13 Critical Lessons from “Rich Dad Poor Dad”

Are there lessons from “Rich Dad Poor Dad”, “Money – Master The Game” or “The Richest Man inBabylon”?

I doubted that back in 2015. That year I had my personal financial breakdown. Some things did not really worked the way I wanted them. And I was not even able to correct it. So I crashed right against a wall and dumbed my finances.

I felt like you already read in the news:

“Money is bad” – “Only frauds make money” – “Money corrupts character” and so on…

Meanwhile, 7 years later I would answer the initial question differently:

Are there lessons from financial books? Yes, there are. But it always what you make out of them.

Table of Contents

Working with books and finding critical lessons

Honestly, I am not the guy to mark half of my book. I do not even mark important sentences or pages. Lessons are always very individual. While some hint is absolutely irrelvant for the first one, it means the world to the second reader.

But I think you might sum up some general lessons from a book. And this is why I wrote this blogpost. Just some weeks ago I started reading Robert Kiyosakis “Rich Dad Poor Dad” again.

From my point of view it is the most valueable book of him. The rest sounds pretty the same, but I have not read them all. So let’s focus on the lessons from “Rich Dad Poor Dad”, which I found out for myself.

#1 Understand the difference between ASSETS and LIABILITIES

In our life there are some crucial decisions to make: Marriage, kids and buying a home – probably the classic questions of every couple. All those big decisions are somehow related to money. But only one of them is affecting your financial health: buying a home.

There is always a big party being pro to buy a home and the other party, which is against it.

Kiyosaki points in his book out, that you should always take care about the character of the “thing” you put money into. Buying a house is not necessarily an asset. Buying it, working on it, take care for it costs money. Sometimes a whole lot of money. Does this sound like an investment, if you need to put more money into it?

Wrapping this point up: Buying a home an living in it, is not an investment. It is a liability, because you need to make the downpayments, you need to save money to take care of it and in the end there is no chance this investment will make you money.

Putting your money into a REIT of a real estate P2P lending platform will make you money. So it is always a matter of your personal perspective. If you buy a home to rent it out, it will make you money.

There is a fundamental difference between assets and liablities. And they won’t change their character just because you want them to. A house you re living in will never be an asset. A watch, a new TV or a new car are never investments. These goods are liabilities as you usual pay money for them to first get them and second take care of them.

#2 What matters is how much money you keep

Back in my early “financial days” in 2015 I read a book from the German author Bodo Schäfer. He said to start off your financial journey you should save at least 10% of your income. And if you think you can’t because you are not able to tackle the month with your current salary, you still should do it.

It does not matter whether you are not able to manage the money with 100% or 90% of your income.

The trick is to keep that 10% and make it your financial employee.

Usually our lifestyle arises the same amount we raise our financial income.

What is the first thing people do, when they are told they will receive an income raise? Correct, they are planning to spend the money on whatever. So it is gone. They are not able to keep it.

I started with those 10% back in 2015. And I kept raising it every year. Anytime I received a bonus or a salary rise I increased my savingsrate at least by 50% of the total rise. Meanwhile my rate climbed up to about 32% throughout the years.

And still is valid for any income. It does not matter whether your 2.000EUR per month or 20.000EUR. It seems easier to keep money, when you earn more. But it is not. As our lifestyle always rises with the same amount as a payment rise the turning point is the moment you stay on the old leverl and increase your savingsrate.

#3 Make your Money Work For you

Kiyosaki flipped houses and rented them out on a quite big scale. But the real lessons from “Rich Dad Poor Dad” are everything about the Cashflow Quadrant. It is the EBSI quadrant, where everyone of us might put himself into.

EBSI Cashflow Quadrant from Rich Dad Poor Dad – Robert Kiyosaki

Usually we all start as E – Employee. We are exchanging our time to work for some else. And therefore we receive a salary. S stands for Self-Employed. The work is the same here, as self-employed people are still exchanging their time for money. But it is on another level with a little more freedom.

E’s and S’s should develop to B’s – Business Owners. That swaps you around and people start working for you. Now they are exchanging their time for you to receive a salary.

