Money Mindset: It is always YOU versus YOU

Today I would like talk about your Money Mindset. I want to show you how you might get out of any struggle by overcoming yourself and your fears. It is not easy and not instant to built a bulletproof money mindset, but it is worth any hour you put in.

Look at some interesting numbers: In Germany about 6,85 million people are over-indebted – it is nearly 10% of the population. Their debts are bigger than their financial assets and it does not look like they are able to get out of this struggle. The average debt sums up to 29.230EUR coming mainly from credit institutions, collection agencies, telecommunication companies and others. In 2020 the average salary was 47.700EUR per year. That means people are over-indebted by more than 60% of their annual income.

In the USA the numbers are pretty the same. When I got the statistics right the average debt sums up to 53.900USD. As I am not experienced in the us-tax-system I checked the GDP income. Here US-citizens earned 63.416USD. That means that the ratio between income and debt is nearly 85% of the annual income in the United States.

Table of Contents

There is only one way to get out of it

From my personal background I know that debts suck. Big time. I was massively in debt back in 2015 when I crashed my first company. Due to some mistakes I made I was responsible to pay about 47.000EUR back. That was more than earned per year, so I guess I could count myself as over-indebted during those times.

Luckily I was able to get myself on track again by adjusting my money mindset and focus mainly on those debts. To be honest they were a pretty present part of my life. Every month I saw the downpayment divided into the principal and the interest payment. It was more or less split 50:50. Therefore half of this payment went into the banks pocket. And I really hated it, because it was my hard earned money.

I could have blamed anyone for being where I was – and of course I did. But it did not took me long to understand that there is only person who could help me: Me myself. And it is the same with any of you. The guy or gal who has to take the biggest struggle and pain is always you. No one else will come to save you and solve your problem.

Aim for a target, put your stuff in order and execute then plan.

You past money mindset is gone – say bye

I had the big advantage of being taught nearly the right mindset. So when I went into struggle due to the crash I was able figures things out quite fast. I had never been in debt for consumer stuff or anything else like that. But the total of 47.000EUR was a big task to tackel down where I felt quite lost and uncomfortable in the beginning.

So even the right money mindset does not help you without getting uncomfortable.

Forgive yourself and stop blaiming

Of course it was you who got you into this situation. But does it really help to slap yourself therefore every day? Again and again? I do not think so.

Make something like a review on your actions to find out what lead you there. Write your key findings down, put them on the wall to never forget about them. And now move on to the next chapter.

To solve such an situation you need to be mentally tough. Slapping yourself mentally makes you weak. Therefore you should find an ending of your past. Maybe you sit down with your bestie, figure things out, make your notes, get drunk on purpose and than go to sleep. From the next day on you are entering the next chapter of your life.

Thinking about the past is not necessary as you already did it and wrote it down. Done.

Probably this requires quite a lot of discipline, especially the first days and weeks. But I can I guarantee you: Those dark times will slightly fade away. It is like a huge wound. There is no way it will disappear within one day. But working on it, teasing and taking care of it will make it heal faster.

Would you make another cut into this wound to remember yourself of the pain? Would you pour gasoline on it? Of course not. So please do not do this to your money mindset.

One step at a time

In the beginning your finances will probably look like a mess. That is reasonable and expected. But by the day you begin it will improve. Sometimes you will ask yourself what the heck you are doing as you do not see any progress. But on other days there will be huge steps forwards without any notice.

And that is what is important. You will not be able to solve all your financial problems within a day or a week. Depending on the size if the mess it will take years. What has come over several years will not go away within days and weeks.

From my personal point of view it is comfortable to cut the big picture down into monthly pics. I made up an Excel-sheet back than, where I calculated the time to kill my debts. As the interest rate and amount of principal is known I was able to calculate quite exactly which impact additional payments will have.

Now I was able to see on my board what another 50EUR downpayment will lead to. It will not make a huge change for the moment. But a lot of tiny downpayments will lead to a massive impact over the period. Make it a habit to”do more than expected” and you will performance will increase the same way as I described it in my review of “Atomic Habits” in the chapter “The Power of Tiny Gains”.

