P2P News CW 09/25 – Bondora’s Grow & Grop interest rate drop to 6%

Welcome to the P2P lending news, where we take a closer look at Bondora Go & Grow’s interest rate cut, Ventus Energy’s transparency drive, Income Marketplace’s latest loan buybacks, Lonvest’s exciting insights into the Mexican loan market and Fintown’s brand new homegrown project.

Table of Contents

#1 Bondora interest rates drop to 6%

Bondora* has made an important change to its Go & Grow product. From 1 April 2025 there will be only one interest rate of up to 6% p.a. for all investors and no more limits – the unpopular Unlimited product with its 4% will also disappear. After seven years of Bondora Go & Grow, this is the first time the company has adjusted interest rates downwards for everyone.

This is bad news for Go & Grow users, who will now pay a maximum of 6% instead of 6.75%. On the other hand, Unlimited users will get a whopping 2%, which many people forget. This means: Depending on where you invested before, you are either happy or angry.

The community is up in arms – and yes, a rate cut always hurts. But let’s be honest: was anyone really surprised, given the high demand and thousands of new investors every month? We are still in an area where companies want and need to make money. Bondora cites long-term sustainability and product simplification as reasons for the change. Speculation about deeper motives (such as poor performance of the underlying loan portfolio) is of little use because the data is simply missing.

What surprises me is the panic reaction of some investors who want to withdraw everything immediately. Completely irrational! The old rates will remain in force for another month – there is no reason to rush into decisions.

I myself remain calm and do not see this as negative as some others. My Bondora portfolio will continue as planned. Those who want to stay with Go & Grow will now get a solid 6% product with still high liquidity – without the limit and product chaos which may have its charm for some.

The company itself has not changed! And those who no longer like Bondora now have a good opportunity to look for alternatives. Because there are plenty of them.

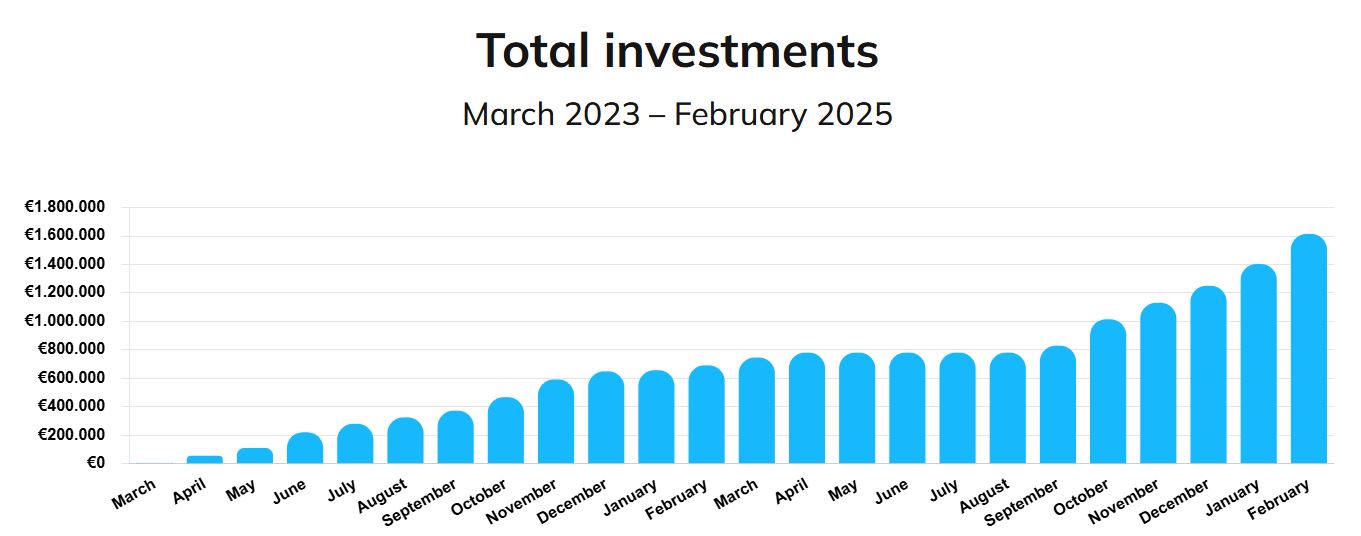

#2 Ventus Energy sets new standards with transparent statistics

You really can’t complain about a lack of interest in Ventus Energy*, and last week a new statistics page went live – and it’s quite something! While many (even partially regulated) P2P platforms publish sparse figures, Ventus goes all out. The data is updated five times a day and offers a level of transparency rarely seen in the industry.

