P2P News CW 10/25 – Nearly 70% Crowdestor projects recalled – Huge update

Welcome to the P2P lending news, where we take a closer look at Crowdestors 70% final recall, Loanchs’ expansion, Smartsaves chances of a breakthrough, Bondoras new statistics and a Mintos update on Planet42, Wowwo and more.

Table of Contents

#1 Final of the recalls at Crowdestor

Signs of life from Crowdestor! The beleaguered P2P platform, which stumbled during the Covid-19 crisis, has issued a new status report on the collection of outstanding loans. The goal: to complete the entire collection process by the beginning of 2026.

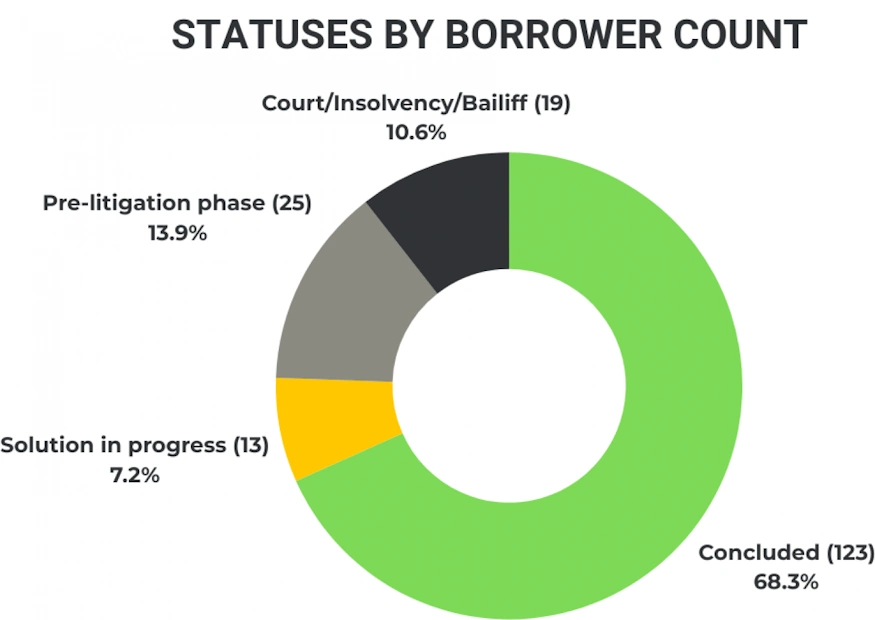

Currently, about 68.3% of the loans have been finally closed – either through repayment or a final agreement. A surprisingly high figure, judging by the constant and active grumbling in the Telegram group.

But 31.7% of loans are still in dispute. 13.9% are in the ‘pre-litigation phase’, i.e. about to be taken to court, while 10.6% are already involved in bankruptcy or court proceedings. A further 7.2% of loans are in an ongoing workout phase, with clear repayment plans up to the end of 2025.

Also interesting: Crowdestor has made it clear that it has no plans to revive the platform. No new deals, no new start – the end is in sight. As soon as the last recalls are completed, the next chapter is likely to be announced: the complete liquidation and closure of the platform.

