P2P News CW 03/25 – Is Bondora going to set new records?

Welcome to the P2P lending news, where we want to talk about Bondora and their performance in 2024, the problems at Twino, loans from Ukraine at Debitum and primary market of Neo Finance. 5 short P2P news in a nutshell on YouTube, the podcast & here to keep you up to date.

Table of Contents

#1 Bondora on the verge of a record year?

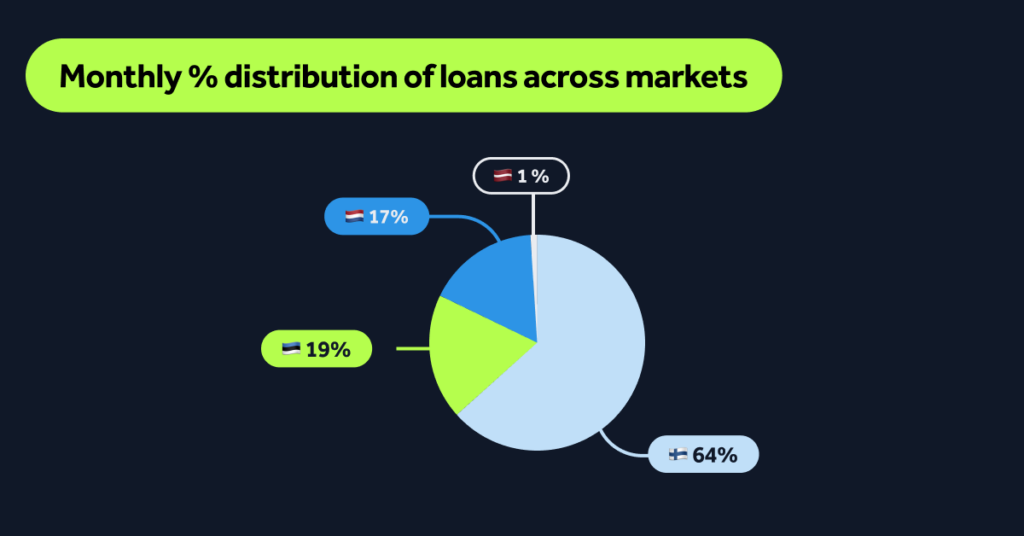

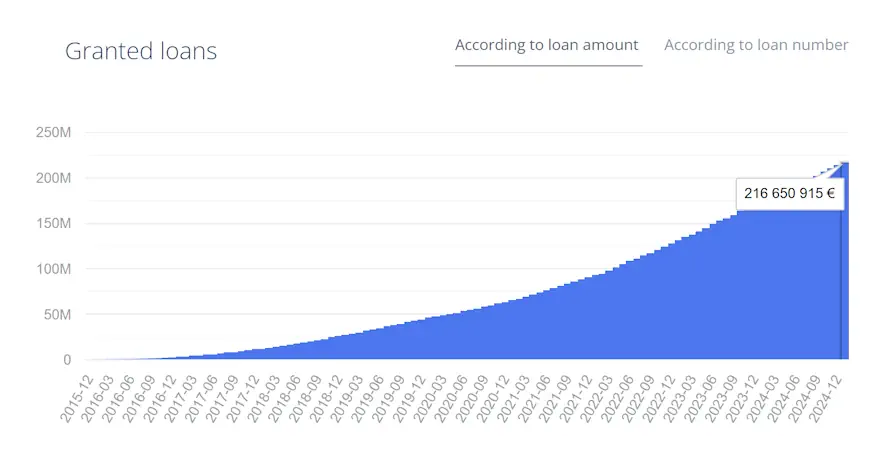

Bondora* ended 2024 with impressive growth. In December, the volume of loans issued by Bondora increased by 11.2% to EUR 27.6 million, with the Finnish market accounting for the largest share (63.5%). Investments in Go & Grow increased by 3.3% to 27.2 million euros. This means that almost as much was paid in as was lent out.

