Invest and Access: 12% easy-to-handle-interest is just one click away!

Invest and Access is a newly launched product from Mintos. It was first shown to the public during the P2P Conference in June 2019. As I was on a personal challenge for saving money, this launch just come in the moment.

Now, something more than a month later, I would like to recap my first impressions about Invest and Access as well as my own challenge.

Table of Contents

What is Invest and Access

P2P lending is still an investment, which is not that easy to understand. As a lot of people are not interested or even scared to try to understand it, Mintos tries so make the P2P investment easier.

Especially on Mintos you are able to adjust your auto-invest with a lot of information. About 10 different P2P loan types in 30 countries and offered from more than 60 loan originators – that is quite complex.

Making P2P investments easier

By the beginning of investing in P2P lending investors are forced to “understand” those adjustments. When I started investing at Mintos is was less than 20 boxes to mark (or not to mark). It seems easy to understand when investors are scared because of the big data.

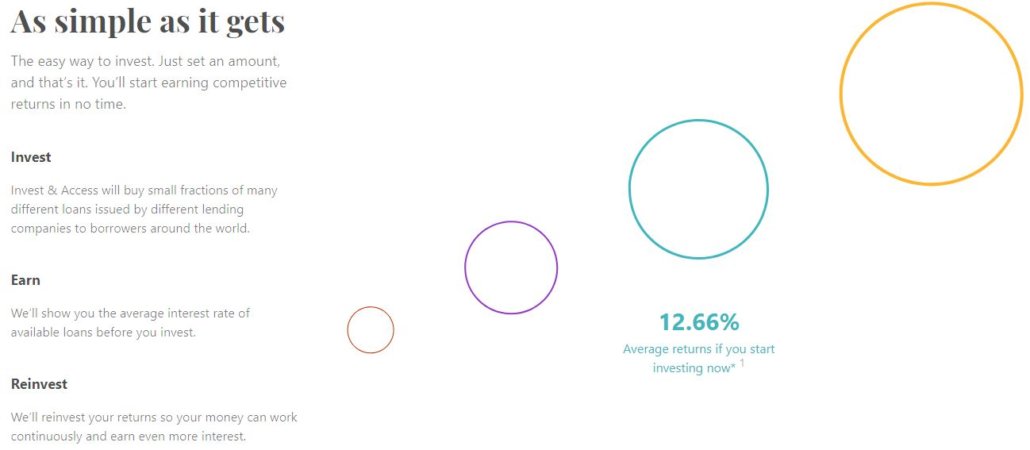

Mintos tried to make investing in P2P lending easy. Invest and Access is something like a “big auto-invest” for anyone, but no investor has to adjust it. It is diversified among any loan originator, loan type and country. But all P2P loans are secured with a buyback guarantee.

One Click and magic happens

Mintos is the leading P2P platform in Europe with a very high liquidity. Therefore Invest and Access is able to “find” fitting P2P loans for its strategy very fast. After the P2P Conference I set up the Invest and Access within less than 10 seconds.

To invest with Invest and Access you have to have a Mintos account. Here you will find the auto-invest right after your dashboard on the tabs above. Just setup your investment target up with one click and your money will be invested in Invest and Access.

12,59% interest in P2P lending with Invest and Access

If you check Mintos on their first page, you are displayed an average interest of 12,21% (checked 22.07.19). My oldest portfolio from 2016 has an average interest of 11,34%. Lars displays 11,54% with his Mintos account on his website. Somehow it seems to always above 11% ?

Lars and I had to setup an auto-invest years ago. Invest and Access is now the opportunity for new (and lazy) investors, to reach the same interest and even more. And additionally their P2P portfolio will be more diversified with Invest and Access than Lars or mine portfolio from 2016.

Invest and Access is not just easy to setup, but as well successful in its interest. Of course the data is just about two months in track recording, but I guess you can compare it to the average yield of Mintos over the last years.

Special requirements for loan originators

Mintos tries to lower the risks as much as possible. Therefore not any loan originator is able to be part of the I&A. Mintos just chooses P2P loans from originators, which are minimum six months on the Mintos-platform and additionally without any problems.

Of course all P2P loans have to be buyback guaranteed. Therefore all loan originators are excluded who do not offer buyback guarantees. In my eyes Mintos succeed with making the product as safe as possible, also you do not know, what this buyback guarantee will be good for in crisis times.

What is the difference from Invest and Access to Bondora Go and Grow?

There were rumors about everything on the P2P Conference. Especially after Mintos published their Invest and Access everyone was talking about the end of Go and Grow. If you check those auto-invests, they look quite similar on the first sight.

So let’s compare the details of those programs, to find the differences. There are several things to know about, because neither Go and Grow nor Invest and Access are without any risk.

Who is able to invest in Invest and Access or Go and Grow?