Expect yourself to fail at some points. Failure does not necessarily mean you lose. You will only lose, when you quit working on your way. Therefore you should be prepared for setbacks and find a routine how to make the best out of them. Fails are only ways which do not work – learn, adjust and try another way.

Do not hide – face your fears

There are a lot of probably good reasons to hide. Being financially ruined is nothing we would talk about on a party or with your workmates. That feeling of being ashamed often leads to hiding in your private area. Do not do that. Put that problem within your sight.

Psychologists will have an opinion on doing so with some basic data. In my eyes our focus always follows the things we are looking at. And making your finances a priority in life, you have to remind yourself of them by any chance. Step out, face it and work on it.

And there are a lot of things you might use. Back in the days I had chart hanging in my kitchen and my living room, which showed me where I started, where I planned to be and where I am right now (that week). Every monday I updated it and renewed the hangout.

You might also use reminders from the calendar of your smartphone or use the background wallpaper of your smartphone to show your ultimate goal. So everytime you pick up your smartphone you will be reminded of it.

Of course there will be the moment where mates will visit your at home or you will be asked at work what this wired background wallpaper stands for. Try to prepare yourself. The moment will come and you should not panic about it, therefore preparation is important. Decide whom you will tell what about it and stick to it. It is okay to not let anyone know and tell them a lie.

Draw a picture of your broke money mindset

People tend to make huge plans. Again and again. The same amount of times they plan they also fail. I am guilty of doing that everytime again. What does it help to make a new plan looking the same as the last one?

In my eyes there is one essential step before planing things another time: Reflection. Within this step we go back to what our last plan was and try to find out why it does not worked out. Usually I find a lot of excuses for myself. But when digging a bit deeper there are fundamental behaviors in my life which made it impossible to succeed.

Just like addicted people there is often a so called trigger making us to behave different from what we planned. The same we have to find our “WHY” to clarfiy our vision we also need to find the “WHY NOT” if anything does not work out. You will not be able to lose weight when you stick to your nutrition plan the whole, but eat a bowl of chips with wine every evening.

The same way you will not get out of debt by saving what is left at the end of the month. Being over-indebted means to find your triggers of spending money on shitty things and avoiding them. Do not ever let this happen again. It kills your plans and dreams.

What stops you or makes you angry?

I cannot really relate to that, but feeling the need to shop stuff online is thing many people struggle with. Especially during that times, when you do not have any money left to pay it.

Sometimes people compare themselves with others and feel the need to buy the same stuff. Or you always dreamt of something and now felt the urgent need to buy it by loan. Whatever it is – as long as you do not have the money to afford it, you will slide deeper into your struggles.

A good way to find out is to review on your emotions. Here are three pretty simple questions you should answer yourself.

- When does those moments happen?

- How often do they happen?

- What is the average financial damage of it?

Figure out, what your trigger is. Having found it try to look how you navigate yourself in those situations. It might be pretty uncomfortable to do so. But it is absolutey necessary. Remind yourself of those triggers and write them down. Try not to judge yourself for it. Those habits belong to your old “me”. Now it is time to shift and within this process habits have to be redesigned.

Make up a long-term vision 30/10/5/3/1

Sometimes goals are motivating your more by avoiding things – sometimes it is better to find a situation to work for. Independ from what works best for your those two ways to get out of the current situation should be checked. For a pretty simple reason which I will tell your in a minute.