The top of everything is the I – Investor. He is only receiving money from his investments.

Is there a right or wrong? Hell no. But increasing your financial health you should always focus on exchanging less time for money and getting your money to work for you. There is no necessity to get selt-employed – no way. But you should always at least be an E + I.

The larger your I becomes the less dependent you are from your E. It looks ideal to be active on all of the quadrants. Over the years and decades you should move your from to the I with the biggest share. The E is the most dependet one – the I is mostly independent.

Since I am taking about that I am mostly an ESI with a the biggest share on the E. But while I started back in 2015 with a 100% E the share now dropped down to maybe 90%, as 10% of my income are coming from the S and the I. Change that in your life and you will come closer to financial wellbeing.

#4 Control Your Emotions

We had a lot of it over the last years. Stock exchanges dropping, cryptos skyrocking and dropping again. Also in P2P lending the first platforms had to declare bankrupcy. Losing money is never a good feeling, no doubt about it.

Kiyosaki says in his book, that you need to control your emotions. As well before making an investment but also when it is running. The less emotions you have while investing, the better your decision will probably be.

Focus on the facts. Try to analyze an investment opportunity without any emotions. And than check whether it is an investment case for you and your goals or not.

I am focussing on increasing my I. I want to be ahead of the inflation rate every at least. And I want to grow my monthly income from capital investments to a certain amount, but also with a good risk reward.

Control your Emotions

Do ETF, dividend shares, P2P lending and crypto stacking help me to get there? Yes.

Do day money, bonds or spending help me? Probably not.

This is why I am strongly investing into ETF, dividend shares and P2P lending. Their “share” in my portfolio is aligned with the risk I am willing to take. It is about 20% into P2P lending, 75% in stocks and only 1-2% crypto staking.

Only once a month I am checking my financial status and writing down the numbers. I am comparing myself to several indicators. If my portfolio loses 3%, but the related indicators loses 3,5% I am quite happy. It outperformed the market by 0,5%. And if I am able to close the year with a “win” of 8% and indicators won 7,5% – I am happy to. Especially when the inflation rate is below my result. That means I was able to generate a net capital growth.