Any investor having an account at Mintos or Bondora is able to invest. Just transfer a deposit to your account. At Go and Grow you have a different address in your account, to send the money to. For using Mintos Invest and Access you just have to confirm, that you want to invest with it.

Am I able to stop the investments?

Sure, at any time. But here is the first difference. Stopping Go and Grow will lead to cash out the sum. Here you just have to recognize, that you will be charged a fee of 1 €. Afterwards you can do whatever you want with the whole sum, which you have invested.

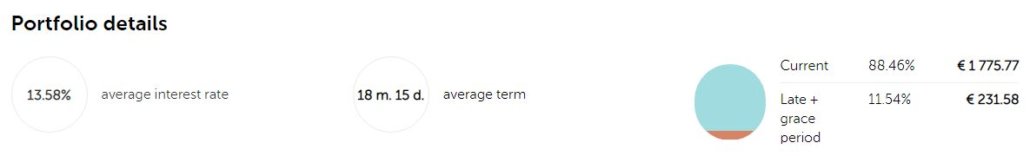

At Invest and Access you are just able to cash out the sum immediately, which has the status “current/instant”. Over the last weeks the share of current P2P loans is between 85% to 95%. So you will not be able to cash out 100% of your invested amount.

Due to timelags you will have to wait, until Mintos or the loan originator pays the rest of loan. Of course you will get the whole sum back, but you possibly have to wait for 10-15%.

What is the expected interest rate for an investor?

And here is another difference. Bondoras Go and Grow offers you 6,75%. There were some rumors about the possibility to not reach that target. As far as I know it was just rumors – nothing more.

In comparison to the usual interest rate you will receive at your bank (of about 0,5% to 1,2%) Bondora offers a great deal and you are able to cash out 100% of your invested amount with a fee of 1 €.

The interest rate at Invest and Access is depending, but constantly above 11%. So Mintos beats the Bondora offer by quite a lot, BUT the circumstances are a bit different for you as an investor. As you are not able to cash out 100% but just the current loans, you will not be able to get your money from today to tomorrow.

Check #2 on the screenshot above, which is displayed at the I&A-conditions. But of rcouse you will get your money back, it may just takes a while. Therefore there is no fee and the interest rate is ways higher.

Choosing Invest and Access for me

I can not tell you, what is the best deal for you. It depends from the points of view, which are important for you. As an investor especially aiming for a passive income, I am interested in a high interest rate. So choosing Invest and Access for me is the logical way.

Maybe you have seen it on my Instagram account. Inspired by Mitch I began a challenge. Beside reading 20 pages per day it also challenges me to save 25 € per day. Usually the challenge is just for 21 days in order to train your habits.

I decided to do it for minimum 100 days. So I try to save as much money as possible. Therefore I transfer a minimum of 175 € per week (25 € per day x 7 days = 175 €). Additionally I save savings directly 1:1. Some weeks ago I cancelled my bank account. Another 96 € savings per year, as well as dropbox with 110 € per year. This is why the sum will not increase in a constant line.

Invest and Access: A short summary

Invest and Access is an auto-invest on Mintos. Here an algorithm invests the total sum of invested capital into P2P loans. All investments are buyback guaranteed. You do not have to do something special, than just to confirm you want to invest with Invest and Access.

Mintos launched I&A so make P2P lending easier. They tried to make to investment opportunities available to anyone – of course to collect money for their platform.

In comparison to you the usual auto-invest the diversification in larger. This is mainly because you invest among any loan originator, country and loan category. Also this sounds magnificent the “usual risks” of P2P lending are still there. And P2P has still a high risk compared to shares or bonds.

How to use Invest and Access?

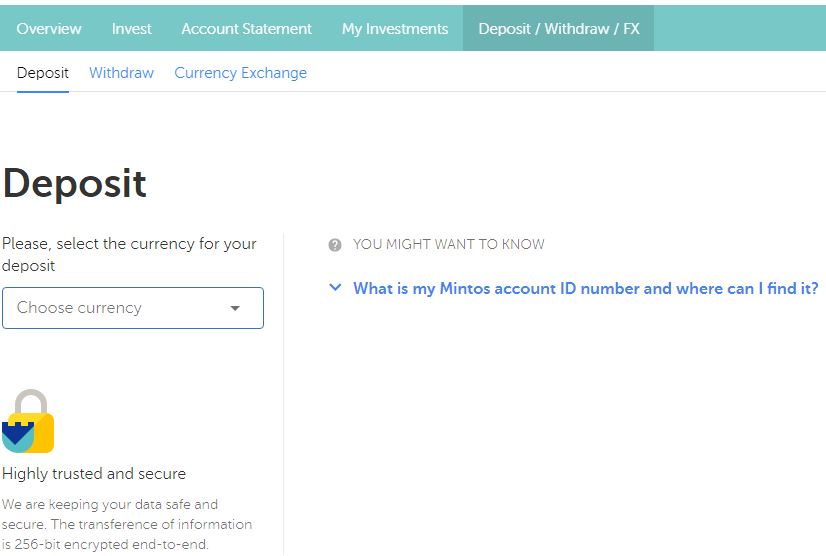

You are ready to invest? Than it is damn easy. Go to Mintos and create a new account. After setting everything up and verifying your person, you will get access to your account. Now you can make your first deposit.