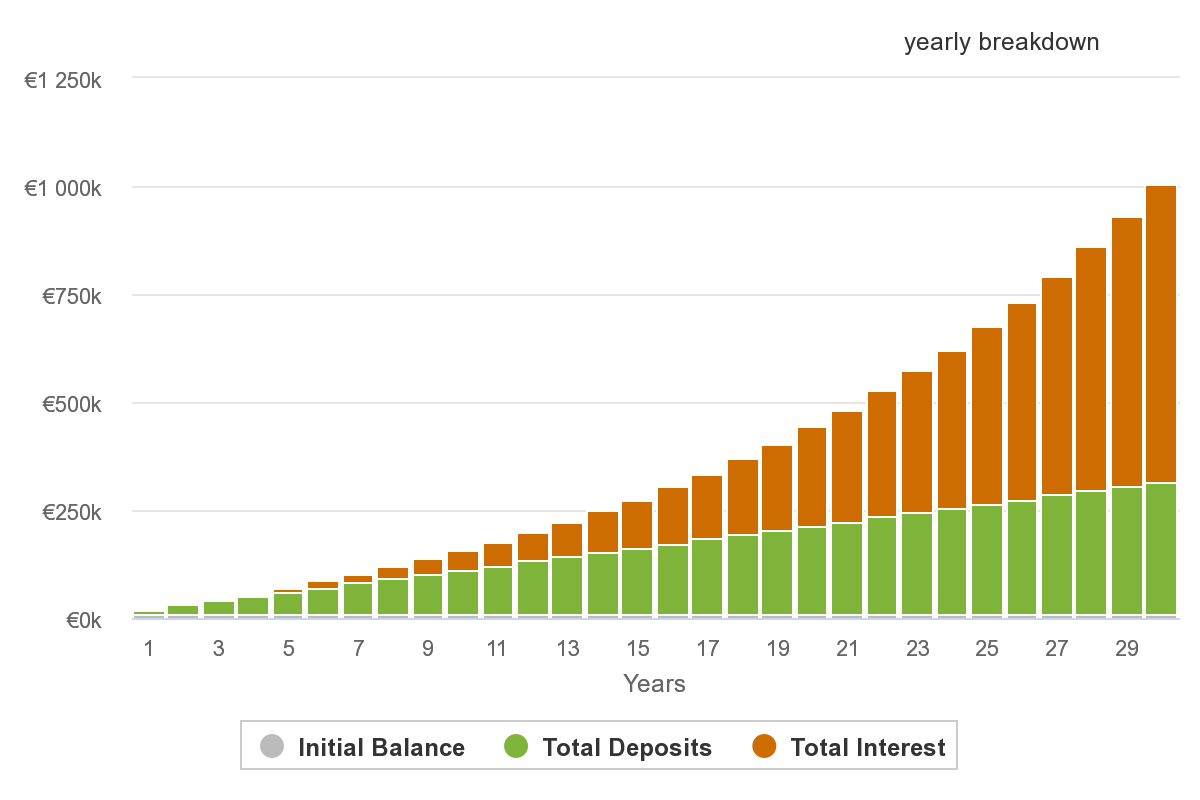

Now focus on your dreams. Find out what your life should like in 30, 10, 5, 3 and one year. You do not need to write a book about it. Try to make bulletpoints and describe your future with short words. The nearer the goals are the more detailed you should get. So if your 30 years goal is to have 10m€ in your bank account – that is cool and enough. Break it down to your one year goal which is maybe having 100k€ in your bank account. Now try do figure out what you should to during the year and each month to hit that target.

There is always the question of how to find those goals. I recommend using the SMART-formula to find a first set of goals. You will be able to adjust after for example one year based on your effort and your experiences. But at first do not use too much time, especially on the long-term goals.

The magical what will happen: Using those two directions from a negative standpoint (I don’t want that/to be like) and the positive money mindset (my goal is to/in x I want to be there) will lead to like one single road. On the left and the right of the road there are either these or these arguments to stay on the road. So there is no reason to get off your track – which makes it a booster to think about both directions.

Make your bigger picture a valueable plan

It is easy to aim for 10m€ on a piece of paper. Never thinking about it again you will lose this goal out of sight. Therefore all gurus and non-gurus claim to make your bigger goals smaller.

As you guys maybe know I really love the content from Andy Frisella. This dude is awesome and I really love listening to his stuff. His “5 Critical Tasks Per Day” stuff is the outcome of a huge goal cut into pieces. If you want to save 3.650EUR per year it might look like a huge goal. Or take 36.500EUR savings per year- it looks huge.

