P2P News CW 02/25 – Monefit SmartSaver Vault with over 10% interest

Welcome to the first P2P lending news of 2025. Today we talk about the launch of the Monefit SmartSaver Vault 2.0, the licensing of Lendermarket, the interest rate cut at PeerBerry, the new Fintown project in Costa Rica and a new milestone at Ventus Energy. 5 short P2P news in a nutshell on YouTube, the podcast & here to keep you up to date.

Table of Contents

#1 Launch of Monefit’s SmartSaver Vault 2.0

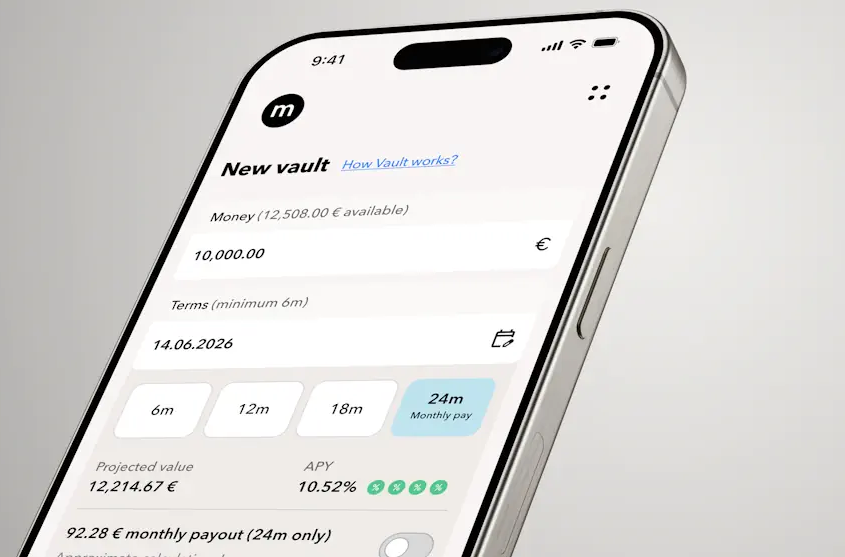

Monefit* has launched a revised version of its SmartSaver Vault, SmartSaver Vault 2.0. This new version offers investors enhanced fixed-term deposit options with greater flexibility, personalisation and higher returns.

Key new features include

- A maximum interest rate of 10.52% per annum for 24-month investments.

- Monthly interest payments on 24-month deposits.

- Flexible maturities from 6 to 24 months.

- Personalised safes for individual savings goals.

- Early exit in emergency situations with interest discount.

I think the new 24-month vaults might be interesting because they have a monthly interest distribution, which is not the case with the others. This provides a regular cash flow despite the long maturity.

Now every investor has to ask himself whether he wants to tie his money to Monefit or Creditstar for two years. But I don’t know yet whether I will use it. I’m in the process of extending SmartSaver to 12 months. In any case, it’s an interesting innovation that offers new options for investors.

Would you like to know more about the product? Then read Lars’ Monefit SmartSaver review with the key background information so you know all the risks and rewards (simply follow the link and translate it to English with Google-Translator in your webbrowser). There is currently a 0.25% cashback* on all investments for the first 90 days + a €5 initial balance.

#2 Lendermarket gains ECSP licence

There was also some notable news from Monefy’s sister platform Lendermarket. Quite surprisingly, it has received authorisation from the Central Bank of Ireland to operate as a crowdfunding service provider in accordance with EU Regulation 2020/1503. This authorisation marks a significant milestone for the platform and should improve investor protection and transparency, which is clearly much needed.

Lendermarket plans to make changes to the platform in the near future to comply with the new regulatory requirements. However, it is unclear exactly what these will be.

However, the granting of this licence to a P2P lending marketplace also raises questions. It remains unclear whether and how Lendermarket will have to adapt its business model to fully comply with the requirements of the ECSP Regulation. Traditionally, P2P lending platforms, and in particular P2P marketplaces, have differed in some respects from traditional crowdfunding providers.

Interested investors and industry observers like myself will now be watching with interest to see what specific changes Lendermarket will make, and whether this licensing could herald a broader trend in the P2P industry. After all, in principle, Esketit, which is also based in Ireland, could now also be regulated.

If you want to know more about Lendermarket, you can read about the basics in Lars’ Lendermarket experience (simply follow the link and translate it to English with Google-Translator in your webbrowser). The platform offers a general sign-up bonus of 1.0%* on your investments for the first 60 days.