#2 P2P platform Loanch grows

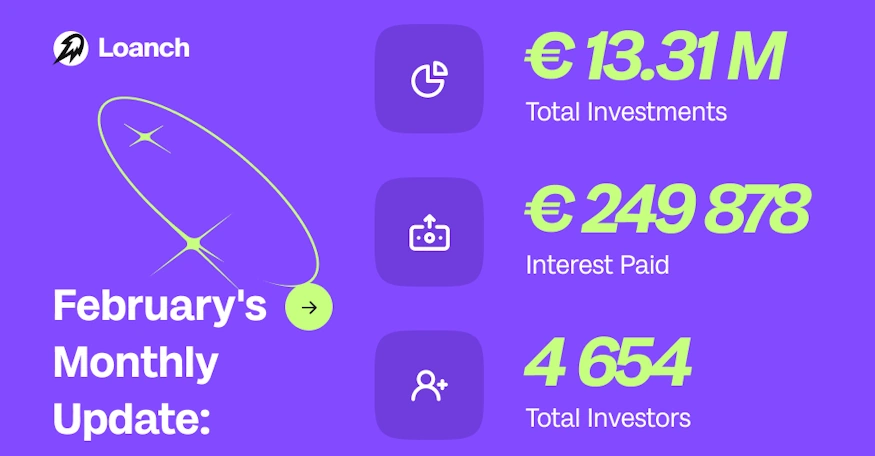

Despite criticism from Cashwagon, the P2P marketplace Loanch* continues to show impressive growth for such a young platform. In February, 1.18 million euros in new investments flowed onto the platform (+8.9%), bringing the total to 13.31 million euros. The number of investors is also increasing: 4,654 investors (+4.9%) are now on board. In addition, almost 250,000 euros in interest has been paid out.

The highlight is that Tambadana, the Malaysian lender on Loanch, has raised the interest rate for instalment loans to a whopping 14.5%. This makes the offer even more attractive to risk-averse investors.

Especially for Lars: Loanch invited him on a (paid) trip to Kuala Lumpur to see the lender in person. Anyone who knows Lars, knows that he is usually critical of new platforms – so he didn’t want to fly solo here.

His request was that he will be accompanied by another, equally critical investor. Loanch agreed, and now they are planning the trip. A brave move on their part! Details will hopefully be available soon.

#3 Is Monefit SmartSaver going to break through now?

Monefit SmartSaver* has been on the market for several years now, but the big breakthrough has yet to come, even though the number of investors continues to grow. Now Bondora has shaken up the market with a brutal interest rate cut.

Could this finally bring Monefit to the attention of investors who have been on the fence? The interest rate differential has now widened again, but with around 18,000 investors (at last count), Monefit still lags far behind Bondora’s 276,000.

Admittedly, Monefit has also slightly lowered the rates for shorter-term vaults, even if hardly anyone has noticed (e.g. 8.33% instead of 8.87% APY for 6 months). However, in a conversation with the company, Lars was told of a trick to continue investing at the old rate. If you simply roll over your investments, you can keep the old, higher rates!

#4 Room for improvement in Bondora’s new statistics

Without much notice, Bondora* has launched a revised statistics page. Investors can now access new data on borrowers, amounts invested and loans granted – but is this really the big deal?

The most important numbers: According to these statistics, Bondora now has 1.29 million loan customers, with an annual growth of over 211,000. Investors have invested a total of €1.52 billion, with a monthly growth of around €8 million. In terms of loans granted, there are 1.26 billion euros on the books, with 12.8 million euros added last month.

Sounds impressive, of course, but compared to Ventus Energy’s recently published statistics, it is a pittance in terms of transparency. At least Bondora admits that the statistics page is still being worked on. So there could be more to come.

However, anyone still hoping for data on portfolio performance or the Outstanding Portfolio is in for a rude awakening.

If you want to know more about Bondora, you can read about the basics in my Bondora experience. There is also a guide specifically for Bondora Go & Grow.

#5 Updates on the recall of the Mintos

Another month has passed and with it the next round of Mintos* withdrawals updates. Notable progress has been made with Alivio Capital from Mexico. Insolvency proceedings have now been officially opened and Mintos is one of the registered creditors. The company expects to recover 100% of the approximately €125,000. So this is a fairly minor case for Mintos.

Planet42, on the other hand, is Mintos’ last major default, with around €10.6 million still outstanding. However, the company seems to be doing well, with €2.8 million already repaid and €600,000 recently received. Again, Mintos is optimistic about a 100% recovery, which would certainly be a great success for Mintos and shows that the lenders had much better structures after the licence was granted than before.

There has also been a lot of activity on Wowwo, which is certainly the most annoying case for many investors. There was a court hearing in February and the next one is expected in March. For security reasons, the company is reluctant to disclose the outcome at this stage. 18.4 million is still outstanding.

If you want to know more about Mintos, you can read about the basics in my Mintos experience.

Leave a Reply

Want to join the discussion?Feel free to contribute!