Now divide this by 12 months. The result is 304EUR or 3041EUR per month depending on your initial goal.

And now divide the initial amount by 365. It is only 10EUR or 100EUR. Is it reasonable to cut goals into pieces making a daily goal out of it? Now you have got a daily goal to put on your list and work on.

Investing over 30 years, taken from www.thecalculatorsite.com/finance

Knowing what you are working on makes the work much easier to cope. There will be days where it is hard. And there will be days where it is easy to hit your goal. In the end you need to go through those tough days and secure your overall win.

Do not work against yourself – you and your ego are partner who need to put anything into this joint venture to succeed.

Write your goals down on a daily basis

Having no goals is poor. To be successful you need to have goals to aim for. And those should be realistic and reasonable, but not easy. I wrote about it earlier.

I am currently working on that point as it is not the best what I have. But I can tell you from my experiences that writing down my goals daily moves something in me. Until now I unfortunately have not been the one to look on a long track record. But everytime I am able to keep my daily writings I feel that it moves something in me.

And that is exactly why successful people do it. There have been surveys about that. You will find a lot of stuff about it on Google.

From my personal point of view and experiences this daily writing down you goals reminds you by the beginning of the day what you have to work on to make that day count. Therefore I really recommend getting into this kind of stuff. Research the web if you are interested or just have a try to the next 30 days – or whatever period.

Summing it up

The header of this chapter was “Draw a picture of your broken mindset”. And all of the dots below this chapter were somehow related to it. I tried to show you habits which will usually lead to a broken mindset. As I do not want you to have a broken mindset as well as I do not want to have I always tried to show you my experience how to avoid it.

This might only work me in the specific way, but more importantly you need to figure your way out to cope with those things.

It is always easy to skip a tough day, jump on the sofa and watch Netflix. But doing so is much more relaxing AFTER you have completed your five critical tasks on the list.

There is ton of content about this Power List principle from Andy Frisella. If you listen to it there is one really important thing from my point of view, which is always says: After I have completed my critical task I fuck off and do whatever I want to do. But only than, not before completing them.

My way out of a broken mindset was to work on it every day with tiny stitches. You daily tasks need to have an impact on your longterm goals, but do not have to be necessarily for long hours. Make good things a habit and automate them to improve in the longrun.

Stop camparing to others

Our money mindset is often influenced by others. Whether it is your neighbour having a new car or a bigger pool, friends going on expensive holidays – whatever. Everybodys day is filled with things from others. Things which for sure influence us in a way that might be contraproductive.

What does it help me to compare with people who are not on my level?

Take Lars as an example. He is successful for sure. And he is really inspiring for me. But what do you think will happen, when I compare my numbers to his? I do not know them, but he is receiving passive income from Bondora Go and Grow holding a stack of 180.000EUR. My investment in Bondora is only 1.700EUR currently. So he is on a completely different level.

And you do this for anything in your life: car, house, investments, holidays, clothes – anything!

Meanwhile I changed to trying to beat myself. Therefore I need to track my stuff very disciplined. But I am able to see changes.

Last year in November I was able to save 1.500EUR every month. This year I will be able to save 2.000EUR during November. This might be only a small change if I compare it to Jeff Bezos, but regarding my improvement I was able increase my savings by 33%. That is a lot.

Therefore my next goal has to be increasing my savingsrate to 2.660EUR next year in November. Just have a guess what will happen when I am able to keep that performance? It will be a huge “wow” in five years from now.

The less you give something about others and their numbers the more you will focus on your stuff. I am pretty convinced that people have an amount of 100% energy per day. Looking at Lars numbers which he shares in his monthly overview I might say: wow. well done. Starting to envy him or even make myself feeling bad about it will cost me a lot of energy. Let’s say for example 10%. So 90% are left for the rest of the day.

Will I be able to make the best out of this days? Probably not as I already 10% into something else. And when we are talking about compound interest of our invest this share will also compound. Wasting 10% every day will be outperformed by those who are able to give more than thoe 90% each day.