At first choose your currency. Afterwards you will see several possibilities to send money to your investors account. Until today I transferred my deposit via bank transfer. Different ways may be possible, but I have not tested them.

Mintos says, that deposits will be send to your account within one to two days. I experienced it exactly that way. Just be sure to mention your investors number somewhere. This is essentially to send the money to your investors account.

Activate Invest and Access in your account

After receiving the deposit in your account, you just have to activate Invest and Access. Click on the tab “Invest” on the upper bar. You will be forwarded to a page, where you can choose to adjust your auto-invest or I&A.

The required minimum invest for Invest and Access is 500 Euro. Everything below does not work. Here you have to use the auto-invest with the minimum invest of 10 Euro per P2P loan. Back to the adjustment: It is nearly done! You just have to save it.

What investment target is best?

As anytime, you are the one, who has to feel comfortable with it. The investment target is a size of the Invest and Access, which will be invested there. If you just want to check it, leave it at 500 Euro. Of course you are able to edit this adjustment at any time.

I adjusted my investment target at 2.500 Euro. There is no special reason for it. I think the size is “big enough” to rate the success of it within the next 6 – 12 months, but small enough to feel comfortable with.

Choose several plans to keep your money working

Interest rate is just paid, when your money is working. Until now I have not experienced a not-working Invest and Access, but the possibility is there. Especially when my investment target is hit, and the money will wait in my account.

For those cases you can act differently:

- Setup and adjust an auto-invest meeting your requirements

- Adjust the investment target at Invest and Access

As there are no experiences with those “risks”, I can not give you any advice. I personally try to not check the portfolio every day. Therefore I setup my usual auto-invest, as I described it in my Mintos-blogpost. So every time the Invest and Access will not work, the money could go possibly into my auto-invest.

Is this possible?

Yes it is. But if you prepared your account for this scenario, it is no big deal. When I made my first investment in I&A, about 60% of the sum was invested. My auto-invest invested the rest. Now, about 1.5 months later, any new payment is invested in I&A.

In fact you just have to prepare things. As I do not want to check my account every day, I have to take care than the money-machine is running. It think its better to loose 1-2% than to have money being not invested.

Challenge myself every day

Honestly, I do not like challenges. I am quite lazy, so challenging myself is something which causes fear and nausea. Leaving the own, warm comfort zone feels like walking through cold rain in the dark. But, any time I left my comfort zone, something magical happened. Walking through uncomfortable times, brings me to a new level (just to use a buzz word).

Some weeks ago I found Mitch from Ireland. He owns a Instagram Channel as well as a blog. He is also in financial things as a trader, but his Instagram channel is about mindset and challenging yourself. And there was a post to challenge yourself with a savings-challenge. The idea was to save 25 Euros per day and read 24 pages per day – for 21 days.

Using Invest and Access for my challenge

I decided to invest the whole 25 Euros. Additionally I made the challenge a 100-day-challenge, knowing about my discipline and laziness. So the idea is to invest 2.500 Euros into I&A and keep the challenge up for that time.

Until now everything is running smoothly and my I&A account is growing like it has never been before. I mean, this is the perfect example for: Where focus goes, money flows!

I am very happy to found Mitch on Instagram and I really like to recommend his blog “Mitchsmastermind” as well. Just read through his “Shots of Mystery” – they are very valuable for me and written in a nice personal style.

Invest and Access: Still P2P and damn easy to use

Checking the best rates for call money, you will just find offers of about 1%. Mintos offers you about 11-12% with an availability of 85% in the shortrun and 100% in the middlerun. Bondora offers you 6,75% for 100% of your invested money. And I think here is a big misunderstanding.

I does not matter if you invest in a usual auto-invest or I&A or G&G – P2P is still at high risk. So I do not understand those offers as a day money account. It is not. I&A is no day money account. The bank has to secure call money by law. In P2P lending it is not. P2P loans are contracts between you and someone else.

If you are not willing to invest into P2P lending with an auto-invest, you should not transfer money into Invest & Access or Go & Grow.

But if you want to lend money in a diversified and automated way in P2P lending, Mintos has a great deal for you. Invest and Access is a product, which makes investing in P2P loans easy and easier for everyone, who is not willing to use time adjusting the auto-invest.

What do you think?

Is I&A interesting for you? Hope to read your opinion below in the comments.

Leave a Reply

Want to join the discussion?Feel free to contribute!