Is Bondster a scam? Let’s try to find out with facts

I received a comment the other day saying: “Bondster is a scam”. This is below my blogpost about taking Bondster into my highyield experiment. As I also take different opinions into account I decided to write a blogpost about it.

Table of Contents

Bondster a scam – how does it come?

Currently Bondster is one of my four focus platforms. On those I am trying to invest as much as possible to receive 25EUR/month of interest payment. After I digged a bit deeper last year about Bondster I decided to choose it as this P2P lending platform fits into my portfolio quite good. They have different loan originators and not focussed on the Baltics which makes my portfolio a bit more diversified.

And yes, when the pandemic situation started in March 2020 Bondster struggled a lot. In April 2020 Bondster reported about the possibility of delayed payments in a short blogpost for their investors – just like most of the other P2P lending platforms did as well.

In October 2020 I published my blogpost about Bondster. Since then it received two comments about Bondster not being trustworthy. Furthermore they are blamed to not react upon requests and buyback guarantees seem not be repaid. That is quite a fact I wanted to react on, especially after one of the commentators called Bondster a scam.

What is Bondster and how does it work?

Bondster is a marketplace where P2P loans are published. Therefore Bondster “uses” several loan originators, which you can find on their website. Here just an example of ACEMA, which also shows links to their financial reports and give a short overview about their data. Those details are not shown for any of their loan providers, but for most of them.

Bondster Loan Originators

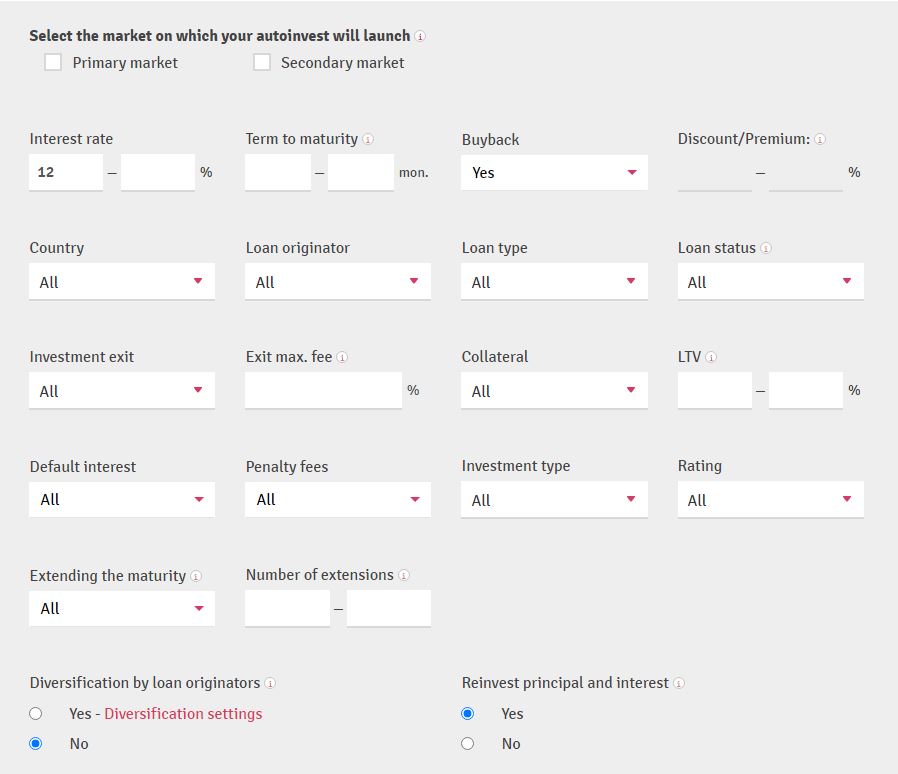

Furthermore investors have the possibility to adjust their auto invest – or invest manually. Therefore they need to login into their account and adjust whatever they like. If you want to know more about how to adjust it, please find my latest blogpost about Bondster where I described it quite detailed. Here you find an overview of what is adjustable:

Bondster Auto Invest

Investors are able to invest into small pieces from 5EUR ongoing of P2P loans. They are able to adjust the risk, interest rate and a lot more to only invest where they want to put their money into.