#5 The Rich acquire assets

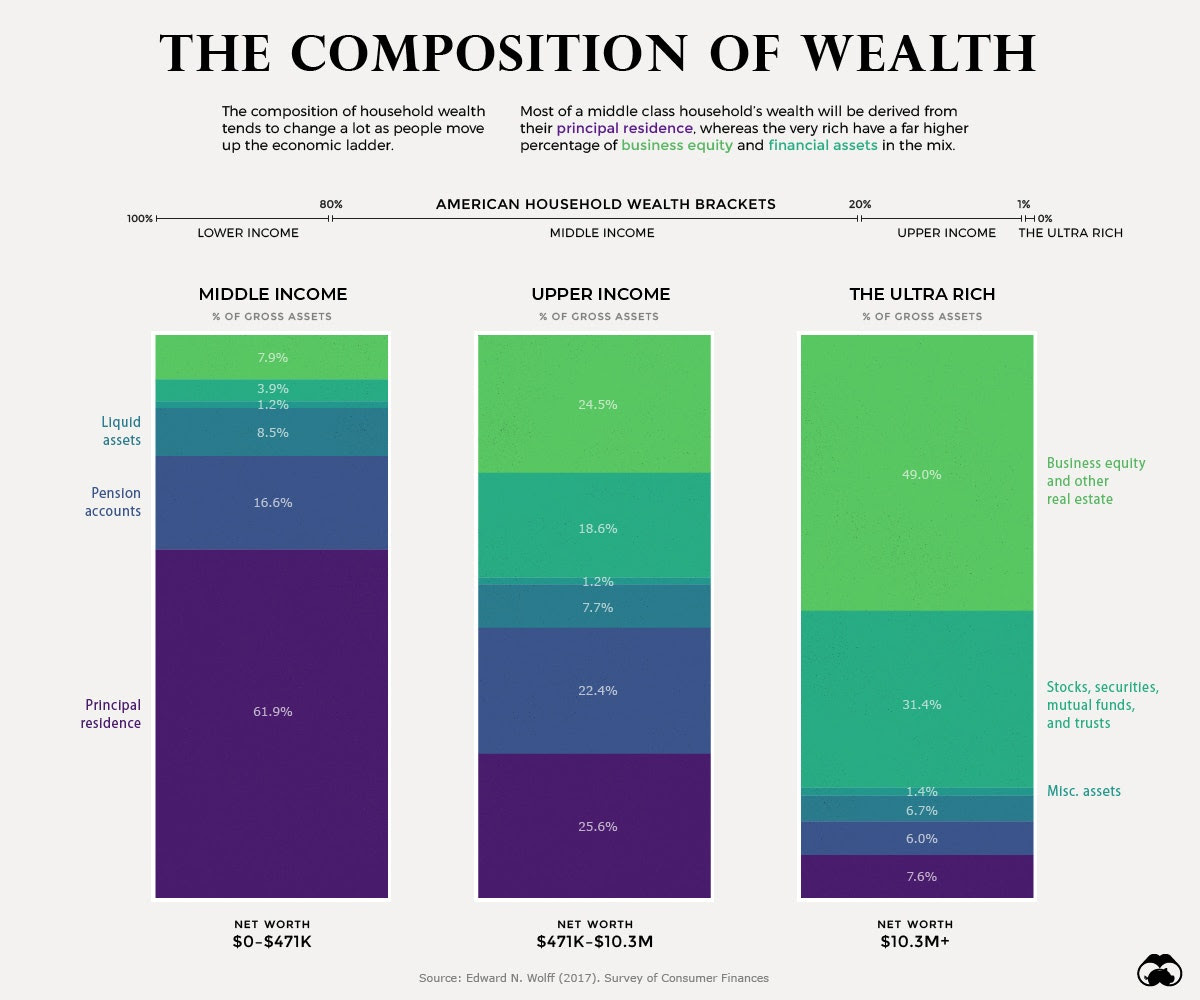

I would like to share “The Composition of Wealth” with you. I found it somewhere in the internet. It shows the shares of investments related to the income of people.

“The Composition of Wealth” – source Edward K. Wolf, survey of Consumer Finances

The stats are divided into different income groups. Furthermore the net worth is clustered after its liquidity.

Look at it – the share of “principal residence” goes down from incredibly 62% to 7,5%.

Question: Do super rich people are rich because of their own homes? Answer: It does not look like it.

Their worth is mainly made out of businesses and stock investments. The more liquid a portfolio is, the bigger it is – contrary to the middle income group.

This was one of the most important lessons from “Rich Dad Poor Dad” for me – finding what is a valueable asset for me and increase the share of it in my portfolio.

Also I am not ultra rich, probably not even in the upper income group I try to structure my portfolio like it. The more money I invest into more liquid assets, the bigger the chance of my portfolio to grow with it.

#6 Dont Trade Freedom for Money

Kiyosaki says we are tending to always chose the easy way in our life. That is quite legit – for me as well.

The moment we decide to commit on what we want to achieve is the moment everything turns. If you do not think about going on holiday from your savingsrate, but to still save it – that is commitment.

This does not have to be the decision to never go on holidays again. Not even right after that moment. But it is the decision to think about in a much different way.

Usually you know which kind of holiday you want to go and what this will cost. Instead of sacrificing your savingsrate you should make a monthly budget. Knowing your holidays will cost your for example 3.000EUR per year, you should save 3000 / 12 = 250EUR every month.

Of course this looks mean as you steal yourself another 250EUR every month. But in the end you avoid stealing your freedom.

The same is valid for any kind trade of your time. You can always convert time into money. Buying the latest iPhone costs your maybe 1.000EUR. But it also costs you your time. If you are earning 50EUR per hour, the latest iPhone costs you 20 hours of working. Is it still worth it?

A little bit different to this idea I try to express the price for something in “missed passive income”. I might now by the latest iPhone, but with this decision I decide against an 1.000EUR investment for example with Bondora Go and Grow at 6.75%.

So I am trading a 1.000EUR smartphone against a monthly income of 5,62EUR for the rest of my life. I am now 41 and I will retire latest at the age of 67. That is 26 years of investment and compound worth 5.464EUR.

