CW 10 – Top #3 P2P News: Kviku Finance Update, Reinvest24 expands and Peerberry facing reality

Another week went by and we are still facing a lot of challenges. Especially the war in Ukraine influences the P2P industry more and more – and the dimensions are getting more and more clear for platforms and investors.

Welcome to my latest P2P News.

Table of Contents

#1 Kviku Finance Update

Kviku Finance is well know as a loan originator from Mintos. Meanwhile they opened up their own platform. Additionally they are also publishing loans on other marketplaces – like Bondster and iuvo.

Since the war in Ukraine started several eyes are targeted on Kviku as the platform generates shares of their loans from Russia and Ukraine. While the share of Ukrainian loans is below 1%, they reported that there are no problems regarding their Russian share of their loans.

How is your Russian entity LLMC AirLoans operating at the moment? Is there a Group guarantee for LLMC AirLoans at Kviku Finance?

LLMC AirLoans operations in Russia remain stable, with borrowers making payments to local bank accounts. NPL rates are currently unchanged and are monitored by our Risk team on a weekly basis.

Since LLMC AirLoans is not placing loans on the platform, it is not covered by the Group guarantee.

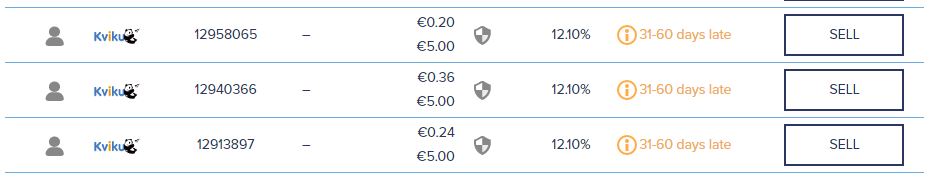

To be honest I am not able to confirm this when looking into my Bondster account.

Bondster Portfolio: Performance Kviku Finance Loans

It looks it is quite complicated to get money back to the platforms. However I think this is just current point of view. Things will probably get better over the time as Russia still needs to be able to make business with the rest of the world.

#2 Reinvest24 expands to Switzerland

Most of you know, that Reinvest24 is one of my Focus Four platforms. While I made it nearly to the target with Bondster aund Robocash, Reinvest24 is a bit behind.

As the number of different projects was there, but quite small for me to diversify I did not invested here last month. Now Reinvest24 published their first loan from Switzerland, which is quite interesting.

Reinvest24 expands to Switzerland

The loan volume is half a million EUR invest into a second stage of rebuilding a ApartHotel. The interest rate is pretty attractive at 15% – but it is only a second ranked mortgage.

So whom ever wants to diversify his portfolio Reinvest24 now offers the chance to invest into real estate in Switzerland.

Interest in investing on Reinvest24? Check my Reinvest24 Review here.

#3 PeerBerry facing reality

PeerBerry is probably the platform being hit the most out of the P2P industry. With a share of 60% loans from Russia and Ukraine are overweighted. While PeerBerry expected no bigger issues shortly before the war, they now had to reflect and adjust their expectations.

Due to the sanctions and the ongoing war their loan originators are heavily influenced. Currently there is no chance of a repayment and the situation is pretty unclear what future will bring for investors. Quite hard times for the platform, which already reacted and had to fire about 400 people.

In their latest blogpost PeerBerry announces as follows:

Why the buyback guarantee cannot be applied for UA/RU loans – the buyback guarantee is being provided by the company, that issued loans. The company, damaged by war, can in no way provide a buyback guarantee or fulfill other obligations the same a person shot in war cannot pay his debt.

We should not mix an ordinary business situation with a war situation. The buyback and the group guarantees are set for ordinary business situations, not for the war. There is a huge difference. In this case, a Group guarantee will be applied which means that UA/RU investments will be repaid in the timeframe, set by our business partners.

So PeerBerry is willing to face the challenge and repay the invested funds of their investors. Therefore they need another timeframe, which is dated up to two years.

Up to you – What is relevant for you?

It seems like the war between Russia and Ukraine is hitting the P2P industry harder than the covid crisis. While during 2020 the P2P market as well as the sotck excahnges managed the risk and fear of the pandemic the war now shows real destruction.

From an investors point of view this is for sure something you have to take into consideration. But honestly, I was not prepared for a war in Europe that fast. However, until now my P2P portfolio works also it is affected, but the influences are easy to handle.

What was your most interesting fact this week? Any news with a huge impact on your P2P portfolio?

If you want to talk about P2P lending just join my small Telegram Channel.

Leave a Reply

Want to join the discussion?Feel free to contribute!