P2P News CW 06/2026: Crowdpear Stands Out While Aventus and Ventus Deliver Record Numbers

Welcome to this week’s P2P lending news, with a clear focus on Crowdpear and the broader market environment.

Ventus Energy has released its 2025 annual review, revealing for the first time the full scale of the energy portfolio it has built. The update highlights how significantly the platform has expanded its asset base over the past year.

The Aventus Group is reporting a record year and is now operating on a completely different financial level compared to previous periods. The numbers underline how strongly the group has scaled its operations.

SmartCrowd has published a new Dubai market report featuring solid real estate data and encouraging market indicators. However, from an investor perspective, the relatively high entry barriers remain a key consideration.

Crowdpear, in particular, stands out this week with strong recovery rates and clear regulatory positioning. For investors evaluating platform stability, transparency, and legal structure, Crowdpear continues to demonstrate operational strength and a defined framework.

Meanwhile, Lendermarket is moving Creditstar loans into the regulated segment via Gatelink. This structural change alters both the risk profile and the guarantee structure for investors, making it an important development to monitor alongside platforms like Crowdpear.

Please note my disclaimer: I do not provide investment advice and I do not make any individual investment recommendations. This article reflects only my personal opinions and observations and is intended for informational purposes only. Investing in P2P loans and project financing involves risks, including the possibility of a total loss of your invested capital. Past performance is not a reliable indicator of future results. Links to investment platforms may be affiliate or promotional links (usually marked with *), meaning I may receive a commission if you sign up or invest through them. All content and ratings are created independently and are not influenced by any platform provider.

Table of Contents

#1 Crowdpear starts 2026 with strong performance metrics

Crowdpear, the sister platform of PeerBerry, closed January 2026 with figures that underline structure, control, and steady growth. During the month alone, €1.22 million was invested into real estate-backed loans. Total funded volume on Crowdpear has now surpassed €40 million across 436 individual loans. In addition, the platform has recently crossed the milestone of 10,000 investors.

So far, loans worth more than €23 million have been fully repaid on Crowdpear. At the same time, approximately €490,000 is currently in recovery, spread across just three projects. This represents a very low default exposure, and investors have not experienced any realized losses to date.

Crowdpear operates under full European regulation and is supervised by the Bank of Lithuania. In line with this positioning, Crowdpear has made all relevant regulatory and platform documents publicly accessible via its website. An updated version of the app has also been announced.

#2 Ventus Energy sharpens its profile for 2026

Ventus Energy used its Annual Review 2025 to demonstrate how quickly a project pipeline can evolve into a fully operational energy player. By the end of 2025, the platform had grown from a single development project to seven operating assets and a total of 13 energy projects across three countries. The portfolio now includes biomass power plants, solar parks with battery storage, wind projects, and standalone BESS installations.

The financial picture is becoming more tangible. The planned total portfolio represents around 270 MW of installed capacity, with expected annual EBITDA of approximately €24.2 million.

The assumed overall valuation stands at roughly €193 million. The loan-to-value ratio is about 57%, which personally strikes me as relatively conservative. That said, energy infrastructure financing is not directly comparable to other platform models, and LTV standards differ accordingly.

Operationally, 2025 marked the first year in which Ventus fully developed and commissioned its own projects. The BESS Jelgava and the Solar BESS project in Kuldīga represent a move toward technical independence. In addition, Ventus became the first private electricity producer in Latvia to receive FCR approval, enabling participation in grid balancing services.

For 2026, Ventus Energy is clearly focusing on refinancing ongoing projects, replacing expensive mezzanine structures with bank capital, scaling further across the Baltic markets, and targeting sustainable EBITDA of more than €1 million per month. The highly discussed energy platform remains one to watch — while I will primarily focus on collecting interest.