Is this spending still in balance for me? Asking yourself this kind of question will make you think and probably decide less intuitiv and more strategically.

#7 Understand Personal Finances

It is like fuel for a car, oil for mechanical machines and food for the horses: understanding personal finances!

Keep up with it. Eduacte yourself and learn the lessons from “Rich Dad Poor Dad” – out of every book. Make it a habit to watch at least 10 minutes a day Youtube videos about finances. Make it a habit to read 10 pages a day in financial educating books. And do what ever is necessary to control your finances.

Understand your Personal Finances

First of all it is important to control your finances. And when you are back at the steering wheel you might change the direction. By deciding consequently towards your goals you might adjust the way. With any kind of actions you can then e.g. increase the savingsrate or setup your own portfolio.

Whatever you do: with your financial “fuel” – which is your financial knowledge and financial intelligence – you will be able to cope any stormy-sea-situations. You won’t be rich tomorrow, but taking over the steering wheel will make you taking responsibilty to go for your financial goals. If it works out you should see the target on the horizon – if not, you have to adjust the course.

#8 Invest In Yourself & Teach yourself financial literacy

This finding out of the book is related to #7 understanding personal finances. But I would like to go deeper into it.

You know ETF’s and fonds and stuff like that. There is always a person or a team working on the investment. It might be some kind of artifical intelligence or a physical fonds management team.

Nevertheless – you have to develop those skills for your personal fonds. Your portfolio is your fonds or your ETF. You are the manager and it is up to you to make the investment a success.

Would invest into an ETF where you know the management is not up to date? Not educating themselves about their investments? Probably not.

Why do you think your investment will succeed when you do not take care about your financial intelligence?

Be the best at what you invest in to make the best decision for your financial wealth.

#9 Become brave and own your shit

In life we often make experiences which are preventing us to do it again. But already at the early age when we were kids we learned to get up again and try it another time. As the things get bigger and the damages grow the same way we get scared.

During 2000 everyone in Germany put their money in stocks. And about 99% of the people failed to make money. The stock exchanges crashed due to the dot.com-bubble and a lot of people lost a lot of money.

No question – losing money does not feel good. But crashing with your bike does not either. Would you think about never getting on a bike again?

Become brave and own the consequences

It is just money you lost. And if you lost a lot it was the stock exchange or the company you bought shares of – it was only you. Your financial intelligence was not ready to invest that much. Therefore start early and start small. The more your experience, the better you will get.

And the more you educate yourself about the topic, the better your decisions will get. Maybe it was not a good idea to invest all of your money into one special share. An ETF might be the better decision in the beginning.

Become brave and do not put yourself out of business just because you made a bad experience.

The slogan “Own Your Shit” is one I really like. I always try to not blame anyone else, also they might be the guilty ones. But it is always up to me and how I react on something happening. And than improve my behavior to avoid this mistake in the future.

#10 Mind Your Own Business

Especially in times of social media we tend to look at people in a different way. We are admiring them. “Look, there is dude. He is ten years younger than me and has already reached his financial freedom” – or similar thoughts like that.

There is huge potential putting ourselves down. I am not like him or her and this is why I am bad.

That is pretty wrong. Is there a chance I would have made it the same way as Mark Zuckerberg, Usain Bolt or in my case Lars?

Maybe, I do not know. But the fact is, that I am not on their level at the moment. I am on my own level. And I am trying to compare my level to theirs. This is of course making me feel bad. But am I really bad or unsuccessful because of this?

Robert says in his book: “Mind your own business”. Take care about where you started, where you are now and where you want to go.

If you need to compare, compare to yourself yesterday, last week, last month or last year. And when Lars tells me he was able to invest 50 hours last week into his blog I am really grateful and happy for him. But my goal is to find at least 12 hours per week.

That is my benchmark. And hitting 12,5 hours is great, whereas 9 hours would be below what I wanted to. Mind your own things. Compare to yourself and try to beat the shit out of you to be better than yesterday.

#11 Use The Power Of Networks

There is a good quote, which I want to mention here: If you want to go fast, go on your own. But if you want to go far, team up with the right people.

