Welcome to my Mintos Review – Are you looking for an attractive way to invest your money and earn a passive income? Then the P2P marketplace Mintos could be just what you are looking for. In this comprehensive Mintos review, you’ll learn everything you need to know about the platform to make an informed decision ✅.

Mintos is Europe’s largest P2P marketplace 🌍 connecting investors and borrowers from around the world. With over 570,000 investors and more than €11 billion in funded loans, Mintos is an established player in the peer-to-peer lending space.

In this article we answer the following questions:

- 📌What is Mintos and how does it work?

- 📌How to invest in Mintos and what products are available?

- 📌What are the advantages and disadvantages of the platform?

- 📌What about risk management?

- 📌What are the fees and taxes?

🔍 I cover both the positive aspects and the potential risks so that you get a complete picture of the platform. By the end of this article you will be well informed to decide if Mintos is the right platform for your P2P investments 🚀.

Mintos in the P2P News

What and who is Mintos?

Mintos* is a peer-to-peer (P2P) marketplace. Unlike traditional credit institutions, Mintos does not lend itself. Instead, Mintos acts as a platform that connects lenders – often called loan originators – with investors. These lenders use Mintos to offer their loans, while investors have the opportunity to invest in these loans and earn a return 💰.

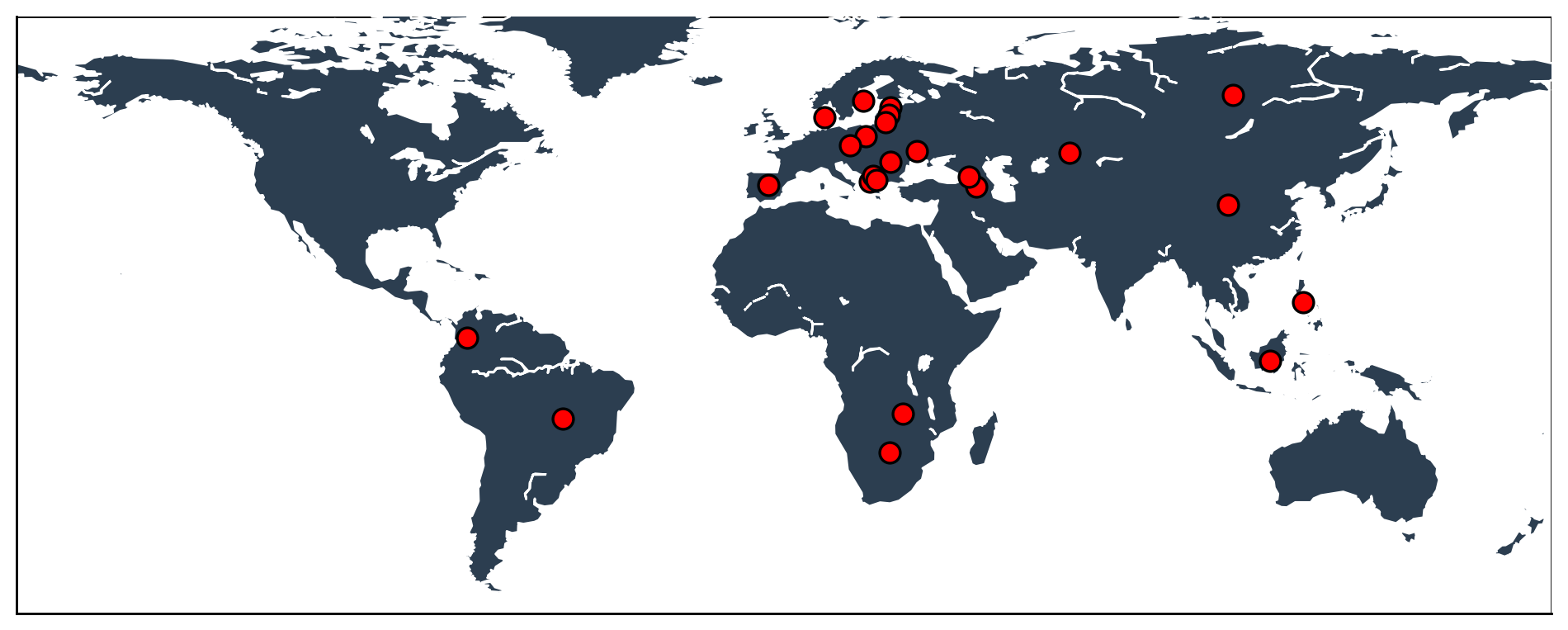

This model allows investors to spread their capital across a wide range of loans, which can help to minimise risk ⚖️. The diversity of Mintos is a key advantage: the loans come from different lenders, from different countries and cover a range of loan types.

Mintos has established itself as one of the largest P2P marketplaces in Europe 🌍. It is regulated by the Financial and Capital Market Commission (FCMC) in Latvia. Mintos is now developing into a multi-asset platform, including not only loans, but also bonds, ETFs and real estate. This expansion allows investors to further diversify their portfolios and take advantage of different asset classes.

⚠️ Important: There are risks associated with P2P investing. It is important to do your research and develop a well thought out investment strategy before investing on Mintos.

Facts about Mintos

| Category | Details |

|---|---|

| Registered Office | Rīga, Skanstes iela 50, Latvia-1013 |

| Regulation | Yes, regulated by the FCMC in Latvia |

| CEO | Martins Schulte |

| Number of Investors | Over 570,000 |

| Volume of Loans Funded | Over €11.1 billion |

