DoFinance is doing your finances long-term with up to 12%

DoFinance is a P2P lending platform, which I have to love from its name. “Do your finances” – sound pretty like “take the responsibility and do your own stuff”. I really like that. But investing just because of good emotions? No way, so let’s check DoFinance today.

The P2P platform belongs to a company called Alfa Finance Group. It is a company established in 2015 trying to make investing possible for anyone. Especially the will to combine typical and modern finances with each other for investors was important to the founds Janis and Viersturs.

Table of Contents

What is the business model of DoFinance?

At the P2P Conference in Riga I met Toms Abele and Ieva Kuka from DoFinance. We had a nice chat about DoFinance and their strategy. Beside now knowing two persons from the office there was another reason for me to invest in their platform: Diversification.

Honestly the business model is not that new: investing in consumer loans. There are tons of other platforms offering those P2P loans. BUT please check the geographical allocation of those loans: Latvia, Georgia, Poland and Indonesia. As Toms explained they have some expertise in investing in Indonesia as well as an own expert down there.

Indonesia as one of the big players soon?

I just ended up reading a book about Asia in the next 10 years. Indonesia plays a quite interesting role today in the Asian economy. They have about 265 million people living there. Until 2030 several valuations say that their population will rise up to 325-350 million people. So, their needs will increase as well as their economic power.

As you can see on that chart the population is quite young. The average age is about 29 years. So a lot of young people will be able to push the economy of Indonesia, as they already did the last years. Goldman Sachs mentioned Indonesia as one of the so called “Next-Eleven-Countries”. Already today Indonesia is Top15 of the world. And their economy grows with about 8-11% per year.More people, more need, more power

I am quite sure, that Asia will be the economic engine of the next years. A lot of people, especially young people live there and will learn from the typical western countries like USA, Germany, France and GB in a very fast way. Connected to their own ability of thinking and without the “western economic problems” Asian countries should be able to catch up very fast and go for the worldwide lead in economics.

But coming back to P2P lending: A lot of young people in an economically brilliant situated country will lead to quite a lot of needs (and of course more income power). So, consumer loans will rise. Seems like a quite good idea to be invested in that area by now.

Diversification among P2P platforms with DoFinance

As you know I am absolutely into diversification. Not because if trust, but because of probabilities. Quite a lot if loan originators visited the P2P Conference in Riga. And it was really nice to get in touch with them. But investing all your money into the biggest platform like Mintos makes it a bit risky in my eyes.

Therefore, I searched especially for Asian alternatives on the conference. And I found one with DoFinance. Also, they are just offering P2P loans in Indonesia, it is still a big national economy you are investing in. Of course, I would loved to see more Asian countries. But for now, DoFinance is an interesting investment.

How to invest on DoFinance

Well, here it get’s a bit strange in my eyes. You can easily sign up on DoFinance with the typical data like your name, your passport and a mailadress. Investing on several P2P platforms I am used setting up an auto-invest and let money work.

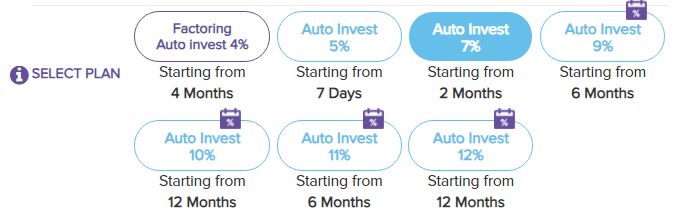

At DoFinance things are bit different. The investors backend offers you several possibilities of investing. As you can just invest in their typical plans OR manually, there is no auto-invest you can adjust manually.

The investment plans are quite easy to understand. You start with 4% for factoring and minimum four months of investment time. Everything ends up with an 11%-auto-invest for a minimum time of six months. Quite untypical, but is not that worse, as it looks irritating on the first sight.

Interest rate in the right way

Interest always comes from risk. The higher the risk, the higher the interest rates rises. For the short-term investments DoFinances offers you’re a 4%-auto-invest into factoring loans. This does not look attractive at all – you are right. But just imagine you have a fixed amount of money to invest in for four to six months, this plan is even more that those day money account with 0.8%.

For investing long term, as I do, those short-term investments are not interested. As well as the interest rate rises with a longer period of investing time. Calculating for myself I “have” to invest in the longest investment-offer, to meet my own requirements.

As a VIP-member of the platform you will receive the highest rate at 12%, but without it at 11%. This is still a good investment I think. It just looks unusual as you are maybe used to different designs from other P2P lending platforms.

Every P2P loan has a buyback guarantee

Maybe you still remember my own requirements for investing into P2P lending. There was especially the point of buyback guarantees. And of course, DoFinance is offering buyback guarantees. Well, you do not have the chance to invest without it. All P2P loans have a buyback guarantee.

