P2P News CW 15/25 – Nectaro 2024 Report With a Clear Vision

Welcome to the Latest P2P News for Calender Week 15 and the first Nectaro 2024 report!

This week in the spotlight:

- Nectaro is one of the first platforms to publish its 2024 report – showing a loss, but also a clear strategic direction.

- Bondora expands rapidly, but at the cost of its bottom line – a risky balancing act.

- Neo Finance shines quietly and steadily, emerging as a stable long-term performer.

- Debitum stages a comeback and finally turns a profit after years of struggles.

- Mintos plunges into the red with over 2 million euros in losses – growing pains or long-term strategy?

Let’s get it started 🙂

Table of Contents

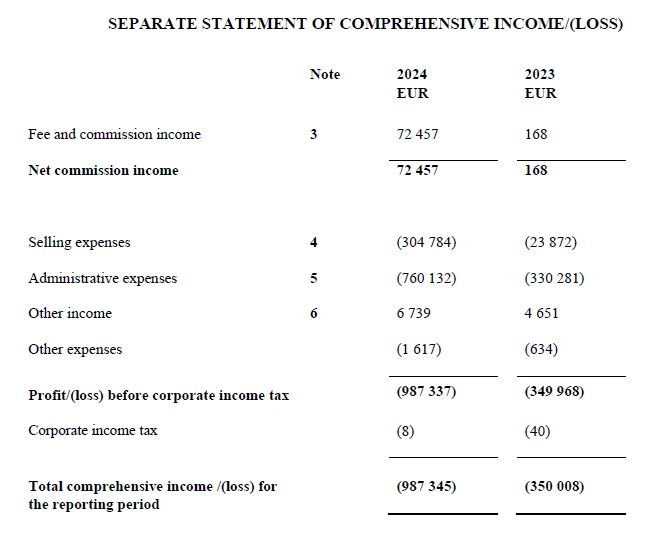

#1: Nectaro 2024 Report – First Real Figures

Nectaro is one of the first platforms to drop its 2024 annual report – a bold move and a clear signal in an often sluggish P2P world. Finally, something concrete, after their 2023 report barely scratched the surface.

The hard numbers: around €72,000 in revenue vs. almost €1 million in losses. Sounds harsh? Totally normal for a platform in build-up mode.

Nectaro didn’t cut corners, especially on staffing and marketing, pouring nearly €500,000 into its team. Building a solid foundation takes investment – no shortcuts to success.

Liquidity looks solid thanks to strong capital injections from parent company Dyninno, and equity ratio stands comfortably above 64%. Nectaro is driven by long-term vision and backing, not short-term margins. A bold start, pointing clearly to serious intent – exactly what investors want to see.

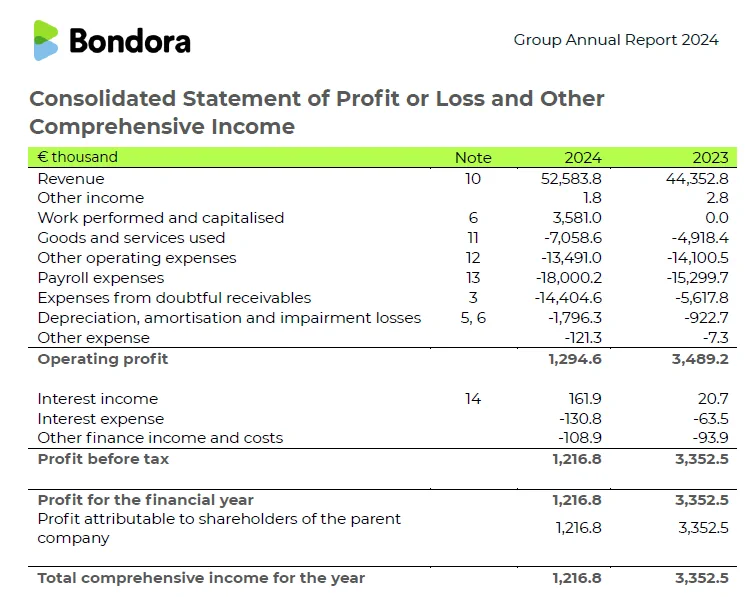

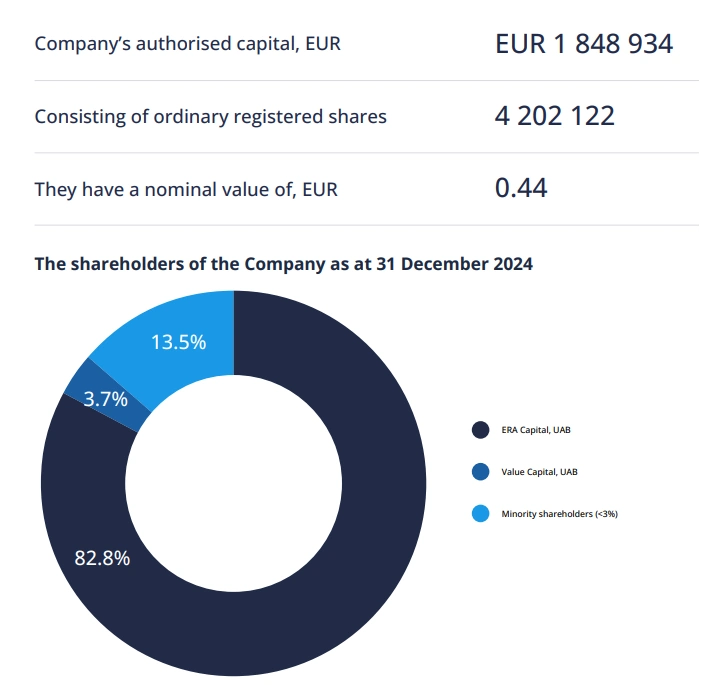

#2: Bondora’s Profits Drop by €2 Million

Bondora* has also shared its 2024 numbers – and they paint a very different picture than what we just looked at from Nectaro.