| Average Return | 12.26% (Weighted Average, source 02/25) |

| Minimum Investment | €50 |

| Assets Under Management | €458.7M (loans), over €700M total (source) |

| Countries | Loans from 30+ countries |

| Loan Originators | Over 60 different lenders (LO overview) |

| Currencies | 10 available currencies |

| Products | Loans, Bonds, ETFs, Real Estate, Smart Cash |

| Diversification | High due to many lenders & countries |

| Automation | Auto Invest & predefined strategies |

| Secondary Market | Yes, loans can be bought/sold |

| Deposit Protection | Up to €20,000 for uninvested funds |

| Risks | Borrower & lender default risk |

| Security | Mintos Risk Score & risk assessment |

| Skin in the Game | Lenders invest their own money |

| Buyback Guarantee | Available, but depends on lender reliability |

| Profitability | Mintos is profitable (annual report 2023) |

| Transparency | Provides lender & platform information |

| P2P Platform Rating* | #1 out for 57 |

The Founders, Leaders and the Team of Mintos

Mintos was launched in Latvia in 2015. The minds behind the platform are Martins Sulte and Martins Valters.

Sulte has been the CEO of Mintos since its inception. Prior to joining Mintos, he worked as a financial analyst at SEB Investment Bank for six years.

Valters is COO of the company. Both founders gained experience at Ernst & Young prior to founding Mintos.

The Mintos management team can be found on the website. The company has over 160 employees in Riga, Vilnius, Berlin and Warsaw. Mintos is the largest employer in the P2P lending industry.

Some of the major shareholders of Mintos are:

- Maris Keiss (co-founder of 4finance and Mogo)

- Aigars Kesenfelds (co-founder of 4finance and Eleving Group, formerly Mogo, and owner of several loan originators)

- Kristaps Ozols (co-founder of 4finance and Eleving Group, formerly Mogo)

- Alberts Pole (co-founder of 4finance and Eleving Group, formerly Mogo)

It is important to note that Aigars Kesenfelds, one of the main shareholders in Mintos, also owns shares in some of the lenders listed on the platform. This has led to discussions about potential conflicts of interest in the past.

Despite these controversies, Mintos is seen as a reputable company, partly because it is regulated by the Bank of Latvia.

Step by step guide: How to get started as an investor on Mintos

Do you want to invest your money in P2P loans and benefit from attractive returns? Mintos is one of the largest and most popular platforms in Europe that offers you this opportunity. In this article I will show you how to get started as an investor on Mintos – from registering to making your first deposit.