Let’s focus on interest income

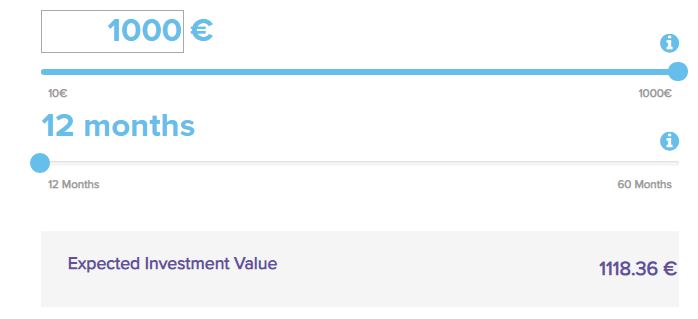

I love to receive money for nothing. And my DoFinance investment plan will pay me monthly interests. The minimum investment amount is 10 Euros. So, I will be able to reinvest again, after receiving the interest repayment.

But this point is again different. As you are usually payed interest and repayment at the same time, DoFinance just pays you the interest. Your initial investment is hold back for the period of time you have chosen. The auto-invest invests the money into new P2P loans.

I invested 1.000 Euros to my account. So, calculating with the official 11% I will receive an interest repayment of about 9,16 Euros per month. This is below the minimum invest of 10 Euros. Make your investment but think about I better than I did. With an investment of 1.100 Euros I would be able to reinvest every month again.

Think about the operational time

If you invest, your money will be invested for the minimum term. Of course, you are able to adjust another operational time. For any reason myself ruffle itself against it. Why? I can not really describe it. I do not want to lend my money away for fixed 24 or 60 months. As I described I want the highest possible flexibility. So I choose the minimum lending time of 12 months.

With the repayments I will be able to check, whether I am investing another time or not. I just have to take care about the operational time. It will be another 12 months for any new investment, if I choose the same plan again. But of course, you can choose any other plan, as maybe to 4%-factoring investment plan for your 2 months minimum investing time. It is just a point you have to think about.

Let’ start investing on DoFinance

I like it, when things are simple. My strategy of investing in P2P loans is that simple. Diversifying the money over several P2P platforms with a focus of spreading the loans all over the world. Especially the worldwide P2P investments are not that easy to achieve. DoFinance is a good opportunity to invest in the booming market in the future.

Registration is very easy

Just go to the website of DoFinance and register yourself. You will be able to login into your account very fast, whereas the registration with your passport will be done in your profile. You have to scan your passport from the front and the back. Afterwards you upload it in your account and will be verified.

Add funds to your investors account

Make you deposit by using the button “Add funds” in your profile. The first deposit must be transferred from a private bank account. If you want to deposit some more cash to your account, you can use Transferwise later on.

Go to your bank account and use the IBAN and BIC from DoFinance as shown on the screen in your account. Never, ever forget about your investors number in the purpose. This makes sure your investors account is credited the amount of money.

Chose the right investment plan

I already mentioned that there are several investment plans. I decided to invest long-term into the plan with the highest interest rate. By clicking on the plan, you see the details.

Also, it sounds strange, I would recommend taking care about the little percentage-icon. This means, that you receive monthly interest payment. I feel good and a bit safer, when the money flows into my account. But investing in the high interest rate plans always includes this icon, so do not be afraid.

Adjust your plan and invest

You can choose the plan size in Euros of your plan, as well as the investment time. The maximum is always your account statement. And the maximum investment period is 60 months. In my case I decided to invest “just for 12 months”. It feels (again) better and I will always have the chance to invest again.

I mentioned it before. You can always setup a new auto-invest as soon as the minimum deposit of 10 Euros is in your account statement. You are able to invest every month and of course you can make another deposit on your account. It will be a new auto-invest with another new investment period.

Forget about the investment

The investment plans make DoFinance a bit fixed. In the first moment this is maybe a thing to care about. It feels different, as you are not that fixed anywhere else. Depending on your investment goals the second moment is not that bad expected. Giving you 11%-12 % interest, you do not have to do anything more.

You do not have to check, whether there are new loan originators. Also, you do not have to check your account and whether the money is invested. You are just receiving the monthly interest repayment to your account and that is it.

It seems quite to forget about your DoFinance investment, as you do not have any tasks. Of course, you can “kick your interest rate” by investing in shorter terms investment like factoring. But you do not have to.

My summary for DoFinance

First of all, I wanted to thank Toms and the DoFinance team for their time. The gave me a lot of answers to my questions. I really appreciate it – thank you!

I invested in DoFinance especially for the diversification reason. The platform has nothing totally special in P2P lending (or maybe I have not found it). But investing here means to invest in Indonesia as one of the biggest economies in Asia. The platform has its own experts over there in Asia and therefore an expertise in P2P lending in the Indonesian area.

Setting up the account as well as the auto-invest is very easy. You just have to get used to the steps. And you also have to accept, that you are not the one to set up your auto-invest. DoFinance offers you several options and you have to cope with them or leave it. In my case I decided to stay and give it a chance.

You want to invest in DoFinance as well?

Just click on this link to their website and register your own account.

Within days you will be able to make your deposit and start investing. It is as easy as I described it – and you do not have to be confused by the different way of the auto-invest design.

Investing with DoFinance means investing in Indonesia as one of the worldwide increasing economic areas. Additionally, your investments will go to Latvia and Poland. Here economics increased over the last year far over the average of the European Union. So be sure you are investing in the increasing areas with its chances and of course theirs risks.

Leave a Reply

Want to join the discussion?Feel free to contribute!