The more you watch who is in your inner circle, the better the circumstances will be to grow. To be honest it is not always able to have all the people around you wishing for. But use the “best fit” for you.

Use the power of networks and cooperations

I think with todays technical opportunities you should be able to also count them in, where you do not have their mobile number. Edward Mylett and Andy Frisella are two guys in my life taking counting in my inner circle.

Their content is impressive and triggers me. Why not choose them? I am able to listen to their podcasts, watch their Instagram stuff and follow their way of thinking. It works for me, also I have never met them.

Beside those “virutal mentors” Robert says in his book you should connect with as many people as possible. Also those you do not want to connect with. Often in our lives we are some kind of biased for no reason. It is always great to break those barriers and look behind.

During your way you will meet a lot of challenges. As todays network will probably not be the one you will have in two or five years you should always watch out and connect. You do not necessarily need to be friends with everyone, but know who might help you to get on that next level.

12# Overcome Your Obstacles

Have you ever been going fast on a highway? What do you see?

Probably you will see a straight road. Hopefully this road is in perfect condition. And you will be sitting in a fast car.

How does this is related to the headline? All of this circumstances have not been then since the first day. Someone decided to built this road, built this car and give you the chance to drive there. And of someelese is not taking care of the road, it will not be in the same condition in five years.

Fact, you way will be full of obstacles. Be the one to built your personal road. You might use shortcuts out of the experience of others. But stay on your road and make it happen, what you decided to go for.

Obstacles on your road are not a sign of a wrong path. Those are challenges who you need overcome. Built our own road. Built your own car and try take care for both of them.

Those obstacles are some kind of challenge, if you are ready for the next step. You do not need to know how to paint the signs on a street as long as you do not know how to create the tarmac. It is all one big process out of a lot of steps inbetween.

When Robert and his wife started they moved into a caravan to save costs. They had not lost – it was their way and their personal interpretation of what to do to get to that next level.

13# Reinvest and Use the Power of The Compound Effect

The compound effect is one of the most powerful things to implement in your life. As I am writing about finances I often mention it on that topic. If you invest 100EUR and you save the interest payment for one year, your investment will grow to 100EUR + X until next year. The interest out of this X is the share your money is working for you.

Compound effect works for everything else. For example in the kitchen: If you take care what you put into your body, it will become more resilient and powerful.

There are two ways of using this power. Robert has one of them and I would like to add another one:

#1 Robert always tries to use other peoples money. In his book he describes how to use money from banks and save taxes and costs. It is a pretty smart way you should always think of. Other peoples money will have a leverage effect on your own money.

#2 Do not touch the compound interest. Investing 100EUR will make you amount X of interest. Try to focus on only using the money X makes for your, especially while you are starting. The compound effect will boost your financial wealth. So do not cut it by taking out money.

Both of them sound somehow weird. Use others peoples money and to not take interest payments to pay yourself. But as the plan is to get wealth as fast as possible – at the speed everyone commited on – you should use every inch of chances to get there.

What are my personal lessons from “Rich Dad Poor Dad”?

First of at all I would recommend reading that book. It is great, easy to read and includes a lot of interesting content.

Kiyosaki published several books, which I have not read all. After the third one I had the feeling that the content in the books repeats. That is great for everyone reading it for the first time, but a little bit annoying if you get through the stuff for the third time.

The probably most import lessons from “Rich Dad Poor Dad” was the idea behind the EBSI-quadrant. Since then I am optimizing my personal income focussing on cashflow from all the quadrants.

Furthermore I really like the idea of leveling yourself at a certain point for a long period of time and/or downgrade you lifestyle to improve the overall wealth. Unfortunately this is pretty hard for me, as I am not living alone at home 🙂

Becoming financially indepents is not a goal to not work for. It just takes a lot of time AND a lot of work. Robert Kiyosaki showed how he commited to this goal and what he was willing to give.

Here you will find the book on Amazon. It is an affiliate link, which pays me a little amount as a provision, but does not have any influence on the price you. If you want donate me a coffee, feel free 🙂

Leave a Reply

Want to join the discussion?Feel free to contribute!