1. Registration and verification: Create your account

The first step in entering the world of P2P lending is to register on the Mintos website. The process is simple and takes only a few minutes. You will need to create an account by entering your personal details. This includes your name, address, date of birth and email address.

The next step is to verify your identity. This is an important step to ensure that you are a real person and to prevent money laundering. Mintos usually requires a copy of your ID card or passport. Verification is done online, either using a webcam or your smartphone.

It is important to note that you must be at least 18 years old and have a bank account in the EU. British citizens cannot currently invest with Mintos.

Once you have provided your personal details and verified your identity, you will be asked to complete a product suitability questionnaire. This test is designed to ensure that you understand the risks of P2P investing and are suitable for this type of investment. If you fail the test, you may not be able to use all the features of Mintos.

2. Make a deposit: Transfer money to your account

After successful registration and verification, you can deposit money into your Mintos account. This is necessary to be able to invest in loans. Mintos accepts deposits in various currencies, but it is advisable to use Euros to avoid unnecessary exchange fees.

Deposits are usually made by SEPA transfer from your bank account. You can find all the necessary information, such as Mintos’ bank details, in your account. It is important to note that the first transfer must come from a personal bank account. This bank account will then be used for future withdrawals.

The deposit process usually takes 1-2 business days. However, it can be faster using services such as Revolut or Wise. Please note that you cannot currently use credit cards for deposits and withdrawals.

3. Product selection and investment: Which credits do you want to invest your money in?

Once the money has been transferred to your Mintos account, you can start investing. Mintos offers a wide range of investment products, including

- Loans (Mintos Notes): These are shares in loans offered by various lenders on the platform.

- Bonds (Mintos Bonds): Corporate bonds issued by Mintos itself.

- ETFs: Exchange Traded Funds, which allow you to invest in a broadly diversified portfolio of shares.

- Real estate: Investments in rented properties where you share in the rental income.

- Smart Cash (money market funds): A way of investing your money in the short term with little risk.

There are several ways to invest in these products:

- Automated strategies (Mintos Core): Here, Mintos selects the credits for you according to a fixed algorithm. This is an easy way to diversify your money, but you pay a management fee.

- Auto Invest: With Auto Invest you can create your own investment strategy and decide which loans you want to invest in. You can use different filters to select the appropriate loans.

- Manual investing: If you want to have full control over your investments, you can select the loans on the primary or secondary market yourself. Here you can view all the details of the loans and decide whether you want to invest.

Once you have chosen an investment strategy and made your first investments, all you have to do is wait and collect interest! You can find out exactly how this works in the next part of this blog post.

4. Lending and repayment: Your money starts to work for you

After you have invested in loans, your money starts to work. In the background, Mintos lends your capital to borrowers through the lender partners (loan originators) active on the platform. These borrowers pay back the loans in monthly instalments.

An important aspect of Mintos is the repurchase guarantee. Many loans on the platform come with this guarantee. This means that if a borrower stops making payments, the lender will automatically buy back the loan after a certain period of time (usually 60 days). You will then get back the capital you invested plus the interest that has accrued.

But beware: the buyback guarantee is only as good as the lender offering it. If the lender itself gets into financial difficulties or becomes insolvent, it may not be able to honour the buy-back guarantee. It is therefore important to check the creditworthiness of lenders and to diversify your portfolio. Mintos offers the Mintos Risk Score, which can give you an initial risk assessment.

5. Interest payments and returns: How to make money with Mintos

You will receive interest payments on your investments. The amount of interest depends on several factors, such as the risk of the loan, the duration and the lender. The interest is usually credited to your account on a monthly basis. You can then either reinvest the interest to take advantage of the compounding effect, or have it paid into your bank account.

The average return on Mintos is around 8.8%, according to the platform. However, some investors report higher returns, especially when investing in longer-term loans or using the secondary market.

To maximise your returns, consider the following tips:

- Diversify your portfolio: invest in loans from different lenders, countries and maturities.