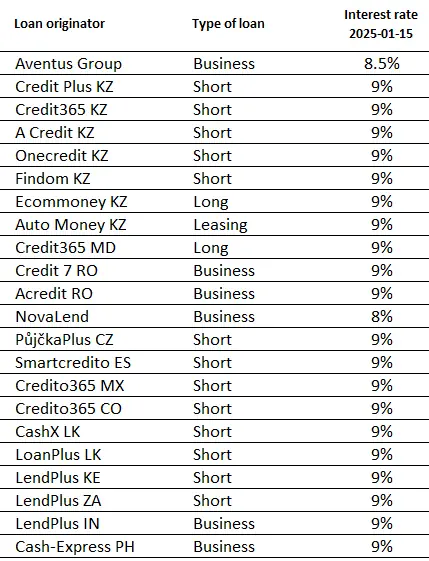

#3 PeerBerry cuts interest rates

The popular P2P platform PeerBerry* has announced another interest rate cut, which will take effect on 15 January, the day after tomorrow. The new rates will now be between 8% and 9%, which is a downward adjustment. This change only affects new investments and has no impact on existing investments.

PeerBerry had a very successful year in 2024, with investors funding €586.11 million in loans and receiving €11.8 million in interest. The platform attracted 17,190 new investors and ended the year with a portfolio value of €117.31 million. This high demand and success inevitably means that the offering has to be adapted.

Despite the positive developments, the question is whether it is still worthwhile for investors to go through the hassle of manually searching for loans. At a time when stress-free investment products with potentially higher returns are available, investors without a loyalty level will be thinking twice about whether it is worth clicking every morning to access loans.

However, PeerBerry has repeatedly shown that even in times of crisis, investors can be confident that our funds are well managed. So for me, the platform is out of the question at the moment. But the more investors withdraw their funds, the easier it will be for me 🙂 .

If you want to know more about PeerBerry, you can read about the basics in Lars’ PeerBerry experience (simply follow the link and translate it to English with Google-Translator in your webbrowser). The platform offers a general sign-up bonus of 0.5%* on your investments for the first 90 days.

#4 Fintown launches new project in Costa Rica

Real estate platform Fintown* has announced a new major project in Costa Rica. The SEED will consist of 75 luxury units, including townhouses, villas and studio apartments. The first phase of financing will focus on the purchase of the land, for which Fintown is offering a return of 15% p.a. over a period of 24 months.

The project is targeted at the growing eco-luxury property market and promises a blend of comfort and closeness to nature. The land purchase, which is scheduled for February 2025, includes a 37,396 square metre plot at a cost of $2.05 million. 75% of this will be financed by Fintown, with the remainder being equity from the Vihorev Group.

While the location and concept seem promising, there are some concerns:

- The size of the project brings with it increased planning and execution risks.

- Although there is first-rate collateral, the full-bullet financing means that interest and principal are only repaid at the end of the term, increasing the risk for investors.

- Dependence on the Costa Rican property market and potential regulatory challenges could add further uncertainty.

If you are considering investing in Costa Rica, you should weigh these factors carefully and consider the project in the context of your overall portfolio.

If you want to know more about Fintown, you can read about the basics in Lars’ Fintown experience. The platform offers a sign-up bonus of 2%* on your first investment, paid out after 3 days.

#5 Ventus Energy Celebrates Another Milestone

The Ventus Energy* platform has made remarkable progress in less than five months of active operation. Six projects have been launched in 2024, including two power plants, one solar farm and two battery energy storage systems (BESS).

With over 1,000 active mezzanine investors, Ventus Energy has secured over €10 million in funding for its projects. In addition, a €7 million senior lender has been secured for the Riga power plant. This brings the total funding raised to over €17 million.

According to Ventus Energy, the company has achieved 100% of its planned targets for 2024 and is already working on key projects for 2025. The number of employees has increased to 21, including the staff of the Riga power plant.

In 2025, Ventus Energy plans to focus on completing existing projects and developing new infrastructure in the energy sector. The first quarter of 2025 will be crucial in consolidating the success achieved so far and continuing the ambitious growth plans. This is also when the second power plant, in which I have personally invested EUR 10,000, is due to be commissioned.

If you want to know more about Ventus Energy, you can read about the basics in Lars’ Ventus Energy experience. The platform offers a general sign-up bonus of 2.0%* on your investments for the first 60 days. Plus 5% cash back until 31/01/25. Details here. The credit will be applied immediately.

Your feedback on the P2P lending news

That was the short news for this week, which this time was mainly about the “Monefit SmartSaver Vault 2.0” issue. Feel free to leave me a comment on the blog with your feedback and if you find the content valuable, please share it! Thank you very much!

Leave a Reply

Want to join the discussion?Feel free to contribute!