The statistics are broken down into two main areas:

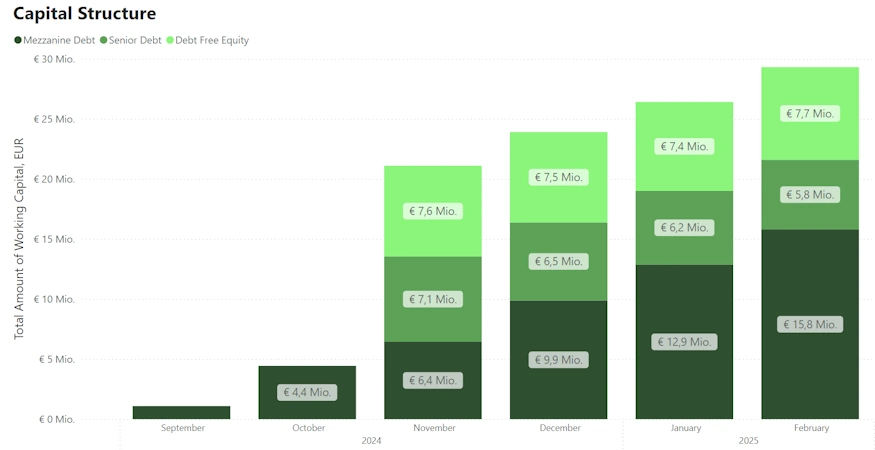

- Energy Production & Capital Structure: This section provides detailed information on energy production, resource consumption and the distribution of capital across different types of financing.

- Project finance & investor data: This section shows exactly how mezzanine finance works – including the average portfolio size per investor, interest income and other key figures.

And this is where it gets really exciting: the mezzanine portfolio currently stands at a whopping €15.8m, spread across just 1,600 investors. In other words, each investor holds an average of around €10,000! That’s a significant amount for a young platform and shows that some investors have a lot of confidence in Ventus.

With this openness, Ventus is taking a bold step towards transparency and, in my opinion, setting new standards for the market. If you want to see for yourself, you can view the latest figures live on the platform at any time.

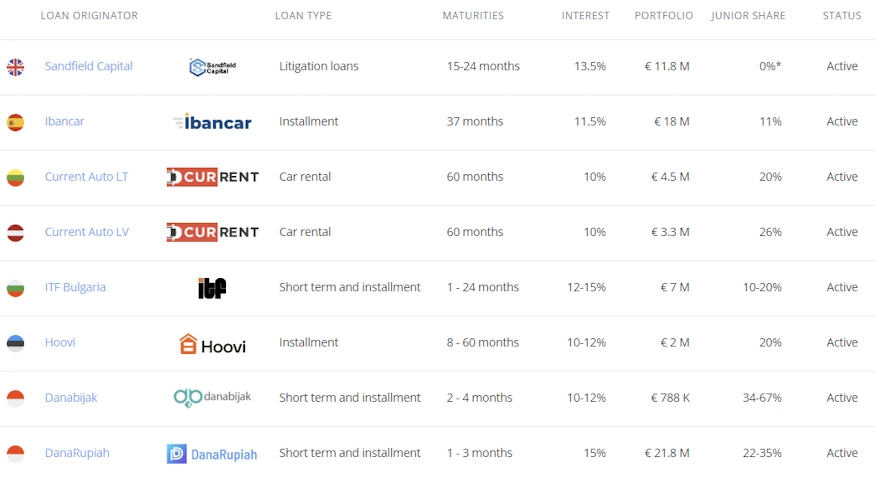

#3 Income Marketplace: “€2 Million Strategic Buyback” from Hoovi

The P2P platform Income Marketplace announces news from Estonian lender Hoovi. The company is planning to buy back loans worth around €2 million from the Income Marketplace – and sources say this has already happened last week.

The move is part of a larger strategic realignment. Hoovi is close to signing a deal with a bank to finance itself with debt in the future. The aim? To drastically reduce financing costs, increase profitability and broaden the business model. The bank will not only be a provider of capital, but also an investor in Hoovi’s loan portfolio.

For investors, this development has two main implications:

- On the one hand, some current loans may disappear from the portfolio prematurely.

- On the other hand, the involvement of a bank signals a strong confidence in Hoovi’s business model – after all, institutional lenders do not get involved without a thorough examination.

Hoovi will continue to operate on an income basis and make new loans. A more diversified financing structure could provide more security and stability in the long term. It remains to be seen whether this strategy really pays off, but for now it looks like a promising step into the future.