- Use Auto Invest: Set up Auto Invest to automatically invest in loans that match your criteria.

- Monitor the secondary market: Buy loans at a discount on the secondary market to increase your return.

- Check the lenders: Check the financial situation of the lenders and pay attention to the Mintos Risk Score.

With the Mintos mobile app, you can keep an eye on your investments at all times.

6. Reinvestment or withdrawal: the choice is yours!

Once you have earned interest, the question arises: what do you do with it? With Mintos, you have two basic options:

- Reinvestment: You can automatically reinvest the interest you earn to take advantage of the compounding effect and make your portfolio grow faster. This is particularly useful if you want to build wealth over the long term. Simply enable automatic reinvestment in your automatic investment settings.

- Withdrawal: You can have the interest paid into your bank account at any time. This is ideal if you want a regular income from your P2P investments. To make a withdrawal, go to the ‘Withdraw’ section of your account. Note that withdrawals are usually made to the same bank account you used to make the deposit. Withdrawals are free.

7. Risk management and diversification: protecting your investment

P2P investments are not without risk. There is always the risk of borrower default and lender default. Careful risk management is therefore essential. Here are some important points to consider:

- Diversification: Spread your capital across as many different loans as possible. Invest in loans from different lenders, in different countries and with different maturities. The broader your portfolio, the lower the risk that a single loan default will affect your overall return.

- Lender analysis: Find out about the financial health of the lender. Look at the Mintos Risk Score, which can give you an initial assessment of risk. Also look at independent ratings.

- Buyback guarantee: Take advantage of the buy-back guarantee that many loans offer. However, remember that the guarantee is only as good as the lender offering it.

- Secondary market: Monitor the secondary market. This is where you can buy loans at a discount to increase your return. You can also sell your loans if you need quick liquidity.

- Regular review: Review your portfolio regularly and adjust your investment strategy if necessary.

Mintos is an attractive platform for investors who want to invest in P2P loans. The platform offers a wide range of loans, a user-friendly interface and attractive potential returns. However, you should also be aware of the risks and manage your portfolio carefully.

With the right strategies and good risk management, you can generate passive income and build long-term wealth with Mintos. Get started today and discover the world of P2P lending!

What is Mintos offering for investors?

Mintos is more than just a P2P platform – it is a marketplace for a wide range of investment products that allow you to diversify your money and earn attractive returns. From classic P2P loans (Mintos Notes) to corporate bonds (Mintos Bonds), ETFs, real estate investments and the flexible Smart Cash solution, Mintos gives you plenty of opportunities to diversify your portfolio.

But be careful: not all products are equally safe! While some forms of investment are considered more conservative, others carry higher risks. Below, we present the different products in detail and highlight the security aspects, so that you can make an informed decision and develop an investment strategy that suits your needs.

Mintos Notes: investing in different loan projects

Mintos Notes are loan bundles consisting of a large number of similar loans. By buying a note, investors invest in these bundled loans to individuals or small businesses. The minimum investment in a note is €50.

Collateral and repurchase guarantee

The individual loans in a note may be secured in a number of ways, including by

- mortgages

- cars

- other assets

Many loans are backed by a repurchase guarantee from the lender (loan originator). This means that the lender will buy back the loan if the borrower defaults (usually after 60 days).

However, this repurchase guarantee is not always reliable. The risk is ultimately borne by the lender – if the lender goes bankrupt, the guarantee no longer applies.

Yield and maturity

The yield on Mintos notes varies depending on the risk profile of the loan and the lender. On average, investors can expect to receive between 6% and 19%. There are no guaranteed returns.

The duration of the loans in the notes can range from one to 80 months. It is also possible to invest in short-term loans.

Loan originator rating

To help you assess risk, Mintos assigns a rating to each individual lender (loan originator). This Mintos Risk Score is designed to help investors assess the financial stability and seriousness of the lender. It is based on several factors such as

- the performance of the loan portfolio

- the efficiency of the lender

- the strength of the repurchase guarantee

- the cooperation structure

However, it is important to note that this rating is not a guarantee and is regularly revised. Investors should not rely solely on the rating, but should conduct their own research.

