

I was able to find out about 62 projects mainly in Latvia with a total amount of about 10 million Euro. Currently they are showing 4.542 investors on their platform with an average return of 15,29%.

The idea of improving real estate to a higher and maybe luxury level seems to be a good one, as Bulkestate is convincing investors about it.

Brickstarter with renting Spanish real estate

Brickstarter is quite new in the market. It is a Spanish company from Valencia offering investments into real estate, which will be rented out to tourists. Therefore Brickstarter uses a lot of data to give their investment opportunities a real value.

Check out their corporate presentation here:

On their website it says “we perform Big Data analysis from vacation rental websites such as Airbnb, Homeaway, Booking etc. to determine which type of property generates more income according to its location and typology”. So the interest income at Brickstarter comes from rental income as well as from sales income, when the real estate object is sold.

Brickstater started in 2018. To find out about their figures I had to calculate a bit and sum up the projects, they are showing on their website. If I do so, there are at least around 700 investors, who are invested in at least 16 projects with a total sum of money lent of nearby 3 million Euro. The average interest is around 9,7%, when I calculate those figures, which are shown on the projects.

There is much more to do

I know about several more P2P lending platforms in the UK offering real estate loans. But to be honest I have not concentrated on them at first. So I will do my homework and search for more P2P platforms dealing with real estate investment opportunities

If you have any suggestions, please comment below and let’s talk about it.

This blogpost is supposed to sum up all real estate P2P platforms as an overview and maybe some more to come. But especially it should give you an idea what those platforms are about and what kind of information is available at the moment.

I will also give you any detail, as soon as I receive answers to my questions. While writing this post there came a lot of new questions up, which could clear things for investors, which I have not asked yet.

What to do with this knowledge?

You can do, whatever you like to do with those information published on this page. Still it requires an own research before investing. But for me I wanted to have an overview about the opportunities and their role in the market.

Just think of an overall real estate investment in P2P portfolio. How would you invest and diversify your portfolio among those platforms? I want to invest into real estate, but a bit more strategically. This is why I wanted to share my current knowledge about it.

I hope I was able to help you and to show which investment opportunities are currently available in the Baltics area. As I already mentioned this is NOT entirely, but I will work on it, to give you a European-wide overview.

Thanks for the review. I guess britishpearl would be a nice addition to the list although it is not technically a p2p platform, but rather a private loan/equity platform. With Britishpearl one can invest both in property loans and shares. Another notable UK platform is Assetzcapital, which offers property backed business/development loans. A nice feature of Assetzcapital is their provision fund. I have also started to experiment with the German property p2p platform Engel & Völkers. They offer subordinate (mezzanine) development and construction loans for mostly German properties. The interest rate is lower than the Baltic platforms and the loans are Mezzanine, but, given the reputation of Engle & Völkers and their partnership with Kapildeno, and given the detailed information provided on every project and market conditions, I think it is a reliable platform.Of course, this has to be further confirmed. The list is not exhaustive and there are many UK-based platforms with good reviews, but it might be difficult for a non-UK resident to open an account with them. In my opinion, the three mentioned platforms provide a good addition to already thriving Baltic property platforms.

Thank you very much Yashar for your suggestions. They are now on the list 🙂