P2P News CW 05/2026: Twino Offers Early Exit for Russian Loans

Welcome to the latest P2P lending news. Twino is offering investors an optional early exit from Russian loan claims at a discount, adding extra liquidity to the platform. Afranga delivers fresh high-yield investment opportunities. Ventus Energy kicks off with its first hybrid power plant project in Latvia. Indemo outlines its 2026 roadmap in the Q4 review. And Monefit SmartSaver has published its first transparency page, providing insights into volumes, returns, and user numbers.

Please note my disclaimer: I do not provide investment advice and I do not make any individual investment recommendations. This article reflects only my personal opinions and observations and is intended for informational purposes only. Investing in P2P loans and project financing involves risks, including the possibility of a total loss of your invested capital. Past performance is not a reliable indicator of future results. Links to investment platforms may be affiliate or promotional links (usually marked with *), meaning I may receive a commission if you sign up or invest through them. All content and ratings are created independently and are not influenced by any platform provider.

Table of Contents

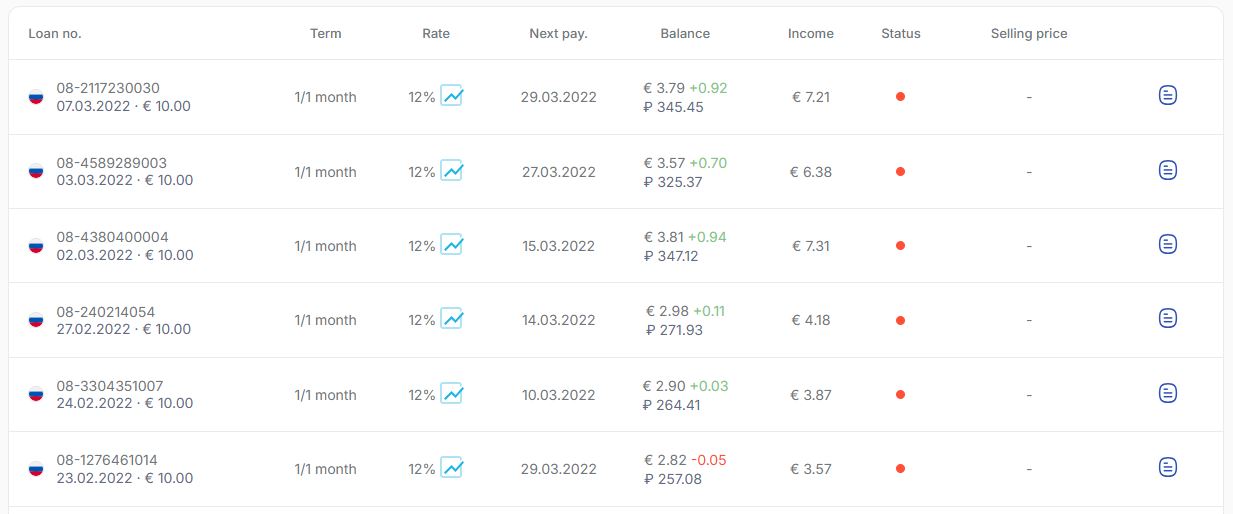

#1 Twino offers early exit from Russian loan claims

Twino has introduced a new option for investors who are still exposed to outstanding Twino Russia loan claims. Affected investors can voluntarily sell their claim rights to Finno and receive an early payout — in exchange for accepting a discount on their invested principal.

Under this Twino early exit offer, investors will receive 80% of the remaining outstanding principal plus 100% of the accrued interest up to the cut-off date. Partial sales are not possible, meaning the exit can only be executed for the full eligible amount. Once an investor accepts the offer, they permanently waive any further rights and future claims related to these Twino Russia receivables.

According to Twino, the payout will be processed after approval and should be completed within up to five weeks. Applications are open until 27 February 2026, or until the total program volume reaches €200,000, whichever comes first.

The background remains unchanged: the geopolitical situation is still uncertain and repayment timelines from Russia continue to lack predictability. At the same time, Twino CEO Nauris is communicating measurable progress in cleaning up legacy issues on the platform.

The Philippines portfolio has been finalized, the rental product is being actively phased down, and Russian claims are being serviced where possible — now complemented by this optional buyout mechanism.

On a personal note, I used the Twino early exit option. Repayments have already progressed significantly and the remaining open amount is economically irrelevant for me. This allows me to close the chapter cleanly. Overall, the strategic shift under the new CEO is clearly visible and backed by concrete actions.

#2 News StikCredit loans at Afranga

Afranga continues to<strong> perform steadily and has built a reputation for smooth operations since the relaunch. One key advantage for investors is that Afranga operates in a regulated market outside the Baltics, which adds an extra layer of confidence compared to many classic P2P platforms in the region.