#4 Lonvest offers insights into Mexico

In a Q&A session, Roman Katerynchyk, CEO of Lonvest, who was recently interviewed in the P2P Cafe, and Tamara Horev-Chuianova, CEO of Clicredito Mexico, provided deeper insights into the Mexican lending market.

Clicredito has been operating in Mexico since July 2024 and has already granted loans totalling USD 2.4 million. Growth is rapid and the plan for 2025 is clear: 9,000 new loans per month, higher loan amounts and longer terms.

According to Lonvest, the Mexican market offers great potential – little competition, no legal interest rate caps and a stable currency.

But where there is light, there are shadows. Fraud prevention remains a challenge, so Lonvest is investing heavily in identity checks and automated scoring models. They also rely heavily on WhatsApp for customer communication and debt collection.

It remains to be seen whether the growth will live up to expectations. Lonvest is a small platform with an attractive interest rate (12.5%) to watch.

#5 Fintown offers new project in Prague

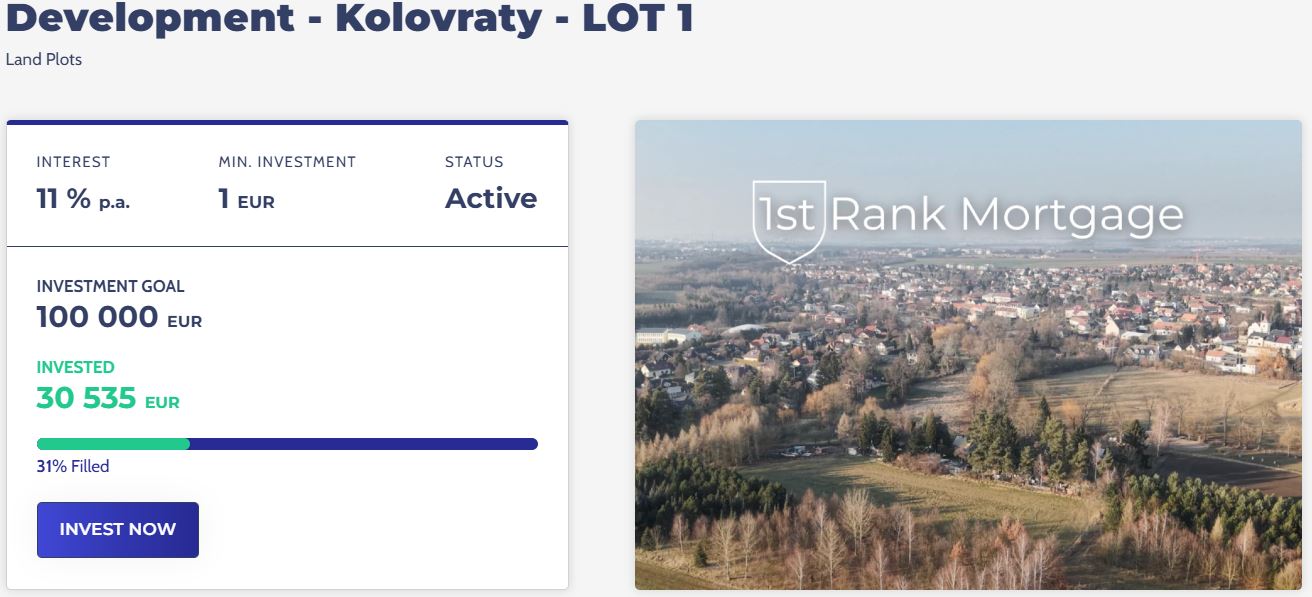

After the trip to Costa Rica, Fintown returns to Prague with a new, ambitious project. In Kolovraty, a sought-after suburb of the Czech capital, a residential area with 18 fully developed plots is to be built. But beware: the project is still in the land acquisition phase – sales will not start until spring 2025, with completion scheduled for March 2027.

Investors will be able to participate in the development of the plots, which will then be resold at a profit. The projected yield is 11% p.a. over a 24-month period. Security is provided in the form of a first charge mortgage, which gives investors preferential protection in the event of insolvency. The figures in detail:

- Project value: EUR 4.62 million

- Total cost: EUR 3.86 million

- Financing: 52% equity, 48% Fintown loan

An exciting project in an attractive location, but still in its early stages. Anyone investing in this project should be aware that land development projects often face regulatory hurdles and delays. Let’s see if Kolovraty becomes a candidate for my portfolio!

Your feedback on the P2P lending news

That was the short news for this week, which this time was mainly about “Bondora’s interest rate drop” issue. Feel free to leave me a comment on the blog with your feedback and if you find the content valuable, please share it! Thank you very much!

Leave a Reply

Want to join the discussion?Feel free to contribute!