Important: Since the switch to Notes, Mintos automatically withholds tax on interest income. The tax rate depends on the investor’s country of residence.

Mintos Bonds: Invest in corporate bonds

From 2023, Mintos will offer its users the opportunity to invest in corporate bonds. Mintos Bonds are a company’s securitised debt that it uses to raise capital. Investors lend money to the company and receive interest payments in return. Again, the minimum investment is €50.

Security and return

Compared to P2P loans, corporate bonds are often seen as a relatively safe investment because they usually have to be repaid before other creditors (depending on the structure of the bond).

However, bonds also carry risks, such as the risk of the issuer defaulting. There is no deposit protection.

The yield on Mintos bonds is usually higher than on short-term loans because the maturity of the bonds is longer. Interest is usually paid quarterly.

Important: With Mintos, you don’t invest directly in the bond, but in a debt security backed by the bond, which is issued by a special purpose vehicle within the Mintos group.

Tradability

Mintos bonds can be traded on the secondary market, which increases liquidity. However, there is a risk of not finding a buyer or having to accept a discount when selling on the secondary market.

Differences to Mintos Notes

Unlike Mintos Notes, which invest in loans to individuals or small businesses, Mintos Bonds channel funds to larger companies. The asset classes also differ in terms of cash flow, interest payments, redemption, maturity and risk.

Before investing

Before investing in Mintos Bonds, investors should carefully read the base prospectus of the relevant bond to find out the exact terms, risks and conditions. It is important to assess the creditworthiness of the issuer and to consider the economic conditions.

Mintos ETFs: Easy access to the global stock market

Since 2023, Mintos has also offered its users the possibility to invest in ETFs (Exchange Traded Funds). ETFs are exchange-traded index funds that track an equity index (e.g. the MSCI World) or invest in specific bonds. Investors can invest from as little as €50.

Advantages of Mintos ETFs

- Easy access: Mintos offers easy access to global equity markets, even for less experienced investors.

- Low effort: Mintos takes care of ETF selection, portfolio construction and rebalancing. Investors don’t have to worry about anything and can benefit from the long-term performance of the stock markets.

- Liquidity: Investors can liquidate their portfolios and withdraw their money at any time (depending on market conditions).

- Diversification: By investing in an ETF, capital is automatically spread across many different stocks, reducing risk.

Customisation

Mintos offers ready-made ETF portfolios with different risk profiles. Investors can also build their own portfolio and determine the weighting of each ETF.

Investment Fees

Mintos charges a fee for managing ETF portfolios. This fee is usually lower than for actively managed funds.

Differences to other providers

Compared to brokers such as Scalable Capital or Trade Republic, Mintos offers the advantage of a simple and automated investment. Investors do not have to worry about selecting ETFs and managing the portfolio themselves.

The risks

Investing in ETFs is not without risk. ETFs may be subject to price fluctuations and investors may lose money. Before investing in Mintos ETFs, investors should do their research and consider their individual risk profile. There is no deposit protection.

Mintos Real Estate: Invest in rental properties without the hassle

From 2024, Mintos will offer the opportunity to invest in already rented residential properties and benefit from the rental income. Investors can enter this asset class with as little as €50.

How does it work?

Mintos works with the Austrian fintech company Bambus. Bambus Immobilien GmbH buys apartments from owners who continue to live in the property and pay rent. Investors on Mintos can invest in these properties without owning or managing them.

Yield and duration

The average return (net rental income) is around 5%, plus an expected annual increase in value of 3%. The duration of the projects is relatively long, ranging from 10 to 30 years.

Tradability

The properties are offered through notes that can be traded on the secondary market. This allows investors to sell their investments early if necessary. However, there is a risk that no buyer will be found or that a discount will have to be accepted.

Investment risks

Investing in buy to let properties involves significant risks which are set out in the relevant factsheets. Investors should consider these carefully before investing. There is no deposit insurance.

