Will P2P lending crash during financial crisis?

Financial crisis as well as economical meltdown – since weeks and months there is a myth-monster called “recession” on the news. You can read it in any newspaper , watch it on any news-video and if you believe in official numbers, the trend is confirmed.

Especially here in Germany the myth-monster is very active. The macroeconomic policy institute just released their newest date of a recession fear. The probability of a recession in Germany within the next three months climbed up from 43% to now 59%.

Table of Contents

Recession might be a sign of financial crisis

I really do not want to discuss, whether we are facing a recession or not. I believe in a different way, as in my eyes there are a lot of fears in the market. German politics, Brexit and of course the global topics like Iran, economic “war” with China. But nevertheless, I would like to talk about what will happen with P2P lending during financial crises.

When income stagnates and economic power cools down, the value of money decreases. The first thing what usual happens here, is that debts will not paid in a reliable way. When people are overfunded and economics are starting to cool down, their model of financing the living expenses breaks down.

What will happen, when debts are overdue?

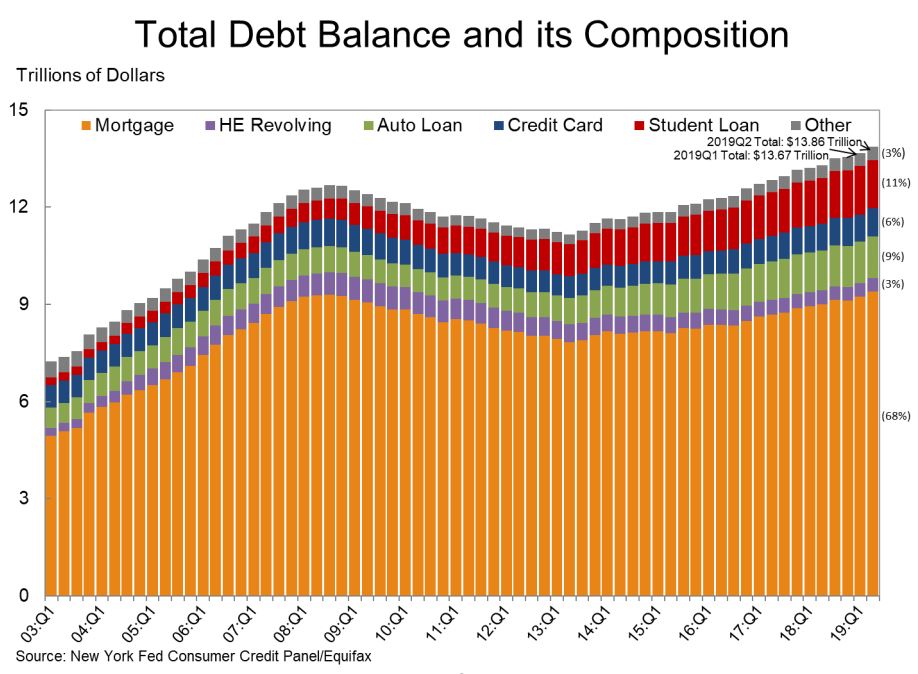

With the help of several indicators a loan is rated in its probability of its repayment – or the risk of a credit fail. There are always debts who are overdue. You can see it in any of your P2P lending accounts, as well as you can see it on those charts from the FED or ECB.

If this share rises, the whole system starts to waver. And if nothing happens and no one takes care about it, the system will shake and afterwards break down. Exactly this is what happened 2007/2008 at the start of the worldwide financial crisis.

Loan to value – what happens, when it changes?

At lot of P2P loans are signed with the so called “LTV” which is the loan to value. Usually not the whole value is financed by a loan, but just 70%. This is reduction as a safety cushion for the lender. So it his loan gets overdue, his loss will be less.

Imagine for example a house with a stated value of 500.000 Euro. The borrower will receive 350.000 from his bank to buy. The LTV is 70%. But now imagine, that economics are cooling down and the area is not that popular anymore. The value decreases from 500.000 to 400.000. Now the LTV is 87,5%. Would you still accept the loan as an investor?

There was no financial crisis in times of P2P lending

Unfortunately P2P lending in its todays size have never been affected by financial crises. There is no data about what happens to P2P platforms, when the economy is struggling seriously. In 2007/2008 there were just American P2P platforms like Lending Club and Prosper.

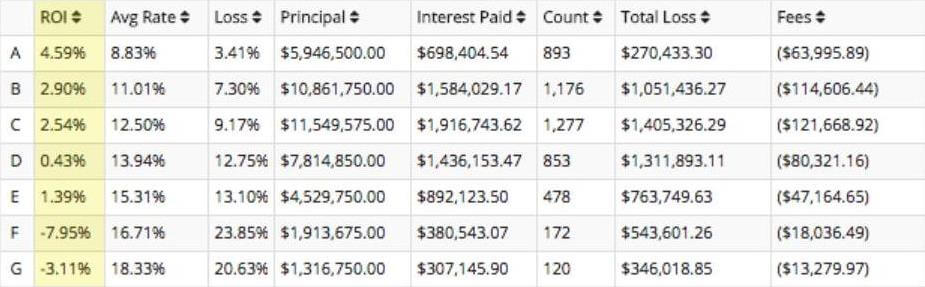

As their size was very low, they were not really affected by those economic crises. But with the small data from Lending Club, which shows the interest rates bet ween 2007 and 2009, you can see, that crises times were still with a positive interest rate. Of course, this is nothing which could be valid today, but it is an interesting indicator.

Especially the safe and good ratings were still with a positive interest rate. Those ratings with a higher risk went into losses, so you would have lost money with those as an investor. But is this somehow comparable to today?