With 147,000 loans issued, €262 million in loan volume, and over €52 million in revenue, Bondora continues to solidify its market position, even breaking the billion mark in total investments.

But beneath the surface, it’s not all rosy: revenue rose by 19%, but profit plunged 64%. Why? A 157% increase in defaults, a large payroll (costing €18 million), and heavy IT investments.

Bondora clearly pursued growth and is aiming to transition into a full-fledged bank. That doesn’t come cheap – nor should it be underestimated.

Still, Bondora remains profitable – for the eighth year in a row – but the foundation is under pressure. For investors, this means staying alert. Growth is great, but not if it comes at the expense of long-term stability. Personally, I’m not worried about Bondora mid-term.

Curious about Bondora? Check out my full Bondora review. There’s also a dedicated guide to Bondora Go & Grow*.

#3: Debitum Returns to Profitability

Debitum* pulled off a remarkable turnaround in 2024 – from deep red into the profit zone with over €100,000 in net income. Revenue exploded by +274% to more than €1.3 million, while costs remained impressively under control.

The balance sheet also shines: equity ratio up to a healthy 52.7%, moderate debt increase, and equity nearly tripled – the capital raise really paid off and leaves room for expansion.

But it’s not all sunshine: the buyback rate has surged above 10% – a clear red flag that not all loans are performing as planned. There’s also lingering Ukraine-related risk via Motor Finance. Still, Debitum has delivered: growth, capital strength, and profitability all at once.

| Description (EN) | 2024, EUR | 2023, EUR |

|---|---|---|

| Commission income | 1,301,834 | 348,174 |

| Other operating income | 14,150 | 0 |

| Other operating expenses | (539,084) | (287,395) |

| Administrative expenses | (671,739) | (418,913) |

| Profit/(loss) before corporate income tax | 105,161 | (358,134) |

| Corporate income tax | (1,249) | (500) |

| Profit/(loss) for the reporting year / Total comprehensive income for the year | 103,912 | (358,634) |

Source: Debitum Annual Report 2024 (PDF)

News 4: Neo Finance – Quiet Performer in the Shadow of Giants

While most investors are watching the big-name platforms, Neo Finance has quietly delivered steady performance. In 2024, it posted a 29% revenue increase and an 86% profit boost – staying consistently profitable for years. EBITDA margin holds steady at 17%, net margin at nearly 8%.

What’s especially interesting: growth isn’t just from P2P lending, but also from e-money services like Neopay (+34%) and an 87% increase in investment income. This is a platform that diversifies smartly, not blindly chasing loans.

Of course, not everything is perfect: loan issuance dipped slightly (-3.3%) and overdue loans ticked up to 9.55%. Liquidity dropped a little but remains solid. Neo Finance might not be loud, but it’s one of the most stable and disciplined players around.

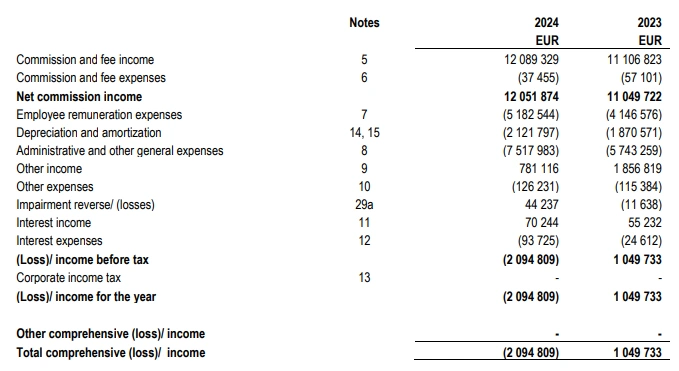

#5: Mintos Pays the Price for Growth

Lastly, let’s look at the industry heavyweight: Mintos*. They quietly released their 2024 report – and it won’t be the headline they wanted.

Despite ramping up their efforts, the numbers took a hit. Revenue rose by a modest 9%, far from enough to offset rapidly rising costs. The result: a €2.09 million loss, down from a profit the year before. That’s a hard fall.

The reason? No secret here: Mintos invested heavily. IT spend hit nearly €2.8 million, and payroll costs jumped 25%. Then there’s share-based payments that pushed the result further down. Without those, the loss would have been a milder €1.67 million.

The platform’s transformation into a multi-asset hub with ETFs, real estate, and more is bold – but expensive. Cash reserves did rise to €4 million, offering a safety cushion, but equity ratio has dropped.

Mintos is going all-in for the future – but it’s riding on credit. Short-term, not much to celebrate. Long-term? It might just pay off.

Read more in my full Mintos review*.

Your feedback on the P2P lending news

That was the short news for this week, which this time was mainly about “Nectaro 2024 Report”. Feel free to leave me a comment on the blog with your feedback and if you find the content valuable, please share it! Thank you very much!

Leave a Reply

Want to join the discussion?Feel free to contribute!