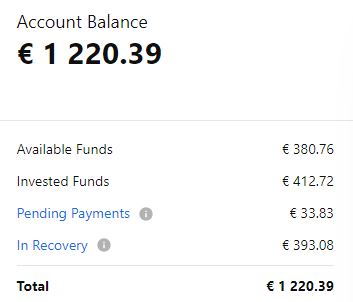

Short recap of my Bondster investment

Currently I am invested on the P2P lending platform with about 1.080EUR. My plan is to raise this up to 3.000 EUR within in the next month to generate the target of 25EUR/month of interest payments. Here you can see my current portfolio overview from today:

Bondster account overview

As you can see there are several lines of interest. Out of my whole portfolio about 238,66EUR are delayed by 8 to 60 days. This is a share of 22,09%. Those who are “late” one to seven days are mentioned in the line “Waiting for entry”. Bondster itself describes this as:

The provider sends us information about debtor payments from the previous calendar week regularly every third working day. This status reflects the delay in the recognition of debtor payments before it is labelled as delayed.

Therefore they are labelled “late” which adds up to a total of 492,98EUR and a share of 45,63%. On the first sight this looks really ugly, but let’s check the figures against other marketplaces. Ahh, and very important: 0 – in words ZERO delayed over 60 days or default loans. Here you will find my numbers from Mintos:

Mintos account overview

Adding the recoveries and the late payments to total is 426,91 EUR and a share of 34,98%. Comparing the figures agains Bondster the period from one to 60 days is much better with a total of 2,77% versus 45,63% from Bondster. But while Bondster has zero loans defaulted or in recovery, Mintos has about 393EUR in my account.

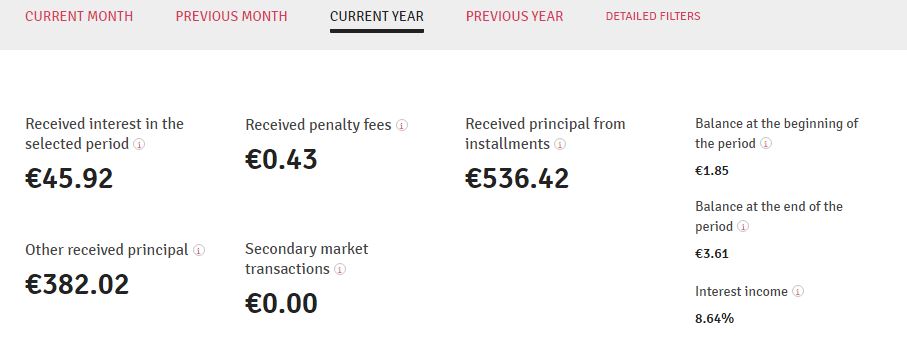

Furthermore Bondster pays interests to my as an investors. This year this summed up to 45EUR until now, which is more or less a interest rate of 12%.

Bondster interest payment

So far I am a happy investor. My deposit is invested and I am able to see where it is invested. Additionally I received interest payments. But I am not an expert to be honest.

Asking the experts about Bondster

I love investing my money into P2P lending. What drives me is especially the idea of passive income. But I am far away from being an expert for legal stuff or company reports. There are some experts in the market being ways better than me in rating it.

First of all I would like to mention Lars’ rating overview. He is invested since more than five years and quite a lot of platforms with an immpressive “skin in the game” of nearly 300.000EUR. Lars is in touch with a lot of platforms are visited some of them. During 2020 he wanted to visit Bondster in Prague, but Covid made it impossible during that time.

In his rating system Bondster receives 13 out of 34 points. As his numbers are mainly based of track record Bondster lacks because of their short period in the market. Please use Google Translate if you are interested in understanding every single point and when the platform receives them.

Furthermore several P2P bloggers wrote about Bondster as shown below:

Philipp from INVESTDIVERSIFIED

Honestly, I do not know how creditable all of these bloggers are. It always depends on what you are searching for – and you will always find the right answer for yourself.

Answering the question if Bondster is a scam for myself

Back in my schooldays I was writing a test in philosophy. The question I needed to answer was: What is relativism? And I sat down and wrote not more than one page. My answer was simple: Just imagine ten people standing around a big stone. And now let them describe it – you will probably receive ten different answers, but none of them is either right or wrong.

The same is when talking about P2P lending. Some like it, some are scared, others go all in and of course some will not like it.

I do like it. It is a great opportunity to invest and receive a huge reward. But P2P lending is far away from “safe” or “strongly regulated”. Therefore every investors should take all of the data into consideration BEFORE investing into the P2P loan on any platform.

People usually say risk and reward are going into the same direction. The more risk you take, to bigger your reward will be.

There have been scams in P2P lending before – no doubt. But there have also been red flags before. If you do not know what I am talking about please check my blogpost about the 9 quality flags.

From my point of view Bondster does not have any red flags at the moment. They are quite new to the market and investors should always watch out and read the news, but calling Bondster a scam seems more like the excuse for your own faults. And by the way: None of the guys leaving a comment ever got in touch with me when I offered it. So maybe they are scam?

Leave a Reply

Want to join the discussion?Feel free to contribute!