Conservative investment with low(er) risk

Investment in rental property can be considered a rather conservative form of investment. It offers the opportunity to participate in rental income and property appreciation without having to worry about management.

Mintos Smart Cash: Flexible investment with daily access

Mintos Smart Cash is a cash management solution that allows you to invest your money in a money market fund where it is available daily. Money market funds are low-risk, but not risk-free, highly liquid investments that pay interest. Smart Cash is a great way to park money.

How it works

Mintos uses the BlackRock ICS Euro Liquidity Fund. Interest is calculated daily and credited monthly to your available balance.

Interest rates and fees

The Mintos solution has a variable interest rate based on the European base rate. Fees are 0.29% (0.1% BlackRock + 0.19% Mintos).

Differences with immediate savings accounts

Although money market funds are a safe alternative to instant access savings accounts, there are some differences:

- Withdrawals: Possible at any time

- Fees for withdrawals: None

- Yield: Close to market and fair

- Interest calculation: Daily, paid monthly

- Credit rating: High credit rating (AAA)

- Diversification: Strong diversification across hundreds of issuers

- Deposit insurance: None

- Tax: 5% withholding tax (deductible)

The risks

Although money market funds are very safe investments, your money is still exposed to risk. There is no deposit insurance.

Pros and Cons of the Mintos Review

Mintos has established itself as the leading P2P marketplace in Europe. The platform offers investors a wide range of opportunities to invest in different types of loans and asset classes.

However, as with any investment, there are pros and cons to consider when investing on Mintos. The table below provides a clear summary of the most important aspects to help you make an informed decision:

| Pros | Cons |

|---|---|

| Wide choice: Many loans, multiple lenders, diversified portfolio possible | Risk: P2P loans are risky, risk of loan and lender default |

| User-friendly: Easy to use, auto-invest function | Buyback guarantee unreliable: Depends on lender’s financial stability |

| Additional products: Invest in bonds, ETFs, and real estate | Complexity: Requires understanding of lenders and risks |

| High returns: Average interest rates around 12% | High default rate: 23.4% non-performing loans |

| Buyback guarantee: Reduces volatility on many loans | Regulation does not guarantee safety: Not the same as bank security |

| Regulation: Licensed in Latvia, investor protection up to €20,000 | Potential conflicts of interest: Mintos shareholders own stakes in lenders |

| Liquidity: Active secondary market for selling loans | Low liquidity: Pending payments and recovery funds limit access |

| Transparency: Detailed lender data, Mintos Risk Score | Taxes: Withholding tax, must be declared in tax returns |

| Mobile App: Well-designed app available | Country selection: Focus on Eastern Europe, not suitable for all |

| Profitability: Mintos is a profitable company | Statistics: Data updates can be slow or incomplete |

| Mintos Bonus: New investors receive a welcome bonus | No deposit protection: Not covered like bank accounts |

Risk management at Mintos: How to protect your investment

Investing in P2P loans through platforms like Mintos offers attractive return opportunities, but it is not without risk. Effective risk management is therefore essential to minimise potential losses and achieve long-term success. The most important aspects of risk management on Mintos are explained below:

Diversification

- Spread your capital across as many loans as possible. Don’t invest in a few individual loans; spread your capital widely to reduce the risk of individual losses.

- Diversify across different lenders. The financial stability of the lenders is crucial to the repayment of the loans and the fulfilment of the repurchase guarantee. Broad diversification across different lenders reduces the risk that the default of a single lender will significantly affect your portfolio.

- Consider different countries and regions. Investing in different countries and regions can help reduce the risk associated with the economic performance of a single country.

- Choose different types of credit. Investing in different types of loans, such as consumer loans, business loans or property loans, can further diversify your portfolio.

Analyse lenders

- Assess the financial health of lenders. Use the Mintos Risk Score to get an initial indication of risk. However, remember that the Risk Score should not be the sole basis for your decision.

- Check independent ratings and reviews of lenders. Use external resources to get a broader picture of the creditworthiness of the lender.