Distributions to investors in December totalled 2.95 million euros – the highest figure in 2024. The platform also attracted almost 2,000 new investors in a single month. Of course, there are higher interest rates elsewhere, but the Bondora Go & Grow product remains unbeatable in terms of simplicity and track record, and investors are rewarding this with new funds.

With interest rates continuing to fall in Europe and investor inflows remaining strong, could Bondora be on the verge of a record year? The stable core markets of Finland, Estonia and the Netherlands suggest a solid foundation. What do you think 2025 will look like for Bondora? I think Bondora will still be a solid pillar in my portfolio in 2025.

If you want to know more about Bondora, you can read about the basics in my Bondora experience*.

#2 Twino struggling with Asian markets

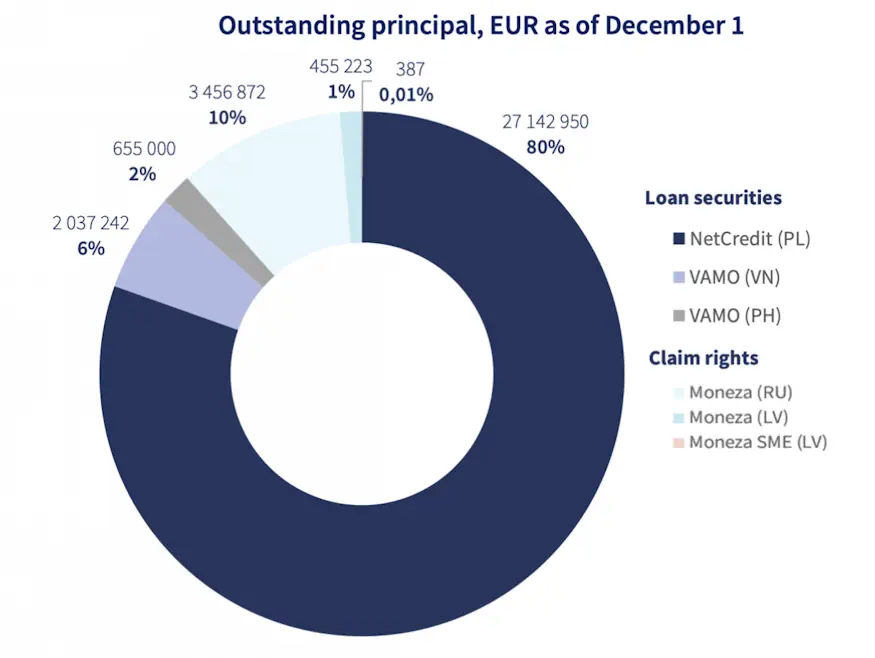

Latvian platform TWINO is certainly not on the verge of a new record year. Although it currently offers an attractive interest rate of 12% and a 2% cashback bonus, its growth rates clearly lag behind those of some of its competitors when comparing the figures in the CEO’s annual report email with the market.

Another problem is the withdrawal from the Asian markets of Vietnam and the Philippines, with the platform providing only vague information on the recovery of investments there. Unlike other platforms, such as Mintos, which provide regular updates on problem cases, TWINO still lacks transparency, leading to large discounts on the corresponding loans on the secondary market.

On the positive side, progress has been made in Poland, where the subsidiary Netcredit 2024 has obtained a national licence for payment institutions. On the negative side, the rental portfolio in Riga is attracting little interest. With more than 20,000 investors, not a single million was collected last year. This compares with 36 for the Polish loans leaves me a little bit irritated.

The lack of transparency in the Asian recovery and the modest growth raise the question of whether TWINO can sustain its position in the increasingly competitive P2P market.

If you want to know more about TWINO, you can read about the basics in Lars’ TWINO experience (simply follow the link and translate it to English with Google-Translator in your webbrowser).