New investment opportunities are expected to go live on Tuesday 4th of February. The focus is on newly listed StikCredit loans, which are set to offer returns of up to 14% with a 48-month maturity. Shorter loan terms should also be available, although they typically come with slightly lower interest rates.

StikCredit has historically been viewed as one of the stronger loan originators available through Afranga. The company reports solid fundamentals, including more than €117 million in total loan volume issued, consistent profitability over multiple years, a relatively low share of non-performing loans, and a customer base of over 40,000 borrowers. Notably, around 70% of these customers are repeat borrowers — a metric that often signals stable demand and a proven lending model.</strong>

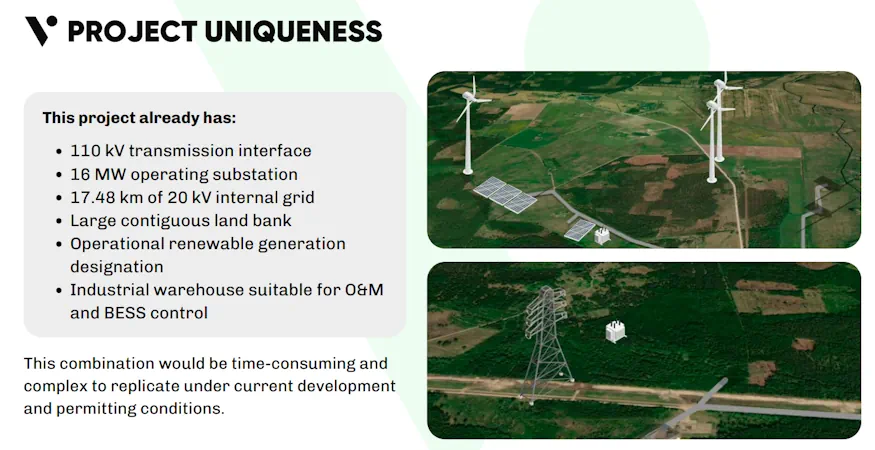

#3 Ventus Energy launches first power plant project for 2026

Ventus Energy* has kicked off its first new power plant project for 2026 with the Hybrid Energy Park Ventspils. The financing is set up to acquire 100% of the shares in two project companies — including all energy infrastructure, land, grid connections, and existing contracts. As the name suggests, the project is located in the Ventspils region of Latvia.

At the heart of the project is an existing, grid-connected energy platform. It already includes a 110 kV high-voltage connection with 16 MW capacity, its own substation, almost 18 km of medium-voltage network, and around 98 hectares of contiguous land. Two wind turbines are already operating at 2.75 MW each, alongside a 1 MW solar power plant. Permitting and environmental procedures for further expansion have also been initiated.

After completion of the acquisition, the plan is to scale the site step by step. The roadmap includes a 15 MW battery storage system, an additional 10 MW solar installation, and replacing the older wind turbines with three modern units totaling 12 MW. Once executed, this creates a true hybrid energy site with 38 MW of combined generation and storage capacity behind a single grid connection.

The investment model combines revenues from power sales, storage income, and balancing services — all within a market characterized by high price volatility and a growing need for storage flexibility. The project is currently offered with a projected 16% return, plus 5% cashback.

If you want to dive deeper into Ventus Energy, you can check out the background details in my Ventus Energy review.

#4 Indemo outlines a clear roadmap for 2026

In its usual high-quality YouTube interview format, Indemo used the Q4 2025 review to look clearly ahead and explain what investors can expect from the real estate platform in 2026. The overall direction is easy to summarize: more automation, faster execution, and better control over investments.

On the platform level, Indemo will continue rolling out the automated creation of Notes. New listings are expected to go live faster and should be aligned more closely with actual demand from the community. At the same time, the<strong> technical groundwork for a secondary market is already underway — a feature many investors have been waiting for.

One of the biggest changes will be a major upgrade of AutoInvest. The upcoming AutoInvest 2.0 is designed to offer more flexibility through individual investment limits, prevent multiple allocations into identical projects, and work with smarter threshold logic. Deposits are also expected to become easier. Automated buying and selling is planned as well — but this feature will only become available after the secondary market has launched.

Beyond that, Indemo is working on a full mobile app for iOS and Android. Planned improvements include a redesigned portfolio inte

rface, stronger filtering and sorting options, and a more transparent breakdown of repayments — both with and without cashback. A new dashboard is also set to improve the overall overview for investors.

Additional updates mentioned include cashback progress tracking, alerts for upcoming debt releases and deadlines, and continued improvements to usability and performance. Indemo also touched on charity activities and gave first hints at a potential loyalty program. Overall, Indemo remains one of the most active platforms in terms of development — and 2026 looks set to be an interesting year to follow.