Create a system to track your improvement

When comparing numbers it is always very important to chose the right numbers. If you invest intially 10.000EUR into the stock market and it rises to 12.000EUR – is it really your personal improvement?

I think it does not. There is no way you were able to influence this result. Of course you might influence it by chosing the right stock and the right time, but did you improve with those results? You wealth increases, but from my very personal point of view there is no growth of me as a person.

This is why I created a system of numbers which I am able to influence. I wont be able to influence the stock market, but I am to put in two hours of work into a specific project today. Do you get what I am trying to point out?

I am able to track my expenses, my savingsrate, my sidebusiness income, the number of pages I read, the kilometers I run and so on. And this is why I am tracking those numbers.

Within those thoughts there is something important to think about: There will be no gratification today! And probably also not tomorrow. But there will be a gratification soon. It is only delayed.

Google will not rank my website better tomorrow because I wrote 1.000 words today. But if I am able to finish this blogpost by writing 1.000 words for seven days Google might find the content attractive and improve my ranking within the next six months. So it is a delayed gratification.

Going on a diet today won’t make your fit tomorrow. But constantly meeting your macros and mastering the input into your body will make your fitness increase over the next six monhts. Delayed gratification again.

Therefore it is important to know your goals, cut them into pieces and know why you have to hit your target today – and what it is good for in the future.

Only track stuff you are in charge of. The rest is something you will not be able to influence also it is important to also track them and keep an eye on them to maybe adjust. But is is nothing you are able to actively influence today.

Money is a tool – not a goal

Maybe you follow my monthly income reports. You might recognized that I am trying to scale four platforms to a monthly interest payment of 25EUR. This is money and this is a goal of me – Why am I now talking about the opposite?

I am working on a passive income stream to make myself less dependent from my salary. The goal is to invest as much money to cover my expenses with this interest payments. It is not about those 25EUR or 1.000EUR or whatever number. It is about freedom, financial freedom and getting more and more independent.

Of course those 25EUR is a number, but it is only a “share of my financial freedom”.

Start thinking about what you will do with this money. Money itself will not make you happy. You are not happier just because you have 100.000EUR in your account. This will change when you think about what you might with this money. Those are the things making you happy.

Therefore it is legit to aim for 100.000EUR as a number. But you need to know how this money will make you happy. I am aiming for severals millions over the next twenty years. As I want to live across the globe with the summertim I need this amount of money to finance it.

Let’s start with your new Financial Money Mindset

Until now I wrote a lot about the circumstances. Why should you take care of your money mindset and what is it to focus on? There is plenty to think about, but I think it is easier to start small.

The more you put into the beginning, the bigger your chances are to fuck up. Therefore you should find something which is challenging but not realistic. Just the way I mentioned it before with those 36.500EUR. Try to find a goal and break it down to a daily basis.

It is the same with starting to improve your financial mindset. So let’s get into it.

Track your health & wealth

Meaning what? Yes, health and wealth. Our capacity doing things is directly connected to our body. And taking care about our body means influencing our capacity of energy. The more you improve the more you will be able to get your shit done.

But that is only a side aspect. The more I would like to focus on tracking your wealth. It might sound pretty ugly to track your stuff, but meanwhile P2P lending platforms and banks made it easy. Often you are able to receive an email with your weekly updates and an overview. So you do not necessarily login into all platforms.

Now just set up a simple Excel sheet and start tracking. Whatever and whenever you want.

I started doing it on a weekly basis. On my weekly schedule there are several things I am working on which should have an impact on my wealth. Therefore I started tracking a weekly basis and kept it. I do not know whether I would be better off with a monthly report for myself – but nevertheless it feels good to do it weekly.

In my sheet I just write down the current sum of the platforms. At the moment I track my four focus platforms and leave out the rest. They will only be updated once a month and until then calculated with a formula and the average interest rate. That might not be right, but saves me some team during my tracking.

My goal is the next step on a official scale of wealth. Also I wrote earlier you should not compare to others my goal is to climb up the wealth ladder. In every country there are statistics about the average wealth, the top 25%, top 10% and so on. While I am aiming for the top 1% the way goes along all of the other steps. And it is quite satisfying to reach the next level and find out you now entered the next step.