#3 Debitum’s battle for investors’ money continues

The P2P platform Debitum* has issued an email update on the ongoing situation with Ukrainian lender Motor Finance. Despite weekly meetings with the management of Motor Finance, a possible solution continues to be delayed.

The main reason for the delays are the different anti-money laundering (AML) requirements of different banks in different countries. Debitum is acting as an intermediary between a Latvian bank and other parties to clarify the origin of the funds of the potential portfolio buyer.

The complexity of the multi-jurisdictional deal, as well as the rigorous due diligence processes and differing AML standards between Ukraine and the EU, have contributed to the extension of the timetable. Debitum stresses that it is actively working on a solution and will keep investors informed of any developments.

Given the ongoing and unsatisfactory situation for investors, there is hope that a possible end to the war in Ukraine in 2025 could help resolve the situation. A peace deal could improve economic conditions, end martial law and pave the way for a successful resolution. I myself have now internally written off 50% of the funds as a loss.

If you want to know more about debitum, you can read the basics in my debitum experience*.

#4 Neo Finance buys its own loans

Lithuanian P2P platform Neo Finance has announced a new strategy to buy up to 80% of the loans it offers. The move is aimed at speeding up loan funding, but it also poses unexpected challenges for investors.

Over the course of 2024, Neo Finance has made several strategic decisions to speed up loan issuance. These include investments by its Dutch subsidiary and partnerships to create multi-million euro investment portfolios.

This aggressive strategy results in loans being funded almost immediately, preventing some investors from investing their funds. In response, Neo Finance plans to lower interest rates for certain ratings in order to further increase its lending volume.

While these measures may increase the efficiency of the platform, they raise questions about fairness to individual investors. Neo Finance recommends that investors review their automated investment settings to adapt them to the new conditions.

This development once again highlights the challenges that P2P platforms face in trying to balance growth and investor satisfaction.

If you want to know more about Neo Finance, you can read about the basics in Lars’ Neo Finance experience (simply follow the link and translate it to English with Google-Translator in your webbrowser). The platform offers a €20 sign up bonus with the code P2P20.

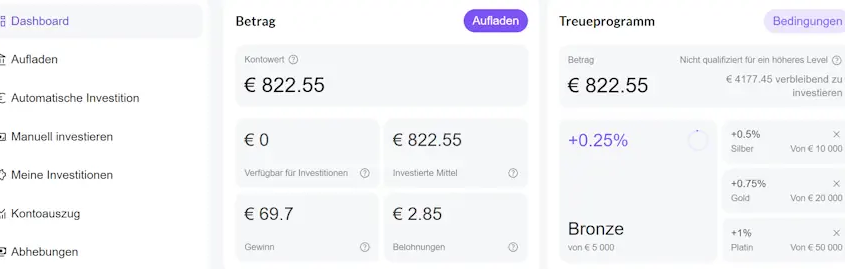

#5 New Loanch interface

The P2P platform Loanch has launched a major overhaul of its website and personal dashboard for investors. The aim of the changes is to improve the user experience and create a more modern look. Key features of the redesign include

- Improved navigation to help users find information more easily.

- An improved visual experience with a modern user interface.

- An adaptation of the new Loanch logo to present a fresh brand identity.

source: Lars’ portfolio at Loanch

Lars himself liked the old interface much better as it was clearer. Instead of worrying about this, you could alternatively continue to work with Fingular (ex-Cashwagon) and keep investors updated. But of course a new logo is also very important and so on!

If you want to know more about Loanch, you can read about the basics in Lars’ Loanch experience (simply follow the link and translate it to English with Google-Translator in your webbrowser).

Your feedback on the P2P lending news

That was the short news for this week, which this time was mainly about “Bondora’s year 2024” issue. Feel free to leave me a comment on the blog with your feedback and if you find the content valuable, please share it! Thank you very much!

Leave a Reply

Want to join the discussion?Feel free to contribute!