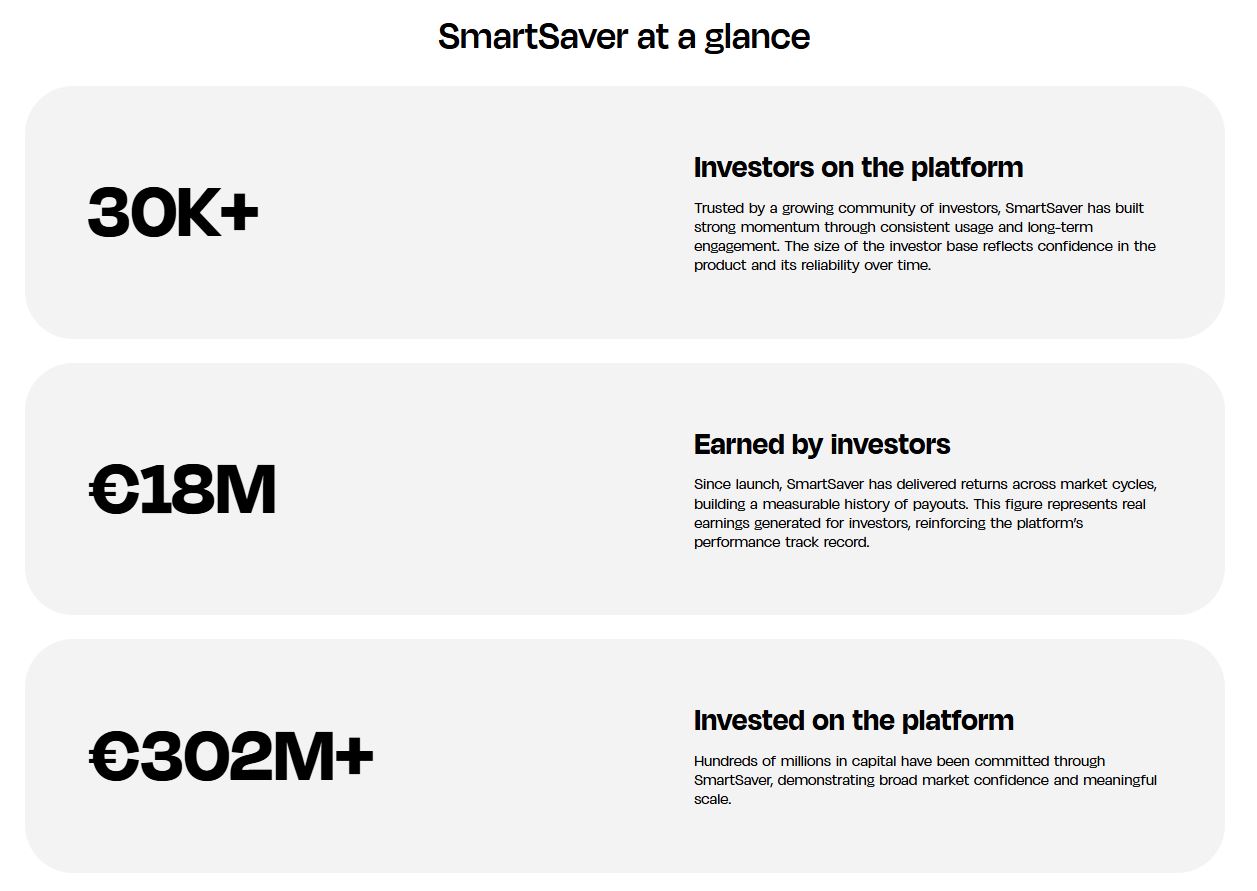

#5 Monefit SmartSaver publishes its first transparency page

Last week, Monefit SmartSaver quietly introduced its own transparency page — a move that largely flew under the radar. With this update, the product is now sharing key platform metrics in one place for the first time, giving investors a much clearer data foundation than before.

The transparency page reports more than 30,000 active investors, over €302 million in invested funds, and already €18 million paid out in returns. The average yield is listed at 8.85%. According to the platform, all withdrawals have been processed in full so far. The reported reinvestment rate stands at 79%. The most recent update is dated 1 January 2026, which suggests that the page will be refreshed on a regular basis going forward.

These numbers highlight that SmartSaver has scaled more strongly than many investors assumed from the outside. Especially the total invested volume is noticeably higher than what most people had on their radar. This positions SmartSaver as a clearly established, large-scale product within the Monefit group — and once again as one of the most direct competitors to Bondora Go & Grow.

The transparency page itself is still fairly minimal and focuses mainly on headline KPIs. Deeper insights into portfolio composition, risk structure, or detailed cashflow reporting are not included yet. Still, it’s a visible first step toward greater disclosure for a product that has historically been marketed primarily around simplicity and automation.

Leave a Reply

Want to join the discussion?Feel free to contribute!