- Look at the “skin in the game” of the lenders. Lenders who invest some of their own capital in the loans have a greater interest in their success.

Buy-back guarantee (buy-back obligation)

- Take advantage of the buyback guarantee that many loans on Mintos offer. This guarantee means that the lender will buy back the loan if the borrower defaults.

- Be aware that the buyback guarantee is not always reliable. The guarantee is only as good as the financial stability of the lender offering it. If the lender goes bankrupt, the buy-back guarantee may be worthless.

Secondary market

- Monitor the secondary market to buy loans at a discount and increase your return.

- Use the secondary market to sell loans when you need quick liquidity or want to change your investment strategy.

Regularly review and adjust

- Review your portfolio regularly and adjust your investment strategy as necessary. Market conditions and the financial position of borrowers and lenders can change.

- Keep up to date with developments on the platform and with lenders. Mintos provides regular updates on issues and changes.

Manage cash flow

Be aware of cash drag, i.e. uninvested capital. Adjust your auto-invest settings to ensure your capital is reinvested quickly.

Look at the big picture

- P2P lending should only be a part of your overall portfolio. Do not invest all your assets in P2P lending, but diversify across asset classes.

- Be aware of the risks and only invest money you can afford to lose.

By following these risk management principles, you can minimise the potential risks on Mintos and increase your chances of a successful P2P investment journey.

Fees and taxes on Mintos: What investors need to know

On Mintos, there are generally no fees for investors to invest in the primary or secondary market. Other actions on the platform are also usually free of charge. One exception is the sale of loans on the secondary market, which is subject to a 0.85% fee. This fee can make it difficult to sell loans quickly if capital is needed at short notice.

It is important to note that Mintos managed products such as Mintos Core or Mintos Smart Cash may incur costs. Investors should therefore make sure they are aware of the fees involved.

Witholding Tax & Tax Certificate

Another important point is the withholding tax. Mintos automatically deducts 5% withholding tax for EU/EEA residents. However, this withholding tax can be credited in the tax return of the country of residence. This requires that the country has a double taxation agreement with Latvia. Investors domiciled outside the EU/EEA who do not provide such a certificate will be subject to a withholding tax of 20%.

In order to facilitate the tax declaration, Mintos provides a tax certificate that can be downloaded from the profile. It is advisable to seek advice on the correct tax treatment of P2P lending in your country of residence, as the rules can be complex.

In summary, while Mintos is generally free for investors, a fee is charged when selling on the secondary market. There is also a withholding tax to be considered, although this can usually be deducted on a tax return. Investors should check the specific fees and taxes in advance to avoid unexpected costs.

Key Takeaways: Mintos Review – weighing up your personal pros and cons

Mintos has established itself as the largest P2P marketplace in Europe, offering investors a wide range of investment opportunities in different loan types and asset classes. The platform is characterised by its ease of use, the diversity of lenders and the opportunity for diversification. With average yields of around 11.5%, Mintos offers attractive profit opportunities.

However, investing in P2P loans is not without risk. Loan defaults, lender insolvency and unreliable repurchase guarantees can lead to capital losses. In addition, the complexity of the platform should not be underestimated, as it requires careful selection of lenders and continuous monitoring of the portfolio.

Investors should therefore thoroughly research Mintos before investing and carefully weigh up the pros and cons. Broad diversification, lender analysis and consideration of the buyback guarantee are essential to minimise risk. P2P lending should also only be one part of an overall portfolio and not be considered as the sole form of investment.

Discover Mintos now and benefit from attractive returns!

Are you ready to dive into the world of P2P lending and benefit from the return opportunities on Mintos? Then register on the platform today and discover the wide range of investment opportunities.

Use the following tips to make a successful start:

- Read up on how Mintos works and the different investment products.

- Create an individual investment strategy that takes into account your risk tolerance and investment goals.

- Diversify your portfolio to minimise risk.

- Monitor your portfolio regularly and adjust your strategy as necessary.