Create a plan to kill your debts

Debts are what holds you back from getting wealthy – especially those you made because of consumer products. Therefore you should find out what you need to change to never ever need a loan again. After you figured out you should make a plan to pay them down.

There are several ideas about it. I like the one to focus on it and pay it down as fast as possible. For others it is okay to pay them down with their planned rate. Whatever is best for you.

The most important thing is to create a plan and kill your debts. The smaller they get the bigger your wealth gets. And after killing it you should add this rate to your savingsrate and increase your wealth.

Now you first of all did everything to avoid new debts and secondly have a plan to get out of your debts. That is great news as debts became quite common and usual during the last years. Stand out with having no debt at all.

Find an investing system that works for you

After putting up you trackers and plans to kill your debts you are now aware of what is left. And here is something I would to make clear: Do no save “what is left” by the end of the month. When setting up your finances you need to figure out how much is left on the table after your expenses and debt payments. But following the principle of paying yourself first you should make the investments always directly after you received money.

I always prefer things to directly invest money into. Therefore I figured some things out I am happy with – and do not think about it for the rest of the year. I am following my personal investing share with 60% into the stock market and 30% into P2P lending. The rest is put on my emergency fund as I am still building it up :p

When it comes to investing I really like to invest time into what to do next. Often this time is wasted from my point of view and I would be better off with not taking it. Therefore I decided to claim one day per month to take myself time for investment topics. This is usually at the end of the month when I am doing my monthly numbers. Shortly after it I will be paid my salary and I could use my investment decisions.

As you guys maybe know I am following the Dividend Alarm. It is a system to invest into the stock market with focus on dividend shares and establishing a passive income stream. That is the 60% stocks. For my 30% P2P lending investments I follow my four focus platforms at the moment. And herewith all the work is done for the next investments.

So try to keep it simple like investing into a MSCI All World ETF or only a few platforms. Try to focus on increasing the investment sum that optimizing your overall interest rate.

This is a great way to keep things simple and implement the habits. And this is what leads me to the next point.

Keep your positive Money Mindset habits

Habits are what your life is out of. In my eyes success is made out of habits and hard work. The more I am able to master my financial habits the faster my wealth will grow. Corresponding to the last chapter: What do you think is easier? Making another 1% of interest or earning another 1% of income?

Of course it depends on your situation. But usually it is way more simple to earn more money.

Maybe on the first two to three attemps it is a good idea to optimize your interest rate. But after making another 2-3% it gets very difficult – and mostly also more risky. Imagine yourself managing a 100k wealth.

- What do you have to do to make another 1% this year?

- And what do you have to do to make another 1% of income?

The more you stick with your habits and remind yourself of them the more financial success you will have. But how is success tracked?

Write down your longermin goals daily

I already wrote about it before, so just a short reminder: Write down your goals! It is a kind of reminding yourself of them every day. And futhermore it is a good motivator to get through the tough day when you know why you are doing it.

I chose a small book and write them down by the beginning of each day. Additionally I already wrote down my five critical tasks for the next day – combined on one page. So I can see what I have to work on – and what bigger goal it will impact on.

Keeping habits means mastering them

When I was in school there was always the task to learn the vocabulary – especially in english and spanish. My mother showed me a box with several cards in it and four smaller areas. The task was now to write a new word on one card and the german expression for it on the back.

The first area was for new words. I looked at them every day. After I executed on the words during the first week I put all of the cards into the second area, which I answered correct during the first week.

Keep your positive Money Mindset habits

- write down your longterm goals daily

- remind yourself as often as possible why you are doing the shit

- Never quit new habits after the first success – keep em

Get comfortable with discomforts and fear

- things will never run the way you want them

- prepare to overcome obstacles

- in every shit there is an ounce of gold

- work in 90 days sprints (before5am) and put up goals (freetime)

Leave a Reply

Want to join the discussion?Feel free to contribute!