P2P got big the last years – so the risks do

Since years P2P lending became very popular for investors. This is mainly because of the high interest rate. Another economic crises will affect P2P lending in a different way. And I would like to draw a picture here, what might happen. But please make your own thoughts about it to make your own decisions.

Especially the “run” on P2P investments makes platforms very creative. Since months every day another platform comes up with a slightly different business model. Everyone is just watching the interest rate but only just a few take care about the business model.

Additionally every P2P platform has its own rating criteria. There is no common standard. You are not able to compare the rating on Mintos to a rating on Bondora – and those are mainly the biggest player.

If your money is important to you, check the platform!

Crises times always bring up new things. People and governments are trying to find their learnings out of those tough times. Especially regulations and standards are set after crisis. Maybe this is quite good and interesting for you and me as an investor, because standardized rating criterias will meet our wish for less risk.

But already today any investor is able to lower its personal risk with P2P lending. The more you diversify over several P2P platforms and as well for ratings, the less risk you have to care. Imagine someone hunting for the highest interest rate. We sets up his auto-invest to maybe 14%. Will he or she receive A/A-/B-rated loans?

I guess not and so the portfolio will be mainly out of high risky P2P loans. If crisis times arrive, his portfolio will be the first one to accept losses out of overdue P2P loans. Maybe the platform will try to help with their buyback guarantees. But what do you think will happen, when a lot of P2P loans are overdue and the buybacks have to be paid?

Do not hunt short term, but in the long run

I really understand everyone, who is hunting for the highest interest rate. I of course do it the same way, as you can see on my Mintos-post. But to build a long-term P2P portfolio your have to think in the long run. Try to build an portfolio, which has all asset classes, all different ratings and of course most of the Top10 platform by size.

Additionally you should check in which geographical areas your P2P loans are located mainly. If you just invest into P2P lending in Latvia, Estonia and Lithuania, this might be an good idea at the moment. But if those Baltics get into trouble or the European Union, your portfolio will be in trouble to.

What you have to do, to avoid portfolio trouble

The sheet from Lending Club and the suggestions from a lot financial experts tell you to diversify your portfolio. Of course your interest rate will drop, but P2P lending should additionally just be a part of your whole portfolio. You are probably doing better with 8% in the long run in your P2P portfolio and your overall portfolio.

Please take care about the following investment rules:

- Never put everything into one basket

- Diversify among different P2P platforms

- Choose several geographical and economical categories

I will get a bit deeper into those points. And of course I am not the inventor of those investment rules. They have been written by legends like Benjamin Graham, Warren Buffet and George Soros. I am just trying to reword them for P2P lending.

Never put everything into one basket

You should have an investment strategy. And here P2P lending should be a part of. Do not focus on P2P lending as the only investment. The more your diversify your whole portfolio, the less risk you have in total.

Imagine financial crises and your P2P portfolio breaks down? With a diversified portfolio you will still have stocks (maybe also affected by financial crisis), real estate and raw materials. Maybe your whole portfolio will decrease, but the shares will be very different. Focussing on P2P lending will leave you with a big loss in case of crisis times.

Diversify among different P2P platforms

With choosing one P2P platform you will have to take the risk that this single platform breaks down for any reason. Maybe not financial crisis, but imagine they are hacked or their server breaks down including all data?

Investing into at least 10 different platforms seems a good idea to diversify. Of course you are able to choose more, but with the biggest 10 platforms you should be quite secured. Claus does good work every month by releasing the lending volumes from P2P lending. Also it is his own research, it is the only valid data here.

Choose several geographical and economical categories

Also consumer loans often seem the get you the highest interest rate, you should not invest just in those. Just imagine the consumer loans will be those being mainly affect by financial crisis (as they were back in 2007/2008). Spreading your investments among several P2P investments like consumer loans, business loans, car loans, short term loans or factoring loans (and several more).

The same is important concerning the geographical belongings. Investing just in one single area makes your portfolio addicted to the economic circumstances there. Looking back in history separate crisis for geographical regions are quite often, so why take this risk?

Diversify your investments among a substantial number of different categories, business model and of course geographical areas. Also you are maybe losing interest rate from 1-2% or maybe 3%, the security of your portfolio will skyrocket.

And of course you are able to invest money beside you main strategy into a highyield P2P portfolio, but please to not take your main portfolio therefore. Gambling is allowed and you do not have to explain it to me, but to your own strategy. But playing the safe way, you should keep the shares of this capital as low as possible.

How much do you invest into P2P lending?

For me P2P lending is something like a passion. It is fun to see those platforms grow and take influence into economics. I like to talk about it and to make my own experiences. Nevertheless P2P lending is still very risky.

Trying to think about my portfolio on a rational level, the share of P2P lending should not be more than 20%. Why?

Gerd Kommer is a german autor, who found a portfolio which is without any risk on the long run (minimum 15 years). He describes his idea with a lot examples out of the last economical crisis. Also I think you can not eliminate risk at all, you are able to descrease its influence dramatically.

Kommer suggests in his worldwide-portfolio aa share of 17,5% of high risk investments. In my case this is P2P lending with a share of about 20% at the moment. I would like to increase the total sum, but I would like to lower the share within the next years down to maybe 15%.

But in the end it is the decision of each and everyone itself. I am not able to recommend anything. Kommer made an example and you can rely on it or not – or you can copy any other portfolio. It is your decision and your responsibility.

What do you think about the risks of a financial crisis in P2P lending? How much of your portfolio is invested in P2P loans?

Leave a Reply

Want to join the discussion?Feel free to contribute!