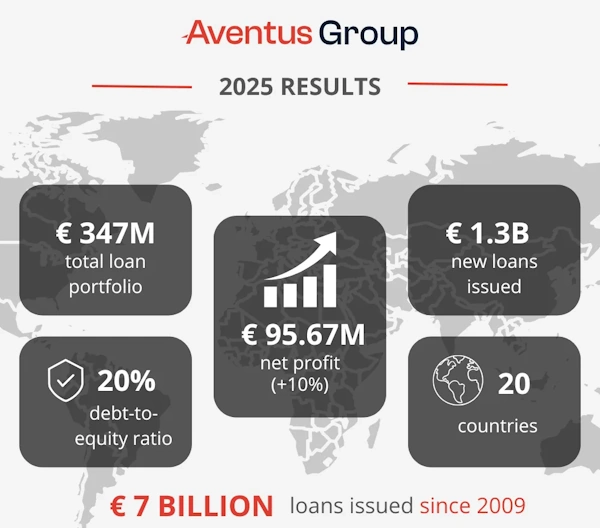

#3 Aventus Group reports record year 2025

The Aventus Group, the key lending partner behind PeerBerry, operates on a completely different scale compared to platforms that are still building up their asset base and cash flow. Last week, the group released unaudited figures for 2025 that clearly illustrate the magnitude of its business.

Aventus reports a net profit of €95.7 million, representing growth of around 10% year over year. The total loan portfolio stood at approximately €347 million at the end of the year, while new loans worth €1.3 billion were issued throughout 2025 alone. Since 2009, the group has originated loans totaling roughly €7 billion.

The equity ratio remains solid at around 20%, with total equity increasing to approximately €225 million. Interest income reached nearly €412 million in 2025, marking a significant increase compared to 2024. Aventus is now active in 20 countries, employs more than 4,500 people, and finances consumers and businesses through a network of local lending companies.

#4 Lendermarket moves Creditstar loans into the regulated segment

Lendermarket implemented a structural change last week that, at first glance, appears to be a regulatory upgrade. With the introduction of Gatelink International OÜ, a new intermediary lender has been added. Certain Creditstar-related loans are now offered within the regulated section of the platform through this structure.

Gatelink is an Estonian company founded in 2024 and registered as a financial institution with the Financial Intelligence Unit. Under this setup, investors no longer lend directly to Creditstar entities.

Instead, they provide capital to Gatelink, which then forwards the funds as a corporate loan to established lending companies, including Creditstar Finland. The contractual counterparty for investors is solely Gatelink, with a clearly defined repayment schedule.

Operationally, the underlying business remains unchanged. Creditstar continues to originate and manage the consumer loans. What is new is the additional intermediary layer. This structure enables Lendermarket to comply with EU crowdfunding regulation by separating platform operations, loan origination, and governance more clearly.

The critical aspect lies in the risk profile. In this setup, the group guarantee of the Creditstar Group may not apply. The buyback obligation rests with Gatelink — a young company with relatively limited equity.

According to its 2024 financial report, there are no significant buffers for stress scenarios. Despite this, Creditstar Finland loans are reportedly offered at 12% via Gatelink, compared to 15% in the unregulated structure.

Unregulated Creditstar offers remain available in parallel on Lendermarket. However, for regulated investments, the platform is expected to increasingly rely on the Gatelink model. From a risk-return perspective, the adjustment does not necessarily appear more attractive.

It is a notable example of how regulatory alignment can change structures — without automatically improving the investor’s position.

#5 SmartCrowd report shows strong market data – Lars’ investment tells a different story

SmartCrowd, based in Dubai, has released a new market and performance report. The platform presents itself as professional and transparent, backed by convincing data on Dubai’s real estate market. Price trends, demand, rental dynamics, and exit figures are clearly structured and easy to follow.

In practice, however, Lars’ investment experience looks different. The entry is heavily impacted by high transaction costs. Every investment effectively starts at a noticeable loss. In his case, this applies to all three properties in the portfolio. The one-time transaction costs amounted to several hundred AED per property and were deducted immediately from the invested capital.

He is currently invested in a unit in Lakeside, one in Dubai Hills Estate, and an apartment in Business Bay. Despite ongoing rental income, the overall positions remain clearly negative. Monthly rental payments are relatively modest compared to the upfront costs. Realistically, the initial losses can only be offset over many years of rental income or through a profitable exit at the end of the holding period.

SmartCrowd highlights solid historical portfolio returns and successful exits in its report. For new investors, however, the model requires patience and creates significant dependence on the final sale price. It raises the question of whether this structure is truly necessary — though testing such setups is exactly why I explore new platforms.

Leave a Reply

Want to join the discussion?Feel free to contribute!